Peter Krauth – “Silver Institute Forecast”

I spent five days in Vancouver, aka junior mining central, to meet with companies either in the portfolio or being considered, as well as to speak at the Metals Investor Forum (MIF) and the Vancouver Resource Investment Conference (VRIC).

But here’s the single most interesting thing that happened in those five days.

At the end of the last day I bumped into one of those new investors in the street that I had met two days earlier at MIF. We’ll call him Charlie. He told me he’s a blueberry farmer in British Columbia, and he’d spent the entire four days listening to newsletter writers, company presentations, and talking with CEOs and geologists.

And then he shocked me.

Charlie said he was in the process of buying about $40,000 of silver and asked me what I thought. I told him I couldn’t give him any personal investment advice, but that I did think owning silver was a great way to get started in this sector. I also said he would do well to assess his own risk tolerance, and how that was crucial in determining how he might allocate funds across the silver investment space.

I also said that from my vantage point, I thought the timing was superb.

That’s because from the perspective of most of the companies there, despondence was so thick you could practically cut it with a dull knife. And yet both conferences were very well attended. That almost never happens. In fact, it was great (and surprising) to see a lot of new investor faces. I had the chance to chat with subscribers, but also many others who are new to mining and/or silver investment.

At MIF I gave my talk: Silver, Critical Metal – Explosive Gains.

MIF was bustling, with over 850 in-person attending, and over 400 watching the webcast online.

At VRIC, I gave essentially the same workshop on silver, and was thrilled to share the stage on the 2024 Silver Forecast Panel with the legendary Robert Kiyosaki, author of Rich Dad, Poor Dad.

It’s encouraging to see that younger investors are growing curious and interested. VRIC’s audience included 24% under the age of 40, and 8% under the age of 25. That’s astonishing. And a recurring theme by speakers was “time horizon”, which is crucial and wise, as the big money will be made with patience. Oh, and one other thing: 35% of attendees had never been to the VRIC before. That’s a great sign that the generalist investor wants to know more about resource investing. These conferences are excellent ways to start learning and building a knowledge base.

I also had the chance to catch up with industry veterans like Rick Rule (formerly of Sprott), Ronnie Stoeferle of the highly regarded annual In Gold We Trust report, as well as Willem Middelkoop of the Commodity Discovery Fund and author of The Big Reset. Rick has told me in the past how silver has been an outsized contributor to his net worth, having invested in early stage plays that paid off in a very big way. Ronnie made an interesting observation most of us Westerners fail to grasp. He has given keynote talks in the Middle East and Asia in recent months and says the mood towards gold is much more upbeat. Perhaps that’s because the average person there understands it much better than we do.

Right now, there’s a huge disconnect in silver, but especially in gold. The silver price has been moving sideways for months, and at $23 remains well off its range highs of near $28. Gold, however, has mostly stayed above $2,000, and yet gold miners have not followed the metal higher. Yet when I thought deeper and looked under the hood, the reasons why become clearer.

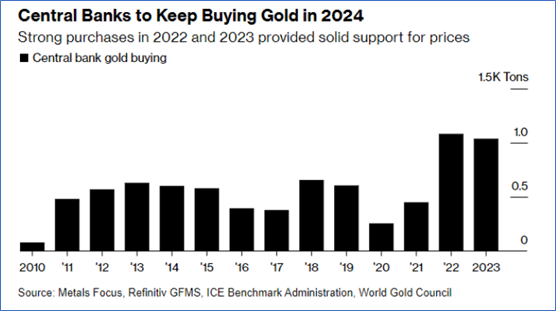

Gold buying has been mostly a central bank and wealthy investor phenomenon. In 2022, central banks bought north of 1,082 tonnes of gold. Consider that the annual gold supply is about 4,700 tonnes. That means better than 1 out of 5 ounces went to a central bank. Last year, they bought nearly as much, acquiring 1,037 tonnes.

You may be wondering what’s motivating them. So let’s try and see things through their eyes.

2022 saw a sudden, outsized burst of sovereign gold purchases.

My view is that the US weaponized the dollar when they froze Russia’s US Treasuries after they walked into the Ukraine. And that was shocking wakeup call to governments the world over, even US allies. They quickly, and rightly, concluded that what they thought was a completely “safe asset” was actually subject to the whim of the current US administration. Period. That made gold a lot more attractive, as it’s no one else’s liability.

Switching to silver…

All the research I do on silver suggests the market deficits of the last three years will continue well into the future. Those deficits, so far, have been met by inventories from what I call the “secondary supply” market, which includes large futures exchanges and silver-backed ETFs. Large consumers of silver have simply had to buy long futures contracts and request delivery on maturity or buy silver ETF units in quantity and redeem them for the physical silver. But both of these sources have seen their inventories drained considerably over the last 2-3 years. I think the market will soon get a shocking wake up call when this “secondary supply” runs dry.

And with the soaring use of silver in solar, electronics, EVs, and medicine, silver is quickly becoming a critical mineral. So it’s great to see a major initiative underway to get Canada to recognize silver in that context.

Jillian Lennartz, who is First Majestic’s Director of ESG, crafted a 22-page research paper demonstrating silver’s role as a critical mineral given Canada’s energy transition and silver’s considerably restricted supply. She also drafted a detailed letter, signed by 20 silver industry executives, making the case that deeming silver to be a critical mineral would place Canada as a preferred supplier for strategic allied nations. You can read more about that

here.

The letter was sent to Canadian Minister of Energy and Natural Resources, Jonathan Wilkinson. The research paper was also sent to Natural Resources Canada to make the industry’s case for silver as a critical mineral. Similar efforts are underway in the US with its Department of Energy to review and consider the approach in assessing silver as a critical mineral. The US Geological Survey said they are considering all minerals for their 2025 list.

This is a significant effort which, if successful, could do wonders for the silver mining industry, perhaps akin to recent developments in the uranium sector.

And there’s one more big piece of great news I’d be remiss if I skipped. It turns out that the egregious mining law reforms that Mexico’s President and his government tried to “fast-track” (without proper procedure) were recently overturned by the country’s supreme court as unconstitutional. It’s early days, and maybe a little soon to declare victory, but it does appear to reestablish Mexico as an attractive destination for foreign investment.

Meanwhile in Turkey…

|

|

MORE or "UNCATEGORIZED"

NEVADA KING INTERCEPTS 3.95 G/T AU OVER 106.7 METRES INCLUDING 9.39 G/T AU OVER 38.4M AND 2.29 G/T AU OVER 123.5M INCLUDING 5.24 G/T AU OVER 35.1M AT ATLANTA

Nevada King Gold Corp. (TSX-V: NKG) (OTC: NKGFF) is pleased to a... READ MORE

OUTCROP SILVER REPORTS ADDITIONAL DRILL RESULTS FROM THE JIMENEZ TARGET AT SANTA ANA

Outcrop Silver & Gold Corporation (TSX-V: OCG) (OTCQX: OCGSF)... READ MORE

MAG Announces Third Quarter 2024 Production from Juanicipio

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) reports productio... READ MORE

Nova Drills 29m @ 7.1 g/t Au from Surface at RPM in Advance of Resource Update

Nova Minerals Limited (NASDAQ: NVA) (ASX: NVA) (FRA: QM3) is plea... READ MORE

Thesis Gold Drills 8.00 Metres of 11.39 Grams per Tonne Gold Equivalent

Thesis Gold Inc. (TSX-V: TAU) (WKN: A3EP87) (OTCQX: THSGF) is ple... READ MORE