ORVANA REPORTS Q2 FY2024 PRODUCTION AND EXPLORATION UPDATE

Orvana Minerals Corp. (TSX: ORV) is pleased to report production and exploration updates from Orovalle, Spain, for the second quarter of fiscal year 2024, ending March 31, 2024.

Highlights

- Production of 10,101 Gold Equivalent Ounces (7,775 gold ounces, 1.1 million copper pounds and 26,728 silver ounces).

- In January 2024, Orovalle successfully concluded negotiations regarding basic terms of its 2023-2025 Collective Bargain Agreement, which were ratified by workers’ assemblies. Upon agreement to the basic terms of the new CBA, the 3-hour stoppages per shift strike that had commenced in mid November 2023 were halted.

- As a consequence of this non-recurrent event, Orovalle’s second quarter performance has been negatively impacted, and the tonnage mined and milled was below the plan for the quarter. Q2 FY2024 throughput of 136,371 tonnes was 23% below the second quarter of fiscal 2023. Gold grade was below the plan for the quarter, and copper grade was above the plan for the quarter, as a result of a different ore blend due to the changes in backfilling and mining sequencing.

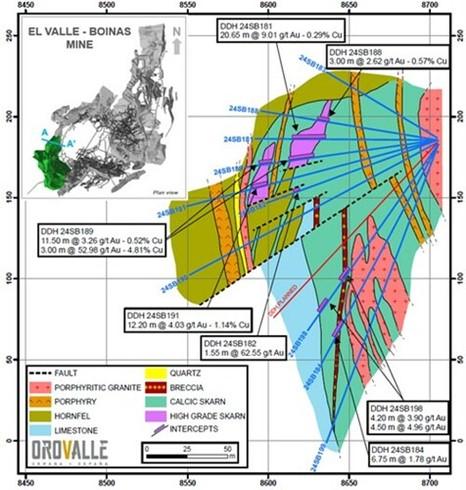

- 2,854 m of Infill and Brownfield drilling, with key intercepts in Boinas South as follows:

-

- DDH 23SB181: 20.65 m @ 9.01 g/t Au – 0.29 %Cu

- DDH 23SB189: 11.50 m @ 3.26 g/t Au – 0.52 %Cu

3.00 m @ 52.98 g/t Au – 0.48 %Cu

-

- DDH 23SB191: 12.20 m @ 4.03 g/t Au – 1.15 %Cu

- DDH 23SB197: 11.00 m @ 4.11 g/t Au – 0.4 %Cu

Juan Gavidia, CEO of Orvana stated: “During the second quarter Orovalle rescheduled the production plan until September 2024, and continues focusing on improving mining operational ratios, which we expect will allow us to increase our monthly throughput to 58,000 t in average over the second half of the year”.

“We are committed to continue optimizing operations at El Valle and improve cost efficiency, always in line with our safety standards”, he added.

Q2 FY2024 Production Results

- 7,775 gold ounces produced. Orovalle is targeting to reach the lower end of the 2024 production guidance of 41,000 – 45,000 Oz.

- 1.1 million copper pounds produced, on track to meet fiscal year 2024 guidance of 3,300 – 3,700 K lbs.

| Q2 FY2024 | Q1 FY2024 | Q2 FY2023 | YTD Q2 FY2024 | FY 2024 Guidance | ||

| Ore milled (tones) | 136,371 | 130,267 | 177,853 | 266,638 | ||

| Gold equivalent (oz)(1) | 10,101 | 9,550 | 14,470 | 19,651 | ||

| Gold | ||||||

| Grade (g/t) | 1.97 | 2.09 | 2.21 | 2.03 | ||

| Recovery (%) | 90.0 | 91.5 | 91.9 | 90.8 | ||

| Production (oz) | 7,775 | 7,994 | 11,599 | 15,768 | 41,000 – 45,000 | |

| Copper | ||||||

| Grade (%) | 0.47 | 0.32 | 0.36 | 0.40 | ||

| Recovery (%) | 78.0 | 76.3 | 81.2 | 77.3 | ||

| Production (K lbs) | 1,095 | 702 | 1,144 | 1,797 | 3,300 – 3,700 | |

| Silver | ||||||

| Grade (g/t) | 8.17 | 6.77 | 8.40 | 7.49 | ||

| Recovery (%) | 74.6 | 72.0 | 72.9 | 73.4 | ||

| Production (oz) | 26,728 | 20,393 | 35,000 | 47,121 |

| (1) | Gold Equivalent Ounces (“GEO”) were calculated using the following average market prices: |

| Q2 FY2024: $2,071.76/oz Au, $23.36/oz Ag, $3.83/lb Cu, | |

| Q1 FY2024: $1,975.87/oz Au, $23.23/oz Ag, $3.71/lb Cu, | |

| Q2 FY2023: $1,888.63/oz Au, $22.56/oz Ag, $4.05/lb Cu | |

| GEO is a Non-GAAP Financial Performance Measure. For further information and detailed reconciliations, please see the “Non-GAAP Financial Performance Measures” section of the Company’s Q1 FY2024 MD&A. |

Exploration Update – Orovalle

| Drilled Meters – Q2 FY2024 | Infill | Brownfield | TOTAL |

| El Valle – Boinas South (SB) | 295 | 2,559 | 2,854 |

Boinás South:

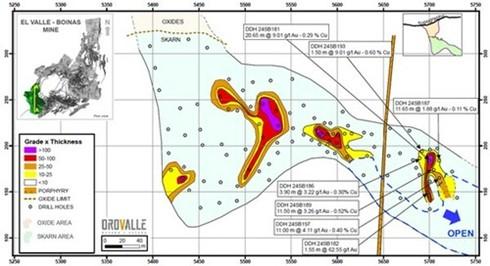

2,854 m were drilled continuing with the mineral definition between Boinas South and Black Skarn to add new resources and using 10*10 m drilling grid (See Figure 1). Twenty drill holes were executed intersecting calcic garnet skarn affected by retrogradation phases and mineralized with copper sulphides (chalcopyrite and bornite). Drilling program will continue during the third quarter to complete the mineral definition.

Quality Control

Infill and brownfield drill holes samples were analyzed in Orovalle’s Laboratory.

Sample preparation was carried out at the El Valle facility. All diamond core samples have been prepared using the following procedure, once split:

The core samples are dried at a temperature of 105ºC and then crushed through a jaw crusher to 95%

<6 mm. The coarse-crushed sample is further reduced to 95%><425 microns using an LM5 bowl-and-puck pulverizer. An Essa rotary splitter is used to take a 450 g to 550 g sub-sample of each split for pulverizing. The remaining reject portion is bagged and stored. The sample is reduced to a nominal -200 mesh using an LM2 bowl-and-puck pulverizer. 140 g sub-samples are split using a special vertical-sided scoop to cut channels through the sample which has been spread into a pancake on a sampling mat. Samples are then sent to the laboratory for gold and base metal analysis. Leftover pulp is bagged and stored. >

After sample preparation, 30g samples are analyzed for Au by fire assay with an atomic absorption spectroscopy (AAS) finish and two-gram samples for Ag, As, Bi, Cu, Hg, Pb, Sb, Se, and Zn by ICP-optical emission spectroscopy (ICP-OES) after an aqua regia digestion.

In case of the samples sent to an external laboratory, 30 g samples are analyzed for Au by fire assay with an atomic absorption (Au AA-25) and 35 elements by ICP (ME-ICP41) after an aqua regia digestion. When Au and Ag values are >100 ppm and Cu and As values are >10,000 ppm, specific analysis methods are used to determinate the final grade.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control (“QA/QC”) program consisting of the insertion of certified reference material, blanks and duplicates samples into the sample stream.

The exploration update was prepared under the supervision of Guadalupe Collar Menéndez, a qualified person for the purposes of NI 43-101 and an employee of Orovalle Minerals S.L., a subsidiary of Orvana.

Financial Performance:

Q2 FY2024 financial highlights will be released with the first quarter financials, expected mid-May, 2024.

ABOUT ORVANA

Orvana is a multi-mine gold-copper-silver company. Orvana’s assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain, the Don Mario gold-silver property in Bolivia, currently in care and maintenance, and the Taguas property located in Argentina.

Figure 1: Section A-A’ Boinás South (CNW Group/Orvana Minerals Corp.)

Figure 2: Grade x Thickness Longitudinal section A-A’ Boinás South (CNW Group/Orvana Minerals Corp.)

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE