ORVANA REPORTS Q4 FY2024 PRODUCTION AND EXPLORATION UPDATE FROM OROVALLE, SPAIN

Orvana Minerals Corp. (TSX: ORV) is pleased to report production and exploration updates for the fourth quarter of fiscal year 2024 ending September 30, 2024, from Orovalle, Spain.

Highlights

- Q4 FY2024 Production: 11,862 gold equivalent ounces (9,888 gold ounces, 1.0 million copper pounds and 29,864 silver ounces).

- FY2024 Production: 44,591 gold equivalent ounces (36,488 gold ounces, 3.7 million copper pounds and 107,858 silver ounces).

- Q4 FY2024 Exploration: 2,462 m of Infill and Brownfield drilling, with key intercepts in Area 208 as follows:

- DDH 24A21939: 17.25 m @ 3.06 g/t Au

- DDH 24A21943: 6.00 m @ 13.69 g/t Au

- DDH 24A21946: 43.30m @ 6.41 g/t Au

- DDH 24A21947: 3.55m @ 18.53 g/t Au

- DDH 24A21948: 13.50 @ 10.33 g/t Au

Juan Gavidia, CEO of Orvana stated: “We are pleased with the quarter results. Although throughput was slightly lower than initially planned, grades and recoveries complied with expectations”.

“The outlook for gold and copper prices continues to be robust. We look forward to 2025 focused on safety, stable production and controlling costs to maximize the generation of free cash flow and taking advantage of the market momentum”, he added.

Q4 FY2024 Production Results

- The mill processed 139,275 tonnes, 8% lower than the prior quarter mainly due to 6 days of stoppage in August. During the stoppage, Orovalle performed several preventive maintenance activities.

- As a result of the lower tonnage milled, gold production and copper production were 9% and 3%, respectively, lower than the prior quarter.

| Q4 FY2024 | Q3 FY2024 | Q4 FY2023 | FY2024 | FY 2024

Revised Guidance |

|||

| Ore milled (tonnes) | 139,275 | 150,843 | 189,527 | 556,756 | |||

| Gold equivalent (oz)(1) | 11,862 | 13,078 | 15,567 | 44,591 | |||

| Gold | |||||||

| Grade (g/t) | 2.39 | 2.37 | 2.23 | 2.21 | |||

| Recovery (%) | 92.5 | 94.1 | 91.3 | 92.2 | |||

| Production (oz) | 9,888 | 10,832 | 12,427 | 36,488 | 37,000 – 39,000 | ||

| Copper | |||||||

| Grade (%) | 0.41 | 0.39 | 0.40 | 0.40 | |||

| Recovery (%) | 75.8 | 76.3 | 81.2 | 76.6 | |||

| Production (K lbs) | 961 | 986 | 1,356 | 3,744 | 3,700 – 3,900 | ||

| Silver | |||||||

| Grade (g/t) | 8.90 | 8.30 | 8.38 | 8.06 | |||

| Recovery (%) | 75.0 | 76.7 | 76.1 | 74.8 | |||

| Production (oz) | 29,864 | 30,872 | 38,861 | 107,858 | |||

| (1) | GEO is a Non-GAAP Financial Performance Measure. For further information and detailed reconciliations, please see the “Non-GAAP Financial Performance Measures” section of the Company’s latest MD&A. Gold Equivalent Ounces (“GEO”) were calculated using the following average market prices: | ||||||

| Q4 FY2024: $2,476.80/oz Au, $29.42/oz Ag, $4.17/lb Cu | |||||||

| Q3 FY2024: $2,337.99/oz Au, $28.86/oz Ag, $4.42/lb Cu | |||||||

| Q4 FY2023: $1,928.61/oz Au, $23.57/oz Ag, $3.79/lb Cu | |||||||

| FY2024: $2,215.60/oz Au, $26.22/oz Ag, $4.03/lb Cu | |||||||

Exploration Update

| Drilled Meters – Q4 FY2024 | Infill | Brownfield | TOTAL |

| El Valle Boinás | |||

| Area 208 (A2) | 833 | 1,236 | 2,069 |

| Boinás South (SB) | 271 | – | 271 |

| Breccia East (BX) | 122 | – | 122 |

| TOTAL | 1,226 | 1,236 | 2,462 |

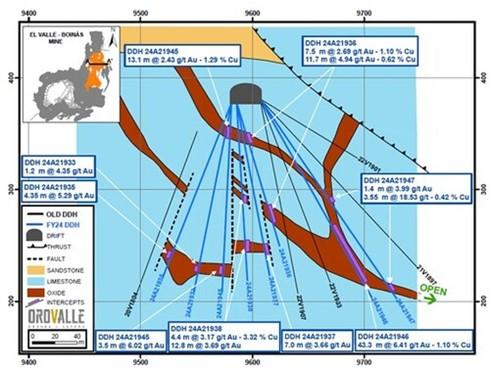

The drilling program in Q4 FY2024 was focused on Area 208, oxide orebody, to convert inferred resources into indicated resources and targeting to extend the mineralization to the east, adding new resources.

Mineralization in Area 208 is located in oxide structures into limestone dipping to the east and usually affected by faults, which causes displacements of mineralization and width changes. See figure 1.

El Valle FY2025 drilling program continues focused on converting the oxides inferred material into measured and indicated material.

The greenfield drilling program in FY2025 will be focused on Ortosa-Godan Project, located three kilometers northwest of our Carlés mine, and within the same gold belt. The exploration program is focused on two areas: Ortosa and Godán. In both cases, the mineral potential is in relation to intrusives. In Ortosa, the mineralization was intersected along 300 m in several bands of calcic skarn and breccias with sulfides trending N40ºE located between 100 m and 200 m below surface. There is potential to extend the mineralization towards NE and at depth. In Godán, drilling program proved the presence of mineralization in the contact between the intrusive and sedimentary rocks with calcic skarn bands dipping 60-70º ESE over 200 m of strike potential. According to current drilling information and based on the dip and mineralization of the skarn, there is a potential connection with Carlés skarn.

Quality Control

Infill and brownfield drill holes samples were analyzed in Orovalle’s Laboratory.

Sample preparation was carried out at the El Valle facility. All diamond core samples have been prepared using the following procedure, once split:

The core samples are dried at a temperature of 105ºC and then crushed through a jaw crusher to 95%

After sample preparation, 30g samples are analyzed for Au by fire assay with an atomic absorption spectroscopy (AAS) finish and two-gram samples for Ag, As, Bi, Cu, Hg, Pb, Sb, Se, and Zn by ICP-optical emission spectroscopy (ICP-OES) after an aqua regia digestion.

In case of the samples sent to an external laboratory, 30 g samples are analyzed for Au by fire assay with an atomic absorption (Au AA-25) and 35 elements by ICP (ME-ICP41) after an aqua regia digestion. When Au and Ag values are >100 ppm and Cu and As values are >10,000 ppm, specific analysis methods are used to determinate the final grade.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control program consisting of the insertion of certified reference material, blanks and duplicates samples into the sample stream.

The exploration update was prepared under the supervision of Guadalupe Collar Menéndez, a qualified person for the purposes of NI 43-101 and an employee of Orovalle Minerals S.L., a subsidiary of Orvana.

Financial Performance & FY2025 Guidance:

Q4 FY2024 financial highlights will be released with the year-end financials, expected mid-December, 2024.

FY2025 guidance will be released with FY2024 year-end financials.

ABOUT ORVANA

Orvana is a multi-mine gold-copper-silver company. Orvana’s assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain, the Don Mario gold-silver property in Bolivia, currently in care and maintenance, and the Taguas property located in Argentina. Additional information is available at Orvana’s website (www.orvana.com).

Figure 1. A-A’ Longitudinal section. Area 208. (CNW Group/Orvana Minerals Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE