ORENINC INDEX up as average offer size significantly increases

ORENINC INDEX – Monday, January 17th 2022

North America’s leading junior mining finance data provider

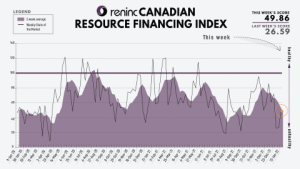

Last Week: 26.59 (Updated)

This week: 49.86

The Oreninc Index increased in the trading week ending January 14th, 2021 to 49.86 from 26.59 a week ago as the average offer size for this week was significantly higher signallng a renewed interest in larger deals.

On to the money: the aggregate financings announced increased to $81 million, a 3-week high, with 3 new brokered financings and 2 new bought-deal financings announced. The average offer size increased to $5.5 million, a 20-week high, and the number of financings decreased to 15.

Gold closed the week up at $1,816/oz from $1,797/oz a week ago. The US dollar index closed down at 95.17 from 95.72 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week up at $40.47 from $39.24 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week higher at 261.62 from 243.35 last week. The SPDR GLD ETF inventory closed the week lower at 976.21 tonnes, or 31.38 million ounces, from 975.66 tonnes last week.

In other commodities, Silver closed the week higher at $22.95/oz from $22.44/oz a week ago. Copper closed higher at $4.42/lb from $4.40/lb a week ago. Oil went higher as WTI closed higher at $83.82 a barrel from $78.90 a barrel a week ago.

The Dow Jones Industrial Average closed lower at 35,911 from 36,331 a week ago. Canada’s S&P/TSX Composite Index closed higher at 21,357 from 21,084 the previous week. The S&P/TSX Venture Composite Index closed lower at 902.99 from 911.46 a week ago.

Summary:

- Number of financings decreased to 15.

- Three brokered financing were announced this week for $62m, an 8-week high.

- Two bought-deal financing were announced this week for $62m, an 8-week high.

- Total dollars increased to $81m, a 3-week high.

- Average offer upped to $5.5m, a 20-week high.

Major Financing Openings:

- Nomad Royalty Company Ltd. (TSX:NSR) opened a $40 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about January 20, 2022.

- Cypress Development Corp. (TSX-V:CYP) opened a $12 million offering underwritten by a syndicate led by PI Financial Corp. on a bought deal basis. Each unit includes 1 warrant that expires in 24 months. The deal is expected to close on or about February 3, 2022.

- Cirrus Gold Corp. (CSE:CI) opened a $10 million offering underwritten by a syndicate led by xxx on a best efforts basis.

- Anfield Energy Inc. (TSX-V:AEC) opened a $8.25 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 24 months.

Major Financing Closings:

- Titanium Corporation Inc. (TSX-V:TIC) closed a $5 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 48 months.

- Desert Gold Ventures Inc (TSX-V:DAU) closed a $1.68 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 36 months. The deal is expected to close on or about February 4, 2022.

- Rathdowney Resources Ltd. (TSX-V:RTH) closed a $1.36 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 60 months.

- Ares Strategic Mining Inc. (TSX-V:ARS) closed a $0.8 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE