Peter Krauth – “Past is Prologue: The Silver Roadmap”

It’s at times like these, when the silver markets continue to struggle for what seems like endlessly, that we need to review and set our sights on the bigger picture.

I’ve had the opportunity and benefit of discussing with a number of subscribers and investors at both the Metals Investor Forum (Vancouver), and the Silver Symposium (Las Vegas) over the last few weeks. (In fact, you can watch my recent presentation at the Metals Investor Forum here: The Silver Roadmap. I lay out my expectations for the next 12-18 months, along with the main silver drivers and outlook.) It’s also your free article for this week.

Meeting with silver investors really is invaluable for insights on how they are thinking and acting. Are they impatient? Yes. Are they frustrated? Yes. Do most of them get the concept that the precious metals investment arena is a long game which ultimately delivers the biggest rewards to the best informed and most patient participants? Definitely yes.

That’s very encouraging. Because after all, the bigger picture has not changed, except to become even more supportive of precious metals’ outlook.

Ayn Rand, the author of Atlas Shrugged, was fond of repeating in that work the phrase “check your premises”. Rand wanted the reader to realize they should continuously re-evaluate their conclusions to consider any new information.

Sometimes new developments are enough to shake people’s belief that the ultimate outcome has changed. Often, all they do is delay that outcome.

I think that’s what we’re witnessing now.

With precious metals struggling over the past month or so, I’ve been getting a lot of questions about where we actually are in this silver bull market. I get it. It’s easy to lose patience and lose sight of the ultimate prize: the culmination of the long term bull market, where silver reaches heights few of us can imagine today.

So, let’s check our premises.

Inflation rates are high, with both the CPI (headline inflation) and the PCE (Personal Consumption Expenditure) the Fed claims as its favoured index, close to 4%, which is nearly double the Fed’s 2% target. Fed rate hikes are likely to lead to recession and/or break something in the economy. That will almost certainly trigger rate cuts, which will cause real rates (rate of interest minus inflation) to compress. When that happens (or maybe even before as precious metals tend to sniff these things our in advance) I believe it will be the firing shot that launches the next significant rally.

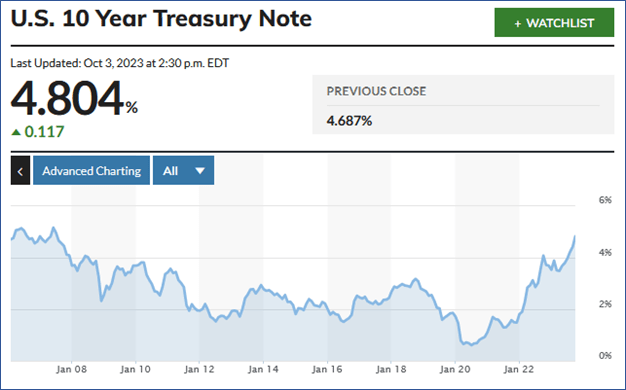

But right now it’s all about bond yields and the dollar. This is causing serious market stresses and dislocations. The S&P 500 is down nearly 8% since July. Bond yields have been screaming higher, lately thanks to another strong jobs report, boosting the case for the next rate hike. This is tough on stocks which compete for investment dollars.

US Money Market funds have reached a new record of $6 trillion in assets. This could cause more market pain, which might lead investors to reverse and start buying oversold bonds. The US 10 year treasury is yielding 4.8%, last seen 16 years ago in 2007.

Consider that Black Monday, back in 1987, the Dow crashed 22.6% in a single day. I remember it well. I was doing my undergrad at university, and my marketing professor gave us the news. It was quite chilling. While there’s no consensus, most people believe that a continuous rally in interest rates triggered that dramatic selloff. Sound familiar?

Remember, rising rates means bond investors are forecasting higher rates, which means they expect inflation to stay high, so they demand a better yield on those bonds maturing well into the future. That’s especially tough on stocks. If we get anything close to the action back in October 1987, I’d look for the Fed to immediately signal it was standing ready to provide liquidity to markets. Would that be enough? Maybe not. Maybe we’d get a rate cut and talk it was standing ready to do more.

Silver’s recent stark selloff is a reminder that markets can become and stay irrational for long periods. Silver is now down 19% since peaking at $26 back in May. That’s close to a bear market.

This month, I explore how on a technical basis silver and silver stocks are looking quite oversold, and potentially due to rally strongly soon. I also look at the US dollar index, which has been soaring. It reminds me of the Dollar Milkshake Theory, put forward by Brent Johnson of Santiago Capital. Johnson suggests that when times get tough, and the Fed is hiking rates, the dollar will strengthen as it gains appeal as a safe haven. This seems to be happening now.

Given silver’s weakness, in this issue I examine in detail how silver has acted in the last two lengthy bull markets of the 1970s and 2000s. Then, I do a deep dive review of one of the most robust, highest grade silver miners on the planet. Its revenues are 85% precious metal, with 75% from silver. That’s followed by the Silver Stock Portfolio and company updates.

In my book, The Great Silver Bull, I detail the predicament the Fed and other central banks face with sticky high inflation and their inability to fight it without crashing the economy. That helps me to make the case for silver as a generational investment opportunity over the next several years. The book is an easy synopsis read on this outlook.

It also details how to build a silver investment portfolio and explains what role junior miners/explorers can play.

If you haven’t picked up a copy yet, it’s easy, and it’s now also available in audiobook format!

CLICK HERE to order The Great Silver Bull

The Silver Road Map

In my book The Great Silver Bull, I examine how silver has behaved in previous bull markets.

I outlined in this month’s intro how there are a number of forces acting right now that contribute to silver’s volatility and weakness.

With this in mind let’s review and analyze silver’s two previous bull markets to glean some clues on how it’s acted, and what may still lie ahead.

I think the single best analog we have for a silver bull market was its dramatic run in the 1970s. It quite clearly ran from 1971 until 1980. There were a few impressive rallies that took place in the 80s and 90s, but they were relatively short lived, and I wouldn’t consider them to be true bull markets.

Then in 2001 silver embarked on a major bull run which peaked in 2011. Few people agree on whether that was a self-contained bull market or part of something larger. I’m in the latter camp. I think that was simply the first half of a secular bull. In my view the period between 2011 and late 2015, when silver bottomed near $14 was the mid-bull correction period which is typical of secular bull markets.

According to legendary commodities trader/investor Jim Rogers, most secular bull markets run through a period, usually about half-ways on the time scale, where the commodity’s price falls by about 50%, sometimes more. It’s true that silver did reach even lower, to $12 in early 2020 during the COVID-19 pandemic panic. But that was very short-lived, and was still 3 times the 2001 $4.14 low.

That suggests to me that we are still in the same secular bull market that began in 2001. If that’s correct, it would put us about 22 years into this bull market. I believe it could well have another 5-7 years (or more) ahead, which would make this an exceptionally long secular bull. But given the massive money-printing and huge underinvestment in mining capital expenditures, not to mention the extreme demands for resources from the energy transition, I think a massive commodities bull market lies ahead.

Now let’s analyze the 1970s and the 2000s bull markets in more detail.

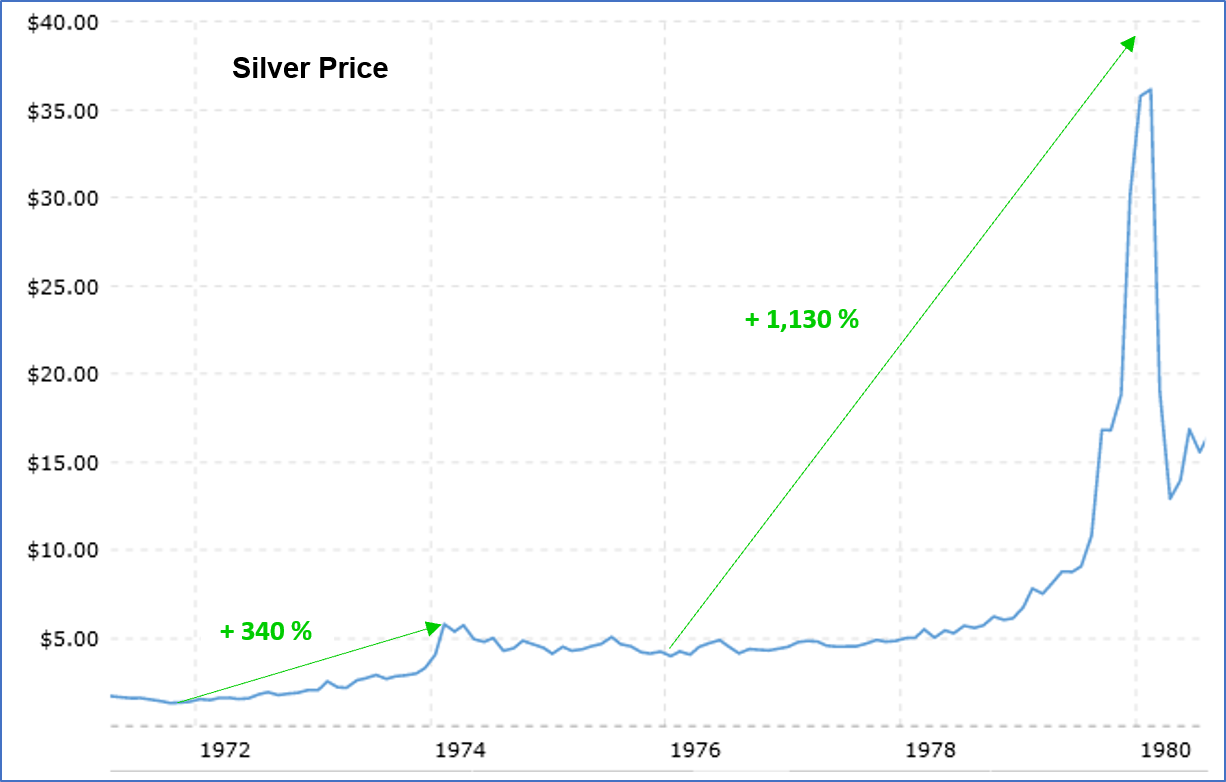

In the 1970s silver rose from a low near $1.40 in 1971 to peak at $49 in 1980. That produced a whopping 36 times return, or 3,600%. Every $1,000 became $36,000.

Then, silver eventually bottomed in 2001 at $4.20, before rising all the way back to $49 in 2011. Investors who had positioned themselves early enjoyed a 1,160% return.

Let’s dissect both of these bull markets in more detail, because understanding how they behave can help you better prepare. As you’ll see, silver is volatile. But if you want to benefit from its big gains, you have to be willing to hold on through what is sometimes a wild ride.

1970’s Silver Bull

As I said, silver bottomed near $1.31 in October 1971. That’s when its 1970s secular bull market began.

It then peaked at $5.78 in February 1974. That was a 340% gain in less than 3½ years. But then silver started to lose ground.

That correction took it from $5.78 to $3.97 in January 1976. It was a relatively shallow, but drawn-out correction. By October 1978 silver had surpassed $5.78, and eventually went onto a blow off mania high near $49 in January 1980, gaining 1,130% from its 1976 low. (Note that the $49 high in 1980 doesn’t appear in this chart because it shows monthly prices).

Silver’s gain from the 1971 low of $1.31 to its $49, 1980 high was an astounding 3,640%.

Two decades later, it would do something similar…again.

2000’s Silver Bull

In November 2001, silver bottomed at $4.14. No one was paying attention, and no one wanted it. Silver was the perfect contrarian trade. It then launched into a new bull market, rising to $19.89 by February 2008, producing a 380% gain.

Silver then corrected from $19.89 to $9.73 in October 2008, putting in a relatively short but sharp 50% correction. It then went on to climb all the way to $49, reaching that level in April 2011, for a 403% gain from its 2008 low.

But during its decade-long run that started in 2001 up to its peak in 2011, silver gained 1,080%. That’s a tenfold gain.

I think the current secular silver bull market will outpace that of the 1970s. Expect volatility ahead. But it’s only by being invested that you can participate. Patience will be rewarded.

Courtesy Of The Silver Stock Investor

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE