Osisko Development Reports Second Quarter 2024 Results

Osisko Development Corp. (NYSE: ODV) (TSX-V: ODV) reports its financial and operating results for the three months ended June 30, 2024.

Q2 2024 HIGHLIGHTS

Operating, Financial and Corporate Updates:

- 805 ounces of gold sold by the Company from operating activities in the second quarter, comprising of 790 ounces of gold sold from the Trixie test mine, and the balance from the Cariboo Gold Project by processing stockpiles at a third-party facility.

- $2.6 million in revenues ($10.8 million in Q2 2023) and $2.7 million in cost of sales ($11.4 million in Q2 2023) generated from operating activities.

- On May 9, 2024, the Company announced, as part of its regular annual remuneration program, the granting of an aggregate of 283,250 deferred share units of the Company to its independent directors in accordance with the DSU Plan of the Company

- On May 30, 2024, Maggie Layman departed from her position as Vice President, Exploration to pursue another opportunity.

- On June 3, 2024, the Company announced that in connection with the terms of the Company’s previously completed acquisition in May 2022 of a 100% ownership interest in the Tintic Project, it had satisfied the second of five deferred payments to the sellers. The deferred consideration of US$2,500,000 was settled by the issuance of 1,228,394 common shares.

- On June 10, 2024, the Company entered into an amending agreement to the credit agreement with National Bank of Canada made as of March 1, 2024, providing for a US$50 million delayed draw term loan. The Amendment provides for, among other things:

- An 8-month extension to the maturity date to October 31, 2025 (from March 1, 2025). The extension is subject to the completion of a capital raise of at least US$20 million prior to October 31, 2024, otherwise the maturity date reverts to February 28, 2025.

- Reduction in the mandatory prepayment amount to 50% of each incremental dollar raised in excess of US$25 million in respect of certain financings, allowing the Company to preserve 50% of such proceeds. There are no mandatory prepayment requirements for amounts up to US$25 million.

- As at June 30, 2024, the Company had approximately $33.7 million in cash.

Cariboo Gold Project – British Columbia, Canada (100%-owned)

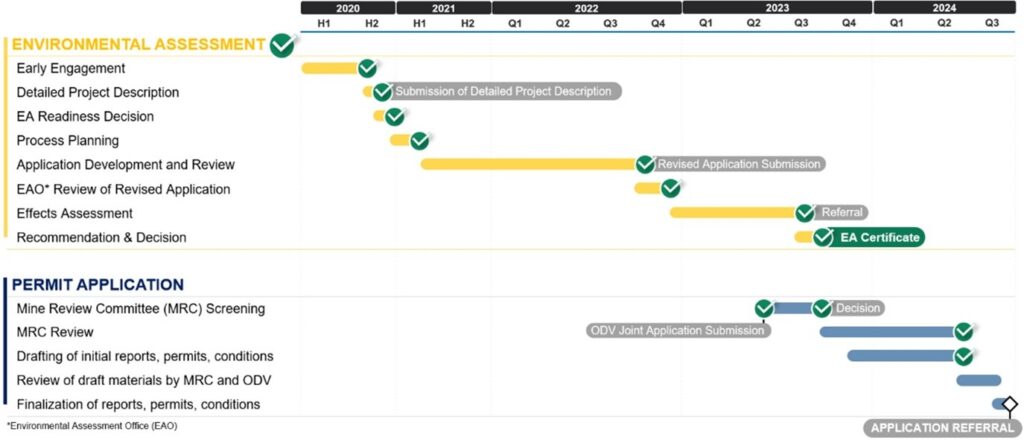

- Permitting Progress. Receipt of the EA Certificate in October 2023 successfully concluded the EA process for the Cariboo Gold Project (see Figure 1).

- The BC Mines Act and Environmental Management Act permits have been drafted, and are currently under review by the Company and the Mine Review Committee.

- The Company anticipates completing its permit application referral and receiving final construction and operating permits in Q3 2024.

- The Company continues to explore funding options, including fully-funded solutions for the Cariboo Gold Project.

Figure 1: Cariboo Gold Project – Permitting Timeline Summary

- Pre-Construction Activities. During Q1 2024, under an existing provincial permit, the Company commenced an underground development drift from the existing Cow Portal into the Cariboo Gold Project’s mineral deposit at the Lowhee Zone. The objective of the bulk sample work program is to reach the ore body and extract a 10,000 tonne bulk sample of mineralized material for ore sorter, heavy equipment and mining testing.

- To date, approximately 510 meters of development has been completed, with another 660 meters remaining to reach the target area.

- The Company anticipates completing the bulk sample in Q4 2024.

- Wildfire Response. On July 22, 2024, the Company temporarily paused non-essential activities at its Cariboo Gold Project following a wildfire evacuation order that included the Project. The wildfire evacuation order was lifted on July 25, 2024, and normal course operations and site activities at the Cariboo Gold Project resumed on July 26, 2024, following the return of non-essential employees to site. The mine site infrastructure was unaffected by the wildfires.

Tintic Project – Utah, U.S.A. (100%-owned)

- Big Hill Porphyry Target Drilling. Two surface diamond drill holes totalling approximately 2,920 meters (9,581 feet have been completed at the Big Hill target area in May 2024 testing for copper-gold-molybdenum porphyry mineralization potential.

- Both drill holes intersected porphyry systems defined by at least three late-mineral monzonite porphyritic intrusive phases and an intrusion breccia.

- Although anomalous copper and molybdenum mineralization was encountered, including low visible presence of chalcopyrite, tennantite, and molybdenite, no significant intercepts of copper, gold or molybdenum were observed. The porphyries encountered to date are considered to lack evidence for the major fluid paths required to be the source of mineralization in the Tintic District.

- Big Hill West Target. The results of the recent and historical drill holes suggest that the early and potentially better mineralized intrusive phase could be in an untested area immediately west and southwest of the area drilled at Big Hill.

- Trixie West Porphyry Target Drilling. One diamond drill hole was completed from underground testing porphyry-style mineralization down plunge of the mineralized structures below Trixie to a depth of 759.6 m (2,492 ft) when it crossed the Eureka Lily fault to the east and out of the prospective alteration zone.

- These results suggest that the western hanging wall block of the Eureka Lilly fault (west of Trixie) is potentially more conducive for porphyry-style mineralization.

- Anomalous mineralization was encountered in the drill hole; however, no significant intercepts of gold, copper or molybdenum were encountered.

- Zuma High-Potential Porphyry Target. Based on the results to date, the Zuma area has been identified as a good porphyry target that merits initial drill testing and may represent one of the causative porphyry centres of the East Tintic district.

- Lower Quartzite CRD Target. Based on the compilation of geological, drilling, and historical data, a potential large scale carbonate replacement deposit may be located below the footwall of the East Tintic thrust fault. A recommended drill program has been proposed that targets downdip extensions of known mineralization at Burgin.

- Trixie Underground Chip Sampling. The Company disclosed chip sample assays from new development areas at Trixie. Select assay highlights included (see news release dated August 7, 2024):

- 11.07 grams per tonne gold and 25.45 g/t silver over 6.10 m in CH01716 (0.32 troy ounces per short ton Au and 0.74 oz/t Ag over 20 ft).

San Antonio Gold Project – Sonora State, Mexico (100%-owned)

- The San Antonio Gold Project remains in care and maintenance, with no production anticipated henceforth.

- The Company awaits next steps from the government of Mexico with respect to the permitting process and the status of open pit mining in the country. The approval process for environmental permits for mining may resume after the new president takes office in October 2024.

- Strategic Review. The Company is conducting a strategic review of the project and has engaged a financial advisor in connection thereof. The strategic review includes, among others, exploring the potential for a financial or strategic partner in the asset or for a full or partial sale of the asset.

SUBSEQUENT TO Q2 2024

- On July 5, 2024, the Company announced that effective July 4, 2024, as part of its annual compensation review, the Board of Directors approved the grant of an aggregate of 2,797,400 incentive stock options and an aggregate of 371,800 restricted share units to certain senior officers of the Company in accordance with the terms of the Company’s Option and RSU plans.

KEY UPCOMING MILESTONES

| Key Project Milestones |

Expected Timing of Completion |

Anticipated Remaining Costs* |

||

| Cariboo Gold Project(1) | ||||

| Bulk Sample | Q4 2024 | $6.8 million | ||

| Water and Waste Management | Q4 2024 | $0.1 million | ||

| Electrical and Communication | Q4 2024 | $0.6 million | ||

| Management, environmental, and other pre-permitting work | Q3 2024 | $5.2 million | ||

| Detailed engineering and permitting(2) | Q4 2024 | $1.3 million | ||

| Tintic Project | ||||

| Regional Drilling | Completed – Q2 2024 | $nil |

_____________________________

*as at June 30, 2024

Notes:

| (1) | The expenditures disclosed in this table include amounts approved by the Board of Directors up until the end of August 2024. Additional expenditures will be required to complete certain of the milestones and are subject to approval by the Board of Directors. |

| (2) | These activities are contributing towards the completion of permitting, which are presently expected to be completed in Q3 2024. Additional costs and time relating to engineering, including water and waste management and electrical and communication, will be required in the construction phase (subject to a positive construction decision and completion of project financing). |

Consolidated Financial Statements

The Company’s unaudited interim consolidated financial statements and management’s discussion and analysis for the three months ended June 30, 2024 are available on the Company’s website at www.osiskodev.com, on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Daniel Downton P.Geo., Chief Resource Geologist of Osisko Development, a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Technical Reports

Information relating to the Cariboo Gold Project and the Cariboo FS is supported by the technical report titled “Feasibility Study for the Cariboo Gold Project, District of Well, British Columbia, Canada“, dated January 10, 2023 (amended January 12, 2023) with an effective date of December 30, 2022) prepared for the Company by independent representatives BBA Engineering Ltd. and supported by independent consulting firms, including InnovExplo Inc., SRK Consulting (Canada) Inc., Golder Associates Ltd. (amalgamated with WSP Canada Inc. on January 1, 2023, to form WSP Canada Inc.), WSP USA Inc., Falkirk Environmental Consultants Ltd., Klohn Crippen Berger Ltd., KCC Geoconsulting Inc., and JDS Energy & Mining Inc. Reference should be made to the full text of the Cariboo Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile and on the Company’s website at www.osiskodev.com.

Information relating to the Tintic Project and the current mineral resource estimate for the Trixie deposit and the assumptions, qualifications and limitations thereof, is supported by the technical report titled “NI 43-101 Technical Report, Mineral Resource Estimate for the Trixie Deposit, Tintic Project, Utah, United States of America” and dated April 25, 2024 (with an effective date of March 14, 2024), prepared for the Company by independent representatives of Micon International Limited, being William Lewis, P. Geo, and Alan J. San Martin, MAusIMM(CP). Reference should be made to the full text of the Tintic Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile and on the Company’s website at www.osiskodev.com.

Information relating to San Antonio is supported by the technical report titled “NI 43-101 Technical Report for the 2022 Mineral Resource Estimate on the San Antonio Project, Sonora, Mexico“, dated July 12, 2022 (with an effective date of June 24, 2022) prepared for the Company by independent representatives of Micon International Limited. Reference should be made to the full text of the San Antonio Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile and on the Company’s website at www.osiskodev.com.

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company’s objective is to become an intermediate gold producer by advancing its 100%-owned Cariboo Gold Project, located in central B.C., Canada, the Tintic Project in the historic East Tintic mining district in Utah, U.S.A., and the San Antonio Gold Project in Sonora, Mexico. In addition to considerable brownfield exploration potential of these properties, that benefit from significant historical mining data, existing infrastructure and access to skilled labour, the Company’s project pipeline is complemented by other prospective exploration properties. The Company’s strategy is to develop attractive, long-life, socially and environmentally sustainable mining assets, while minimizing exposure to development risk and growing mineral resources.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE