Power Metallic Intercepts 5.35 Meters of 11.97% Cu (16.35% CuEqRec) in Hole 25-022 Infill Drilling Expanding the Lion Zone and Updates on Fall/Winter Drill Program and Land Assembly

Power Metallic Mines Inc. (TSX-V: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV1) is pleased to provide a release of assays from its summer drill program, an update on its land assembly activities together with an outlook to the fall and winter key exploration objectives.

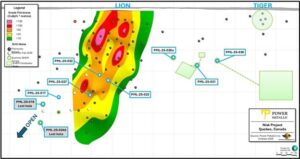

Figure 1: Lion Area long-section with drill hole locations reported in this news release. (CNW Group/Power Metallic Mines Inc.)

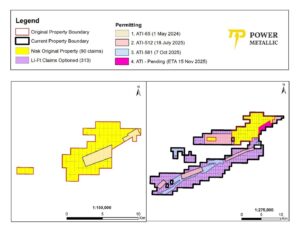

Figure 2: Land package showing land additions (Li-Fi & Hydro Land Expansion and new claims) (CNW Group/Power Metallic Mines Inc.)

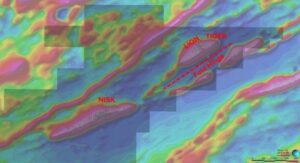

Figure 3: Nisk / Lion / Hydro land showing 2D Residual magnetic intensity of interpreted ultramafic structures and fold hinge (CNW Group/Power Metallic Mines Inc.)

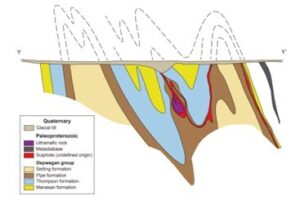

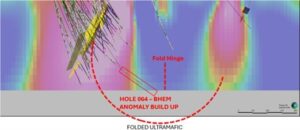

Figure 4: Cross-section through the Thompson Structure facing northeast (line Y-Y’, figure 9; Bleeker 1990). (CNW Group/Power Metallic Mines Inc.)

Figure 5: Cross section from Lion to southern Hydro land showing magnetic inversion and interpreted ultramafic structures including fold. (CNW Group/Power Metallic Mines Inc.)

Summer Drilling Release 2 – Lion – Tiger Area

The summer drilling program was designed to search for extensions to the Lion Zone, specifically down plunge from known mineralization, and to infill drill, including ‘edge’ holes, on the Lion zone to define the zone geometry to a confidence level that would allow a future mineral resource estimate to be carried out to an Indicated Resource classification.

Extensional Drilling Results (Table 1, Figure 1)

Extensional drilling was slow during the summer program as technical problems with the helicopter supported drills led to lost holes (such as holes PML-25-019 and 024a in this release) that did not reach the mineralization horizon for Lion. Hole PML-25-017 has extended the zone to the west but failed to intersect the High-grade massive sulphide portion of the Lion zone and returned a disseminated zone of 7.00m @ 1.41% CuEqRec1 that confirms the extension of the mineralizing Lion structure which will see continued follow-up in the 2025 fall program.

The Company intends to use more powerful skid drills when possible going forward when testing the Lion Zone extension at depth to avoid similar issues.

Mineral Resource(MRE) Drilling Results (Table 1, Figure 1)

In-fill drilling has successfully defined mineralization along some of the high-grade shoots that are internal to the Lion zone and defined the edges of the Lion zone for future MRE modelling. Drilling reported here intersected mineralization on Hanging-wall, High-grade, and Footwall portions of Lion, including High-grade sulphide intersections of 6.85m @ 13.15% CuEqRec1 in hole PML-25-022 (inclusive of 5.35m of 16.35% CuEqRec1), and 5.90m @ 10.43% CuEqRec1 in hole PML-25-022, included within 27.50m @ 2.75% CuEqRec1. All the in-fill drilling to date has largely confirmed the size, grade, and orientation that was modelled prior to the drilling, leading to increased confidence in the interpreted zones.

Terry Lynch, CEO of Power Metallic states “These are some amazing high-grade intersections. Any hole delivering over 50 meter % (Grade %*Metres) scores is an extremely lucrative hole. We have extended the known resource area and increased our understanding of the plunge of the Lion Zone. Our objective with drilling this summer was to extend the Lion Zone which is being accomplished and also to discover the next Lion Zone. That part we have not yet completed. But we have gained excellent insight that is guiding our fall and winter drilling program. In addition, we didn’t drill our highest priority drill targets due to their proximity to the land assembly activities we were working on. With that ground now secured we can discuss those targets below.”

| Table 1: Release 2 – Assay results Summer 2025 – Nisk Project | ||||||||||

| Hole | From | To | Length | Au | Ag | Cu | Pd | Pt | Ni | CuEq Rec 1 |

| (m) | (m) | (m) | (g/t) | ( g/t ) | ( %) | (g/t) | ( g/t ) | ( %) | ( %) | |

| LION | ||||||||||

| PML-25-017 | 539.00 | 546.00 | 7.00 | 0.92 | 2.35 | 0.38 | 0.01 | 0.01 | 0.14 | 1.41 |

| Including | 539.00 | 540.00 | 1.00 | 4.90 | 10.90 | 2.32 | 0.01 | 0.01 | 0.18 | 6.35 |

| PML-25-019 | Hole lost before intersecting the mineralized horizon | |||||||||

| PML-25-022 | 358.20 | 364.40 | 6.60 | 0.11 | 1.78 | 0.23 | 3.46 | 0.54 | 0.02 | 1.71 |

| Including | 358.20 | 360.20 | 2.00 | 0.30 | 4.20 | 0.59 | 10.60 | 1.66 | 0.05 | 5.05 |

| and | 372.65 | 379.50 | 6.85 | 2.09 | 43.79 | 9.39 | 8.57 | 0.83 | 0.26 | 13.15 |

| Including | 372.65 | 378.00 | 5.35 | 2.55 | 54.78 | 11.97 | 10.38 | 0.65 | 0.33 | 16.35 |

| including | 412.70 | 413.75 | 1.05 | 0.03 | 10.40 | 2.45 | 0.02 | 0.01 | 0.17 | 2.45 |

| PML-25-023 | 341.00 | 368.50 | 27.50 | 0.10 | 15.05 | 1.68 | 1.89 | 0.91 | 0.12 | 2.75 |

| Including | 352.75 | 368.65 | 5.90 | 0.20 | 66.36 | 7.28 | 6.84 | 3.28 | 0.25 | 10.43 |

| PML-25-024a | Hole lost before intersecting the mineralized horizon | |||||||||

| PML-25-027 | 422.00 | 436.50 | 14.50 | 0.09 | 2.27 | 0.32 | 0.50 | 0.98 | 0.16 | 1.15 |

| including | 428.00 | 430.00 | 2.00 | 0.11 | 6.50 | 1.40 | 0.53 | 6.22 | 0.75 | 4.81 |

| LION – TIGER | ||||||||||

| PML-25-021 | 436.30 | 440.00 | 3.70 | 0.57 | 3.93 | 0.55 | 0.41 | 0.18 | 0.18 | 1.48 |

| including | 437.85 | 438.55 | 0.70 | 2.90 | 14.30 | 2.11 | 0.95 | 0.23 | 0.31 | 4.90 |

| PML-25-026a | no significant assay results | |||||||||

| PML-25-030 | no significant assay results – Off hole BHEM anomaly | |||||||||

Note: Reported length is downhole distance; true width based on model projections is estimated as 85% of downhole length

1 Copper Equivalent Rec Calculation (CuEqRec1)

CuEqRec represents CuEq calculated based on the following metal prices (USD) : 2,360.15 $/oz Au, 27.98 $/oz Ag, 1,215.00 $/oz Pd, 1000.00 $/oz Pt, 4.00 $/lb Cu, 10.00 $/lb Ni and 22.50 $/lb Co., and a recovery grade of 80% for all commodities, consistent with comparable peers.

Tiger Deep Target (Table 1, Figure 1)

Three holes reported here (PML-25-021, 026a, 030) were drilled below the depth resolution of the recent 2025 airborne VTEM survey completed by Power Metallic. These holes (Figure 1) were testing the area between Lion and Tiger to intersect the mineralized horizon and provide drill holes for BHEM surveys. Although essentially blind exploration drill holes, evidence from previous work, including shallow drilling, including intercepts of >2% Ni with >5% CuEq, suggested a high potential for mineralized zones between Lion and Tiger.

Hole PML-25-026, drilled closest to Lion returned no significant assays, while the BHEM survey off-hole conductors were pointing to the presence of the Lion deposit. Hole PML-25-021 intersected a modest Lion style mineralized zone (3.70m @ 1.48% CuEqRec1) and indicated an off-hole anomaly separate from the Lion deposit. This location is proximal to a postulated off-set shoot from the Lion zone, or possibly could be indicating a new Lion style zone.

Hole PML-25-030 did not intersect significant mineralization, but the BHEM survey produced a large, possibly thick bodied anomaly deeper and to the east of the hole. The BHEM panel defined at Tiger Deep represents one of the biggest EM panels identified to date, larger than the original Lion airborne VTEM panel. This location is proximal to a postulated ‘Deep Tiger’ target that is based on reinterpretation of previous Tiger drilling and surface mapping that suggests Tiger is made up of ‘rip-up’ blocks of massive sulphides carried in a tonalitic intrusion from a deeper and larger deposit. Both the PML-25-030 and PML-25-021 BHEM anomalies are being prioritised for drilling (the PML-25-030 BHEM is currently being drilled).

For more detail on the results, the land assembly program and our future exploration program please check out the podcast we recorded along with this release just below the next image.

Power Metallic Podcast Discussing Results and Future Exploration Plans

Please click on or copy and paste the below web address into your browser

Land Assembly Activities

Power Metallic’s discovery of the Lion Zone changed the geological understanding for the basin. We now understand that the Lion zone and the Nisk deposits are parts of a remobilized polymetallic Ni-Cu system, which are rare, but historically have always occurred at district scales and produce giant deposits. Based on this knowledge over the last several months we assembled more than a 600% increase in our land package growing from 46 km2 to 313 km2.

For now, we are in sole possession of the geological understanding about what works in respect to making discoveries in this regional Basin. Our search encompasses the entire basin, but we have acquired the local basin edges as the lowest hanging fruit to explore first (shallower deposits close to known mineralization), and this was the central strategy for acquiring the Li-FT ground in June (Figure 2). Subsequent exploration, including airborne VTEM and magnetics and field mapping and sampling, have developed dozens of target areas for Cu- Ni mineralization. These are currently being prioritized and drilled following receiving drill permits (ATIs in Figure 2).

Arguably our most important acquisition is land that had been under an exclusion from Hydro Quebec surface leases (Hydro ground – Figure 2). With the assistance of the James Bay Cree, we were able to successfully convince the Quebec government to open these lands for mineral staking, and we staked it in late September. This area is most important to Power Metallic as it covers the extension of the Lion mineralizing system (i.e. our discovery). Prior to the acquisition of the Hydro ground, we did not have claim ownership over a target area that contains an important fold axis through the mineralized geological horizons as seen by 2D Residual magnetic intensity interpreted ultramafic structures (Figures 3 and 4). In addition, the entire north limb of this fold hosting the strike length between Lion and Nisk was too close to the old property boundary to safely explore the ground, thus delaying exploration on our highest priority target.

The Hydro area covers an interpreted fold hinge that could provide a thickening of projected Cu and Ni mineralization proximal to the Lion and Tiger zones. An analogue deposit we believe is comparable to the Nisk and Lion deposits is the Thompson nickel deposit. A cross section of the Thompson deposit is shown in Figure 4.

The potential of a fold hinge target is supported by magnetic data (Figures 4 and 5) that has modelled the folded ultramafic host rocks. Subsequent BHEM anomalies in holes PN-24-064 (Figure 4) and PML-25-030 and 021 further suggest a large body of mineralization is coincident with the anticipated fold hinge. The BHEM anomaly detected in PN-24-064 had greater than one hundred meters of build up at the bottom of the hole however the hole didn’t have the required length to show the full anomaly. Re-entry of PN-24-064 is underway to extend the hole a further 250 meters – to fully define where the BHEM panel exists, and to potentially intersect a portion of the conductive body.

Power Metallic Announces Marketing Services Programs

In advance of potential expansion to broader capital market exchanges, Power Metallic has entered the following marketing services agreements.

In addition, the Company is pleased to announce that it entered into a service agreement with Native Ads, Inc. dated October 29, 2025 pursuant to which Native Ads will provide a marketing campaign for a total retainer of up to US$168,000, with a term of up to eighteen months or until the retainer is depleted. Under the agreement, Native Ads will execute a comprehensive digital media advertising campaign for the Company, where approximately 75% of the campaign budget will be allocated to cost per click costs, media buying and content distribution, and search engine marketing. The remaining budget will be allocated for content creation, web development, advertising creative development, search engine optimization, campaign optimization, and reporting and data insights services. Native Ads is a full-service advertising agency based out of New York and Vancouver, BC. Native Ads and its principal Jon Malach are arms length to the Company and hold no interest, directly or indirectly, in the securities of the Company or any right to acquire such an interest. The engagement of Native Ads by the Company is subject to the approval of the TSX Venture Exchange.

The Company has also entered into a service agreement with Sideways Frequency November 3, 2025 pursuant to which Sideways will provide a market awareness campaign for a total retainer of up to US$150,000 with a term running until December 31, 2026. Under the agreement, Sideways will provide services aimed at raising awareness, including articles, and email campaigns, social media and digital media campaigns. Sideways and its principals are independent of Power Metallic, operating at arm’s length, and are not related parties. As part of this marketing agreement, the Company has granted 250,000 options to vest in four segments quarterly over the initial 12 months exercisable at a price of $1.45 and for a term ending 2 years from the date of issuance. The engagement of Sideways by the Company is subject to the approval of the TSXV.

Finally, the Company has retained Apaton Finance GmbH who will provide a market awareness campaign for a total retainer of up to 84,817 Euro with a term running until December 31, 2026. Under the agreement, Apaton will provide services aimed at raising awareness, including articles, and email campaigns, social media and digital media campaigns. Apaton and its principals are independent of Power Metallic, operating at arm’s length, and are not related parties. As part of this marketing agreement, the Company has granted 100,000 options to vest in four segments quarterly over the initial 12 months exercisable at a price of $1.45 and for a term ending 2 years from the date of issuance. The engagement of Apaton by the Company is subject to the approval of the TSXV.

Qualified Person

Joseph Campbell, P.Geo, VP Exploration at Power Metallic, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Metallic Mines Inc.

Power Metallic is a Canadian exploration company focused on advancing the Nisk Project Area (Nisk–Lion–Tiger)–a high–grade Copper–PGE, Nickel, gold and silver system–toward Canada’s next polymetallic mine.

On 1 February 2021, Power Metallic (then Chilean Metals) secured an option to earn up to 80% of the Nisk project from Critical Elements Lithium Corp. (TSX–V: CRE). Following the June 2025 purchase of 313 adjoining claims (~167 km²) from Li–FT Power, the Company now controls ~212.86 km² and roughly 50 km of prospective basin margins.

Power Metallic is expanding mineralization at the Nisk and Lion discovery zones, evaluating the Tiger target, and exploring the enlarged land package through successive drill programs.

Beyond the Nisk Project Area, Power Metallic indirectly has an interest in significant land packages in British Columbia and Chile, by its 50% share ownership position in Chilean Metals Inc., which were spun out from Power Metallic via a plan of arrangement on February 3, 2025.

It also owns 100% of Power Metallic Arabia which owns 100% interest in the Jabul Baudan exploration license in The Kingdon of Saudi Arabia’s JabalSaid Belt. The property encompasses over 200 square kilometres in an area recognized for its high prospectivity for copper gold and zinc mineralization. The region is known for its massive volcanic sulfide (VMS) deposits, including the world-class Jabal Sayid mine and the promising Umm and Damad deposit.

For further information, readers are encouraged to contact:

Power Metallic Mines Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE