Orla Mining Continues to Intersect Wide, Higher-Grade Sulphide Zones and Expose Deeper Potential at Camino Rojo, Mexico

4.66 g/t Au over 64.0 m (Sulphide Zone), 4.02 g/t Au & 1.5% Zn over 22.9 m (Deep Potential), Regional Program Ramping Up with Encouraging Results.

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) is pleased to provide an update on its 2022 exploration activities at Camino Rojo and provide an overview of its 2023 exploration plans in Mexico. Updates on Orla’s exploration activities in Nevada, US and Panama will be provided in the first quarter.

2022 Exploration Highlights: Camino Rojo (Mexico)

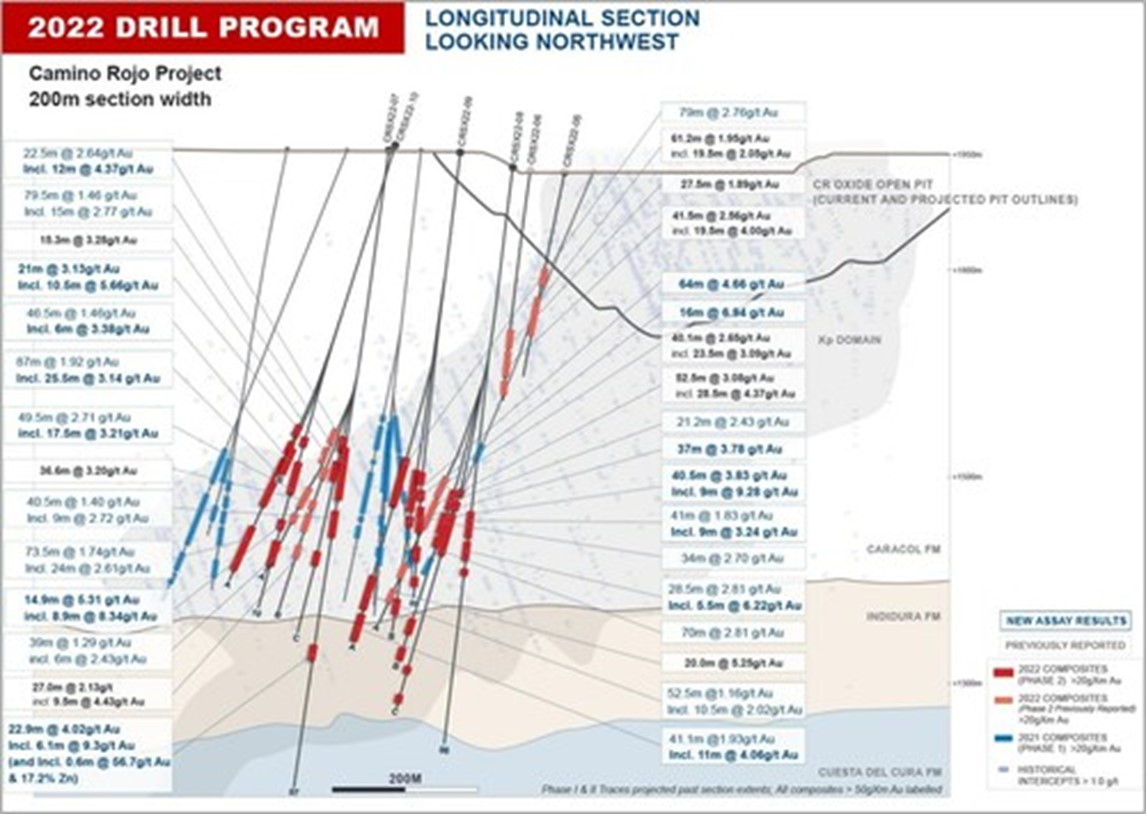

Camino Rojo Sulphides: The Sulphide drill program continued to return higher-grade gold intercepts (>2 g/t) over wide widths (>30 m). Notable results include:[1]

- Hole CRSX22-09B: 4.66 g/t Au over 64.0 m

- Hole CRSX22-09A 2.76 g/t Au over 79.0 m, incl. 3.22 g/t Au over 55.0m

- Hole CRSX22-08C: 2.81 g/t Au over 70.0 m

- Hole CRSX22-10A: 1.92 g/t Au over 87.0 m, incl. 3.14 g/t Au over 25.5 m and 1.74 g/t Au over 73.5m, incl. 2.61 g/t Au over 24.0 m

- Hole CRSX22-09: 3.83 g/t Au over 40.5 m, incl. 9.28 g/t Au over 9.0 m and 6.94 g/t Au over 16.0 m

- Hole CRSX22-08B: 3.78 g/t Au over 37.0 m

- Hole CRSX22-10: 2.71 g/t Au over 49.5 m, incl. 6.80 g/t Au over 8.0 m

Camino Rojo Deep Potential: Drill results have shown that gold mineralization extends deeper than the limit of the current mineral resource. These deeper intercepts suggest gold mineralization remains open at depth along and adjacent to interpreted feeder-like structures for the currently defined Camino Rojo deposit. Notable result include:1

- Hole CRSX22-07: 4.02 g/t Au & 1.5% Zn over 22.9 m, incl. 56.7 g/t Au & 17.2% Zn over 0.6 m

Regional Exploration: Encouraging drill result on the first diamond drill core hole completed outside the footprint of the Camino Rojo mine. The Guanamero target area is located approximately 7 km northeast of the Camino Rojo mine along the mine structural trend. Notable results include:1

- Hole CRED22-01: 0.54 g/t over 7.10 m, incl. 4.12 g/t over 0.7 m (from 51.4 m) and 1.35 g/t over 2.35 m, incl. 5.59 g/t over 0.5 m (from 104.95 m)

“The 2022 infill drilling of the sulphide extension of the Camino Rojo deposit has consistently generated exceptional gold intersections enhancing future development opportunity scenarios and potential to grow the resource at depth”, stated Sylvain Guerard, Orla’s Senior Vice President, Exploration. “We are excited to advance a full exploration pipeline in 2023 in an effort to upgrade and expand reserves and resources and make new discoveries on our large and under explored land package”.

2022 Exploration: Camino Rojo (Mexico)

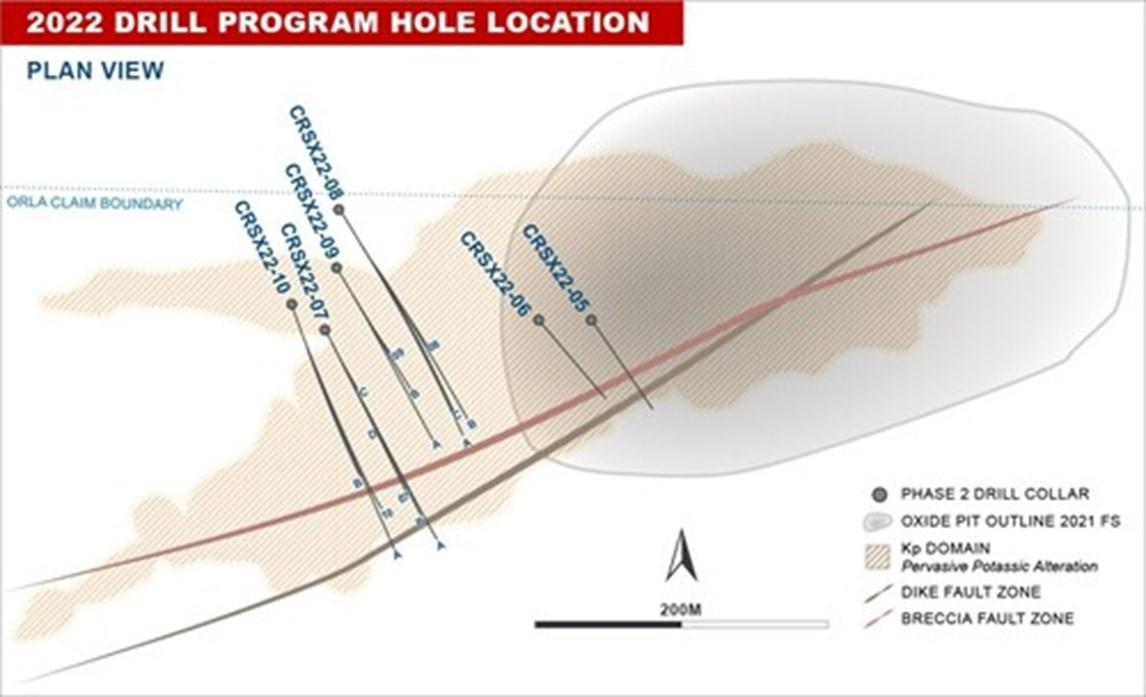

Exploration at Camino Rojo in 2022 focused on advancing the understanding of the sulphide deposit (the “Sulphide Project” or “Camino Rojo Sulphides”) and testing priority regional targets to make new satellite discoveries.

Near Mine Exploration Results

Drill results at Camino Rojo Sulphides continue to support potential for underground development

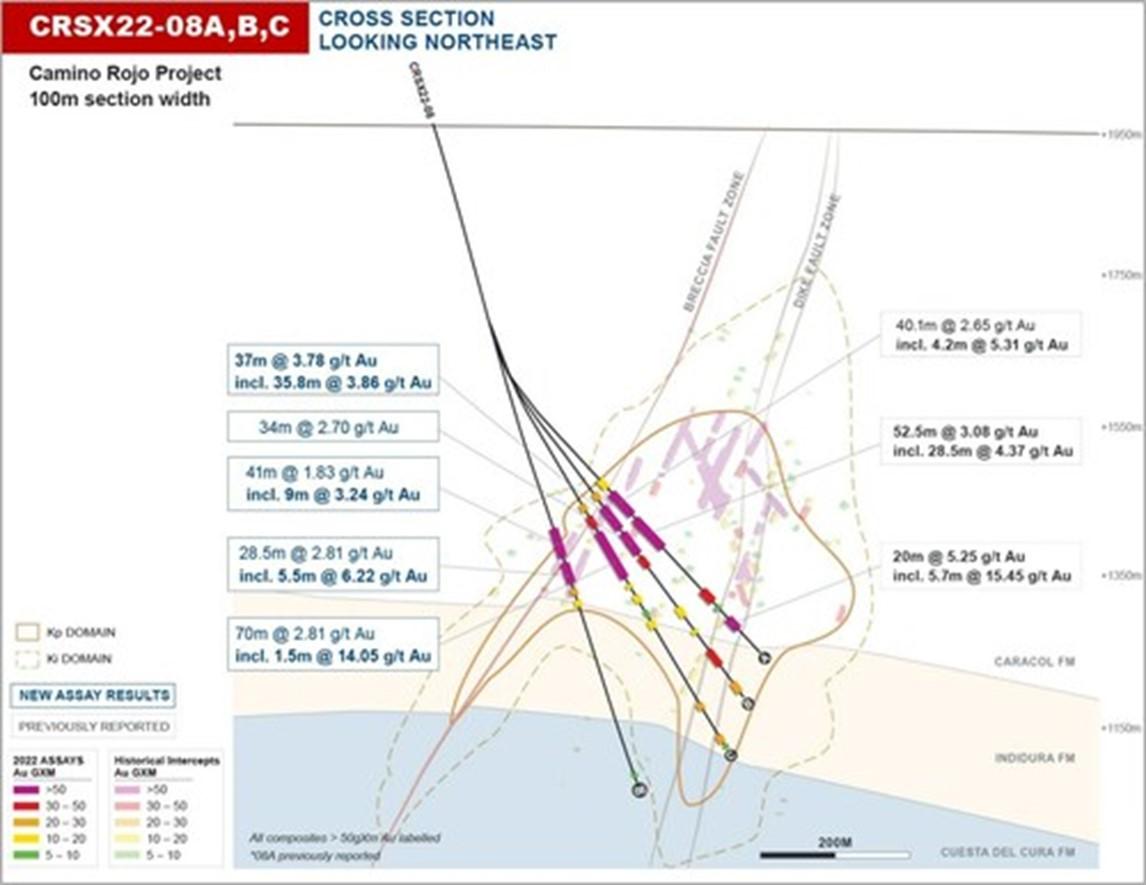

Drilling continues to intercept wide zones of higher-grade gold mineralization, and in conjunction with metallurgical results from the 2021 drilling (see news release dated May 9, 2022), supports the potential for underground development and a standalone processing option for the Camino Rojo Sulphides. A large part of the 2022 program included infilling the sulphide deposit and improving the geological model to support potential underground mine development scenario. A total of 9,174 metres was completed in 15 holes, with 5 holes previously reported (see news release dated September 12, 2022 – Orla Mining Advances Exploration & Growth Pipeline). The 15 holes completed in 2022 returned 32 significant mineralized drill intercepts with grade-by-thickness factor greater than 50 g/t by metre Au (g/t * m), including 16 intercepts with grade-by-thickness factor greater than 100 g/t by metre Au. Full drill results are available in the Appendix to this news release and are available at www.orlamining.com.

The current mineral resource estimate for the Sulphide Project at Camino Rojo consists of 74 koz of measured resource (3.358 million tonnes at 0.69 g/t gold) and 7,221 koz of indicated resources (255.445 million tonnes at 0.88 g/t gold) and has an effective date of June 7, 2019.2

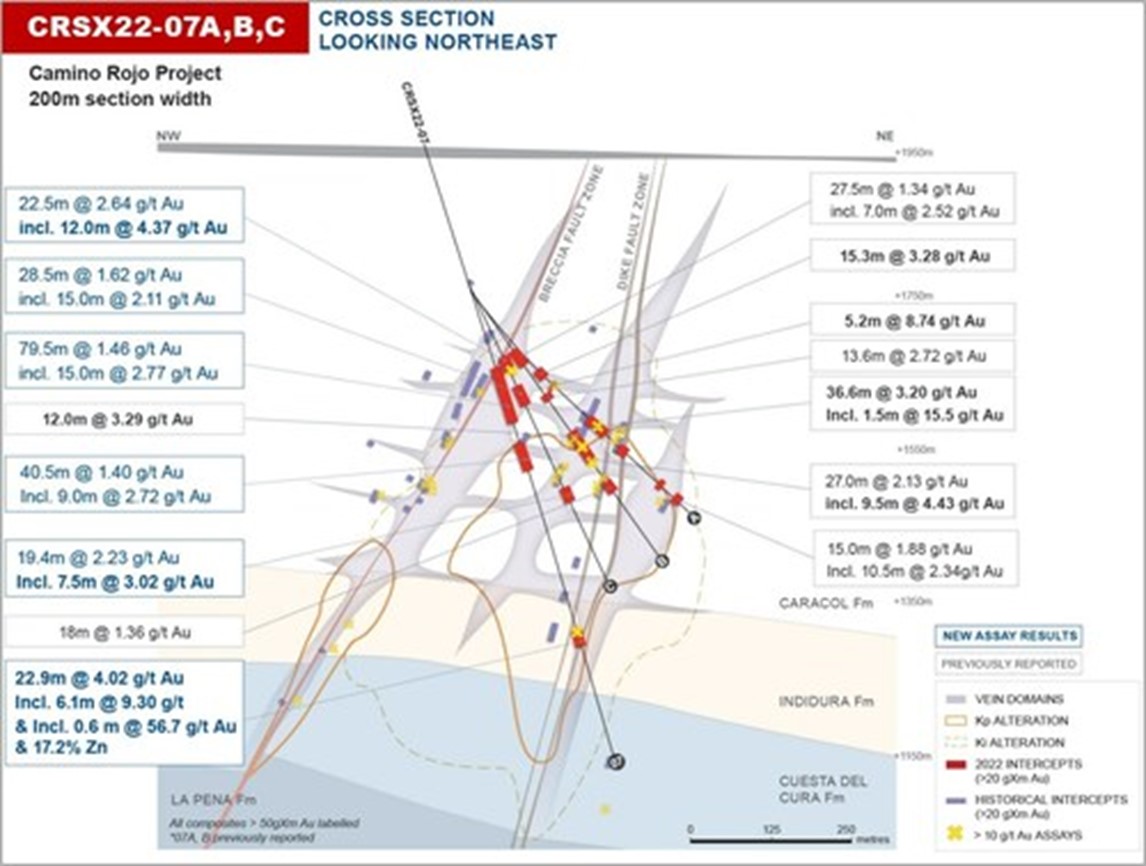

Vein domains constraining higher grade gold in sulphide deposit

The 2022 sulphide drill program has helped define areas of high vein concentrations (“vein domains”) which coincide with higher grade (>2 g/t) gold mineralization. The vein domains are important geological controls on gold mineralization, constraining the distribution and continuity of higher-grade gold mineralization within the sulphide deposit. Improved confidence in geological controls will strengthen future mineral resource estimations.

Vein domains have been defined by combining recent oriented diamond drill core data and approximately 70,000 m of historical vein density and orientation data within the main zone of potassic alteration (Kp). This work has resulted in the definition of three steep northwest and five shallow south-southwest dipping vein domains (Figure 4). High grade gold (>10 g/t Au) appears to be concentrated at the intersection of these steep and shallow dipping domains.

Potential new oxide mineralization outside current pit boundaries

Hole CRSX22-05, drilled as part of the 2022 sulphide drill program, intersected a mix of oxide and transitional material on the edge of the oxide open pit along the dike structure with mineralized intersections of 1.95 g/t over 61.2 m and 1.03 g/t over 25.3 m (see news release dated September 12, 2022 – Orla Mining Advances Exploration & Growth Pipeline). This positive intersection triggered follow-up drilling to further assess potential oxide pit extension over this area. Two holes were drilled in 2022 with CROX22-01, returning 1.10 g/t Au over 136.5 m[3] and CROX22-02 returning 0.70 g/t Au over 290 m including 0.97 g/t Au over 147.5 m3. Both holes intercepted the extension of the mineralization and associated oxidation that was intercepted in hole CRSX22-05, but within the current feasibility pit. Results so far indicate that mineralizing structures also act as pathways for deep oxidation beyond the current pit boundary. Further drilling is planned in 2023 to test for zones of oxidized mineralization that could potentially allow for local expansion of the oxide pit.

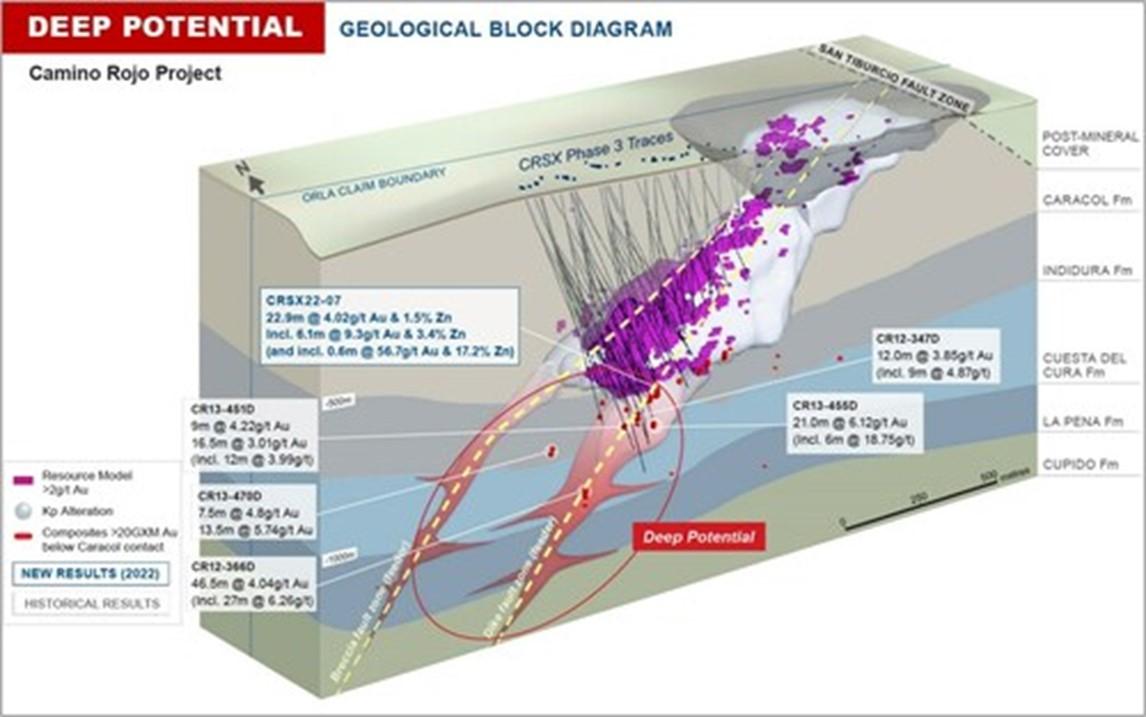

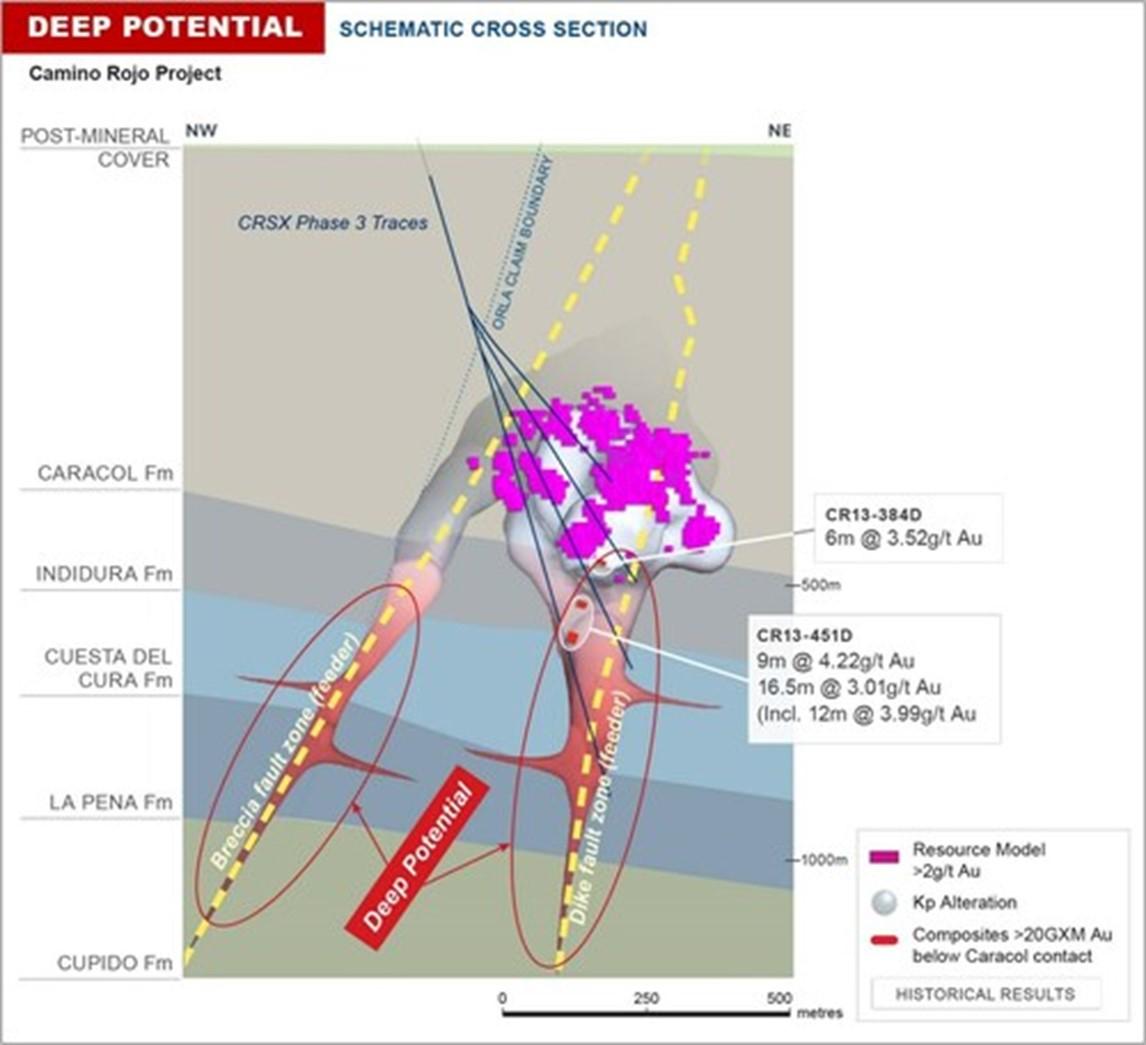

Deeper intersections suggest deep potential for extension of Camino Rojo Sulphides

Select holes from the recently completed 2022 sulphide drill program were extended to test the down plunge continuity of gold mineralization along the Dike Zone. These drill holes have returned encouraging and highly significant results, such as 4.02 g/t Au over 22.9 m. Compilation of historical drill data has also confirmed high-grade gold intercepts over significant widths with a similar style of mineralization elsewhere below the current extents of the Camino Rojo resource estimation model.

Most of the gold mineralization at Camino Rojo has been defined in the Caracol Formation where auriferous veins are mostly constrained to a broad envelope of potassic alteration (Kp). Recent and compiled historical drilling indicates gold mineralization extends deeper into the underlying Indidura and Cuesta del Cura formations (and potentially deeper into other underlying units) along the Dike Zone and Breccia Fault Zone, suggesting these faults may be feeder-like structures for the Camino Rojo deposit. This deeper gold mineralization is hosted by skarn and calc-silicate alteration associated with manto-type mineralization with semi-massive to massive sulphides replacing bedding.

2022 notable results hosted in Indidura or Cuesta del Cura formations:

- Hole CRSX22-07: 4.02 g/t Au over 22.9 m, incl. 9.30 g/t Au over 6.1 m

- Hole CRSX22-08B: 1.28 g/t Au over 24.6 m

- Hole CRSX22-08B: 1.33 g/t Au over 17.2 m

- Hole CRSX22-08C: 2.50 g/t Au over 9.1 m

- Hole CRSX22-08C: 1.81 g/t Au over 19.4 m, incl. 2.51 g/t Au over 9.0 m

Selected historical4 results below Caracol Formation in Indidura or Cuesta del Cura Formations:

- Hole CR12-366D: 4.04 g/t Au over 46.5 m, incl. 6.26 g/t Au over 27.0 m

- Hole CR13-507DB: 3.08 g/t Au over 55.5 m, incl 5.67 g/t Au over 22.5 m

- Hole CR13-455D: 6.12 g/t Au over 21.0 m, incl 18.75 g/t Au over 6.0 m

- Hole CR13-454D: 2.11 g/t Au over 51.0 m, incl 6.72 g/t Au over 4.5 m

- Hole CR13-453D: 3.62 g/t Au over 27.0 m

- Hole CR14-597DG: 3.68 g/t Au over 25.5 m incl 11.49 g/t Au over 6.0 m

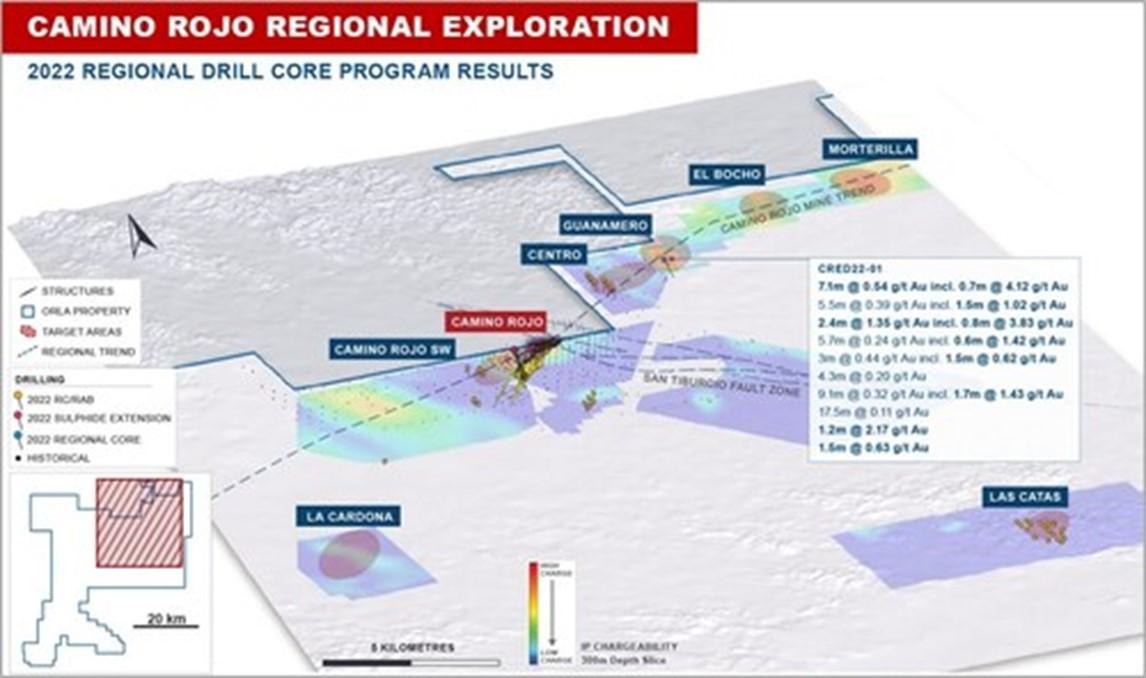

Regional Exploration Results

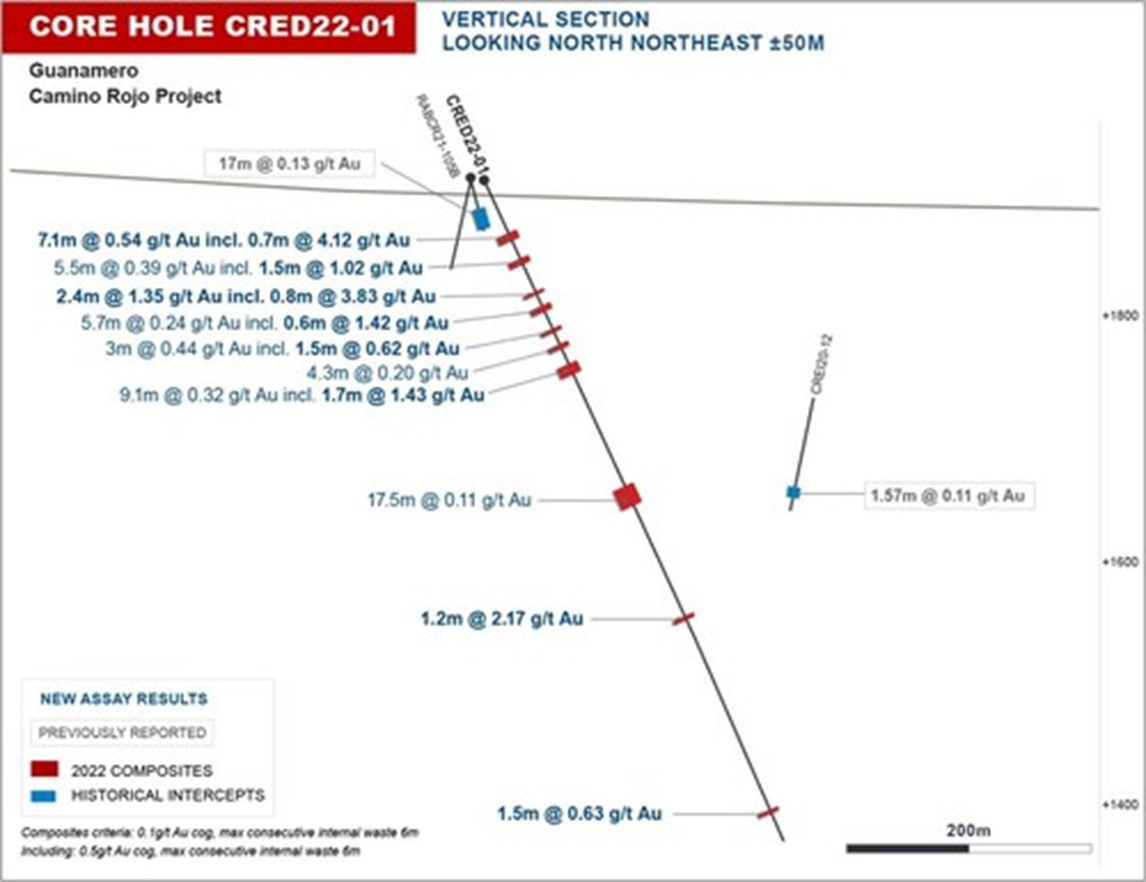

Orla’s first diamond drill core hole outside the Camino Rojo deposit returned 0.54 g/t Au over 7.10 m and 1.35 g/t Au over 2.35 m at the Guanamero target. Prior to this drill hole, meaningful gold mineralization had been restricted to the footprint of the Camino Rojo Deposit. These new regional exploration results, combined with strong exploration markers are a very encouraging step towards making a regional discovery. The positive exploration markers for Guanamero include the presence of gold-bearing mafic dikes, alteration and rock types similar to Camino Rojo deep potential target, as well as the Guanamero target being located on an extension of the mine trend.

Early-stage exploration targets were tested with reverse circulation drilling along the Camino Rojo Mine trend as well as to the south of the mine. One core hole (CRED22-01) was drilled into an IP anomaly at the Guanamero target area, approximately 7 km to the northeast of the mine. The Guanamero target area is defined by the northeast extension of diorite dikes along the regional structure hosting the Camino Rojo Mine, the presence of a large high magnetic signature (1 km2) and anomalous to significant results from Orla’s wide-spaced 2021 RAB drill program (see news release dated March 14, 2022). Drill hole CRED22-01 intersected geology similar to that encountered in the deep potential at the Camino Rojo Mine: altered diorite and hornblende porphyry diorite dikes with calc-silicate to propylitic altered Cuesta del Cura, La Peña, and Cupido formations. Trace to 2% disseminated and fine sulphide (pyrite, pyrrhotite, sphalerite, magnetite) veinlets, stringers and breccia zones were intercepted throughout the length of the hole. Anomalous to significant gold results, as listed below, are associated with zones of breccia and sulphide dissemination and veinlets. Follow-up drilling will be performed in early 2023.

- 0.54 g/t over 7.10m, incl. 4.12 g/t over 0.7m (from 51.4 m)

- 0.39 g/t over 5.50 m, incl. 1.02 g/t over 1.5 m (from 74.5 m)

- 1.35 g/t over 2.35 m, incl. 3.83 g/t over 0.8 m (from 104.95 m)

- 0.24 g/t over 5.65 m, incl. 1.42 g/t over 0.6m (from 116.9 m)

- 0.44 g/t over 3.0 m (from 137.5 m)

- 0.20 g/t over 4.3 m (from 151.0 m)

- 0.32 g/t over 9.05 m (from 169.95 m)

- 0.11 g/t over 17.5 m (from 279.5 m)

- 2.17 g/t over 1.20 m (from 398.3 m)

- 0.63 g/t over 1.5 m (from 571.5 m)

Composites for the regional exploration drilling were calculated using 0.1 g/t Au cut-off grade and maximum 6 metres consecutive waste.

2023 Exploration Plans & Strategy: Camino Rojo (Mexico)

| Mexico Exploration 2023 | Program | Drilling Planned | Spend |

| Camino Rojo Layback Drilling (capitalized) | Infill on oxide mine

layback area |

3,000 m DD | $2m |

| Camino Rojo Sulphides Drilling | Infilling sulphides

and other near-mine drilling |

34,000 m DD sulphides

(20% deep extension) 6,500 m DD (oxides) |

$16m |

| Camino Rojo Regional Exploration | Target drill testing

and target definition |

15,000-20,000 m RC

2,000-5,000 m DD +Geophysical & geochemical surveys |

$4m |

| Total Mexico Exploration | $22m |

Near Mine Exploration

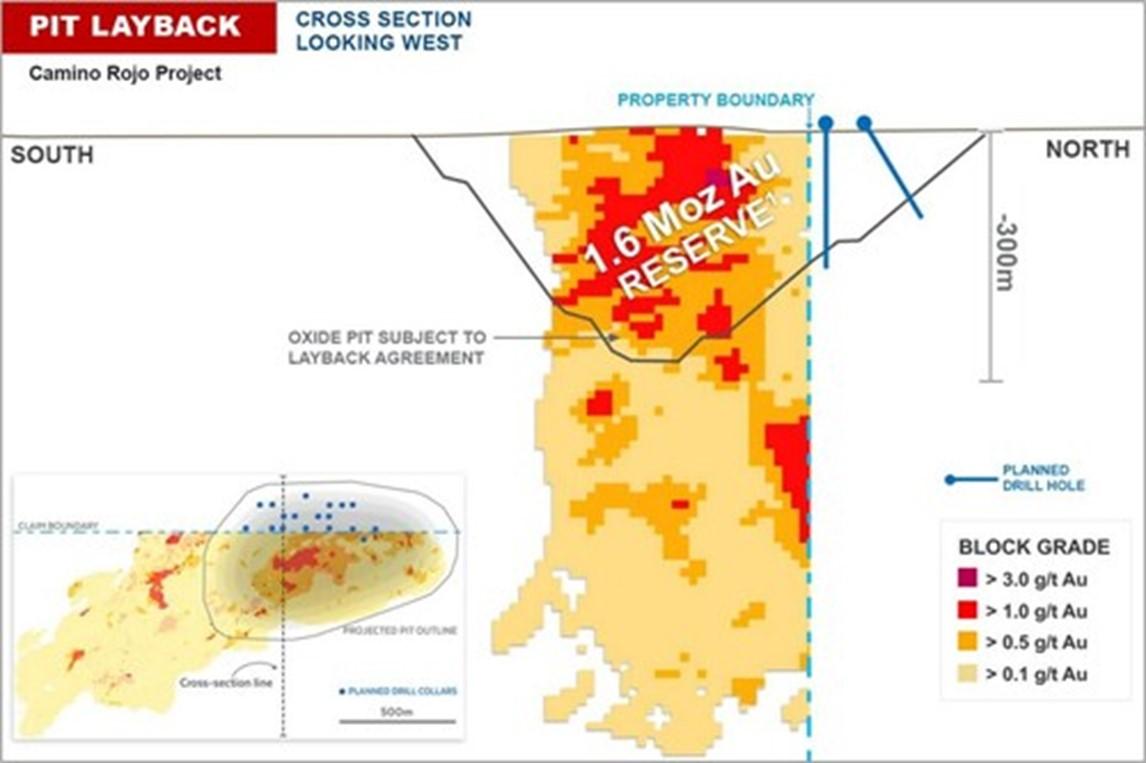

Camino Rojo layback reserve drilling

A 3,000 metre, 22-hole drill program to confirm and delineate mineralization located in the oxide pit layback and allow for potential update of mineral resource and reserve estimates will be completed in 2023. This program will seek to define additional oxide reserves at the Camino Rojo Mine following confirmatory core drilling on the Fresnillo Plc (“Fresnillo”) property, located immediately north and adjacent of the Camino Rojo oxide mine open pit. While historical drilling indicates that mineralization continues across the property boundary onto the Fresnillo layback area, no ounces from this area are currently included in the Camino Rojo mineral reserve estimate.

Camino Rojo Sulphides drilling continuation

A 34,000-metre, 57 hole follow-up drill program will continue to infill the Camino Rojo Sulphides in 2023. 20% of the holes will extend to test the deep potential of the deposit. In addition, 6,500m will be drilled on the extensions of the Camino Rojo oxide deposit to update and expand resources and reserves.

Based on the positive results encountered in the 2021 and 2022 programs, more closely spaced, south-oriented drilling will be required to fully capture the extent of a potential underground resource. To date, 15,253 metres of directional drilling has been completed. This drilling has continued to inform Orla’s perspective on the development approach to the deposit. The 2023 drilling is expected to strengthen the confidence for the development of a Preliminary Economic Assessment (“PEA”) that contemplates underground mining by infilling the higher-grade (>2 g/t) portions of the deposit with 50 metre spacing of South-oriented drill holes. Overall drill spacing at the end of this next phase, including historical north-oriented drill holes, will be 25-30 metres. Upon the completion of the 2023 additional south oriented directional drilling and test work programs, a PEA is expected to be completed based on the optimal development scenario for Orla.

Regional Exploration

Approximately 15,000-20,000 metres of RC drilling and 2,000-5,000 metres of core drilling is planned for regional exploration in 2023. Regional exploration will consist of drill testing multiple targets outside the Camino Rojo deposit including priority targets along the northeast-southwest mine trend, including targets associated with recently defined IP anomalies. Priority targets such as Guanamero and Monterilla at the north-east and CR SW immediately to the south-west of the Camino Rojo deposit were only partially tested in 2022 and will be drill tested in 2023. Geophysical and geochemical surveys are also planned for 2023 to keep defining new targets.

Qualified Persons Statement

The scientific and technical information in this news release has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Person as defined under the definitions of National Instrument 43-101.

To verify the information related to the 2022 drilling programs at the Camino Rojo property, Mr. Guerard has visited the property in the past year; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

Quality Assurance / Quality Control – 2022 Drill Program

All gold results at Camino Rojo were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including silver, copper, lead and zinc using a four-acid digestion with ICP-AES finish (ME-ICP61) method at ALS Laboratories in Canada. If samples were returned with gold values in excess of 10 ppm or base metal values in excess of 1% by ICP analysis, samples are re-run with gold (Au-GRA21) by fire assay and gravimetric finish or base metal by (OG62) four acid overlimit methods. Drill program design, Quality Assurance/Quality Control and interpretation of results were performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Standards were inserted at a frequency of one in every 50 samples, and blanks were inserted at a frequency of one in every 50 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. ALS Laboratories is independent of Orla. There are no known drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the drilling data at Camino Rojo.

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” dated January 11, 2021, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled “Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama” dated January 18, 2022, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled “South Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada” dated March 23, 2022, is available on SEDAR and EDGAR under the Company’s profile at www.sedar.com and www.sec.gov, respectively. The technical reports are available on Orla’s website at www.orlamining.com.

Appendix: Drill Results

Table 1: Camino Rojo Near Mine Composite Drill Results

| HOLE-ID | From (m) |

To (m) |

Core Length (m) |

True Width (m) |

Au g/t | Ag g/t | Au GXM | Au GXM (TW) |

Including 2.0g/t Au COG |

Including 10g/t Au HG |

Ox / Sx |

| CRSX22-07 | 439.80 | 441.30 | 1.50 | 1.01 | 1.32 | 39.3 | 1.98 | 1.33 | SX | ||

| CRSX22-07 | 454.80 | 456.30 | 1.50 | 1.01 | 3.47 | 49.0 | 5.21 | 3.51 | 1.5m @ 3.47g/t Au | SX | |

| CRSX22-07 | 465.30 | 544.80 | 79.50 | 53.59 | 1.46 | 5.5 | 115.85 | 78.09 | 15m @ 2.77g/t Au 1.5m @ 2.03g/t Au 1.5m @ 2.91g/t Au 4.5m @ 2.88g/t Au 3m @ 2.28g/t Au 1.5m @ 2.41g/t Au 3m @ 3.74g/t Au |

SX | |

| CRSX22-07 | 556.80 | 561.30 | 4.50 | 3.04 | 1.55 | 4.3 | 6.97 | 4.71 | SX | ||

| CRSX22-07 | 567.30 | 607.80 | 40.50 | 27.35 | 1.40 | 4.0 | 56.54 | 38.19 | 1.5m @ 5.12g/t Au 9m @ 2.72g/t Au |

SX | |

| CRSX22-07 | 619.80 | 627.30 | 7.50 | 5.09 | 1.82 | 1.4 | 13.62 | 9.25 | 1.5m @ 5.67g/t Au | SX | |

| CRSX22-07 | 646.80 | 648.30 | 1.50 | 1.02 | 2.29 | 8.4 | 3.44 | 2.33 | 1.5m @ 2.29g/t Au | SX | |

| CRSX22-07 | 663.30 | 664.80 | 1.50 | 1.02 | 1.16 | 6.5 | 1.74 | 1.18 | SX | ||

| CRSX22-07 | 673.50 | 675.00 | 1.50 | 1.02 | 1.19 | 7.5 | 1.78 | 1.20 | SX | ||

| CRSX22-07 | 681.00 | 682.50 | 1.50 | 1.01 | 1.55 | 5.2 | 2.33 | 1.57 | SX | ||

| CRSX22-07 | 685.50 | 687.00 | 1.50 | 1.01 | 1.20 | 37.5 | 1.79 | 1.21 | SX | ||

| CRSX22-07 | 777.60 | 800.50 | 22.90 | 15.43 | 4.02 | 12.2 | 92.03 | 62.01 | 6.05m @ 9.3g/t Au 9.1m @ 3.19g/t Au |

0.6m @ 56.7g/t Au 1m @ 16.75g/t Au |

SX |

| CRSX22-07 | 807.00 | 808.50 | 1.50 | 1.01 | 1.28 | 1.0 | 1.92 | 1.29 | |||

| CRSX22-07 | 813.00 | 814.50 | 1.50 | 1.00 | 1.37 | 11.0 | 2.05 | 1.37 | |||

| CRSX22-07 | 819.00 | 820.50 | 1.50 | 1.00 | 1.46 | 9.1 | 2.18 | 1.46 | |||

| CRSX22-07 | 831.00 | 834.00 | 3.00 | 2.00 | 1.32 | 2.4 | 3.97 | 2.65 | |||

| CRSX22-07 | 888.00 | 890.20 | 2.20 | 1.46 | 2.86 | 8.2 | 6.29 | 4.17 | 1m @ 4.9g/t Au | ||

| CRSX22-07C | 295.90 | 297.40 | 1.50 | 1.02 | 1.52 | 5.5 | 2.28 | 1.56 | SX | ||

| CRSX22-07C | 304.90 | 306.40 | 1.50 | 1.02 | 1.08 | 1.5 | 1.61 | 1.10 | SX | ||

| CRSX22-07C | 307.90 | 316.50 | 8.60 | 5.87 | 1.01 | 8.3 | 8.70 | 5.93 | 1.8m @ 2.02g/t Au | SX | |

| CRSX22-07C | 338.35 | 340.15 | 1.80 | 1.23 | 1.16 | 5.4 | 2.09 | 1.43 | SX | ||

| CRSX22-07C | 435.80 | 441.60 | 5.80 | 4.52 | 2.03 | 48.3 | 11.76 | 9.15 | 4.3m @ 2.29g/t Au | SX | |

| CRSX22-07C | 455.10 | 477.60 | 22.50 | 17.39 | 2.64 | 11.3 | 59.39 | 45.91 | 12m @ 4.37g/t Au | 1.5m @ 12.85g/t Au | SX |

| CRSX22-07C | 496.90 | 525.40 | 28.50 | 21.99 | 1.62 | 8.1 | 46.30 | 35.72 | 15m @ 2.11g/t Au 1.5m @ 2.56g/t Au |

SX | |

| CRSX22-07C | 534.40 | 535.90 | 1.50 | 1.16 | 1.54 | 6.9 | 2.31 | 1.78 | SX | ||

| CRSX22-07C | 540.40 | 541.90 | 1.50 | 1.16 | 1.18 | 2.3 | 1.77 | 1.37 | SX | ||

| CRSX22-07C | 559.90 | 562.90 | 3.00 | 2.31 | 3.20 | 4.3 | 9.59 | 7.39 | 1.5m @ 4.6g/t Au | SX | |

| CRSX22-07C | 569.70 | 572.50 | 2.80 | 2.15 | 4.55 | 20.1 | 12.74 | 9.79 | 2.8m @ 4.55g/t Au | SX | |

| CRSX22-07C | 580.00 | 585.00 | 5.00 | 3.83 | 1.62 | 6.3 | 8.08 | 6.19 | 1.5m @ 3.21g/t Au | SX | |

| CRSX22-07C | 610.00 | 614.05 | 4.05 | 3.12 | 1.61 | 1.3 | 6.54 | 5.03 | 1.5m @ 3.19g/t Au | SX | |

| CRSX22-07C | 636.15 | 637.65 | 1.50 | 1.15 | 1.22 | 19.5 | 1.82 | 1.40 | SX | ||

| CRSX22-07C | 645.15 | 664.50 | 19.35 | 14.85 | 2.23 | 21.8 | 43.20 | 33.15 | 1.5m @ 9.87g/t Au 7.2m @ 3.02g/t Au |

SX | |

| CRSX22-07C | 673.50 | 675.00 | 1.50 | 1.15 | 2.54 | 25.2 | 3.81 | 2.92 | 1.5m @ 2.54g/t Au | SX | |

| CRSX22-07C | 760.50 | 763.50 | 3.00 | 2.34 | 1.11 | 8.8 | 3.34 | 2.60 | SX | ||

| CRSX22-07C | 771.00 | 772.70 | 1.70 | 1.33 | 3.55 | 12.4 | 6.04 | 4.71 | 1.7m @ 3.55g/t Au | SX | |

| CRSX22-08 | 523.00 | 524.50 | 1.50 | 1.40 | 1.99 | 7.6 | 2.99 | 2.79 | SX | ||

| CRSX22-08 | 542.50 | 544.00 | 1.50 | 1.40 | 1.17 | 1.0 | 1.76 | 1.64 | SX | ||

| CRSX22-08 | 564.50 | 605.50 | 41.00 | 38.26 | 1.83 | 7.7 | 75.16 | 70.14 | 0.9m @ 9.3g/t Au 9m @ 2.77g/t Au 9m @ 3.24g/t Au |

SX | |

| CRSX22-08 | 612.50 | 641.00 | 28.50 | 26.52 | 2.81 | 9.5 | 80.07 | 74.51 | 6m @ 4.35g/t Au 5.45m @ 6.22g/t Au 1.5m @ 4.73g/t Au |

1.5m @ 13.5g/t Au 1.5m @ 15.3g/t Au |

612.5 – 619.3 SX 619.3 – 626.65 626.65 – 627.5 OX 627.5 – 636.4 TRSX 636.4 – 641 SX |

| CRSX22-08 | 648.60 | 657.50 | 8.90 | 8.27 | 2.53 | 6.4 | 22.55 | 20.95 | 0.6m @ 29.3g/t Au | 0.6m @ 29.3g/t Au | SX |

| CRSX22-08 | 665.00 | 673.60 | 8.60 | 7.98 | 2.02 | 22.7 | 17.35 | 16.10 | 3.05m @ 3.93g/t Au | SX | |

| CRSX22-08 | 849.00 | 850.50 | 1.50 | 1.01 | 1.72 | 2.3 | 2.58 | 1.74 | SX | ||

| CRSX22-08 | 879.00 | 880.50 | 1.50 | 1.00 | 1.25 | 15.2 | 1.87 | 1.25 | 879 – 879.3 FR 879.3 – 880.5 TROL |

||

| CRSX22-08 | 910.50 | 914.00 | 3.50 | 2.35 | 1.76 | 1.8 | 6.15 | 4.13 | 0.5m @ 7.33g/t Au | SX | |

| CRSX22-08B | 495.50 | 497.00 | 1.50 | 1.50 | 1.07 | 9.1 | 1.61 | 1.60 | SX | ||

| CRSX22-08B | 519.00 | 520.70 | 1.70 | 1.70 | 1.14 | 40.9 | 1.93 | 1.93 | SX | ||

| CRSX22-08B | 545.50 | 557.30 | 11.80 | 11.77 | 2.07 | 10.9 | 24.47 | 24.40 | 2m @ 9.27g/t Au | 0.5m @ 29.5g/t Au | 545.5 – 546.7 SX 546.7 – 557.3 TRSX |

| CRSX22-08B | 568.50 | 605.45 | 36.95 | 36.83 | 3.78 | 14.7 | 139.68 | 139.22 | 35.75m @ 3.86g/t Au | 1.5m @ 21.7g/t Au 1.5m @ 16g/t Au |

568.5 – 578.75 TRSX 578.75 – 579 TROL 579 – 580.5 TRSX 580.5 – 580.78 TROH 580.78 – 584.79 TRSX 584.79 – 586.39 TROL 586.39 – 599.42 TRSX 599.42 – 599.46 TROH 599.46 – 602 TROL 602 – 605.45 TROH |

| CRSX22-08B | 611.50 | 645.50 | 34.00 | 33.87 | 2.70 | 4.5 | 91.83 | 91.47 | 1.5m @ 9.88g/t Au 24m @ 2.8g/t Au |

1.4m @ 21g/t Au | 611.5 – 619.2 TROL 619.2 – 645.5 SX |

| CRSX22-08B | 651.60 | 668.00 | 16.40 | 16.33 | 1.85 | 4.9 | 30.40 | 30.26 | 10.4m @ 2.54g/t Au | 651.6 – 651.7 SX 651.7 – 654 TRSX 654 – 668 SX |

|

| CRSX22-08B | 693.00 | 698.00 | 5.00 | 4.38 | 1.20 | 0.7 | 6.00 | 5.25 | TRSX | ||

| CRSX22-08B | 734.50 | 751.50 | 17.00 | 14.93 | 1.05 | 3.8 | 17.80 | 15.64 | 1.3m @ 2.75g/t Au | 734.5 – 736.7 TROL 736.7 – 742.15 SX 742.15 – 748.4 748.4 – 751.5 TROL |

|

| CRSX22-08B | 756.00 | 757.50 | 1.50 | 1.32 | 1.23 | 12.7 | 1.85 | 1.62 | TRSX | ||

| CRSX22-08B | 772.00 | 777.70 | 5.70 | 4.99 | 1.75 | 11.8 | 10.00 | 8.76 | 1m @ 3.86g/t Au 1.7m @ 2.17g/t Au |

TRSX | |

| CRSX22-08B | 785.00 | 786.50 | 1.50 | 1.31 | 2.06 | 17.0 | 3.09 | 2.70 | 1.5m @ 2.06g/t Au | TRSX | |

| CRSX22-08B | 806.00 | 830.60 | 24.60 | 21.49 | 1.28 | 9.6 | 31.44 | 27.46 | 4.5m @ 3.01g/t Au | SX | |

| CRSX22-08B | 858.80 | 876.00 | 17.20 | 14.97 | 1.33 | 17.8 | 22.87 | 19.90 | 1.5m @ 4.92g/t Au | SX | |

| CRSX22-08C | 534.00 | 535.50 | 1.50 | 1.48 | 4.03 | 3.8 | 6.05 | 5.97 | 1.5m @ 4.03g/t Au | SX | |

| CRSX22-08C | 550.00 | 559.50 | 9.50 | 9.37 | 2.64 | 8.6 | 25.12 | 24.78 | 9.5m @ 2.64g/t Au | SX | |

| CRSX22-08C | 568.50 | 585.00 | 16.50 | 16.26 | 2.32 | 19.3 | 38.34 | 37.79 | 1.5m @ 6.3g/t Au 3m @ 7.1g/t Au |

SX | |

| CRSX22-08C | 593.00 | 663.00 | 70.00 | 68.90 | 2.81 | 9.1 | 196.45 | 193.35 | 70m @ 2.81g/t Au | 1.5m @ 11.55g/t Au 1.5m @ 14.05g/t Au |

593 – 595.6 TRSX 595.6 – 597.7 TROL 597.7 – 600.25 OX 600.25 – 602.4 TROL 602.4 – 607.4 TRSX 607.4 – 609 TROL 609 – 611.56 TRSX 611.56 – 613.13 SX 613.13 – 613.65 TROL 613.65 – 615.65 TRSX 615.65 – 617.8 TROL 617.8 – 619.9 SX 619.9 – 627.7 TROL 627.7 – 663 SX |

| CRSX22-08C | 673.50 | 679.50 | 6.00 | 4.94 | 2.88 | 4.2 | 17.29 | 14.25 | 4.5m @ 3.35g/t Au | SX | |

| CRSX22-08C | 690.00 | 702.00 | 12.00 | 9.91 | 1.32 | 2.0 | 15.79 | 13.03 | 1.5m @ 3g/t Au 1.5m @ 2.77g/t Au |

TRSX | |

| CRSX22-08C | 715.00 | 723.00 | 8.00 | 6.61 | 1.21 | 5.7 | 9.69 | 8.01 | 0.85m @ 4.13g/t Au | 715 – 720.35 TRSX 720.35 – 723 SX |

|

| CRSX22-08C | 730.50 | 740.50 | 10.00 | 8.27 | 1.11 | 3.8 | 11.10 | 9.17 | 1.5m @ 2.88g/t Au 1.5m @ 2.88g/t Au |

730.5 – 736.05 SX 736.05 – 740.5 TRSX |

|

| CRSX22-08C | 784.00 | 785.50 | 1.50 | 1.25 | 1.94 | 11.7 | 2.90 | 2.41 | SX | ||

| CRSX22-08C | 800.50 | 802.00 | 1.50 | 1.25 | 4.42 | 40.8 | 6.63 | 5.51 | 1.5m @ 4.42g/t Au | SX | |

| CRSX22-08C | 849.95 | 852.00 | 2.05 | 1.70 | 2.14 | 10.0 | 4.39 | 3.65 | 2.05m @ 2.14g/t Au | SX | |

| CRSX22-08C | 858.40 | 867.50 | 9.10 | 7.56 | 2.50 | 8.2 | 22.73 | 18.89 | 7.6m @ 2.79g/t Au | SX | |

| CRSX22-08C | 876.50 | 878.00 | 1.50 | 1.25 | 2.07 | 1.8 | 3.11 | 2.58 | 1.5m @ 2.07g/t Au | SX | |

| CRSX22-08C | 885.00 | 886.50 | 1.50 | 1.25 | 2.35 | 11.9 | 3.53 | 2.93 | SX | ||

| CRSX22-08C | 908.50 | 927.85 | 19.35 | 16.08 | 1.81 | 9.2 | 34.96 | 29.06 | 9m @ 2.51g/t Au 2.6m @ 2.75g/t Au |

SX | |

| CRSX22-09 | 489.50 | 491.00 | 1.50 | 1.34 | 2.23 | 5.3 | 3.35 | 3.00 | 1.5m @ 2.23g/t Au | SX | |

| CRSX22-09 | 522.00 | 538.00 | 16.00 | 13.15 | 6.94 | 36.5 | 111.10 | 91.30 | 14.5m @ 7.48g/t Au | 1.5m @ 17.7g/t Au 1.5m @ 11.8g/t Au 2m @ 17.77g/t Au |

SX |

| CRSX22-09 | 547.00 | 587.50 | 40.50 | 36.23 | 3.83 | 12.1 | 154.96 | 138.63 | 7.5m @ 6.74g/t Au 9m @ 9.28g/t Au |

1.5m @ 26.4g/t Au 1.2m @ 29g/t Au 1.5m @ 13.1g/t Au |

547 – 567.7 TRSX 567.7 – 582.8 SX 582.8 – 587.5 TRSX |

| CRSX22-09 | 595.50 | 606.00 | 10.50 | 9.39 | 1.08 | 4.4 | 11.39 | 10.18 | 1.5m @ 2.88g/t Au 1.5m @ 2.32g/t Au |

SX | |

| CRSX22-09 | 609.00 | 631.00 | 22.00 | 18.09 | 1.01 | 1.5 | 22.32 | 18.35 | 1.5m @ 3.33g/t Au 1.2m @ 3.54g/t Au |

SX | |

| CRSX22-09 | 656.50 | 671.00 | 14.50 | 12.95 | 1.90 | 4.2 | 27.53 | 24.59 | 7m @ 3.17g/t Au | SX | |

| CRSX22-09 | 678.50 | 679.50 | 1.00 | 0.89 | 1.85 | 0.7 | 1.85 | 1.65 | SX | ||

| CRSX22-09A | 467.40 | 468.40 | 1.00 | 0.99 | 5.78 | 16.6 | 5.78 | 5.70 | 1m @ 5.78g/t Au | FR | |

| CRSX22-09A | 482.00 | 485.00 | 3.00 | 2.96 | 1.08 | 20.2 | 3.23 | 3.18 | 482 – 482.6 FR 482.6 – 485 SX |

||

| CRSX22-09A | 492.50 | 571.50 | 79.00 | 77.87 | 2.76 | 9.3 | 218.25 | 215.14 | 55m @ 3.22g/t Au 1.5m @ 5.71g/t Au 3m @ 4.44g/t Au |

1.5m @ 10.1g/t Au | SX |

| CRSX22-09A | 579.00 | 591.00 | 12.00 | 11.81 | 1.32 | 3.5 | 15.86 | 15.61 | 4.5m @ 2.3g/t Au | SX | |

| CRSX22-09A | 600.00 | 605.50 | 5.50 | 5.41 | 2.53 | 5.2 | 13.91 | 13.69 | 1.5m @ 6.31g/t Au | SX | |

| CRSX22-09A | 612.50 | 614.00 | 1.50 | 1.48 | 3.18 | 3.5 | 4.77 | 4.69 | 1.5m @ 3.18g/t Au | SX | |

| CRSX22-09A | 620.50 | 624.50 | 4.00 | 3.94 | 1.37 | 5.2 | 5.46 | 5.38 | 620.5 – 621.6 SX 621.6 – 624.5 TRSX |

||

| CRSX22-09A | 629.70 | 631.00 | 1.30 | 1.07 | 2.32 | 2.7 | 3.02 | 2.48 | 1.3m @ 2.32g/t Au | OX | |

| CRSX22-09A | 648.00 | 656.50 | 8.50 | 6.99 | 1.22 | 5.8 | 10.40 | 8.55 | 2.5m @ 2.94g/t Au | 648 – 651.5 TRSX 651.5 – 656.5 SX |

|

| CRSX22-09A | 671.50 | 682.00 | 10.50 | 8.64 | 1.19 | 2.9 | 12.47 | 10.27 | 1.5m @ 4.37g/t Au | SX | |

| CRSX22-09A | 695.50 | 748.00 | 52.50 | 43.22 | 1.16 | 8.9 | 60.98 | 50.19 | 1.5m @ 4.39g/t Au 1.5m @ 2.36g/t Au 1.5m @ 2.1g/t Au 10.5m @ 2.02g/t Au |

695.5 – 722 SX 722 – 723.7 TROL 723.7 – 748 SX |

|

| CRSX22-09A | 760.40 | 801.50 | 41.10 | 34.04 | 1.93 | 15.1 | 79.14 | 65.55 | 3m @ 3.31g/t Au 11m @ 4.06g/t Au |

1.05m @ 25.6g/t Au | SX |

| CRSX22-09B | 460.50 | 462.00 | 1.50 | 1.43 | 1.40 | 15.8 | 2.09 | 2.00 | SX | ||

| CRSX22-09B | 481.50 | 483.00 | 1.50 | 1.44 | 2.13 | 24.7 | 3.20 | 3.06 | 1.5m @ 2.13g/t Au | SX | |

| CRSX22-09B | 499.50 | 563.45 | 63.95 | 61.07 | 4.66 | 17.2 | 298.22 | 284.78 | 57.55m @ 5.08g/t Au | 0.85m @ 10g/t Au 0.75m @ 35.2g/t Au 1.2m @ 13.75g/t Au 1.6m @ 10.85g/t Au 0.75m @ 73.6g/t Au 1.5m @ 16.5g/t Au 1.5m @ 19.7g/t Au |

499.5 – 533.85 SX 533.85 – 553.9 TRSX 553.9 – 563.45 SX |

| CRSX22-09B | 571.00 | 592.20 | 21.20 | 20.21 | 2.43 | 7.2 | 51.55 | 49.14 | 18.2m @ 2.64g/t Au | 571 – 582.1 TRSX 582.1 – 587.5 SX 587.5 – 592.2 |

|

| CRSX22-09B | 600.00 | 615.50 | 15.50 | 14.78 | 1.26 | 1.7 | 19.50 | 18.59 | 1.5m @ 2.07g/t Au 0.6m @ 11.9g/t Au |

0.6m @ 11.9g/t Au | 600 – 606.35 606.35 – 615.5 SX |

| CRSX22-09B | 646.65 | 652.75 | 6.10 | 4.49 | 3.05 | 7.9 | 18.61 | 13.70 | 4.05m @ 4.01g/t Au | 0.8m @ 15.05g/t Au | SX |

| CRSX22-09B | 659.80 | 660.50 | 0.70 | 0.51 | 8.04 | 8.3 | 5.63 | 4.14 | 0.7m @ 8.04g/t Au | SX | |

| CRSX22-09B | 671.00 | 684.50 | 13.50 | 9.91 | 1.21 | 3.5 | 16.34 | 11.99 | 3m @ 2.51g/t Au 1.5m @ 2.14g/t Au |

671 – 671.1 SX | |

| CRSX22-09B | 708.50 | 730.90 | 22.40 | 16.37 | 1.18 | 7.9 | 26.40 | 19.30 | 0.7m @ 8.8g/t Au 1.5m @ 3.13g/t Au |

||

| CRSX22-09B | 747.70 | 749.20 | 1.50 | 1.09 | 1.68 | 23.4 | 2.51 | 1.83 | |||

| CRSX22-10 | 368.00 | 369.00 | 1.00 | 0.81 | 1.64 | 4.4 | 1.64 | 1.32 | FR | ||

| CRSX22-10 | 370.50 | 372.00 | 1.50 | 1.21 | 1.26 | 12.2 | 1.88 | 1.52 | FR | ||

| CRSX22-10 | 418.50 | 420.00 | 1.50 | 1.21 | 1.10 | 3.4 | 1.65 | 1.33 | SX | ||

| CRSX22-10 | 456.00 | 462.00 | 6.00 | 4.82 | 2.09 | 26.3 | 12.55 | 10.08 | 1.5m @ 5.54g/t Au | SX | |

| CRSX22-10 | 483.00 | 484.50 | 1.50 | 1.20 | 1.19 | 6.4 | 1.78 | 1.43 | SX | ||

| CRSX22-10 | 491.00 | 501.50 | 10.50 | 8.43 | 3.93 | 14.3 | 41.29 | 33.15 | 4.5m @ 8.48g/t Au | 1.5m @ 18.8g/t Au | SX |

| CRSX22-10 | 515.00 | 524.00 | 9.00 | 7.22 | 1.26 | 10.5 | 11.32 | 9.09 | 1.5m @ 3.47g/t Au | SX | |

| CRSX22-10 | 531.50 | 581.00 | 49.50 | 39.70 | 2.71 | 6.6 | 134.37 | 107.77 | 1.5m @ 2.86g/t Au 17.5m @ 3.21g/t Au 8m @ 6.8g/t Au 3m @ 2.06g/t Au |

1.5m @ 22.7g/t Au 2.7m @ 17.3g/t Au |

SX |

| CRSX22-10 | 588.50 | 603.50 | 15.00 | 12.02 | 1.20 | 5.2 | 18.00 | 14.42 | 1.5m @ 2.32g/t Au 1.5m @ 4.81g/t Au |

SX | |

| CRSX22-10 | 618.50 | 620.00 | 1.50 | 1.20 | 10.30 | 7.1 | 15.45 | 12.38 | 1.5m @ 10.3g/t Au | 1.5m @ 10.3g/t Au | SX |

| CRSX22-10 | 626.60 | 641.50 | 14.90 | 11.93 | 5.31 | 14.9 | 79.19 | 63.38 | 8.9m @ 8.34g/t Au | 1.4m @ 12.15g/t Au 2.6m @ 18.89g/t Au |

SX |

| CRSX22-10 | 652.00 | 655.00 | 3.00 | 2.40 | 1.97 | 4.1 | 5.92 | 4.73 | 1.5m @ 2.46g/t Au | SX | |

| CRSX22-10 | 664.00 | 703.00 | 39.00 | 31.05 | 1.29 | 9.2 | 50.39 | 40.12 | 6m @ 2.43g/t Au 1.5m @ 2.54g/t Au 1.5m @ 4.73g/t Au 1.5m @ 3.77g/t Au |

SX | |

| CRSX22-10 | 712.00 | 715.30 | 3.30 | 2.62 | 3.32 | 35.0 | 10.95 | 8.70 | 1.8m @ 4.9g/t Au | SX | |

| CRSX22-10 | 725.50 | 732.50 | 7.00 | 5.56 | 1.86 | 20.4 | 13.03 | 10.34 | 5.5m @ 2.08g/t Au | SX | |

| CRSX22-10 | 739.50 | 741.00 | 1.50 | 1.19 | 1.89 | 14.9 | 2.84 | 2.25 | SX | ||

| CRSX22-10 | 747.00 | 748.50 | 1.50 | 1.19 | 1.32 | 8.2 | 1.98 | 1.57 | SX | ||

| CRSX22-10 | 762.00 | 763.50 | 1.50 | 1.19 | 4.57 | 26.1 | 6.86 | 5.44 | 1.5m @ 4.57g/t Au | SX | |

| CRSX22-10 | 775.50 | 777.00 | 1.50 | 1.22 | 1.09 | 10.7 | 1.64 | 1.32 | SX | ||

| CRSX22-10A | 456.50 | 459.50 | 3.00 | 2.72 | 1.87 | 12.3 | 5.61 | 5.09 | 1.5m @ 2.65g/t Au | SX | |

| CRSX22-10A | 468.50 | 470.00 | 1.50 | 1.36 | 2.00 | 13.4 | 3.00 | 2.72 | 1.5m @ 2g/t Au | SX | |

| CRSX22-10A | 492.50 | 506.00 | 13.50 | 12.23 | 3.10 | 33.8 | 41.84 | 37.89 | 10.5m @ 3.55g/t Au | SX | |

| CRSX22-10A | 524.00 | 545.00 | 21.00 | 18.96 | 3.13 | 6.8 | 65.71 | 59.33 | 10.5m @ 5.66g/t Au | 1.5m @ 24g/t Au | SX |

| CRSX22-10A | 555.50 | 642.50 | 87.00 | 78.32 | 1.92 | 7.8 | 167.35 | 150.65 | 1.5m @ 3.07g/t Au 25.5m @ 3.14g/t Au 9m @ 2.99g/t Au 1.5m @ 5.7g/t Au 1.5m @ 2.94g/t Au 9m @ 2.03g/t Au |

1.5m @ 10.5g/t Au | SX |

| CRSX22-10A | 657.50 | 665.00 | 7.50 | 6.73 | 2.53 | 21.9 | 18.98 | 17.04 | 1.5m @ 8.87g/t Au | SX | |

| CRSX22-10A | 678.50 | 680.00 | 1.50 | 1.35 | 1.83 | 22.9 | 2.75 | 2.46 | SX | ||

| CRSX22-10A | 689.00 | 762.50 | 73.50 | 65.86 | 1.74 | 10.6 | 127.80 | 114.52 | 4.5m @ 2.08g/t Au 24m @ 2.61g/t Au 4.5m @ 2.25g/t Au 1.5m @ 2.4g/t Au 7.5m @ 2.23g/t Au |

SX | |

| CRSX22-10A | 774.50 | 780.50 | 6.00 | 5.36 | 5.61 | 16.4 | 33.68 | 30.11 | 4.5m @ 6.85g/t Au | 1.5m @ 11.95g/t Au | SX |

| CRSX22-10A | 788.00 | 789.00 | 1.00 | 0.90 | 1.61 | 13.8 | 1.61 | 1.45 | SX | ||

| CRSX22-10B | 464.50 | 466.00 | 1.50 | 1.38 | 1.24 | 45.8 | 1.85 | 1.71 | SX | ||

| CRSX22-10B | 487.50 | 489.00 | 1.50 | 1.38 | 4.93 | 68.6 | 7.40 | 6.81 | 1.5m @ 4.93g/t Au | SX | |

| CRSX22-10B | 496.50 | 504.00 | 7.50 | 6.91 | 3.29 | 23.6 | 24.69 | 22.75 | 3m @ 6.58g/t Au | SX | |

| CRSX22-10B | 516.00 | 517.50 | 1.50 | 1.38 | 12.20 | 95.1 | 18.30 | 16.86 | 1.5m @ 12.2g/t Au | 1.5m @ 12.2g/t Au | SX |

| CRSX22-10B | 526.50 | 573.00 | 46.50 | 42.32 | 1.46 | 4.6 | 67.82 | 61.73 | 1.5m @ 2.15g/t Au 6m @ 3.38g/t Au 9m @ 2.29g/t Au |

SX | |

| Criteria: Cut off grade 1g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m, if Au grade x length > 1.5 the composite will be added | |||||||||||

Table 2: Camino Rojo Oxide Pit Composite Drill Results

| HOLE-ID | From (m) |

To (m) |

Core Length (m) |

Au g/t | Ag g/t | Au GXM | Including 0.5g/t Au COG |

Including 1g/t Au COG |

Including 2g/t Au COG |

| CROX22-01 | 21.50 | 71.50 | 50.00 | 0.99 | 11.5 | 49.48 | 1.5m @ 1g/t Au 39.5m @ 1.18g/t Au |

1.5m @ 1.58g/t Au 25m @ 1.56g/t Au |

1.6m @ 2.93g/t Au 6.05m @ 2.37g/t Au 1.5m @ 2.03g/t Au 1.3m @ 6.18g/t Au |

| CROX22-01 | 79.00 | 84.40 | 5.40 | 1.31 | 4.3 | 7.07 | 5.4m @ 1.31g/t Au | 1.5m @ 4.1g/t Au | 1.5m @ 4.1g/t Au |

| CROX22-01 | 98.70 | 133.50 | 34.80 | 0.42 | 13.3 | 14.63 | 1.3m @ 0.64g/t Au 1.5m @ 0.64g/t Au 1.5m @ 0.75g/t Au 1.5m @ 2.34g/t Au 2.9m @ 0.94g/t Au |

1.5m @ 2.34g/t Au 1.4m @ 1.2g/t Au |

1.5m @ 2.34g/t Au |

| CROX22-01 | 144.50 | 281.00 | 136.50 | 1.10 | 17.5 | 149.55 | 1.5m @ 0.62g/t Au 112.2m @ 1.29g/t Au |

5.5m @ 1.6g/t Au 1.5m @ 1.83g/t Au 3m @ 4.9g/t Au 56.5m @ 1.64g/t Au 4.5m @ 1.41g/t Au |

1.4m @ 3.11g/t Au 1.5m @ 7.82g/t Au 21.5m @ 2.06g/t Au 1.5m @ 2.08g/t Au 4.3m @ 2.06g/t Au 1.5m @ 2.02g/t Au 1.5m @ 2.57g/t Au |

| CROX22-02 | 0.00 | 290.00 | 290.00 | 0.70 | 10.6 | 203.01 | 3.6m @ 0.54g/t Au 1.5m @ 0.66g/t Au 1.5m @ 1.44g/t Au 147.5m @ 0.97g/t Au 10.65m @ 0.86g/t Au 25.95m @ 0.59g/t Au 4.5m @ 0.92g/t Au 3.2m @ 0.72g/t Au 1.5m @ 0.53g/t Au 1.5m @ 0.88g/t Au |

1.5m @ 1.44g/t Au 5.5m @ 1.33g/t Au 45.5m @ 1.59g/t Au 10.5m @ 1.17g/t Au 1.5m @ 1.17g/t Au 4.95m @ 1.07g/t Au 15.65m @ 1.12g/t Au 5.7m @ 1.15g/t Au 1.5m @ 1.05g/t Au 1.5m @ 1.01g/t Au 1.7m @ 1.37g/t Au |

1.5m @ 3.18g/t Au 4m @ 2.8g/t Au 6m @ 3.13g/t Au 1.5m @ 2.3g/t Au 1.75m @ 2.21g/t Au 1.8m @ 2.22g/t Au 1.15m @ 3.11g/t Au |

| Criteria: Cut off grade 0.2g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m | |||||||||

Table 3: Camino Rojo Regional Program Composite Drill Results

| HOLE-ID | From (m) |

To (m) |

Core Length (m) |

Au g/t |

Ag g/t |

Au GXM | Including 0.5g/t Au COG |

Including 1g/t Au COG |

Met Code |

| CRED22-01 | 51.40 | 58.50 | 7.10 | 0.54 | 0.6 | 3.81 | 0.7m @ 4.12g/t Au | 0.7m @ 4.12g/t Au | 51.4 – 52.48 SX 52.48 – 52.83 OX 52.83 – 58.5 SX |

| CRED22-01 | 74.50 | 80.00 | 5.50 | 0.39 | 0.6 | 2.13 | 1.5m @ 1.02g/t Au | 1.5m @ 1.02g/t Au | SX |

| CRED22-01 | 104.95 | 107.30 | 2.35 | 1.35 | 1.1 | 3.17 | 0.8m @ 3.83g/t Au | 0.5m @ 5.59g/t Au | 104.95 – 105 OX 105 – 107.3 SX |

| CRED22-01 | 116.90 | 122.55 | 5.65 | 0.24 | 1.3 | 1.38 | 0.6m @ 1.42g/t Au | 116.9 – 120.73 SX 120.73 – 122.55 OX |

|

| CRED22-01 | 137.50 | 140.50 | 3.00 | 0.44 | 0.3 | 1.32 | 1.5m @ 0.62g/t Au | SX | |

| CRED22-01 | 151.90 | 156.20 | 4.30 | 0.20 | 0.3 | 0.87 | SX | ||

| CRED22-01 | 169.95 | 179.00 | 9.05 | 0.32 | 0.6 | 2.91 | 1.7m @ 1.43g/t Au | 1.7m @ 1.43g/t Au | SX |

| CRED22-01 | 279.50 | 297.00 | 17.50 | 0.11 | 1.8 | 1.95 | SX | ||

| CRED22-01 | 398.30 | 399.50 | 1.20 | 2.17 | 0.8 | 2.60 | 1.2m @ 2.17g/t Au | 1.2m @ 2.17g/t Au | SX |

| CRED22-01 | 571.50 | 573.00 | 1.50 | 0.63 | 0.6 | 0.95 | 1.5m @ 0.63g/t Au | SX | |

| Criteria: Cut off grade 0.1g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m. | |||||||||

Table 4: Camino Rojo Drill Hole Collars

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

| CRSX22-07 | 243658 | 2676063 | 1953 | 152 | -74 | 1001 |

| CRSX22-07C | 243658 | 2676063 | 1953 | 152 | -65 | 779 |

| CRSX22-08 | 243680 | 2676269 | 1954 | 148 | -73 | 922 |

| CRSX22-08B | 243680 | 2676269 | 1954 | 148 | -73 | 881 |

| CRSX22-08C | 243680 | 2676269 | 1954 | 148 | -73 | 929 |

| CRSX22-09 | 243677 | 2676170 | 1951 | 152 | -75 | 691 |

| CRSX22-09A | 243677 | 2676170 | 1951 | 151 | -58 | 802 |

| CRSX22-09B | 243677 | 2676170 | 1951 | 150 | -76 | 760 |

| CRSX22-10 | 243599 | 2676109 | 1954 | 160 | -60 | 785 |

| CRSX22-10A | 243599 | 2676109 | 1954 | 159 | -61 | 790 |

| CRSX22-10B | 243599 | 2676109 | 1954 | 160 | -61 | 585 |

| CROX22-01 | 244153 | 2676098 | 1920 | 145 | -56 | 282 |

| CROX22-02 | 244190 | 2676120 | 1920 | 145 | -59 | 290 |

| CRED22-01 | 250253 | 2680276 | 1930 | 180 | -65 | 600 |

| ___________________________________________ |

| 1 All metres reported above are down-hole intervals, with true width estimates ranging from 66-100% of the reported interval. See Table 1 for estimated true widths of individual composites. All assays were performed on 1.5 metre core intervals and all drill core is HQ in diameter in size. The reported composites were not subject to “capping”, however a preliminary analysis suggests that only 6 out of 2,910 samples exceeded the potential capping level of 27.0 g/t – these samples averaged 42.2 g/t gold (max. 73.6 g/t) and Orla believes that applying a top cut would have a negligible effect on overall grades. Composites for the sulphide drilling were calculated using 1 g/t Au cut-off grade and maximum 6 metres consecutive waste. |

| 2 Additional information can be found in the Camino Rojo Technical Report entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” and dated January 11, 2021. |

| 3 Composites for the oxide drilling were calculated using 0.2 g/t Au cut-off grade and maximum 6 metres consecutive waste. |

| 4 Drill results presented are historical in nature. Such results were completed by Goldcorp Inc., a prior owner of the Camino Rojo Project. Composites for the sulphide drilling were calculated using 1 g/t Au cut-off grade and maximum 6 metres consecutive waste. |

Figure 1: Camino Rojo Sulphides 2022 Drill Program Hole Location (Plan View) (CNW Group/Orla Mining Ltd.)

Figure 2: Camino Rojo Sulphides 2022 Drill Program Hole Location (Long Section) (CNW Group/Orla Mining Ltd.)

Figure 3: Camino Rojo Sulphides 2022 Results (Cross Section, Hole CRSX22-08) (CNW Group/Orla Mining Ltd.)

Figure 4: Camino Rojo Sulphides 2022 Program Vein Domains (Cross Section, Hole 7) (CNW Group/Orla Mining Ltd.)

Figure 5: Camino Rojo Sulphides Deep Potential 2022 Results (CNW Group/Orla Mining Ltd.)

Figure 6: Camino Rojo Sulphides Deep Potential (Schematic Cross Section) (CNW Group/Orla Mining Ltd.)

Figure 7: Camino Rojo Regional Exploration Program Guanamero Results (Hole 1) (CNW Group/Orla Mining Ltd.)

Figure 8: Guanamero Drill Results (Hole 1) (CNW Group/Orla Mining Ltd.)

Figure 9: Camino Rojo Oxide Layback Drilling Plan (Cross Section) (CNW Group/Orla Mining Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE