ORVANA REPORTS Q1 FY2024 PRODUCTION AND EXPLORATION UPDATE

Orvana Minerals Corp. (TSX: ORV) is pleased to report production and drilling updates from Orovalle, Spain, for the first quarter of fiscal year 2024, ending December 31, 2023.

Highlights

- Production of 9,550 Gold Equivalent Ounces (7,994 gold ounces, 0.7 million copper pounds and 20,393 silver ounces).

- Orovalle-Spain successfully concluded negotiations regarding its 2023-2025 Collective Bargain Agreement with basic terms ratified by the mine workers last week. Upon agreement to the basic terms of the new CBA, the 3-hour stoppages per shift strike, that commenced in mid November 2023, were halted, and labour attendance and operational conditions were returned back to normal.

- OroValle-Spain Drilling:

- 2,659 m of Infill and Brownfield drilling, with key intercepts in South Boinas as follows:

- DDH 23SB162: 6.10 m @ 12.18 g/t Au

- DDH 23SB163: 3.00 m @ 14.82 g/t Au and 4.35 m @ 5.38 g/t Au

- DDH 23SB169: 5.10 m @ 21.40 g/t Au

- DDH 23SB171: 2.40 m @ 16.17 g/t Au

- 445 m of Greenfield Drilling

- 2,659 m of Infill and Brownfield drilling, with key intercepts in South Boinas as follows:

Juan Gavidia, CEO of Orvana stated: “Although negotiations with the labour unions were challenging, management strongly believes Orovalle’s long term sustainability requires detailed attention to its costing and operational frameworks which were adequately addressed in the agreed basic terms with the workers. As a result of the strikes, Orovalle is currently re-assessing production estimates for the fiscal year, while continuing to work on the operational efficiencies planned for the year. We are satisfied with the agreement of the basic terms of the new Collective Agreement, which will provide stability to labour relations until the end of 2025”.

Q1 FY2024 Production Results

- 7,794 gold ounces produced, on track to meet fiscal year 2024 guidance of 41,000 – 45,000 Oz.

- 0.7 million copper pounds produced, on track to meet fiscal year 2024 guidance of 3,300 – 3,700 K lbs.

| Q1 FY2024 | Q4 FY2023 | Q1 FY2023 | FY 2024 Guidance | ||

| Ore milled (tones) | 130,267 | 189,527 | 156,681 | ||

| Gold equivalent (oz)(1) | 9,550 | 15,567 | 13,815 | ||

| Gold | |||||

| Grade (g/t) | 2.09 | 2.23 | 2.30 | ||

| Recovery (%) | 91.5 | 91.3 | 92.5 | ||

| Production (oz) | 7,794 | 12,427 | 10,711 | 41,000 – 45,000 | |

| Copper | |||||

| Grade (%) | 0.32 | 0.40 | 0.43 | ||

| Recovery (%) | 76.3 | 81.2 | 82.6 | ||

| Production (K lbs) | 702 | 1,356 | 1,216 | 3,300 – 3,700 | |

| Silver | |||||

| Grade (g/t) | 6.77 | 8.38 | 10.98 | ||

| Recovery (%) | 72.0 | 76.1 | 81.2 | ||

| Production (oz) | 20,393 | 38,861 | 44,903 | ||

| (1) Gold Equivalent Ounces (“GEO”) were calculated using the following average market prices: | |||||

| Q1 FY2024: $1,975.87/oz Au, $23.23/oz Ag, $3.71/lb Cu, | |||||

| Q4 FY2023: $1,928.61/oz Au, $23.57/oz Ag, $3.79/lb Cu | |||||

| Q1 FY2023: $1,729.21/oz Au, $21.18/oz Ag, $3.63/lb Cu | |||||

GEO is a Non-GAAP Financial Performance Measure. For further information and detailed reconciliations, please see the “Non-GAAP Financial Performance Measures” section of the Company’s FY2023 MD&A.

Q1 FY2024 Drilling Update – Orovalle

| Drilled Meters | Infill | Brownfield | Greenfield | TOTAL |

| El Valle Boinás | ||||

| Boinas South (SB) | 2,355 | 304 | – | 2,659 |

| Ortosa-Godán | – | – | 61 | 61 |

| Lidia | – | – | 384 | 384 |

| TOTAL | 2,355 | 304 | 445 | 3,104 |

Boinás South:

2,659 m were drilled continuing with the mineral definition in garnet skarn between 180 and 230 levels, completing 12 drill holes. DDH 23SB162 intersected 6.10 m @ 12.18 g/t Au; DDH 23SB163 intersected 3.00 m @ 14.82 g/t Au and 4.35 m @ 5.38 g/t Au, DDH 23SB169 intersected 5.10 m @ 21.40 g/t Au and DDH 23SB171 intersected 2.40 m @ 16.17 g/t Au; converting indicated resources into measured resources using 10 * 10 m drilling grid (See Figure 1). Six drill holes were executed to define mineralization between Boinas South and Black Skarn orebodies and three drill holes to look for skarn in the same area. The drilling program will continue during the second quarter in order to define the mineralization continuity to the North.

Ortosa-Godán

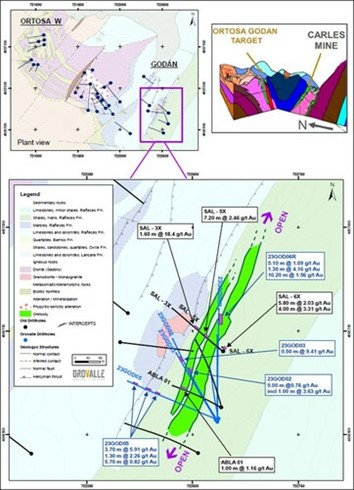

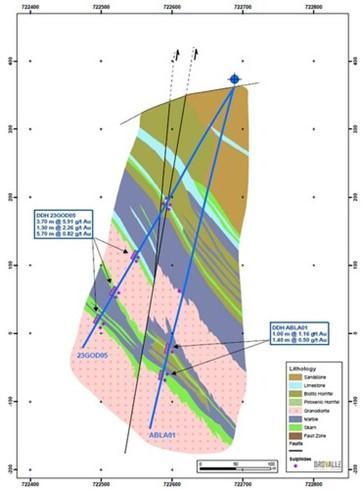

This Project is located three kilometers northwest of our Carlés mine, and within the same gold belt. The exploration program is focused on two areas: Ortosa and Godán. In both cases, the mineral potential is in relation to intrusives. A drilling program was executed in Godán from November 2022 to October 2023 totalling 2,544 meters in 8 drill holes. The drilling campaign proved the presence of mineralization in the contact between the intrusive and sedimentary rocks with calcic skarn bands dipping 60-70º ESE over 200 meters of strike potential. See Figure 2.

According to current drilling information and based on the dip and mineralization of the skarn, as depicted in Figure 2 and 3, there is a potential connection with Carlés skarn. Next steps are currently under reassessment.

Lidia

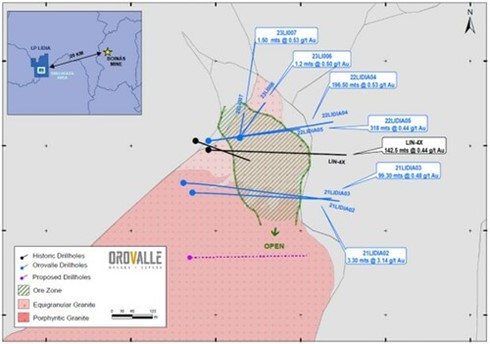

This Project is located in Navelgas Gold Belt, 20 km west from El Valle mine. This gold porphyry occurs within the easternmost part of Navelgas fracture systems. A granodiorite intrusive outcrops over an area of approximately 1 km2. It is dissected by a set of northeast trending mineralized quartz veins and affected by different alteration phases. The drilling program completed between fiscal years 2021-2022 confirmed the presence of gold in the granodiorite (see PR April 17, 2023).

Two drill holes were completed in Q1 FY2024 targeting to define mineralization in the North part of the orebody. Upon reviewing the drilling results from the Q1 FY2024 campaign, it is evident that the boundary of mineralization to the north is well-defined, while remaining open to the south and at depth. The strategy in the area will be redefined to target higher-grade zones based on the available drillhole information.

Quality Control

Greenfield drill hole samples were sent to an external laboratory (ALS Laboratory) for analyses. Infill and brownfield drill holes samples were analyzed in Orovalle’s Laboratory.

Sample preparation was carried out at the El Valle facility. All diamond core samples have been prepared using the following procedure, once split:

The core samples are dried at a temperature of 105ºC and then crushed through a jaw crusher to 95%

<6 mm. The coarse-crushed sample is further reduced to 95%><425 microns using an LM5 bowl-and-puck pulverizer. An Essa rotary splitter is used to take a 450 g to 550 g sub-sample of each split for pulverizing. The remaining reject portion is bagged and stored. The sample is reduced to a nominal -200 mesh using an LM2 bowl-and-puck pulverizer. 140 g sub-samples are split using a special vertical-sided scoop to cut channels through the sample which has been spread into a pancake on a sampling mat. Samples are then sent to the laboratory for gold and base metal analysis. Leftover pulp is bagged and stored. >

After sample preparation, 30g samples are analyzed for Au by fire assay with an atomic absorption spectroscopy (AAS) finish and two-gram samples for Ag, As, Bi, Cu, Hg, Pb, Sb, Se, and Zn by ICP-optical emission spectroscopy (ICP-OES) after an aqua regia digestion.

In case of the samples sent to an external laboratory, 30 g samples are analyzed for Au by fire assay with an atomic absorption (Au AA-25) and 35 elements by ICP (ME-ICP41) after an aqua regia digestion. When Au and Ag values are >100 ppm and Cu and As values are >10,000 ppm, specific analysis methods are used to determinate the final grade.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control program consisting of the insertion of certified reference material, blanks and duplicates samples into the sample stream.

The exploration update was prepared under the supervision of Guadalupe Collar Menéndez, a qualified person for the purposes of NI 43-101 and an employee of Orovalle Minerals S.L., a subsidiary of Orvana.

Financial Performance:

Q1 FY2024 financial highlights will be released with the first quarter financials, expected mid-February, 2024.

ABOUT ORVANA

Orvana is a multi-mine gold-copper-silver company. Orvana’s assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain, the Don Mario gold-silver property in Bolivia, currently in care and maintenance, and the Taguas property located in Argentina.

Figure 1. Boinas South Section. (CNW Group/Orvana Minerals Corp.)

Figure 2. Godán intercepts (CNW Group/Orvana Minerals Corp.)

Figure 3. Godán section (CNW Group/Orvana Minerals Corp.)

Figure 4. Lidia Project Plan View (CNW Group/Orvana Minerals Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE