ORENINC INDEX plummets as dollars dry up

ORENINC INDEX – Monday, December 2nd 2019

North America’s leading junior mining finance data provider

Subscribe to our free weekly newsletter at oreninc.com/subscribe

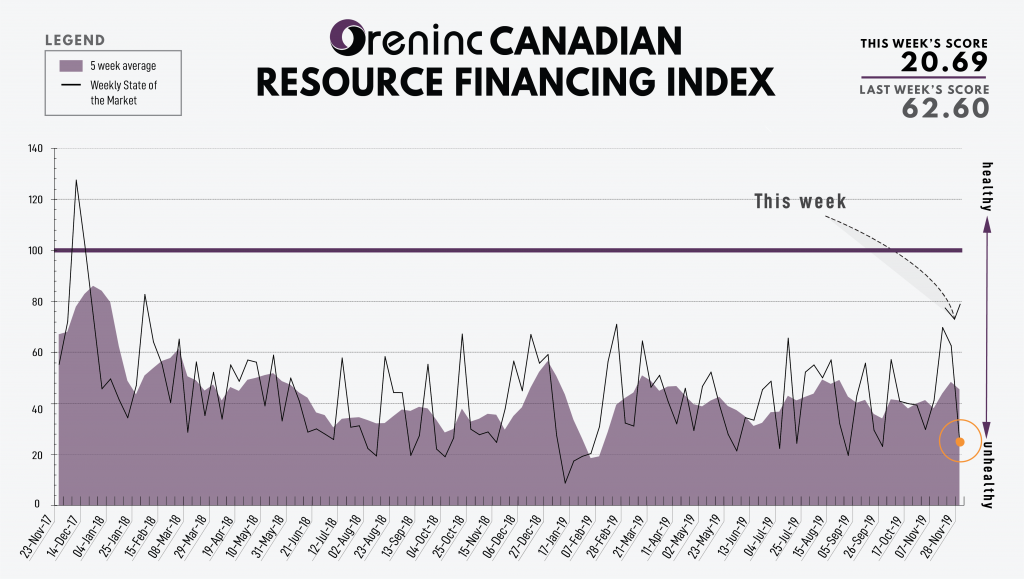

Last Week: 62.60

This week: 20.69

The Oreninc Index plummeted in the week ending November 29nd, 2019 to 20.69 from 62.60 a week ago as financings dried up as the Thanksgiving Day celebration in the US reduced market activity.

Trade talks between the US and China continue in their on-again-off-again mobius strip pattern. China began the week issuing positive signals until US President Donald Trump signed the Hong Kong humans rights bill, angering the Asian nation for what it deems a serious interference in its internal affairs. Protests in Hong Kong began in June about the democratic rights of its citizens.

In the mining space, M&A hit town as Kirkland Lake Gold agreed an all paper deal to acquire Detour Gold for $4.9 billion at a 24% premium. This was followed by Newmont Goldcorp announcing it will sell its Red Lake gold mine in Quebec, Canada to Australia’s Evolution Mining for US$375 million in cash and a $100 million payment contingent on the discovery of new resources.

On to the money: total funds raised announced fell away to $43.56 million, a three-week low, which included no brokered financings and no bought-deal financings. The average offer size more than halved to $2.18 million, a three-week low, while the number of financings decreased to 20.

Gold gained a couple of dollars as the spot price closed up at US$1,463/oz from $1,461/oz a week ago. The yellow metal is up 14.15% so far this year. The US dollar index closed the week flat at 98.27. The VanEck managed GDXJ closed up at US$38.15 from $36.66 a week ago. The index is now up 26.24% so far in 2019. The US Global Go Gold ETF closed up at US$15.97 from $15.42 a week ago. It is up 40.00% so far in 2019. The HUI Arca Gold BUGS Index closed up at 214.80 from 210.77 last week. The SPDR GLD ETF added to its inventory again as it closed up at 895.6 tonnes from 891.79 tonnes a week ago.

In other commodities, silver added a cent as it closed up at US$17.03/oz from $17.02/oz a week ago. Copper did the same as it closed the week up at US$2.66/lb from $2.65/lb. The oil price shed a couple of dollars as WTI closed down at US$55.17 a barreml from $57.77 a barrel a week ago.

The Dow Jones Industrial Average had another strong week as it closed up at 28,051 from 27,875 a week ago. Canada’s S&P/TSX Composite Index also closed up at 17,040 from 16,954 the previous week. The S&P/TSX Venture Composite Index closed up at 531.68 from 530.02 last week.

Summary

- Number of financings decreased to 20.

- No brokered financings were announced this week.

- No bought-deal financings were announced this.

- Total dollars decreased to $43.56m, a three-week low.

- Average offer lessened to $2.18m, a three-week low.

Financing Highlights

Major Financing Openings

- Skeena Resources (TSX-V:SKE) opened a $15 million offering on a best efforts The deal is expected to close on or about December 16th.

- GT Gold (TSX-V:GTT) opened a $25 million offering on a strategic deal basis. The deal is expected to close on or about December 13th.

- GK Resources (TSX-V:NIKL) opened a $5 million offering on a best efforts The deal is expected to close on or about December 18th.

- Metron Capital (TSX-V:MCN) opened a $3 million offering on a best efforts The deal is expected to close on or about November 30th.

Major Financing Closings

- Great Bear Resources (TSX-V:GBR) closed a $7 million offering underwritten by a syndicate led by Cormark Securities on a bought deal basis.

- Integra Resources (CSE:ITR) closed a $62 million offering on a strategic deal basis.

- Brigadier Gold (TSX-V:BRG.H) closed a $2 million offering on a best efforts Each unit includes half a warrant that expires in a year.

- Ethos Gold (TSX-V:ECC) closed a $76 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

KOOTENAY SILVER CLOSES BROKERED PUBLIC OFFERING FOR GROSS PROCEEDS OF C$10.35 MILLION

Kootenay Silver Inc. (TSX-V: KTN) is pleased to announce that the... READ MORE

U.S. Gold Corp. Closes $4.9 Million Non-Brokered Registered Direct Offering

U.S. Gold Corp. (NASDAQ: USAU), is pleased to announce that it h... READ MORE

Getchell Gold Corp. Announces Final Tranche of Debenture Financing

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) (FWB: GGA1) is ple... READ MORE

Imperial Reports Production Update for 2024 First Quarter

Imperial Metals Corporation (TSX:III) reports quarterly copper an... READ MORE

ALX Resources Corp. Intersects Additional Uranium Mineralization at the Gibbons Creek Uranium Project, Athabasca Basin, Saskatchewan

ALX Resources Corp. (TSX-V: AL) (FSE: 6LLN) (OTC: ALXEF) is pleas... READ MORE