ORENINC INDEX plummets as big September hopes fizzle

ORENINC INDEX – Monday, October 1st 2018

North America’s leading junior mining finance data provider

Free newsletter sign-up at www.oreninc.com

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

Last week index score: 54.58

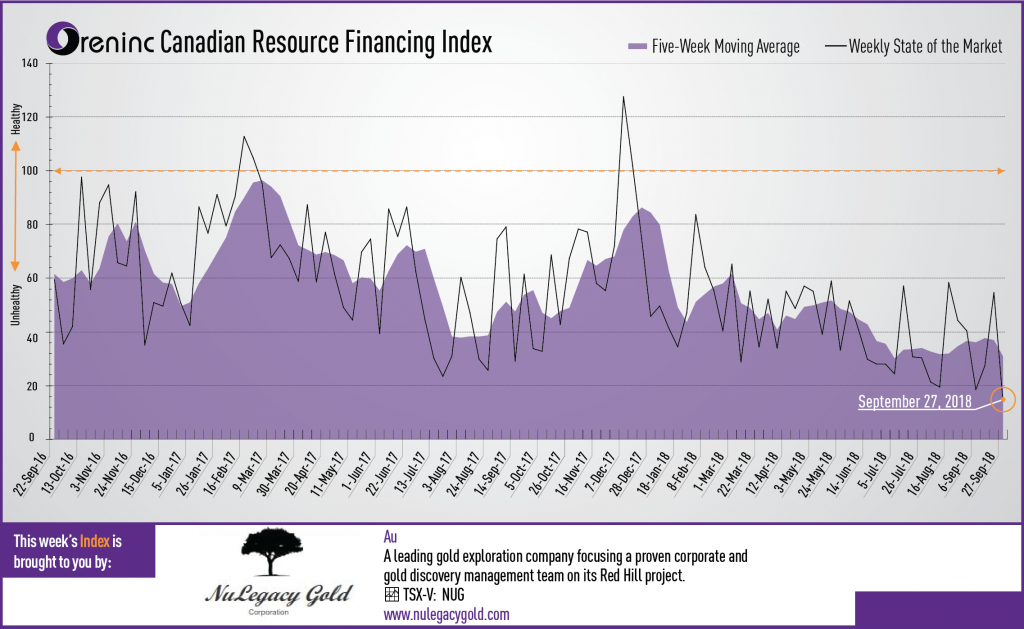

This week: 14.04

Avrupa Minerals (TSXV:AVU) reported final results from first pass exploration drilling at the Alvito iron oxide copper-gold (IOCG) project in south Portugal.

The Oreninc Index plummeted in the week ending September 28th, 2018 to 14.04 from 54.58 a week ago, as markets failed to recover interest in precious metals despite the announcement of a mega-merger between Barrick Gold and Rangold Resources whilst precious metals investors were arriving for the Denver Gold Forum (DGF) in Colorado Springs.

The US$6.5 billion all-share, non-premium deal will create the world’s largest gold miner with a combined 78 million ounces of proven and probable gold reserves and the ownership of five of the world’s top ten tier one gold assets by cash costs, with the new company likely to have cash costs estimated at $538/oz. It will also produce over 413 million pounds of copper.

Gold saw yet another volatile week, spending most of it fighting to claw back towards the US$1,200/oz level after falling hard early in the week. The US Federal Reserve Open Market Committee raised interest rates by 25 basis points, bringing the federal funds rate to a range of 2.00% and 2.25%, their highest level in nearly a decade. US President Donald Trump again failed to respect the independence of the organization by criticizing the rate increase and stating that he is “not happy about that.” Analysts believe there will be one more rate increase this year, followed by more increases into 2019.

Gold appears to be stuck in its horse latitudes, garnering little investor interest whilst it waits for a big gust to drive it upwards, despite positive market signals such as signs of a weakening US dollar index early in the week.

On to the money: total fund raises announced plummeted to C$14.5 million, a 29-week low, which included no brokered and no bought-deal financings. The average offer size also plummeted to C$1.1 million, a two-week low, whilst the number of financings decreased to 13, a 29-week low.

Another wild week for gold as closed down at US$1,190/oz from US$1,200/oz a week ago, recovering from a mid-week low of US$1,182/oz. It is now down 8.59% this year. The US dollar index overcame a stagnate start to the week to close with a bang, ending the week up at 95.13 from 94.22 last week. The van Eck managed GDXJ closed down at US$27.36 from US$28.08 a week ago. The index is down 19.84% so far in 2018. The US Global Go Gold ETF closed down at US$10.57 from US$10.90 a week ago. It is now down 18.75% so far in 2018. The HUI Arca Gold BUGS Index also closed down at 141.07 from 142.87 last week. The SPDR GLD ETF had a neutral week with its inventory falling a smidge to 742.23 tonnes from 742.53 tonnes a week ago.

In other commodities, silver continued to gain as it closed up at US$14.66/oz from US$14.30/oz a week ago. Copper lost a few cents to close down at US$2.80/lb from US$2.85/lb last week. Oil also continued to grow as WTI closed up at US$73.25 a barrel from US$70.78 a barrel a week ago.

The Dow Jones Industrial Average pulled back from the prior week’s record levels as it closed down at 26,458 from 26,743 last week. Canada’s S&P/TSX Composite Index followed suit as it closed down at 16,073 from 16,224 the previous week. The S&P/TSX Venture Composite Index also pulled back as it closed down at 709.16 from 719.95 last week.

Summary:

- Number of financings decreased to 13, a 29-week low.

- No brokered financings were announced this week, a three-week low.

- No bought-deal financing was announced this week, a three-week low.

- Total dollars plunged to $14.5m, a 29-week low.

- Average offer size fell to $1.1 m, a two-week low.

Major Financing Openings:

- Telson Mining Corp. (TSX-V:TSN) opened a $5 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Golden Arrow Resources Corp. (TSX-V:GRG) opened a $63 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 24 months.

- Benchmark Metals Inc. (TSX-V:BNCH) opened a $1 million offering on a best efforts

- Medgold Resources Corp. (TSX-V:MED) opened a $1 million offering on a best efforts Each unit includes 1 warrant that expires in 24 months.

Major Financing Closings:

- Regulus Resources Inc. (TSX-V:REG) closed a $6 million offering underwritten by a syndicate led by PI Financial Corp. on a best efforts basis.

- Ascot Resources Ltd. (TSX-V:AOT) closed a $3 million offering on a best efforts

- Galantas Gold Corporation (TSX-V:GAL) closed a $69 million offering on a best efforts basis.

- Tudor Gold Corp. (TSX-V:TUD) closed a $86 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE