Peter Krauth – “Inflation is Sticky”

Inflation remains high, central banks remain hawkish, the US dollar is rallying, and bond yields keep rising.

These are some hefty headwinds for silver, and gold.

And as much as they need to be considered, I don’t expect all of these to be sustained, and I don’t see them as enough to kill the precious metals bull market.

I’ve been saying for some time that silver will eventually be considered a critical metal. I’ve also been saying I expect a wave of mergers and acquisitions in the silver space.

In the February mid-month issue I mentioned how Newmont Mining was bidding on acquiring Newcrest. And I also highlighted that B2gold was acquiring Sabina Gold & Silver. More recently, Integra Resources and Millennial Precious Metals are to consummate a friendly merger. That’s interesting, but it’s still involves transactions between mining companies.

Now we’ve got news that automaker Stellantis (NYSE:STLA), a $56B behemoth that builds and sells Chrysler, Dodge, Fiat, Jeep, Maserati and a host of other brand name vehicles is investing $155M in McEwen Mining (TSX:MUX). The prize is McEwen’s Los Azules copper project in Argentina. That gives Stellantis 14.2% of McEwen, and helps secure access to copper. Los Azules will supply 100,000 tons of copper cathode per year starting in 2027. That comes on the heels of Stellantis making deals to secure raw materials for electric batteries.

Meanwhile, rumours abound that Tesla is mulling the acquisition of Sigma Lithium (TSX-V:SGML) as it scrambles to secure its own critical resources.

It believe it’s only a matter of time before we see something similar in the silver space. Numerous technology companies already have offtake deals with silver producers to ensure a reliable supply. But I’m talking about something bigger, like the Stellantis or the Tesla deals.

Silver is critical to solar panels, electronics, and medical applications, to name a few. Last year the silver market experienced a deficit of over 250m ounces, representing a stunning 20% of global supply from mining and recycling. The Silver Institute expects such deficits to persist for years.

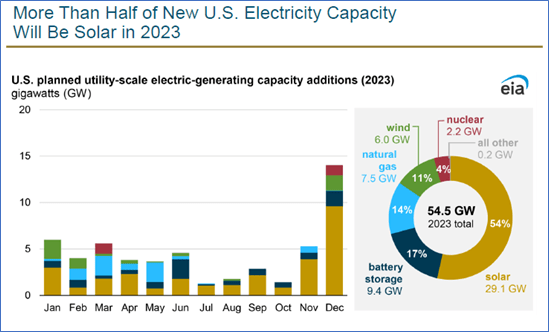

Silver’s single biggest industrial use is in the solar panel industry. In the US it’s expected that more than 50% of utility-scale electric-generating capacity additions will be from solar this year alone.

Source: US EIA

Chinese photovoltaic module production was up 8.6% in January (over December) at 29.1 GW, and is expected to surpass 30 GW in February. Heraeus Precious Metals (a major refiner) expects overall productivity to rise later this year as labour recovers from pandemic lockdowns in China. Capacity growth in the PV supply chain last year, boosted by expansion this year, suggests very strong demand for silver paste in solar panels. Even with the risks of recession, Heraeus sees silver PV demand to reach a record high this year, surpassing last year’s record ~150Moz.

With all this in mind, I’d be the last one surprised if a major manufacturer of solar panels or electronics decided to make sizeable investment in a silver miner, or even an outright takeover, in order to secure critical silver supply. And that could well kick off a feeding frenzy like haven’t seen before.

The best we can do meanwhile is to seek out and invest in the best prospects the market offers us. Right now, with sentiment weighing on the whole silver space, opportunities abound as majors, mid-tiers, and juniors are oversold.

As I write, my latest addition to the portfolio from early February, is up an impressive 55% in just 3 and a half weeks, on superb first-pass very high-grade silver intercepts over long intervals. This is one example where the market is grasping the true potential of their main project, located in a top jurisdiction to boot. It also suggests that quality projects don’t need rising silver prices to charge ahead, as the optionality gets priced in. Another holding reported an astoundingly long copper intercept, one of the longest of any such project in North America over last few years. Its shares jumped 33% that day alone!

I’ve been tracking these drivers for years, and I cover all these topics in my recent book, The Great Silver Bull.

If you haven’t picked up a copy yet, it’s easy, and it’s now also available in audiobook format!

CLICK HERE to order The Great Silver Bull

I expect the headwinds caused by a rallying dollar and rising interest rates to be short-lived. Sentiment is weak, as silver also faces competition from higher bond yields.

Remember, it’s these same forces of higher rates in the coming months that will up the odds of a recession, and increase its intensity. And that will ultimately cause the Fed to lower rates and the government to spend to stimulate. All of this will be great for precious metals.

The fundamental setup of a supply crunch in the face of extremely robust demand is difficult to overstate.

Contrarians buy when their favorite investments are on sale. Layering in during periods of weakness tends to pay off for patient investors. Now looks like one of those periods to be bold.

MORE or "UNCATEGORIZED"

First Phosphate Intersects 92.5 m of 11.82% Igneous Phosphate Starting at Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

Kuya Silver Provides Update on Mine Start-up and Uncovers New Major Silver-Mineralized Vein Zone South of the Bethania Mine, Peru

Kuya Targeting Commencement of Production at Bethania in H1 2024 ... READ MORE

Silvercorp Reports Operational Results and Financial Results Release Date for Fiscal 2024, and Issues Fiscal 2025 Production, Cash Costs, and Capital Expenditure Guidance

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) reports pr... READ MORE

Lithium Ionic Expands Newly Discovered Zone at Salinas; Drills 1.53% Li2O over 15m, incl. 2.31% Li2O over 8m; 1.15% Li2O over 19m, incl. 1.67% Li2O over 10m, and 1.32% Li2O over 14m

Excellent follow-up drill results from high-grade discovery holes... READ MORE

Solaris Reports First Drilling Results from 2024 Program and Exploration Update, Including 150m of 0.67% CuEq within 384m of 0.51% CuEq and 284m of 0.53% CuEq from Near Surface

Solaris Resources Inc. (TSX: SLS) (NYSE: SLSR) is pleased to repo... READ MORE