Power Nickel Closes $0.90 per share Flow-Through Financing of $2.75 Million

Power Nickel Inc. (TSX-V: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV) is pleased to announce it has closed its previously announced flow-through financing of $2.75 million CAD at $0.90 per share.

The financing was completed with investors secured for Power Nickel by Wealth Creation Preservation & Donation Inc. To ensure this process was done in the least dilutive way possible, Power Nickel arranged to have WCPD Group organize a consortium of Quebec-based investors who made an initial investment of $2.75 million representing 3,055,556 flow-through shares at $0.90 per flow-through share. As part of the process, CVMR Inc acquired these shares from the front-end purchasers for $0.45 per share. All shares issued bear a hold period of four months and one day from the closing date. The private placement is subject to the Company’s completion of its filing requirements with the TSX Venture Exchange and TSXV approval.

CVMR is a shareholder of Power Nickel and is currently conducting several studies on the Nisk Nickel Sulfide PGM project in Quebec with the objective of delivering a feasibility study on the project in Q2 of 2024. This was previously announced on August 15th, 2023.

Last week Power Nickel announced their inaugural NI 43-101 mineral resources estimate (see Table 1 below) that demonstrated it had more than 5.4 million tonnes of Indicated mineral resources grading 1.05% NiEq and 1.8 million tonnes of Inferred mineral resources grading 1.35% NiEq.

The Mineral Resource Estimate presented herein in Table 1 is either constrained within a pit shell developed from a pit optimization analysis or presented as underground mineral resources using an appropriate cut-off grade and reasonable potential mining shapes which include must-take material.

Table 1 – 2023 Nisk Project Mineral Resource Estimate at a cut-off grade of 0.20% NiEq for the open pit potential and 0.55% NiEq for the underground portion.

| Potential Mining Method |

In-Situ Grade | Calculated | |||||

| Class | Tonnage | Ni | Co | Cu | Pd | NiEq | |

| t | % | % | % | g/t | % | ||

| Indicated | Open Pit | 519,000 | 0.63 | 0.04 | 0.30 | 0.56 | 0.84 |

| Underground | 4,910,000 | 0.78 | 0.05 | 0.42 | 0.78 | 1.07 | |

| Inferred | Underground | 1,787,000 | 0.98 | 0.06 | 0.45 | 1.11 | 1.35 |

| Potential Mining Method |

In-Situ Material Content | Calculated | |||||

| Class | Tonnage | Ni | Co | Cu | Pd | NiEq | |

| t | t | t | t | t | t | ||

| Indicated | Open Pit | 519,000 | 3,300 | 200 | 1,600 | 9,400 | 4,400 |

| Underground | 4,910,000 | 38,300 | 2,400 | 20,500 | 123,100 | 52,300 | |

| Inferred | Underground | 1,787,000 | 17,500 | 1,100 | 8,100 | 64,000 | 24,100 |

Please Refer to the Notes to Table 1 below at the end of this news release

“This report constitutes a base case study which assumes that Power Nickel would make a concentrate from the material extracted. In this base case study, metallurgical work suggests that our concentrate would show recovery rates of 70% Ni, 45% Cu, 75% Co and 40% Pd; neither Iron nor Platinum were considered being part of the “payables”. While rigorous and in accordance with all CIM Guidelines and NI 43-101 requirements, such base case likely doesn’t show the very positive impacts that the CVMR process will bring to this project down the road,” commented Kenneth Williamson, VP Exploration.

Ongoing work with CVMR suggests sharply higher recovery rates using the CVMR process which, rather than making a typical concentrate, is optimized at producing a finished product. The CVMR process also would create Iron and Platinum by-products, further increasing the potential yield.

Power Nickel would expect to release prior to year-end benchmark studies from CVMR that provide insight into these enhanced recoveries. Based on data gathered through their multiple plants around the world and initial work done on Nisk Main, the CVMR process is expected to show recoveries 25-30% better than the recovery estimates used in the 2023 MRE following a more common “concentrate and smelter” approach.

The objective of the CVMR process is to develop finished products like powders, nano powders, wire, anodes, and other precursors. These finished products show typical command prices that are 2-3 times the LME pricing that Power Nickel would expect to get from production of a concentrate.

“Since August, Power Nickel has drilled 4,700 metres over seven holes and the 2023 MRE only includes the first hole of this program, PN-23-036. We are planning to add a second rig in January to test the Platinum-rich Wildcat Target area, while continuing to expand on Nisk Main. We expect to drill about 2,000 metres a month and plan to drill through the end of April 2024.

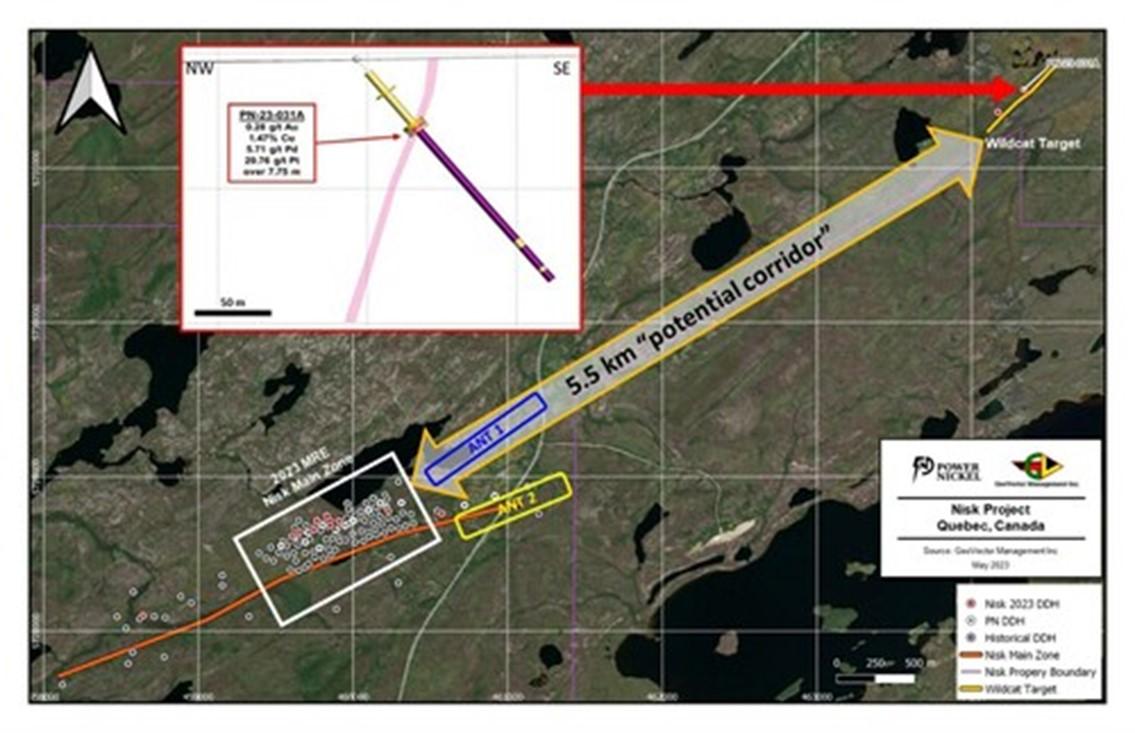

More specifically, the second rig will be targeting step-out drilling of our impressive PN-23-031A hole that had over one ounce of PGMs over 7.75 metres. The Wildcat Target is located at a full 5.5 kilometres away from Nisk Main, where the 2023 MRE noted above has been reported (see Figure 1 below).”

The Fleet Ambient Noise Tomography program (see release dated January 31, 2023) has identified several targets that have similar signatures to Nisk Main that occur within this 5.5-kilometre corridor, potentially connecting Nisk Main with the Wildcat Target area discussed above.

“We have continued to hit significant Ni-PGMs mineralization at Nisk and we look forward to accelerating its exploration in the coming months,” Mr. Lynch commented.

Qualified Person

Kenneth Williamson, Géo, M.Sc., VP Exploration at Power Nickel, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold and battery metal prospects in Canada and Chile.

On February 1, 2021 Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE:TSXV)

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Nickel, formerly Chilean Metals is focused on confirming and expanding its current high-grade nickel-copper PGE mineralization historical resource by preparing a new Mineral Resource Estimate in accordance with NI 43-101, identifying additional high-grade mineralization, and developing a process to potentially produce nickel sulphates responsibly for batteries to be used in the electric vehicles industry.

Power Nickel (then called Chilean Metals) announced on June 8th, 2021 that an agreement has been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in total of 67 million ounces of gold, 569 million ounces of silver and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is 100-per-cent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, recently sold to a subsidiary of Teck resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $3-million at any time. The Copaquire property borders Teck’s producing Quebrada Blanca copper mine in Chile’s first region.

Notes to Table 1:

- The independent qualified persons for the 2023 MRE, as defined by National Instrument 43-101 guidelines, are Pierre-Luc Richard, P.Geo. of PLR Resources; Jeffrey Cassoff, P.Eng. of BBA is the independent qualified person for the Pit shell analysis and cut-off grade calculations; Gordon Marrs, P.Eng. of XPS is the independent qualified person for Metallurgy and Smelter Costs. The effective date of the 2023 MRE is November 26, 2023.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Mineral Resources in this MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as Indicated or Measured; however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Mineral resources are presented as undiluted and in-situ for an open-pit and underground scenario and are considered to have reasonable prospects for economic extraction. Reasonable potential mining shapes were modeled, and must-takes were included. The constraining pit shell was developed using overall pit slopes of 45 degrees in bedrock and 25 degrees in overburden. Mineral resources show sufficient continuity and isolated blocks were discarded.

- The MRE was prepared using Leapfrog Edge version 2023.2.0 and is based on 117 surface drillholes and 3,835 samples, of which 96 drillholes were intercepting in the Nisk Main Zone. The cut-off date for the drillhole database was November 26, 2023 with hole PN-23-036 being the last hole being included.

- The MRE encompasses one mineralized zone defined by a constraining solid with a minimum true thickness of 2.0 m. A value of zero grade was applied where core has not been assayed.

- High-grade capping was done on the composited assay data. Capping grades are as follow: 2% for Nickel, 1.5% for Copper, 0.15% for Cobalt, 1.2 g/t for Platinum, and 3 g/t for Palladium.

- Density values were calculated for the Main Zone from the density of the host rock, adjusted by the amount of Nickel as determined by metal assays. A formula was calculated and validated using a database of measured densities. Country rock density vary from 2.70 g/cm3 to 2.85 g/cm3. The Main Zone density vary from 2.63 g/cm3 to 3.96 g/cm3.

- Grade model mineral resource estimation was calculated from drillhole data using an Ordinary Kriging interpolation method in sub-block model using blocks measuring 5 m x 5 m x 5 m in size.

- Nickel equivalency grade was calculated using metal prices (see below), metallurgical recoveries, smelter payables and charges. Metallurgical recoveries are 70% for Nickel, 44% for Copper, 79% for Cobalt, and 67% for Palladium. Payables are 73% for Nickel, 69% for Copper, 27% for Cobalt, and 78% for Palladium. NiEq = Ni grade + (0.2359 x Cu grade) + (0.9388 x Co grade) + (0.1810 x Pd grade)

- The estimate is reported using a NiEq cut-off grade of 0.20% for open-pit mineral resources and 0.55% for underground mineral resources. The cut-off grade was calculated using the following parameters (amongst others): Nickel price: USD10.00/lb; Copper price: USD4.00/lb; Cobalt price: USD22.50/lb; Palladium price: USD1,215.00/oz; CAD:USD exchange rate = 1.30. The cut-off grade will be re-evaluated in light of future prevailing market conditions and costs. The pit shell optimization used the same parameters.

- The pit shell includes 3.6M tonnes of overburden and waste rock resulting in a strip ratio of 7:1.

- The MRE presented herein is categorized as Inferred and Indicated Mineral Resources. The Inferred Mineral Resource category is constrained to areas where drill spacing is less than 150 metres and the Indicated Mineral Resource category is constrained to areas where drill spacing is less than 80 metres. In both cases, reasonable geological and grade continuity were also a criteria during the classification process.

- Calculations used metric units (metre, tonne). Metal contents are presented in percent, tonnes, or ounces. Metric tonnages were rounded and any discrepancies in total amounts are due to rounding errors.

- CIM definitions and guidelines for Mineral Resource Estimates have been followed.

- The QP is not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical or marketing issues, or any other relevant issues that could materially affect this MRE.

- The QP is not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical or marketing issues, or any other relevant issues that could materially affect this MRE.

Figure 1 – Plan view showing the location of the “Wildcat Target” area with respect to Nisk Main. (CNW Group/Power Nickel Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE