Playfair Plans Drilling at Mount Uniacke

Playfair has planned a three-pronged exploration program on its Mount Uniacke property consisting of 2,950 metres of drilling at an estimated cost of just over CAD$1 million. Largely focused on a little drilled, high-grade structurally controlled zone, the “Crumple”, the program also will test bulk tonnage potential near large, century-old open cuts.

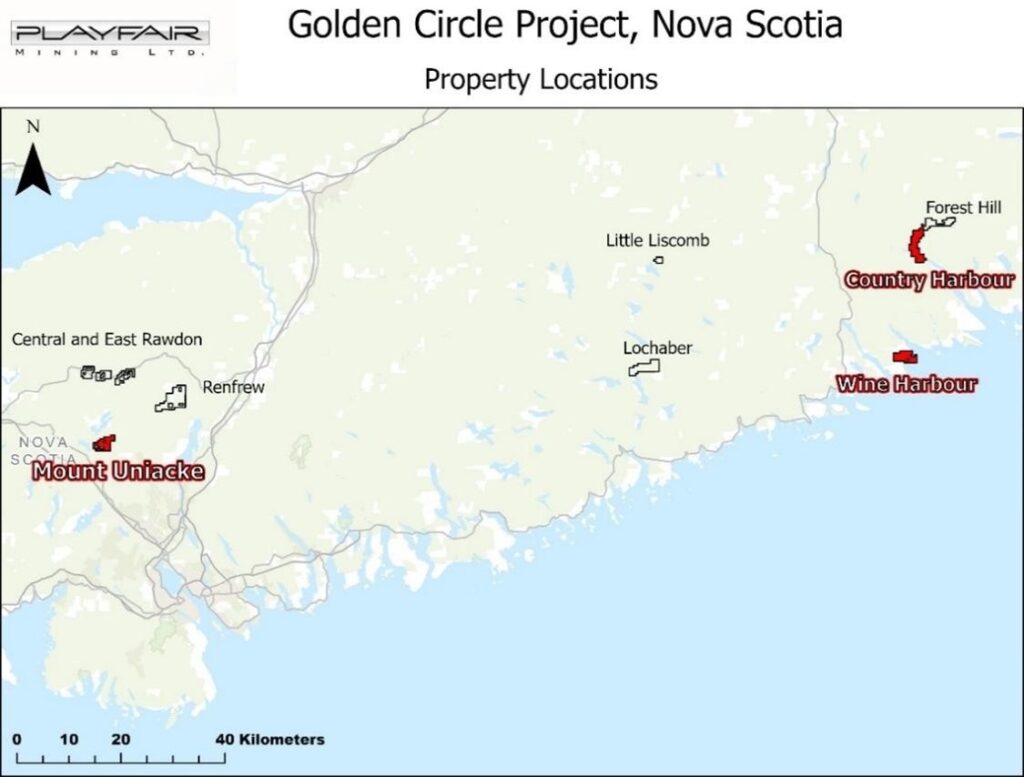

The Golden Circle Project was acquired from Perry MacKinnon, a well-known Nova Scotian geologist with extensive local experience to capitalize on Nova Scotia’s renewed potential. It is the result of many years of careful acquisition ensuring that the selected properties represent some of the most prospective ground in the region.

Playfair reviewed 1,400 assessment files for these properties to assess program scenarios for both high-grade and high-tonnage gold exploration. The opportunity at the Mount Uniacke property clearly stood out followed by priority prospects at Wine Harbour and Country Harbour.

A convergence of factors has created a compelling opportunity for Nova Scotia’s gold sector. Historically rich in gold production yet underexplored by modern standards, the Province is reemerging as a premier jurisdiction for mineral exploration. Buoyed by all-time high gold prices and a provincial government that is now implementing tangible, pro-investment policies that directly mitigate regulatory risk, Nova Scotia presents a de-risked and high-potential environment for investors seeking exposure to the precious metals market. The recent, significant progress made by St. Barbara and NexGold provides a critical third-party validation of the jurisdiction’s renewed commercial viability.

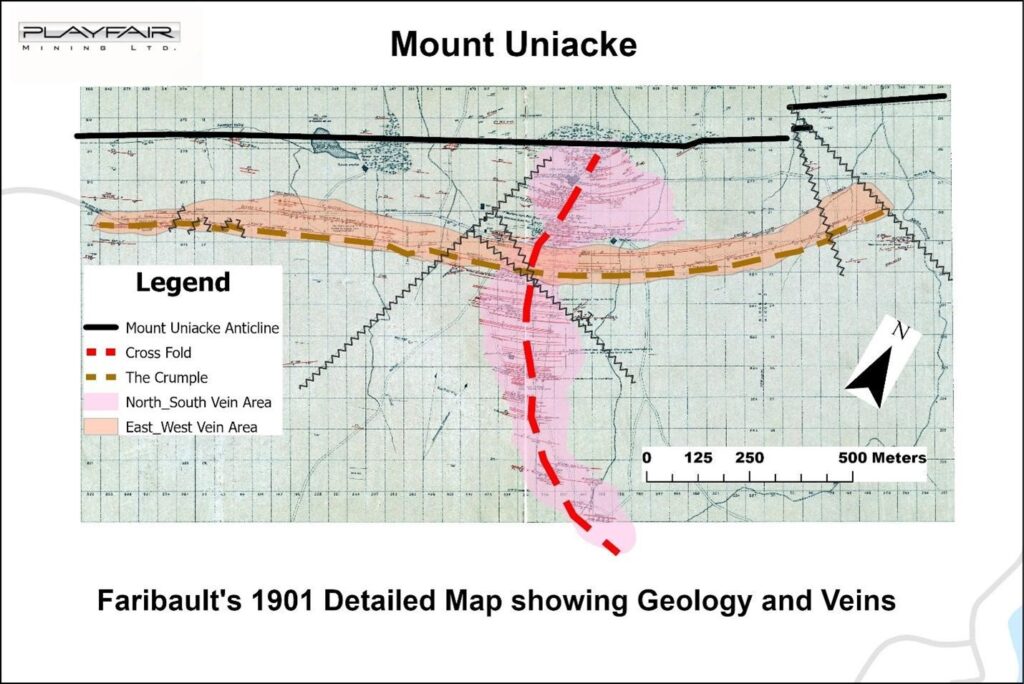

The 120-year-old Treasure Map

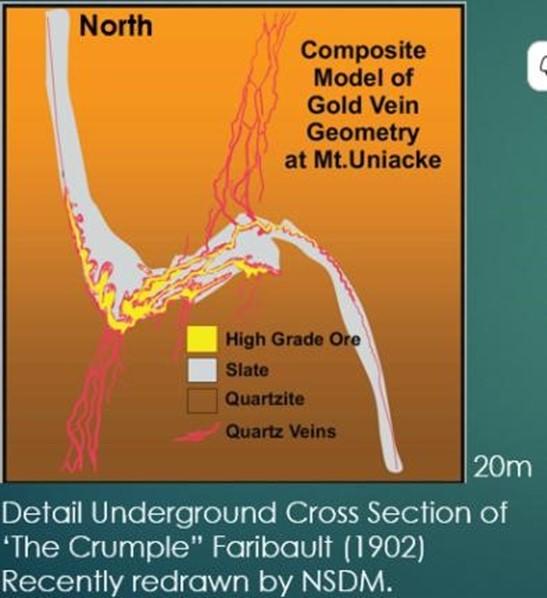

The primary guide for this planned drilling project isn’t satellite imagery or advanced geophysics — it’s a map and a theory developed in 1901 by E. R. Faribault. While mapping for the Geological Survey of Canada at the West Lake Mine in the Mount Uniacke area, Faribault identified a key structural feature designated as the “Crumple,” a parasitic fold as a focus of the area’s gold-rich shoots.

Faribault theorized that this “Crumple”, which he mapped at West Lake Mine, extended deep underground, creating the potential for rich deposits in veins that had not yet been reached by shallow 19th-century mining. A brief underground drilling program in 1932 seemed to prove him right.

The Provincial Mines Inspector at the time reported that the drilling was “sufficient to indicate that the leads (veins) north of the Borden apparently followed the same system of crumpling as projected by Dr. Faribault.” However, after this confirmation, no further work was done, and his hypothesis was left untested for the better part of a century.

Faribault’s original insight, highlighted by W. Malcolm in a 1929 government report, remains the foundational logic for today’s exploration. “In no part of the district has mining been carried to any great depth, and it seems probable that in many cases the workings have not been carried to the bottom of the pay-shoots… The Crumple already described… probably extends to greater depth and produces rolls in other veins farther north that might be worth exploring.”

Playfair’s Drilling Plans

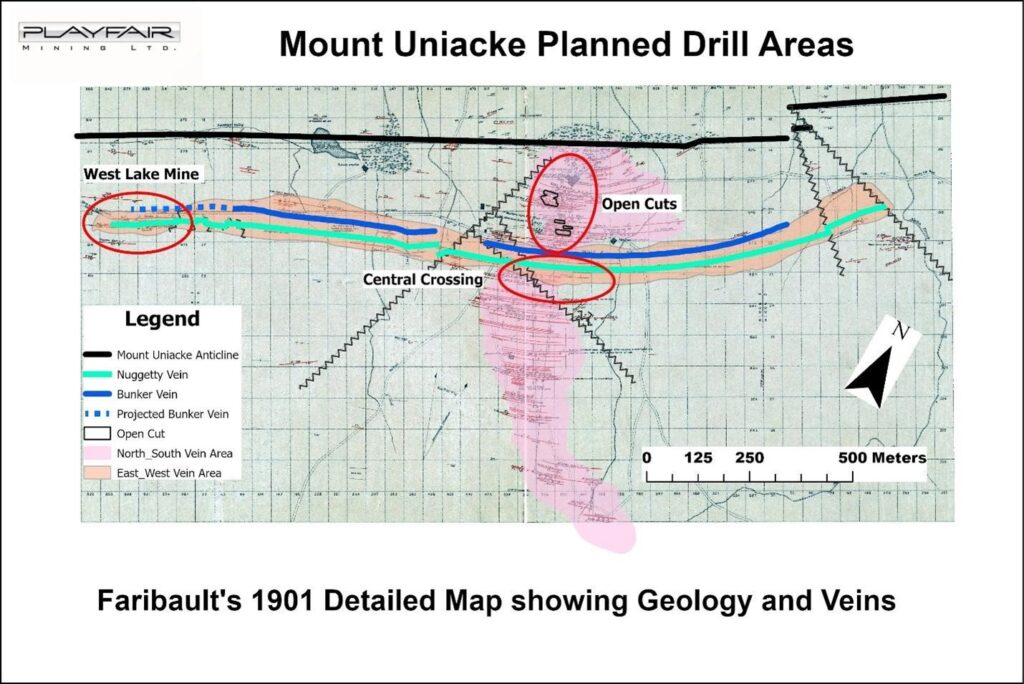

Playfair plans a targeted three-prong drill program to test the “Crumple” at modest depths below the shallow historical surface workings together with drill testing for bulk tonnage near historical large open cuts. The three areas selected by Playfair for drilling are shown below using Faribault’s 1901 map as a base.

West Lake Mine Area

This initial drilling is designed to directly test the conclusion of E.R. Faribault, as reported by

Malcolm (1929), that veins north of the historic Borden Vein “may prove very rich at the crumple.” The program consists of two groups of three 100-metre holes (600 metres total) each group drilled from the same setup. The strategic objective is to test this specific, high-grade structural target where the veins are predicted to be thickened by the “Crumple” at a relatively shallow depth, providing a rapid and cost-effective validation of a long-standing geological thesis.

Central Crossing

This phase of drilling will consist of 10 locations with 3 shallow drill holes each (total 1,550 metres). It is designed to locate and explore the “Crumple” structure where it is projected to intersect a major north-south vein zone, approximately 850 metres away from the well-mapped West Lake Mine. The objective of this work is to delineate the scale and continuity of this critical gold-bearing structure and understand its potential to host significant mineralization where it interacts with, and potentially thickens, other known gold-bearing veins.

Open Cut Area

This component of the program will test an entirely different deposit model, leveraging historical evidence of open-cut mining of low-grade material (estimated 2.8 g/t Au as per data reported by Malcolm, 1929). This drilling, comprising four 100-metre holes and one 400-metre hole (800 metres total), will test the potential for a high-tonnage, disseminated gold deposit. The rationale is strongly supported by a poorly sampled 1995 drill hole (MU 95-1) which assayed 2.6 g/t Au from unremarkable core that was adjacent to unsampled sections, underscoring the potential for a much larger mineralized system than previously understood.

Exploration Budget

The scope and estimated cost of the proposed program are summarized below:

- Proposed Drilling: 2,950 metres, comprising 41 diamond drill holes across the three distinct target areas at Mount Uniacke.

- Estimated All-Inclusive Cost: CAD $1,032,500, based on a cost of CAD $350 per metre, including supervision and assaying.

The detailed exploration plan for the Golden Circle Project is available on Playfair’s website at the following link Exploration Plan.

To see an explanatory video click Here .

The technical contents of this release were reviewed and approved by Greg Davison, PGeo, a qualified person as defined by National Instrument 43-101.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE