Peter Krauth – The Silver Institute, World Silver Survey 2023

In the April issue of Silver Stock Investor, I wrote extensively about the ongoing problems with the banking crisis. The first victim was Silicon Valley Bank in the US with, as it turned out, several more close behind.

Then, as I was preparing to participate in the Swiss Mining Institute’s March event in Zurich, news of Credit Suisse’s imminent demise was everywhere. Its Swiss rival, UBS Bank, acquired it in a weekend shotgun wedding.

Some of the world’s most powerful central banks were hoping, “fingers crossed”, that they had extinguished the fire of this banking crisis.

At the time, I said “I just don’t buy it. It’s not over. These fires may seem to have been put out, but I’m convinced there are plenty of embers burning. We just don’t know exactly where they are…yet.”

Well, just last week, NYSE-listed First Republic Bank’s shares dropped 50% in one day as they reported having $100 billion of depositor outflows since the start of 2023. That was more than half its total deposits before the banking crisis. Since February, its shares had fallen an astounding 96%.

And this happened despite 11 U.S. banks forking over $30 billion to First Republic to shore up confidence. Clearly, it didn’t work.

Here’s what’s interesting about the parallels between First Republic and Silicon Valley Bank, whose troubles got the crisis rolling. These are both based in California and have mostly high net worth clients. That means most accounts were likely to be well above the $250,000 FDIC insurance limit.

What else? Well, the source of their problems was owning too many long-term bonds, whose values crashed as the Fed aggressively raised rates.

And Moody’s ratings agency downgraded the bonds of 11 regional banks, saying that “deterioration in the operating environment and funding conditions” were to blame.

None of this was enough. Yesterday morning regulators seized First Republic and sold most of its operations to JPMorgan Chase, making this the largest bank failure since the 2008 financial crisis. That’s scary. At $229 billion, First Republic was bigger even than Silicon Valley Bank or Signature Bank. Washington Mutual, which had $307 billion in 2008, was the largest US bank failure ever.

JPMorgan agreed to secure First Republic depositors. Still, the Federal Deposit Insurance Corp. (FDIC) does see its burden grow, estimating that First Republic will cost $13 billion, in addition to the $22 billion in March from Silicon Valley and Signature Banks.

Is still don’t think we’ve seen the end of this saga. The Fed’s aggressive rate hiking binge is almost certainly going to generate several more casualties. And these may well be in other sectors too, like commercial real estate.

The Fed’s currently in the midst of its May FOMC meeting. Odds are it will hike rates by another 0.25%, though it will be interesting to see if the First Republic debacle is enough to change that. I think they’ll go ahead with the hike for the sake of demonstrating their resolve. They’ve actually admitted a recession was all but a done deal. Odds are good this could be the last rate hike in this cycle, and that the next meeting will bring a pause in rates. The markets see a more than 80% chance of a rate cut by September. In this market, that’s just too far off to say, in my view.

I do think this hike could provide a little more strength for the US dollar. That in turn could lead to a bit more softness in silver and gold, but only temporarily, making for a great opportunity to add if one is so inclined.

In any case, the reason I discuss this at length is to show how precious metals are more important than ever. As I write, gold continues to hover close to all-time nominal highs around $1,995. Meanwhile, silver is up 40% since last fall, and looks poised to continue its ascent.

In the April issue I detailed for you why central banks now love gold. It’s become their currency of choice as the world moves away from the US dollar, weaponized by Washington when it froze Russian treasury bond holdings. But it’s not just central banks.

In the first quarter of 2023, the U.S. Mint said historical demand for its gold and silver have been very strong. Philip Newman of Metals Focus told Kitco News recently that silver demand was likely to remain near the historical highs of last year and that “Coin and bar demand since the pandemic have been eye-watering high. Global demand for gold and silver are expected to remain healthy through 2023.”

There’s little doubt the banking crisis is contributing to this. Once ounce American Silver Eagles are currently commanding premiums north of 80%.

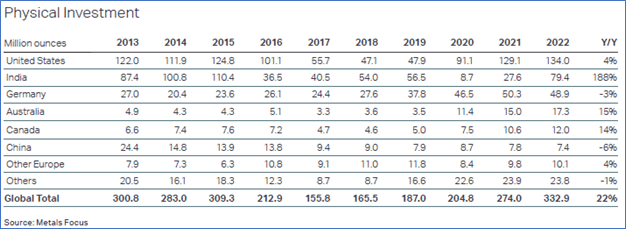

In May’s issue, I did an in-depth review of the recently released Silver institute’s World Silver Survey 2023 to understand what shaped the silver market last year, and what we might expect this year and beyond. It tells us that US silver coin and bar demand were up 4% last year to 134Moz, but that was a new high. That’s your free article for this week.

Equally important is that there is very little of this silver being sold back to dealers. Instead, once sold, it’s mostly staying “off the market’. Dealers are struggling to buy back from customers, keeping their supply extremely tight, leading to very high premiums.

If you’ve read my book, the Great Silver Bull, then the events of the past few months are no surprise. Financial crises are set to come with increased frequency. In the book, I tell you exactly how you can prepare. I also discuss how tight physical silver markets have become, how high premiums have reached, and what alternative options you have.

If you haven’t picked up a copy yet, it’s easy, and it’s now also available in audiobook format!

CLICK HERE to order The Great Silver Bull

To finish up the May issue, I followed on with my technical analysis, and did a deep dive into an outstanding silver company with two impressive and growing silver deposits, and a third in the works, to see what we can expect from them this year. That was followed by the Portfolio table, where I moved one holding from the developer to the producer category, as they recently achieved that status. I finished up with my thoughts on company updates.

Right now, silver appears to be in a consolidation phase since rising strongly from last fall, and has spiked higher since March. Once this consolidation is over, I do think the next leg will be higher, with a potential to reach $28 this year.

Courtesy of the Silver Stock Investor

Subscribe today and GET 30% OFF

Add Promo Code SILVER30 at Checkout

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE