Palisade Research – Rise Gold Corp. (CSE: RISE, OTC:RYES) – Reactivating the Second Largest Gold Mine in America

Of the top ten gold mines currently operating in Canada and the United States, half of them are re-starts.

This means they were once smaller, producing mines that ran out of ore – only to be brought back to life by a breath of exploration.

These mines that were shuttered for various reasons, including: low prices, high costs, operational problems, and even labour disputes, are reactivated in better environments.

After all – no matter what happens in the world – the gold stays in the ground. . .

Detour Gold’s ‘Detour Lake’ is one example.

The project is the restart of the historic Detour Lake open pit/underground mine – which produced 1.8 million ounces of gold from 1983 to 1999. It was closed down due to ore depletion.

Detour Lake was re-activated in 2003 to re-assess the economic viability of the remaining resources within the mine and to consider further exploration.

The mine is now back in operation. It has a 23-year mine life with an average gold production of 656,000 ounces per year.

As the adage goes, “the best place to find a new mine is next to an old mine.”

But it really should be, “the best place to find a new mine is an old mine.”

I mention this because we believe Rise Gold Corp has the ultimate re-start cycle gold mine potential.

Their flagship, the Idaho-Maryland, was once the second largest producing gold mine in America – and it was only shut down because of World War 2.

Let’s take a better look. . .

The Idaho-Maryland Mine

(Idaho Maryland Mine, ca. 1894, Source: Company Website)

The Idaho-Maryland mine was a very profitable mine.

In fact, from 1937 to 1941, the all-in cost for mining averaged a mere $24 per ounce.

This was due to the outstanding continuity of mineralized veins. . .

For instance – a single vein produced one million ounces of gold at an average grade of 34 g/t – after dilution and recovery.

This vein, the Eureka vein, was mined from surface over a pitch length of 1.6 kilometers with strike lengths from 150 meters to 300 meters.

(Single Deck Cage, ca. 1939, Source: Company Website)

Metallurgical recovery ranged from 94-97%, with 65% of the gold recovered by gravity processes, and the remainder by flotation.

In 1940, the Idaho-Maryland mine reached production of 129,000 ounces gold per year. This made the Idaho-Maryland the second largest gold mine in the United States.

The goal was to increase production to 240,000 ounces per year. And a new headframe and hoist, crushing plant, and complete refit of the processing plant was completed before the US government shutdown the mine due to World War II.

Afterwards, the Idaho-Maryland mine was never the same. . .

Its innovative leader, Mr. MacBoyle, suffered a debilitating stroke in 1943, which caused infighting among the Board and Management.

The mine was restarted in 1946, but due to a lack of working capital – production was severely impacted.

The final blow happened with the sky rocketing post-war inflation.

Idaho-Maryland finally closed for good in 1954. . .

“The Best Place to Find a New Mine is an Old Mine”

Rise Gold Corp. believes that there is still a lot of gold left in Idaho-Maryland.

Just like Detour Lake did, Rise aims to re-evaluate the gold that was left un-mined in the existing works and to explore for further potential mineralization.

Rise Gold’s acquisition of the project also came with a comprehensive database of records, including thousands of documents and maps which show mine workings, production data, drill results, and assays.

Emgold Mining Corp., which previously owned Idaho-Maryland and held an option on the mine from 1991 to 2013, did not drill one single hole beneath the mine workings. But the company did complete an internal resource estimate (not 43-101 compliant), which states an M&I resource of 423,000 ounces gold at an average grade of 9.1 g/t, and an inferred of 898,000 ounces gold at an average grade of 12.7 g/t.

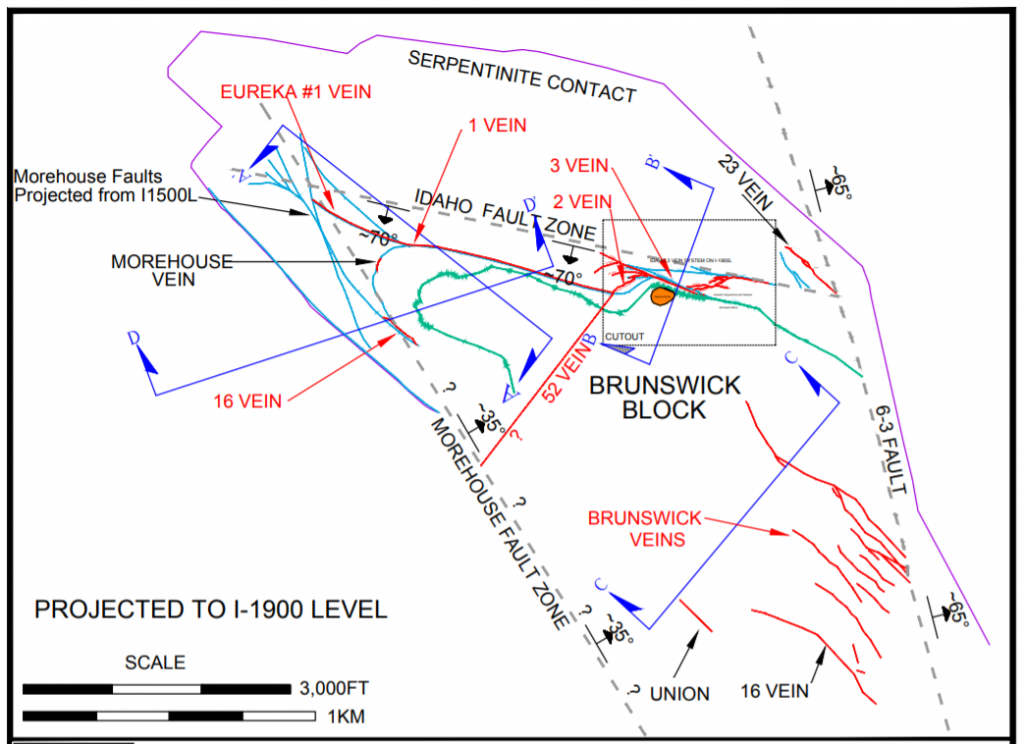

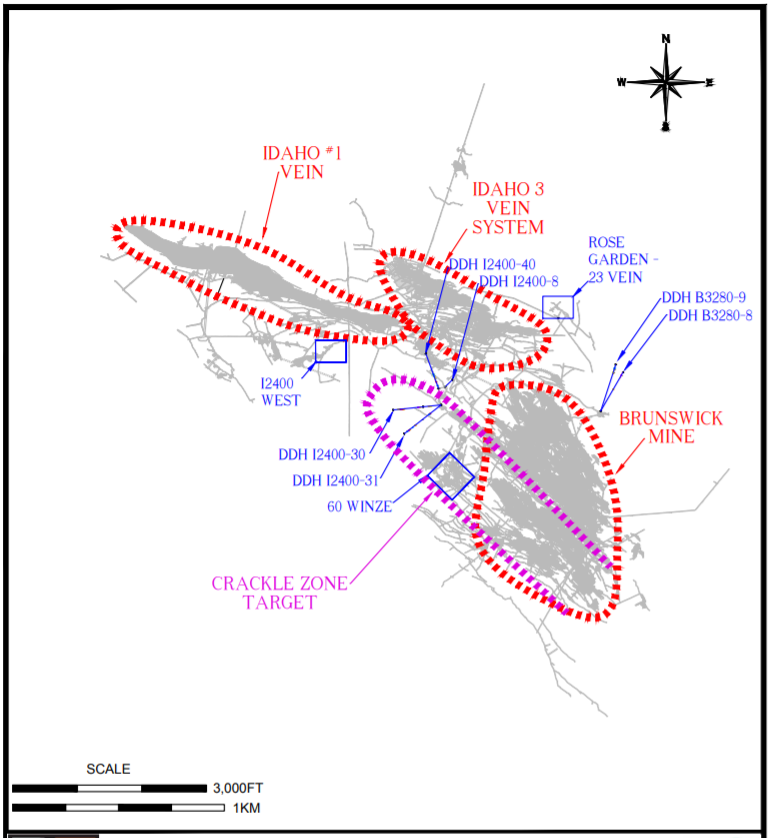

The Idaho-Maryland Mine is actually the consolidation of several early day producing mines – including Eureka, Idaho, Maryland, Brunswick, and Union Hill Mines.

In a recently filed 43-101 report for Idaho-Maryland, Rise outlines numerous exploration targets in untested ground below the mine workings. . .

Idaho No. 1 Vein

The ‘No. 1’ vein exploration target is an area below the current workings of the Idaho No. 1 vein. Stoping in the prolific No. 1 vein did not continue below the Idaho 1,500 level, and it appears that the mineralization pinches out below the Idaho 1,500 level.

Very little exploration and development took place at the No. 1 vein after the first mine closure in 1901. However, in 1953, a vein was located by drilling and development of the Idaho 2400 East. This continued until March 1954, just before the mine was closed.

At the time of shutdown, reports indicate that the vein and the adjacent diabase dike were well mineralized over a width of 9 meters.

3 Vein System

The Idaho ‘No. 3’ vein was mined over a vertical distance of 460 meters and an average horizontal strike length of 210 meters.

There were several important veins, which splayed from the main No. 3 Vein, forming the larger 3 Vein system. The most important of which were named the 5 Vein, 13 Vein and 22 Vein.

Similar to the Idaho No. 1 vein, the diabase dikes adjacent to the quartz veins were found to be mineralized in many areas. There were some areas in the 3 Vein system where highly mineralized diabase was mined in material volumes.

In addition to the down-dip potential of the 3 Vein system, there is potential for discovery of mineralization within the serpentinite unit – particularly ‘23 Vein’ or ‘Rose Garden’.

There are no historical exploration drill holes or mine workings which explore the area below the 23 Vein. However, on the 3,280 level, there are several promising historical mineralized drill intercepts in the general area below the Rose Garden, which may be related and indicative of exploration targets in the area.

Crackle Zone

The Crackle Zone exploration target is a conceptual target based on that mineralizing fluids responsible for the gold mineralization encountered at the Idaho-Maryland mine may have formed a zone of intense quartz veins and stockwork within the Brunswick block in response to the interaction of the Idaho, 6-3 and Morehouse faults.

The Crackle zone target lies beneath all historical development and drilling, but quartz vein and stockwork-hosted gold mineralization identified by drilling, development and mining of the 52 Vein and 60 winze area on the I2,700 level may represent portions or extensions of this target.

Brunswick Mine

The historical Brunswick mine offers many areas with potential for discovery of mineralization, particularly the extension of the Brunswick veins below the existing stopes and in an untested area in the immediate footwall of the 6-3 fault.

In the Brunswick mine, the richest mineralization was typically found near the 6-3 fault. Below the 1,600 level, development in the southern region of the Brunswick mine deviated to the west, away from the 6-3 fault, leaving a region of unexplored ground in the footwall adjacent to the fault 152 meter to 305-meter-thick, 305 meter to 610 meter wide and 305 meter to 914 meter downdip.

Rise Gold has a Market Cap of C$12 Million

Rise Gold has C$2.9 million in cash and is currently drilling – uncovering what potential is underneath them.

They’re drilling a series of widely-spaced holes to test a target area on the western side of the Idaho-Maryland deposit below the area where the historical operator ceased operations upon the mine’s shutdown in 1942 and 1955.

Each ‘mother hole’ will have an average length of 1,230 meters with numerous veins and stockwork zones to be tested starting from a drill hole depth of 930 meters to the end of the hole.

The first hole has already been released, DDH B-17-01 completed in November 2017, headlined by intercept of 62.7 g/t Au over 2.7 meters in the centre vein of the Brunswick No. 1 Vein set, at a depth of about 540 meters below surface.

The substantial gold values assayed from the drill hole are surprising – given the limited focus on the Brunswick No. 1 vein documented in historic records. . .

Assay data from the drill hole indicates that the highest gold grades in the composites are located in the wall rocks immediately adjacent to the quartz vein – rather than in the quartz veins themselves.

Rise Gold’s observation that the wall rocks of the quartz veins host high-grade gold could have major implications for the interpretation of the historic data from the mine. . .

In most cases, the historic operator reported drill-core and channel sample assay results for only intersections of quartz, and rarely conducted sampling of the adjacent material. If there are important gold values in the adjacent wall rock, the historic sampling would have greatly underreported the gold grades of the mineralized veins.

Rise Gold now plans to drill additional holes to follow-up B-17-01. These holes will target an area between the B1600 level and the B2300 level. Historical records report both levels on the B1 vein to be mineralized.

The company will also test several other Brunswick veins which are parallel to the B1 Vein.

The company expects to be drilling the Brunswick targets until approximately mid-June and then will move the drill to test the Idaho No. 1 Vein target.

Moving Forward

We are betting Idaho-Maryland will be the next prolific restart.

There are just over 30 mines in North America that produce over 100,000 ounces of gold per year.

That just tells you the kind of mine Idaho-Maryland was – and we believe there is a lot of gold left in the ground.

And even more undiscovered.

Using Rise’s historical resource of 1.3 million ounces of gold, the company currently trades at just $7/ounce. That’s 5x times cheaper than the average of their peers – this provides a great margin of safety for investors already.

This is a ground-floor bet with incredible upside. . .

MORE or "UNCATEGORIZED"

Greenridge Exploration Announces Letter of Intent to Acquire ALX Resources Corp.

Greenridge Exploration Inc. (CSE: GXP) (FRA: HW3) and ALX Resourc... READ MORE

Blue Star Reports Initial Assay Results for Massive Sulphide Discovery: 17.1 Metres of 0.973% Copper Equivalent

Blue Star Gold Corp. (TSX-V: BAU) (OTCQB: BAUFF) (FSE: 5WP0) prov... READ MORE

Premium Nickel Expands Deposit While Advancing Infill Drilling at Selebi North: Assays Include 26.35 Metres 4.31% CuEq OR 2.09% NiEq

“Ongoing underground drilling at Selebi North totaling appr... READ MORE

STLLR Gold Intersects 1.10 g/t Au over 74.00 m (Including 2.06 g/t Au over 29.60 m) at the Last Chance Zone at the Tower Gold Project

STLLR Gold Inc. (TSX: STLR) (OTCQX: STLRF) (FSE: O9D) announces a... READ MORE

Blue Sky Uranium Closes Fully-Subscribed Non-Brokered Private Placement

Blue Sky Uranium Corp. (TSX-V: BSK) (FSE: MAL2) (OTC: BKUCF) is p... READ MORE