Peter Krauth – “Launching Coverage of Skeena Gold + Silver”

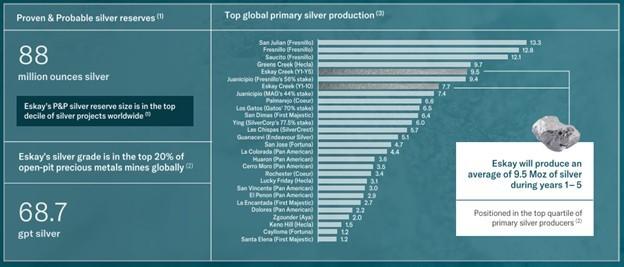

Skeena’s Eskay Creek Mine will produce 9.5Moz silver annually in the first 5 years – in the top 10% of silver projects globally!

We have some really big silver and gold production on tap…

Skeena Gold & Silver (TSX:SKE; NYSE:SKE) is a leading precious metals developer that is focused on advancing the Eskay Creek Gold-Silver Project – a past producing mine located in the renowned Golden Triangle in British Columbia, Canada. Eskay Creek will be one of the highest-grade and lowest cost open-pit precious metals mines in the world, with substantial silver by-product production that surpasses many primary silver mines.

People

Walter Coles is Executive Chair, having served as president of several Toronto Venture Stock Exchange listed junior mining exploration and development companies. Randy Reichert is President, CEO and Director. He was VP Operations at B2B Gold and helped build the Fekola mine, and previously worked at Cominco, including their Snip Mine. That was followed by a stint at Bema Gold and other junior companies. He’s led construction or development projects around the globe and has spent 40 years in operations. Craig Parry is a Director, who has been CEO, President and Chair for several Australian and Toronto Venture Stock Exchange listed mining companies. He is co-founder and director of NexGen Energy and is currently chair of Vizsla Silver Corp.

The Project

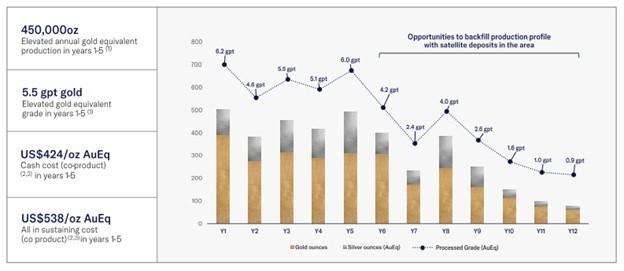

Skeena is an advanced development company. A Definitive Feasibility Study was completed in November 2023 on their Eskay Creek Project, which showcased many tier 1 attributes for a world class gold and silver project. It holds high-grade, pit-constrained reserves of 4.6Moz of gold equivalent ounces, 80% of which are in the proven category. The mine plan is front loaded and will produce an average of 450,000 oz gold equivalent metal per year in years 1-5, supported by a grade profile of 5.5 gpt, which is triple the global open pit average. The mine life is 12 years and will average of 228,000 gold ounces and an impressive 6.6 million silver ounces annually.

This project is so robust, it boasts a Net Present Value (NPV) of $1.6 billion, the payback is just 1.6 years, and the Internal Rate of Return (IRR) is a solid 37%, but that’s at $1,600 gold and $21 silver. If we instead use higher gold prices around $2,630 and silver at $30, the payback is just 0.8 years, the IRR jumps to 62%, and the NPV is a superb $3.6 billion. Eskay Creek will generate an outstanding $726 million annually, after-tax, in the first five years.

As this infochart shows, the production profile is front loaded, which explains the rapid payback period.

But because there are additional satellite deposits such as Snip, there’s potential for these to be tapped to backfill and maximize the 2nd half of the mine’s production life.

Overall, we’re talking high-grade precious metals…

But here’s what has me particularly excited. Proven and probable silver reserves are a whopping 88Moz. That’s in the top 10% of silver projects globally, and grades of 68.7 g/t silver puts this in the top 20% of open pit precious metals mines worldwide. The mine will produce a significant 9.5Moz silver annually over the first 5 years, placing it in the top quartile of primary silver producers.

Eskay Creek benefits from having a low Capex/NPV ratio. This means that, when you compare the project’s value to the cost to build it, it’s actually the most valuable mining project globally.

Corporate Structure

Skeena is owned by a lot of smart money, with more than 70% of outstanding shares in the hands of large funds like BlackRock, Van Eck, Franklin Resources, and T. Rowe Price. Retail investors own 28% and insiders own the balance of 2%. There are only 114million shares outstanding, and 122 million fully diluted. The market cap is about CAD$1.5 billion. Skeena has drawn down on a $45 million gold stream tranche in addition to a recent bought deal, so the company is well financed, and will continue to draw down on the gold stream for a total of $200 million in 2025 to fund development activities.

That’s a solid war chest to help push forward through permitting and construction.

Catalysts

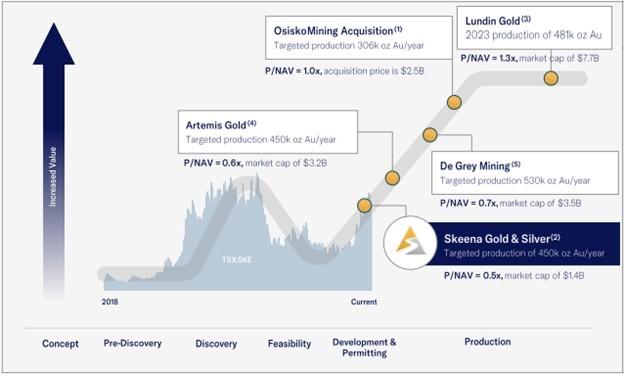

I especially like Skeena because the market hasn’t fully recognized its significant potential to be re-rated. Since Skeena is in the pre-development phase, its shares are being discounted compared to peers that are closer to production. At spot prices, the company is valued at 0.4x P/NAV which provides a very compelling investment opportunity as the company is anticipating initial production in 2027.

There are a number of catalysts that can help propel Skeena’s shares higher. The project boasts significant quantities of essential metals like antimony, zinc, lead and a bit of copper which aren’t included in the current economics, potentially boosting concentrate payabilities and the total NPV by as much as $1 billion. As an interesting sidenote, China recently banned exports to the US of critical minerals, including antimony. Consider that China produces half the world’s antimony, which is used in weaponry, and the US is completely reliant on imports. A North American source of the metal could command premium prices.

This is about as bullish a profile for a silver-gold developer that you could want. Location, grade, infrastructure, financing, low-capex, high-return, and tons of brownfields and greenfields exploration upside. I think we could see SKE shares gain 50% over the next 12 months.

We are officially adding Skeena Gold & Silver to the portfolio and will cover major developments going forward. They support the site financially, which allows us to bring free newsletter-quality analysis of stocks we personally own. Please do your own due diligence.

Courtesy of the Silver Stock Investor

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE