OUTCROP SILVER INTERCEPTS 6.52 METRES OF 828 GRAMS SILVER EQUIVALENT PER TONNE AT THE AGUILAR DISCOVERY

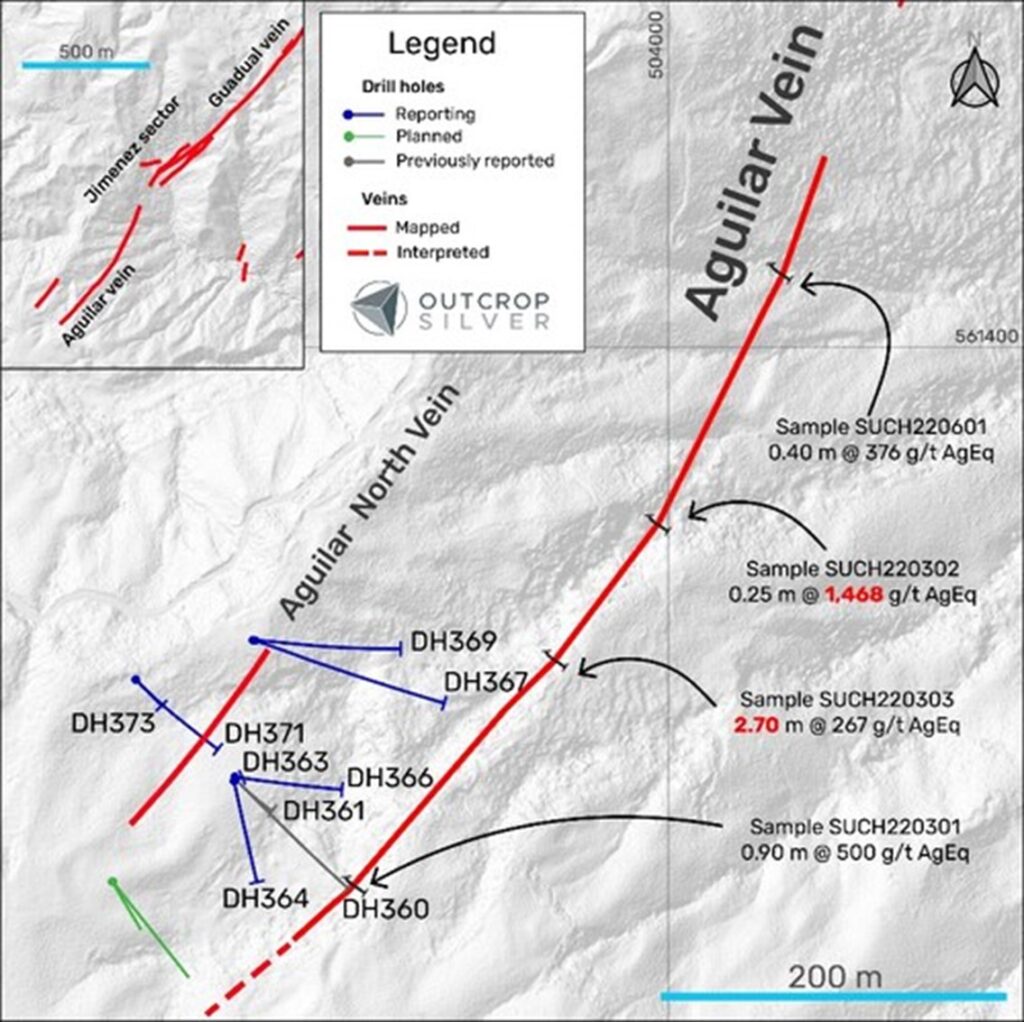

Outcrop Silver & Gold Corporation (TSX-V: OCG) (OTCQX: OCGSF) (DE: MRG) is pleased to announce additional drill results at the Aguilar vein discovery located 5 kilometres south of the existing resource along the 30 kilometre vein corridor. These recent drill holes at Aguilar have confirmed the continuity of high-grade silver along dip and revealed a new parallel blind vein, Aguilar-HW, with the potential of discovering additional veins. Outcrop Silver has two active drill rigs on site, focusing on drill testing the extensive inventory of exploration targets to expand the current resource. One rig is currently at Aguilar testing extension along strike and depth, while the other has begun testing the Guadual target, located 1.8 kilometres north of the Aguilar vein system (Figure 1).

HIGHLIGHTS

- DH369 intercepted 6.52 metres of 828 grams per tonne of silver equivalent, including 0.63 metres at 6,943 grams per tonne of silver equivalent

- DH371 intercepted 1.11 metres of 969 grams per tonne of silver equivalent and 0.31 metres of 3,741 grams per tonne of silver equivalent confirming the extension of Aguilar North at depth

- DH364 intercepted 1.63 metres of 717 grams per tonne of silver equivalent

- DH363 intercepted 1.04 metres of 1,218 grams per tonne of silver equivalent in a new blind discover, Aguilar-HW

“After confirming the existence of high grade further south with our current drilling campaign, we are excited with the recent holes that suggest more blind veins can be discovered,” explains Guillermo Hernandez, VP of Exploration. “Aguilar is demonstrating a robust vein system with many parallel veins, including splays that carry encouraging results. These types of complex vein systems are showing great potential for our drill campaign.”

The current drill campaign on the Aguilar vein aims to test the continuity of high grades that were identified through Outcrop Silver’s regional target generation program (see news release from May 09, 2022 and January 03, 2023). This surface exploration program traced the Aguilar vein system along more than 550 metres; as part of the Aguilar-Guadual vein zone, which extends for 1.8 kilometres (Figure 1). Geological mapping suggests higher-grade mineralization occurs at flexures within the dominant northeast trend of the veins with outcrops confirming the existence of high grade along the 550 metre long exposure (Figure 1 and Table 2). These flexures are interpreted to represent structural intersections between northerly trending faults and northwest-trending lineaments, which are currently being drill-tested.

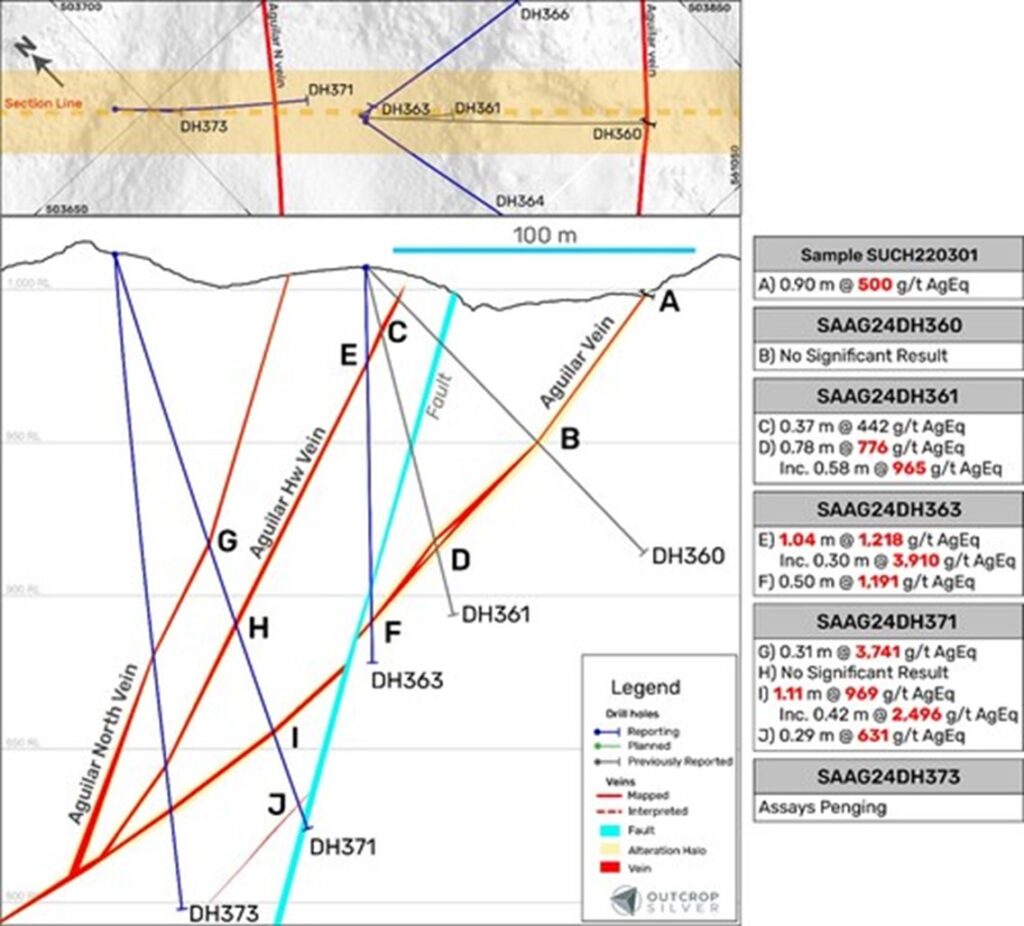

The initial drilling of the Aguilar vein tested the continuity at depth from outcrop channel samples (SUCH220301, SUCH220302, SUCH220303, and SUCH220301) with high-grade assays from the regional target generation program, such as 0.90 m @ 500 g/t AgEq (see news release from May 9, 2022), and 2.70 m @ 267 g/t AgEq (see news release from January 03, 2023). The Aguilar vein at depth has been confirmed through seven drill holes as a low-angle structure, generally dipping 55° to the West, and showing 5 to 10% total sulfide content with parallel secondary veins and splays (Figure 2).

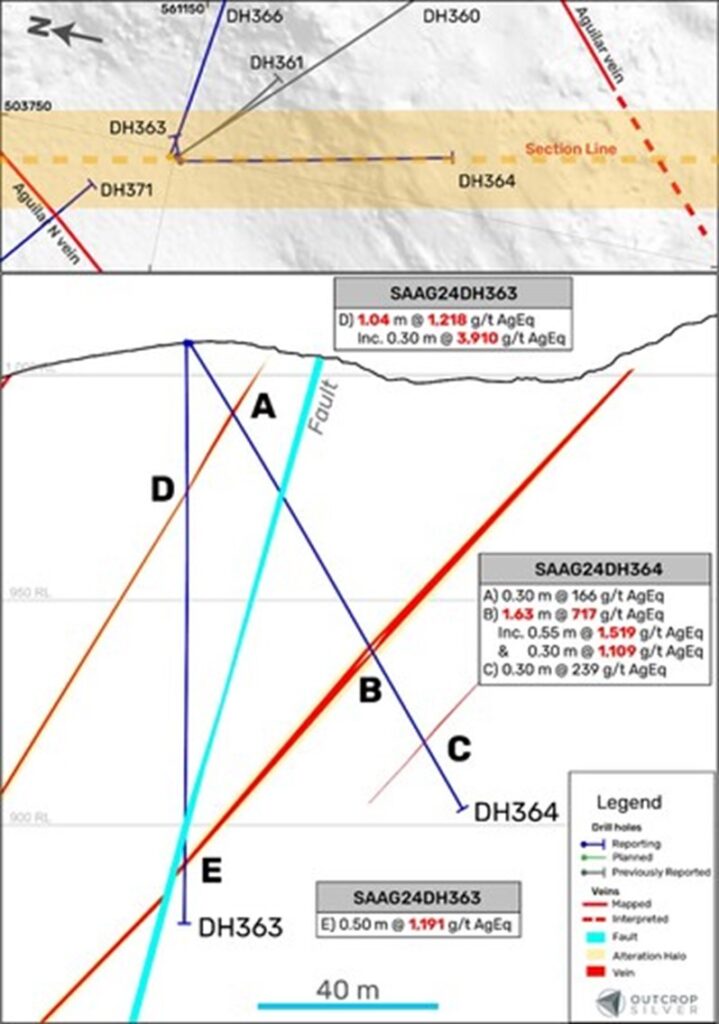

- DH363 intercepted 1.04 metres of quartz vein that assayed 8.57 grams per tonne of gold and 574 grams per tonne of silver, named as Aguilar-HW (Figure 2 and Table 1), while the Aguilar vein was intercepted at 0.50 m of 4.20 grams per tonne of gold and 876 grams per tonne of silver.

- DH364 intercepted 1.63 metres of 1.88 grams per tonne of gold and 576 grams per tonne of silver from the Aguilar vein towards the south (Figure 3 and Table 1).

Follow-up drilling focused on testing the lateral continuity of high-grade mineralization using the known sampled outcrops along the 550 metres of Aguilar vein exposure returned high-grade intercepts.

- DH369 intercepted 6.52 metres of 828 grams per tonne of silver equivalent, including 0.63 metres of 21.38 grams per tonne of gold and 5,337 grams per tonne of silver (Table 1).

- DH371 intercepted 1.11 metres of 969 grams per tonne of silver equivalent, including 0.42 metres of 8.64 grams per tonne of gold and 1,847 grams per tonne of silver (Table 1).

Drilling at Aguilar has one hole with assays pending: DH373 (Figure 1 and Figure 2).

| Target | Hole ID | From (m) |

To (m) |

Interval Length (m) |

Estimated True Width (m) |

Au g/t | Ag g/t | AgEq g/t |

Vein |

| Aguilar | DH363 | 29.33 | 29.63 | 0.30 | ** | 0.70 | 61 | 114 | |

| DH363 | 32.96 | 34.00 | 1.04 | ** | 8.57 | 574 | 1,218 | Aguilar HW | |

| Including | 32.96 | 33.26 | 0.30 | ** | 27.37 | 1,855 | 3,910 | ||

| DH363 | 115.66 | 116.16 | 0.50 | ** | 4.20 | 876 | 1,191 | Aguilar | |

| DH364 | 18.34 | 18.64 | 0.30 | ** | 0.65 | 118 | 166 | Aguilar HW | |

| DH364 | 78.19 | 79.82 | 1.63 | ** | 1.88 | 576 | 717 | Aguilar | |

| Including | 78.19 | 78.74 | 0.55 | ** | 3.15 | 1,282 | 1,519 | ||

| And | 79.52 | 79.82 | 0.30 | ** | 4.38 | 780 | 1,109 | ||

| DH364 | 106.43 | 106.73 | 0.30 | ** | 0.99 | 164 | 239 | Aguilar FW | |

| DH366 | No Significant Result | ||||||||

| DH369 | 46.90 | 47.20 | 0.30 | 1.41 | 410 | 516 | Aguilar HW | ||

| DH369 | 158.11 | 164.63 | 6.52 | ** | 3.14 | 592 | 828 | Aguilar | |

| Including | 158.11 | 158.75 | 0.64 | ** | 10.66 | 731 | 1,532 | ||

| And | 164.00 | 164.63 | 0.63 | ** | 21.38 | 5,337 | 6,943 | ||

| DH371 | 98.86 | 99.17 | 0.31 | ** | 13.50 | 2,727 | 3,741 | Aguilar North | |

| DH371 | 164.28 | 165.39 | 1.11 | ** | 3.33 | 719 | 969 | Aguilar | |

| Including | 164.97 | 165.39 | 0.42 | ** | 8.64 | 1,847 | 2,496 | ||

| DH371 | 176.55 | 176.84 | 0.29 | ** | 2.14 | 471 | 631 | Aguilar FW | |

| DH373 | Assays Pending | ||||||||

| Table 1. Current drill assay results. ** Lengths are drill intersections and not necessarily true widths. The current knowledge of the Aguilar vein does not allow for estimating the true width of the vein intercept. |

|||||||||

| Sample type | Sample number |

From (m) |

To (m) |

Sample Length (m) |

Au g/t | Ag g/t | AgEq g/t | Reporting Date |

| Outcrop Channel SUCH220301 | 0.00 | 0.90 | 0.90 | 1.33 | 400 | 500 | May 9, 2022 | |

| including | RX5644 | 0.00 | 0.40 | 0.40 | 1.57 | 349 | 467 | |

| and | RX5645 | 0.40 | 0.90 | 0.50 | 1.14 | 441 | 526 | |

| Outcrop Channel SUCH220302 | ||||||||

| RX5654 | 0.00 | 0.25 | 0.25 | 5.64 | 1,045 | 1,468 | ||

| Outcrop Channel SUCH220303 | 0.00 | 2.70 | 2.70 | 1.56 | 149 | 267 | January 3, 2023 | |

| including | RX5650 | 2.00 | 2.70 | 0.70 | 2.91 | 254 | 472 | |

| Outcrop Channel SUCH220601 | ||||||||

| RX5444 | 0.00 | 0.40 | 0.40 | 1.28 | 281 | 376 | ||

| Table 2. Channel sample results from the Target Generation program previously reported (see NR dated May 9, 2022 & January 03, 2023). |

||||||||

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth | Dip |

| SAAG24DH363 | 503748.969 | 561149.485 | 1007.110 | 129.27 | 0 | -90 |

| SAAG24DH364 | 503748.164 | 561148.475 | 1006.987 | 120.09 | 169 | -58 |

| SAAG24DH366 | 503749.707 | 561150.295 | 1007.264 | 117.04 | 100 | -58 |

| SAAG24DH367 | 503760.247 | 561229.999 | 1003.079 | 170.03 | 109 | -45 |

| SAAG24DH369 | 503760.228 | 561230.341 | 1003.043 | 196.29 | 93 | -65 |

| SAAG24DH371 | 503693.046 | 561205.427 | 1010.864 | 195.37 | 135 | -73 |

| SAAG24DH373 | 503692.991 | 561205.470 | 1011.551 | 224.94 | 135 | -86 |

| Table 3. Collar and survey table for drill holes reported in this release. All coordinates are UTM system, Zone 18N and WGS84 projection. |

||||||

Silver Equivalent

Metal prices used for equivalent calculations were US$1,800/oz for gold, and US$25/oz for silver. The equivalency formula as follows:

Metallurgical recoveries based on Outcrop Silver’s Metallurgical test work are 97% for gold and 93% for silver (see NR from August 23, 2023).

QA/QC

For exploration core drilling, Outcrop Silver applied its standard protocols for sampling and assay. HQ-NTW core is sawn with one-half shipped. Core samples were sent to either ALS, Actlabs or SGS in Medellin, Colombia, for preparation. Samples delivered to Actlabs were AA assayed on Au, Ag, Pb, and Zn at Medellin using 1A2Au, 1A3Au, Multi-elements AR (Ag Cu Pb Zn), and Code 8 methods. Then, samples are sent to Actlabs Mexico for ICP-multi-elemental analysis with code 1E3. After preparation, the samples sent to ALS Colombia were shipped to ALS Lima for assaying using Au-ICP21, Au-GRA21, ME-MS41, Ag-GRA21, Ag-AA46, Pb-AA46, and Zn-AA46 methods. In line with QA/QC best practices, blanks, duplicates, and certified reference materials are inserted at approximately three control samples every twenty samples into the sample stream, monitoring laboratory performance. A comparison of control samples and their standard deviations indicates acceptable accuracy of the assays and no detectible contamination. No material QA/QC issues have been identified with respect to sample collection, security and assaying. The samples are analyzed for gold and silver using a standard fire assay on a 30-gram sample with a gravimetric finish for over-limits. Multi-element geochemistry was determined by ICP-MS using either aqua regia or four acid digestions. Crush rejects, pulps, and the remaining core are stored in a secured facility at Santa Ana for future assay verification.

Qualified Person

Edwin Naranjo Sierra is the designated Qualified Person for this news release within the meaning of the National Instrument 43-101 (NI 43-101) and has reviewed and verified the technical information in this news release. Mr. Naranjo holds a MSc. in Earth Sciences, and is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM) and the Society of Economic Geology.

ATM Program

Further to an at-the-market offering of common shares made pursuant to a prospectus supplement dated September 6, 2023, the Company issued 5,826,000 common shares and raised gross proceeds of $1,350,494 pursuant to such offering from April 1 to June 30, 2024. Fees of 2.5% of the gross proceeds of the at-the-market offering were paid to Research Capital Corporation, being $33,762.

About Santa Ana

The 100% owned Santa Ana project covers 27,000 hectares within the Mariquita District, known as the largest and highest-grade primary silver district in Colombia with mining records dating back to 1585.

Santa Ana’s maiden resource estimate, detailed in the NI 43-101 Technical Report titled “Santa Ana Property Mineral Resource Estimate,” dated June 8, 2023, prepared by AMC Mining Consultants, indicates an estimated indicated resource of 24.2 million ounces silver equivalent at a grade of 614 grams per tonne and an inferred resource of 13.5 million ounces at a grade of 435 grams per tonne. The identified resources span seven major vein systems that include multiple parallel veins and ore shoots: Santa Ana (San Antonio, Roberto Tovar, San Juan shoots); La Porfia (La Ivana); El Dorado (El Dorado, La Abeja shoots); Paraiso (Megapozo); Las Maras; Los Naranjos, and La Isabela.

The 2024 drilling campaign aims to extend known mineralization and test new high-potential areas along the project’s extensive 30 kilometres of strike. These efforts underscore the scalability of Santa Ana and its potential for substantial resource growth, positioning the project to develop into a high-grade, economically viable, and environmentally responsible silver mine.

About Outcrop Silver

Outcrop Silver is a leading explorer and developer focused on advancing its flagship Santa Ana high-grade silver project in Colombia. Leveraging a disciplined and seasoned team of professionals with decades of experience in the region. Outcrop Silver is dedicated to expanding current mineral resources through strategic exploration initiatives.

At the core of our operations is a commitment to responsible mining practices and community engagement, underscoring our approach to sustainable development. Our expertise in navigating complex geological and market conditions enables us to consistently identify and capitalize on opportunities to enhance shareholder value. With a deep understanding of the Colombian mining landscape and a track record of successful exploration, Outcrop Silver is poised to transform the Santa Ana project into a significant silver producer, contributing positively to the local economy and setting new standards in the mining industry.

Figure 1. The Aguilar plan view shows the detailed drill plan and reported holes in this release (Table 1), including holes with pending assays, previous drilling, and channel samples previously reported (Table 2). (CNW Group/Outcrop Silver & Gold Corporation)

Figure 2. The Aguilar vein cross-section shows the reported holes in this release, including holes with assays pending. Holes DH360 and DH361 were previously reported (see NR dated June 18, 2024). The cross-section shows a total of 20 meters width projection with 135° of azimuth. (CNW Group/Outcrop Silver & Gold Corporation)

Figure 3. The Aguilar vein cross section showing drill holes DH363 and DH364 from this release. The cross-section shows a total of 20 meters width projection with 169° of azimuth. (CNW Group/Outcrop Silver & Gold Corporation)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE