OUTCROP SILVER INTERCEPTS 0.90 METRES OF 767 GRAMS EQUIVALENT SILVER PER TONNE IN LAS MARAS AND PROVIDES AN UPDATE ON THE RESOURCE ESTIMATION AT SANTA ANA

Outcrop Silver & Gold Corporation (TSX-V: OCG) (OTCQX: OCGSF) (DE: MRG1) is pleased to announce the results of two additional core holes in the Las Maras shoot on its 100% owned Santa Ana high-grade silver project in Colombia and provide an update on its pending maiden compliant resource estimation.

Highlights

- DH308 intercepted 0.9 metres true thickness of 767 grams equivalent silver per tonne.

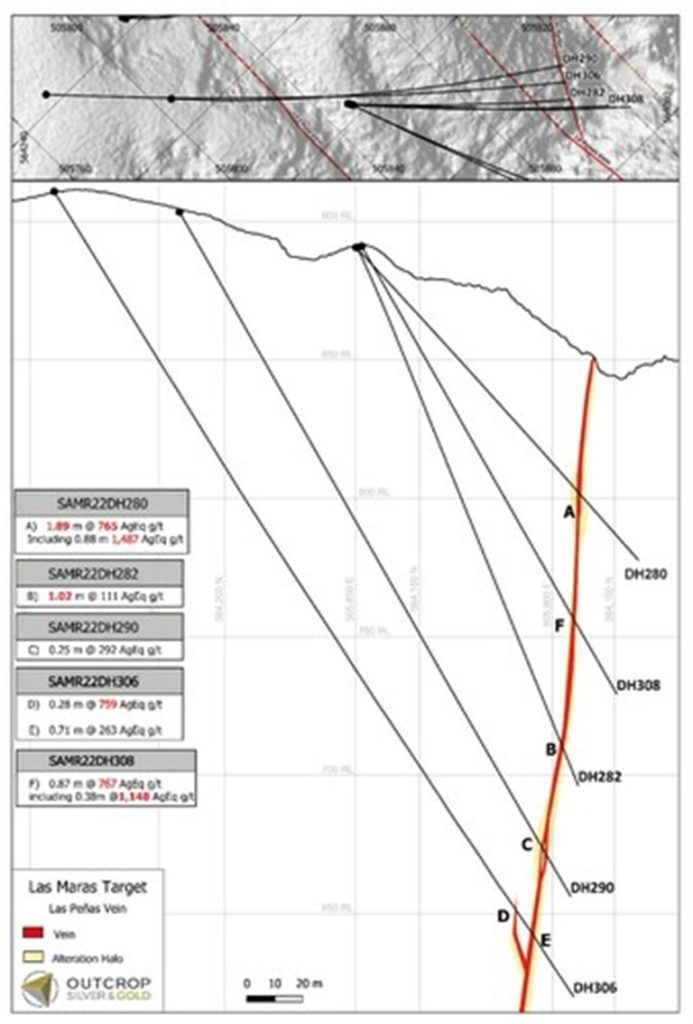

- DH306 and DH308 extend Las Maras high-grade mineralization at depth and to the south. (Figure 3).

- Definitive flotation tests in progress by SGS labs will provide higher confidence diagnostic flotation recovery tests and allow Micon International to use higher metal recoveries in Santa Ana’s maiden resource report. Initial metallurgical testing showed recoveries of 94% of contained silver and 96% of contained gold in a concentrate containing 6,540 grams per tonne of silver and 83 grams per tonne of gold (press release November 3, 2022).

- A third drill rig has been added at Santa Ana.

“The resource report will be delayed until the first quarter in order to capture the benefit of optimized higher recoveries,” comments Joseph Hebert Chief Executive Officer. “Further, a third drill rig was added at Santa Ana in December in order to complete planned deeper delineation drilling of some of the high-grade shoots which can now be included in the resource estimation. Las Maras high-grade mineralization extends to over 350 metres and is open at depth. Other shoots to be included in the resource report are only drilled to an average depth of 170 metres.”

Maras Drilling

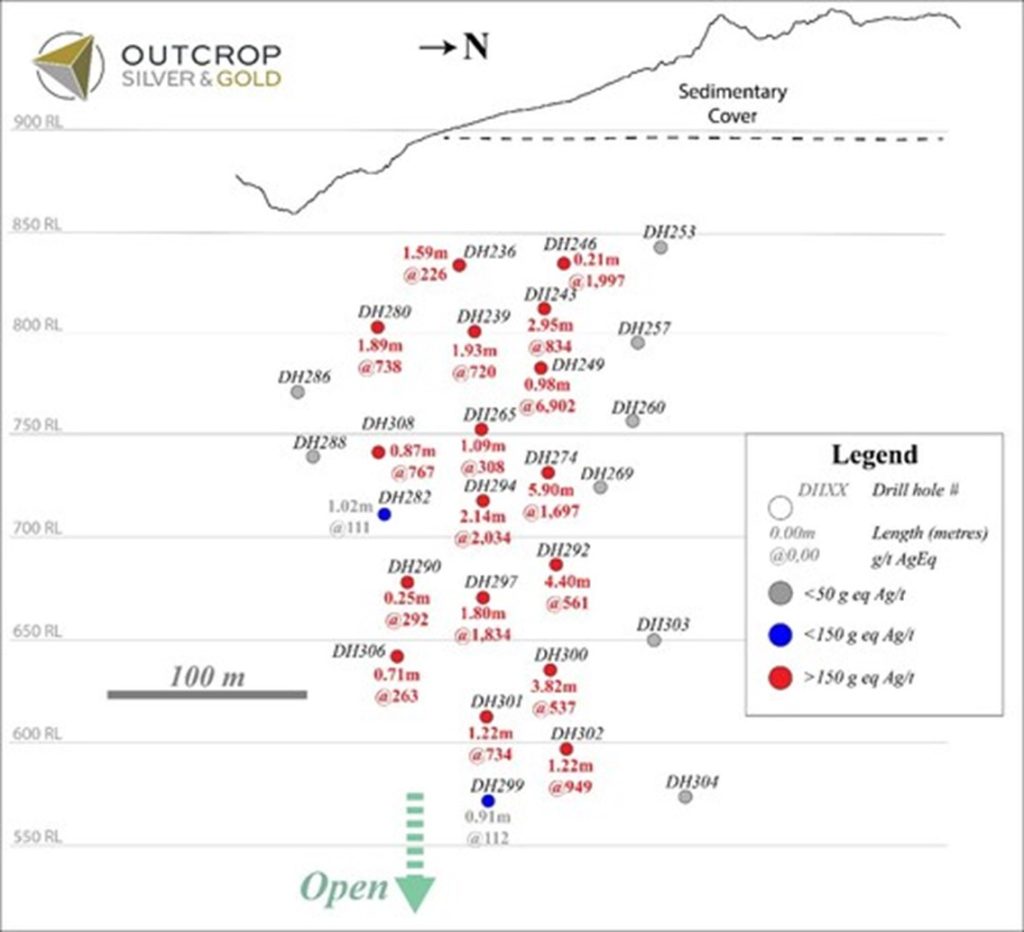

Twenty-seven drill holes have been completed in Las Maras to date. Seventeen have returned high-grade assays (Figure 3) including 2.1 metres of 2,034 grams equivalent silver per tonne and 5.9 metres of 1,697 grams equivalent silver per tonne. Recent drilling targeted step-down intercepts from hole DH290. Las Maras remains open at depth.

| Target | Hole ID | From (m) |

To (m) |

Width* (m) |

Au g/t | Ag g/t | Pb % | Zn % | AgEq g/t |

| Las Maras | SAMR22DH306 | 306.63 | 306.93 | 0.28 | 2.65 | 523 | 0.59 | 0.81 | 759 |

| SAMR22DH306 | 319.54 | 320.48 | 0.71 | 0.78 | 194 | 0.35 | 0.20 | 263 | |

| including | 320.09 | 320.48 | 0.29 | 1.70 | 453 | 0.84 | 0.45 | 606 | |

| SAMR22DH308 | 171.46 | 173.10 | 0.87 | 2.72 | 537 | 0.47 | 0.62 | 767 | |

| including | 171.94 | 172.65 | 0.38 | 4.11 | 801 | 0.60 | 0.97 | 1,148 | |

| *Estimated True width. Metal prices used for equivalent calculations were US$1,827/oz for gold, US$21.24/oz for silver, US$0.90/lb for lead and US$1.56/lb for zinc. Metallurgical recoveries assumed are 93% for gold, 90% for silver, 90% for lead and 92% for zinc. | |||||||||

| Table 1. Significant drill assays from the Las Maras Target.

|

|||||||||

| Hole ID | Easting | Northing | Elevation (m) |

Depth (m) | Azimuth | Dip |

| SAMR22DH306 | 505775.127 | 564244.355 | 910.011 | 345.94 | 137 | -58 |

| SAMR22DH308 | 505850.075 | 564165.053 | 890.412 | 185.92 | 138 | -60 |

| Table 2. Collar and survey table for reported drill holes. | ||||||

Metallurgy Update

Outcrop has continued a sequence of more definitive processing flotation tests that will allow Micon International, the resource estimate report author, to use higher metal recoveries than would be possible with the testing completed to date.

Outcrop Silver reported excellent preliminary metallurgical test results on November 3, 2022, which show that gold is 90% in native free state, with 8% native silver and electrum comprise 8% by mass, and 88% of silver occurs in a single mineral argentite. These metal distributions present a very simple “ore” mineralogy, allowing a simple processing design. The results show average recoveries of 94% for silver and 96% for gold in concentrate, grading 6,540 grams per tonne of silver and 82.94 grams per tonne of gold.

The current second phase of metallurgical tests includes locked cycle kinetic flotation, cleaner stage flotation, concentrate gold screening and concentrate mineralogical characterisation. This more comprehensive metallurgical testing will significantly derisk the Santa Ana Project by determining processing parameters that will optimize metal recoveries. This sequence of testing will allow higher metal recoveries to be used in the estimation report by Micon International.

In order to include the results of this second phase of metallurgical tests, the resource estimate has been delayed under Q1 2023. A third drill rig was added in December to complete planned deeper delineation drilling of some of the high-grade shoots which can now be also included in the resource estimation.

QA/QC

Core samples are sent to either Actlabs or SGS in Medellin, Colombia, for preparation and AA assaying on Au and Ag, then to SGS Lima, Peru, for multi-element analysis. Samples sent to Actlabs are then shipped to Actlabs Mexico for multi-element analysis. In line with QA/QC best practice, approximately three control samples are inserted per twenty samples (one blank, one standard and one field duplicate). The samples are analyzed for gold using a standard fire assay on a 30-gram sample with a gravimetric finish when surpassing over limits. Multi-element geochemistry is determined by ICP-MS using aqua regia digestion. Comparison to control samples and their standard deviations indicate acceptable accuracy of the assays and no detectible contamination.

About Santa Ana

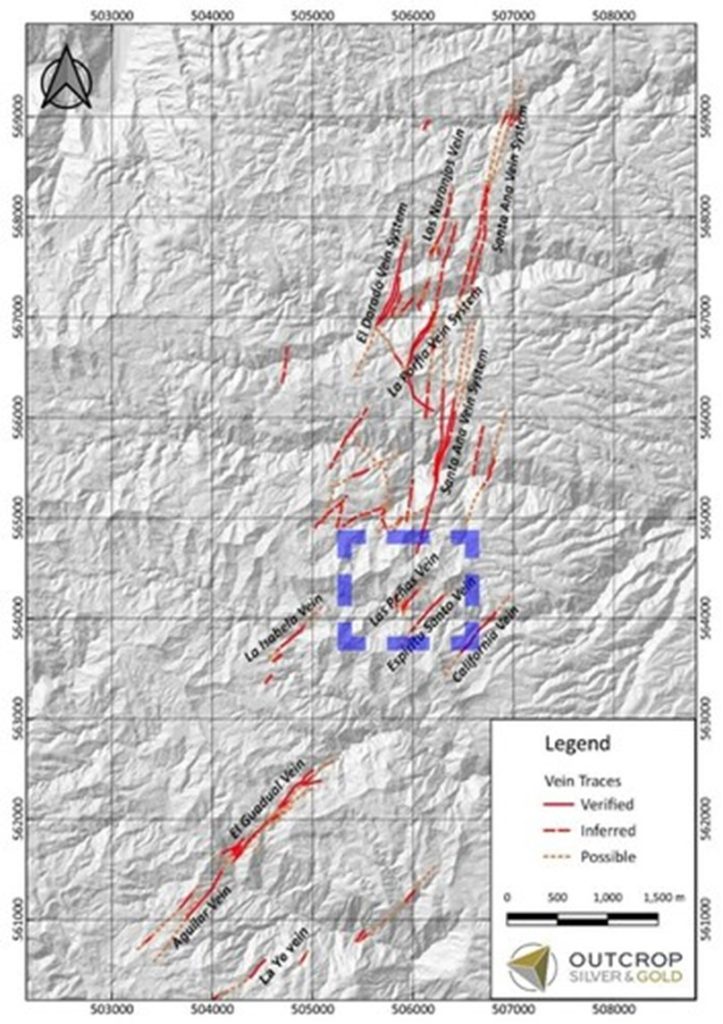

The 100% owned Santa Ana project comprises 36,000 hectares located in the northern Tolima Department, Colombia, 190 kilometres from Bogota. The project consists of five or more regional scale parallel vein systems across a trend 12 kilometres wide and 30 kilometres long. The Santa Ana project covers a majority of the Mariquita District, where mining records date to at least 1585. The Mariquita District is the highest-grade primary silver district in Colombia, with historic silver grades reported to be among the highest in Latin America from dozens of mines. Historic mining depths support a geologic and exploration model for composite mesothermal and epithermal vein systems having mineralization that likely extends to great depth. At Santa Ana, it is unlikely that there is sharp elevation restriction common to high-grade zones in many epithermal systems with no mesozonal component. The extremely high silver and gold values on Santa Ana reflect at least three recognized overprinting mineralization events.

At the core Royal Santa Ana project, located at the northern extent of just one of the regional vein systems controlled by Outcrop, thirteen high-grade shoots have been discovered to date – La Ivana hanging-wall and footwall (La Porfia vein system); San Antonio, Roberto Tovar, San Juan (Royal Santa Ana vein systems); Las Maras (Las Penas vein system); El Dorado, La Abeja (El Dorado vein systems); Megapozo, Paraiso (El Paraiso vein system); Espiritu Santo (Aguilar vein system); La Isabela and Los Naranjos. Each zone commonly contains multiple parallel veins. The veins can show both high-grade silver and high-grade gold mineralization, and low-angle veins appear to connect to more common high-angle veins.

Outcrop drilling indicates that mineralization extends from surface or near surface to depths of at least 370 metres. Cumulatively, over 60 kilometres of mapped and inferred vein zones occur on the Santa Ana project. The Frias Mine on the south-central part of the project, 16 kilometres south of the Royal Santa Ana Mines, produced 7.8 million ounces of silver post-production in the Spanish colonial era at a recovered grade of 1.3 kg Ag/t. The Frias Mine is considered an analogue to each of the thirteen shoots discovered to date by Outcrop. Numerous priority drill targets have been discovered along this 16 kilometre trend with outcropping veins up to 4.7 metres wide.

About Outcrop Silver & Gold

Outcrop Silver & Gold is rapidly advancing the Santa Ana high-grade silver discovery with ongoing expansion drilling and an initial resource to be released in the coming months. Outcrop is also progressing exploration on four gold projects with world-class discovery potential in Colombia. These assets are being advanced by a highly disciplined and seasoned professional team with decades of experience in Colombia.

Qualified Person

The technical information in this news release has been approved by Joseph P Hebert, a qualified person as defined in NI43-101 and President and Chief Executive Officer of Outcrop.

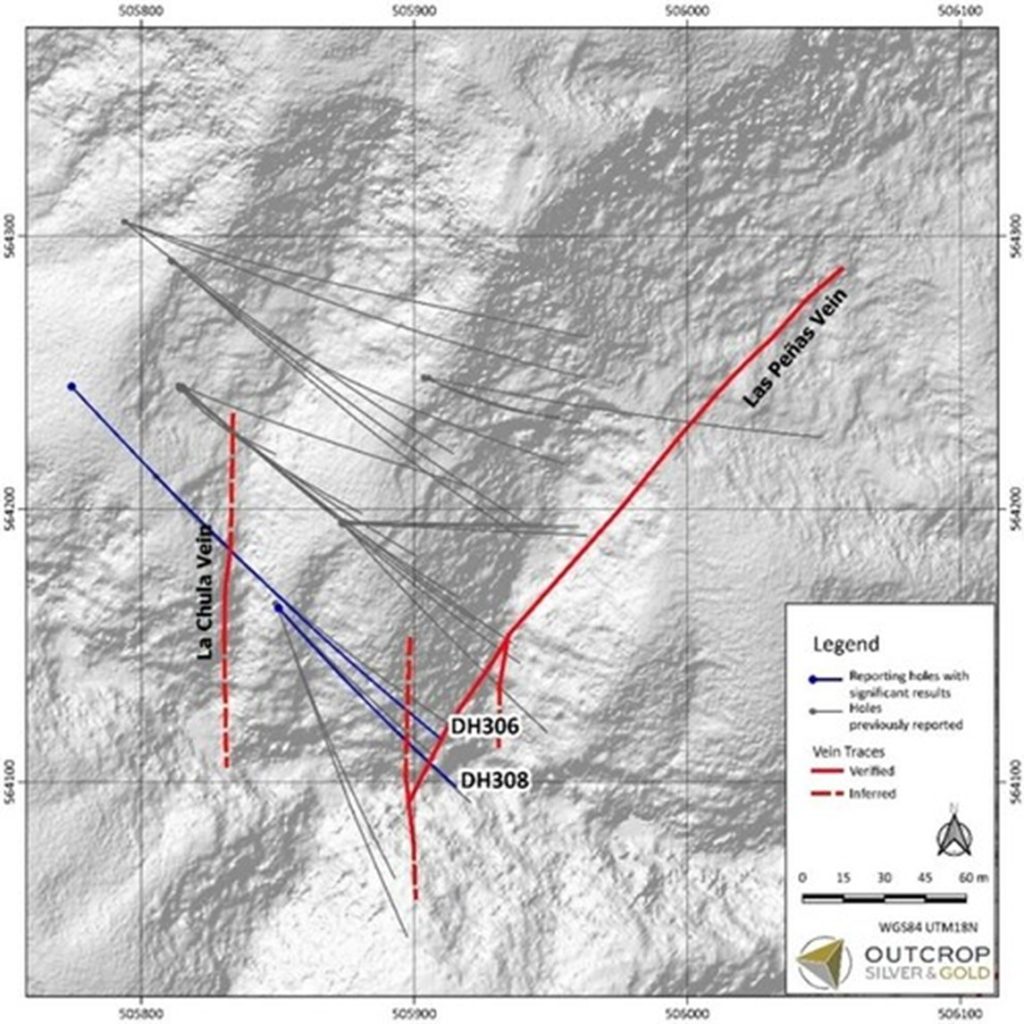

Map 1. Las Maras area with DH306 and DH308 drill hole traces. (CNW Group/Outcrop Silver & Gold Corporation)

Figure 1. Las Maras cross section with DH306 and DH308 reported in this release. (CNW Group/Outcrop Silver & Gold Corporation)

Map 2. Location of Las Peñas vein in Las Maras target, 3 km south of the main Santa Ana vein system. (CNW Group/Outcrop Silver & Gold Corporation)

Figure 3. Las Maras long section shoot illustrating drill pierce points with true widths. (CNW Group/Outcrop Silver & Gold Corporation)

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE