PAN GLOBAL INTERCEPTS 1.5% COPPER OVER 8m AT LA ROMANA TARGET AND DISCOVERS COPPER-TIN-SILVER AT LA PANTOJA TARGET, SOUTHERN SPAIN

![]()

- Drill results confirm strong VMS-style mineralization at La Romana continues northwest and remains open on strike and at depth, including 1.51% copper, 0.02% tin and 3.6 g/t silver over 8m

- Initial drilling at La Pantoja target highlights new zone of copper-tin mineralization beneath La Romana, including copper assays up to 5.36%

- Drilling underway at the Bravo target 1km east of La Romana, and the Providencia target in the Cármenes Project, northern Spain

Pan Global Resources Inc. (TSX-V: PGZ) (OTCQB: PGZFF) (FRA: 2EU) is pleased to announce positive results for three additional step-out drillholes at the La Romana target, and three initial drill results at the La Pantoja target west of La Romana, in the Company’s 100%-owned Escacena Project in the Iberian Pyrite Belt, southern Spain.

La Romana drill highlights

- Drillhole LRD186 – northwest step out, open at depth

- 8.0m at 1.57% CuEq1 (1.51% Cu, 0.02% Sn, 3.6 g/t Ag) from 123m, including

- 3.0m at 3.35% CuEq1 (3.20% Cu, 0.04% Sn, 7.8 g/t Ag)

- 8.0m at 1.57% CuEq1 (1.51% Cu, 0.02% Sn, 3.6 g/t Ag) from 123m, including

- Drillhole LRD184 – near-surface, up-dip extension

- 16.0m at 0.65% CuEq1 (0.53% Cu, 0.04% Sn, 2.2 g/t Ag) from 44m, including

- 8.0m at 1.08% CuEq1 (0.92% Cu, 0.05% Sn, 3.8 g/t Ag)

- 3.0m at 2.06% CuEq1 (1.88% Cu, 0.05% Sn, 8.5 g/t Ag)

- 2.0m at 1.16% CuEq1 (1.12% Cu, 138m

- 16.0m at 0.65% CuEq1 (0.53% Cu, 0.04% Sn, 2.2 g/t Ag) from 44m, including

- Drillhole LRD185 – down-dip extension, open at depth

- 5.0m at 0.66% CuEq1 (0.63% Cu, 0.01% Sn, 2.0 g/t Ag) from 133m, and

- 9.0m at 0.69% CuEq1 (0.55% Cu, 0.05% Sn, 1.7 g/t Ag) from 180m, including

- 3m at 1.13% CuEq1 (0.91% Cu, 0.08% Sn, 2.6 g/t Ag)

La Pantoja drill highlights

- Drillhole LPD01

- 1.35m at 1.83% CuEq1 (1.80% Cu, 76.75m, and

- 3.0m at 1.70% CuEq1 (1.53% Cu, 0.05% Sn, 3.9 g/t Ag) from 97m

- Wide tin anomalous zone, 22.0m at 0.05% Sn from 116m, including

- 6.0m at 0.11% Sn

- Drillhole LPD03

- 1.0m at 5.42% CuEq1 (5.36% Cu, 117m

“The first results from the 2025 multi-target Escacena drill program confirm that the higher-grade copper-tin corridor at La Romana remains open to the northwest with the mineralized trend now extending over 1.7km east-west. New downhole electro-magnetic geophysics (DHEM) indicates excellent potential to expand the higher-grade zone at depth at La Romana. We are also pleased to report that a similar style of mineralization has been intersected in the maiden drill program at the La Pantoja target to the west of La Romana,” said Tim Moody, Pan Global President and CEO.

“The early results at La Pantoja confirm a new zone of copper-tin mineralization stratigraphically beneath La Romana, providing further confirmation of the potential for additional discoveries at the Escacena Project. La Pantoja is a large-scale target with compelling geophysical indicators of stronger mineralization at depth. We look forward to advancing this target with further drilling.”

Drilling continues at the flagship Escacena Project in southern Spain, with the focus on the high-priority Bravo target east of La Romana where wet weather initially hampered access, and at the Providencia target in the Cármenes Project in northern Spain. Additional drill results will be announced over the coming weeks.

Key points about the new results:

La Romana

- Step-out drilling was focused on testing the western extent of the near-surface higher-grade copper mineralization

- Drillhole LRD186 with 8.0m at 1.5% Cu confirms the continuity of the La Romana target extending the higher-grade zone 50m, and remains wide-open at depth to the northwest

- Excellent potential to extend the higher-grade zone coincident with an untested downhole electro-magnetic anomaly (190m x 70m) projecting down-dip from drillhole LRD186

- Two additional wide-spaced step-out drillholes (LRD 187 and LRD188) indicate the mineralized trend at La Romana extends a further 300m to the west, with more than a 1.7 km strike-length overall

- Assay results are pending for two westernmost drillholes at La Romana (LRD187 and LRD188), and DHEM is in-progress in hole LRD188

- Additional step-out drillholes are planned, aiming to add to a maiden resource

La Pantoja

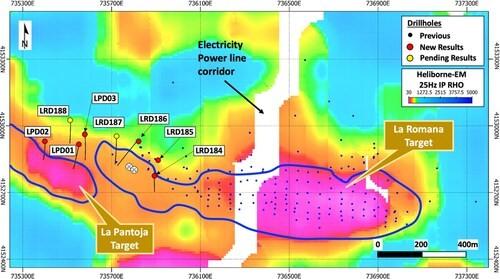

- Large geophysical target located west of La Romana, with a 500m NW-SE orientation, and extending to over 600m depth

- Geophysical indicators (Heliborne-EM and IP) at La Pantoja are analogous to those at La Romana with coincident copper-tin-silver mineralization

- Initial drilling in the upper part of the target confirms copper-tin mineralization and extensive related mineral alteration at stratigraphic levels beneath La Romana

- Heliborne EM and new DHEM survey results suggest stronger mineralization exists laterally and at depth

- Results suggest additional untested mineral potential beneath La Romana, at depths below current drilling

Table 1 –Selected Drill Results from La Romana (LRD184 to LRD186) and La Pantoja (LPD01 to LPD03)

| Drillhole | From | To | Interval | CuEq1 | Cu | Sn | Ag | Pb | Zn | True Thickness |

| m | m | m | % | % | % | g/t | ppm | ppm | (m) | |

| LRD184 | 44.00 | 60.00 | 16.00 | 0.65 | 0.53 | 0.04 | 2.2 | 16 | 87 | 15.2 |

| including | 52.00 | 60.00 | 8.00 | 1.08 | 0.92 | 0.05 | 3.8 | 28 | 114 | 7.6 |

| including | 57.00 | 60.00 | 3.00 | 2.06 | 1.88 | 0.05 | 8.5 | 67 | 183 | 2.9 |

| and | 138.00 | 140.00 | 2.00 | 1.16 | 1.12 | <0.01 | 3.0 | 47 | 107 | 1.9 |

| LRD185 | 133.00 | 138.00 | 5.00 | 0.66 | 0.63 | 0.01 | 2.0 | 155 | 409 | 2.1 |

| including | 133.00 | 134.00 | 1.00 | 1.38 | 1.31 | 0.02 | 4.5 | 255 | 1190 | 0.7 |

| and | 180.00 | 189.00 | 9.00 | 0.69 | 0.55 | 0.05 | 1.7 | 14 | 73 | 6.3 |

| including | 186.00 | 189.00 | 3.00 | 1.13 | 0.91 | 0.08 | 2.6 | 30 | 101 | 2.1 |

| LRD186 | 123.00 | 131.00 | 8.00 | 1.57 | 1.51 | 0.02 | 3.6 | 11 | 93 | 7.8 |

| including | 127.00 | 130.00 | 3.00 | 3.35 | 3.20 | 0.04 | 7.8 | 21 | 125 | 2.9 |

| including | 129.00 | 130.00 | 1.00 | 7.00 | 6.73 | 0.07 | 14.6 | 29 | 207 | 1.0 |

| and | 165.00 | 166.00 | 1.00 | 1.19 | 1.10 | 0.03 | 1.7 | 17 | 80 | 1.0 |

| and | 183.00 | 185.00 | 2.00 | 0.69 | 0.64 | 0.02 | 1.0 | 34 | 166 | 2.0 |

| and | 224.00 | 225.00 | 1.00 | 0.63 | 0.60 | <0.01 | 3.5 | 38 | 72 | 1.0 |

| LPD01 | 41.00 | 42.00 | 1.00 | 0.93 | 0.79 | 0.05 | 2.0 | 19 | 83 | 0.8 |

| and | 53.00 | 54.00 | 1.00 | 0.56 | 0.46 | 0.04 | 0.7 | 6 | 49 | 0.8 |

| and | 76.75 | 78.10 | 1.35 | 1.83 | 1.80 | <0.01 | 3.5 | 34 | 138 | 1.1 |

| and | 97.00 | 100.00 | 3.00 | 1.70 | 1.53 | 0.05 | 3.9 | 31 | 118 | 2.5 |

| including | 98.00 | 99.00 | 1.00 | 2.79 | 2.5 | 0.10 | 7.0 | 58 | 168 | 0.8 |

| and | 121.00 | 143.00 | 22.00 | 0.17 | 0.02 | 0.05 | 0.3 | 6 | 49 | 17.9 |

| including | 137.00 | 143,00 | 6.00 | 0.33 | 0.02 | 0.11 | 0.3 | 8 | 48 | 4.9 |

| LPD02 | 81.00 | 95.00 | 14.00 | 0.16 | 0.14 | 0.01 | <0.1 | 11 | 117 | 11.9 |

| LPD03 | 117.00 | 118.00 | 1.00 | 5.42 | 5.36 | <0.01 | 8.7 | 36 | 145 | 0.9 |

| 1 Copper Equivalent = CuEq. CuEq is calculated using Cu, Sn, and Ag grades. Metallurgical recoveries include 86% for Cu, 68% for Sn and 56% for Ag, based on preliminary studies performed by Wardell Armstrong International and MinePro. The CuEq calculation uses US$ 8,693/tonne Cu, US$ 29,069/tonne Sn and US$ 23.72/oz Ag, corresponding to the three-year monthly price averages to July 2023. The effective formula is [CuEq %] = [Cu %] + 2.6440 * [Sn %] + 0.0057 * [Ag ppm] |

Table 2 – Drillhole Collar Information

| Hole ID | Easting2 | Northing2 | Azimuth (º) | Dip (º) | Length (m) |

| LRD184 | 735892 | 4152780 | 180 | -60 | 152.40 |

| LRD185 | 735907 | 4152848 | 0 | -90 | 240.00 |

| LRD186 | 735819 | 4152936 | 220 | -50 | 229.50 |

| LPD01 | 735553 | 4152918 | 190 | -75 | 359.00 |

| LPD02 | 735400 | 4152930 | 180 | -70 | 239.25 |

| LPD03 | 735581 | 4152965 | 180 | -70 | 337.25 |

| 2 Coordinate system: UTM29N ERTS89 |

About the Escacena Project

The Escacena Project comprises a large, contiguous, 5,760-hectare land package controlled 100% by Pan Global in the east of the Iberian Pyrite Belt. Escacena is located near the operating mine at Riotinto and is immediately adjacent to the former Aznalcóllar and Los Frailes mines where Minera Los Frailes (Grupo México) is in the final permitting stage for mine development. The Escacena Project hosts Pan Global’s La Romana and La Pantoja copper-tin-silver discoveries and the Cañada Honda copper-gold discovery. Escacena hosts a number of other prospective targets, including Bravo, Barbacena, El Pozo, Romana Norte, San Pablo, Zarcita, Hornitos, La Jarosa, Romana Deep, and Cortijo.

About Pan Global Resources

Pan Global Resources Inc. is actively exploring for copper-rich mineral deposits along with gold and other metals. Copper has compelling supply-demand fundamentals and outlook for strong long-term prices as a critical metal for global electrification and energy transition. Gold is also attracting record prices.

The Company’s flagship Escacena Project is located in the prolific Iberian Pyrite Belt in southern Spain, where a favourable permitting track record, excellent infrastructure, mining and professional expertise, and support for copper as a Strategic Raw Material by the European Commission collectively define a tier-one low-risk jurisdiction for mining investment. The Company’s second project, at Cármenes, in northern Spain, is also an area with a long mining history and excellent infrastructure. The Pan Global team comprises proven talent in exploration, discovery, development, and mine operations – all of which are committed to operating safely and with utmost respect for the environment and our partnered communities. The Company is a member, and operates under the principles, of the United Nations Global Compact.

Qualified Persons

Álvaro Merino, Vice President Exploration for Pan Global Resources and a qualified person as defined by National Instrument 43-101, has approved the scientific and technical information for this media release. Mr. Merino is not independent of the Company.

QA/QC

Core size was HQ (63mm) and all samples were ½ core. Nominal sample size was 1m core length and ranged from 0.5 to 2m. Sample intervals were defined using geological contacts with the start and end of each sample physically marked on the core. Diamond blade core cutting and sampling was supervised at all times by Company staff. Duplicate samples of ¼ core were taken approximately every 30 samples and Certified Reference materials inserted every 25 samples in each batch.

Samples were delivered to ALS laboratory in Seville, Spain and assayed at the ALS laboratory in Ireland. All samples were crushed and split (method CRU-31, SPL22Y), and pulverized using (method PUL-31). Gold analysis was by 50gm fire assay with ICP finish (method Au-ICP22) and multi element analysis was undertaken using a 4-acid digest with ICP AES finish (method ME-ICP61). Over grade base metal results were assayed using a 4-acid digest ICP AES (method OG-62).

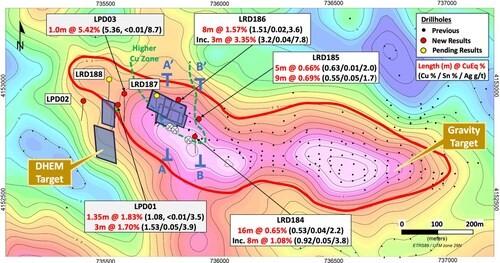

Figure 1 – La Romana gravity anomaly map showing locations of new drillholes LRD184 to LRD188, and LPD01 to LPD03, and cross-section locations A-A’ (Figure 2) and B-B’ (Figure 3) (CNW Group/Pan Global Resources Inc.)

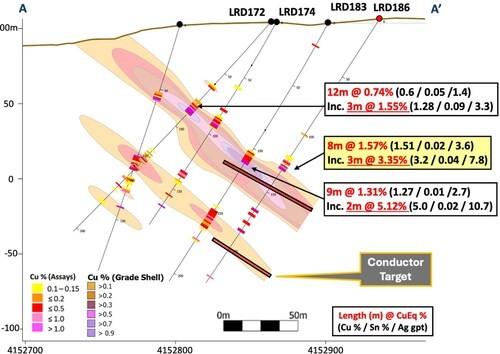

Figure 2 – La Romana Cross Section A – A’ highlighting new drillhole LRD186 (CNW Group/Pan Global Resources Inc.)

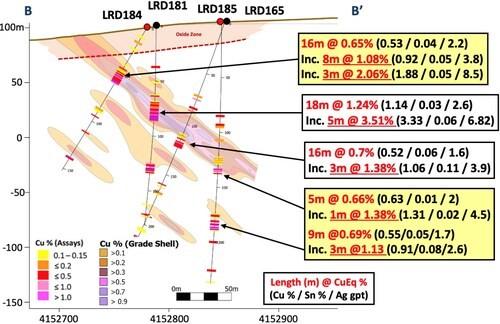

Figure 3 – La Romana Cross Section B – B’ highlighting new drillholes LRD184 and LRD185 (CNW Group/Pan Global Resources Inc.)

Figure 4 – Helicopter Electro-magnetic Resistivity anomaly map, showing the La Romana and La Pantoja targets, and drillhole locations (CNW Group/Pan Global Resources Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE