ORENINC INDEX lower in volatile commodity market

ORENINC INDEX – Monday, March 21st, 2022

North America’s leading junior mining finance data provider

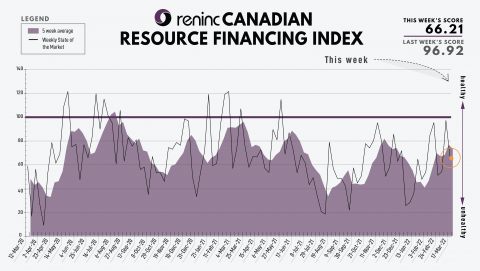

Last Week: 96.92

This week: 66.21

The Oreninc Index decreased in the trading week ending March 18th, 2022 to 66.21 from 96.92 a week ago as commodity markets remain volatile.

On to the money: the aggregate financings announced decreased to $150 million, a 2-week high, with 14 new brokered financings and 1 new bought-deal financings announced. The average offer size increased to $5.8 million, a 4-week high, and the number of financings decreased to 26.

Gold closed the week lower at $1,929/oz from $1,985/oz a week ago. The US dollar index closed lower at 98.23 from 99.12 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week down at $47.06 from $47.64 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week lower at 304.20 from 312.74 last week. The SPDR GLD ETF inventory closed the week higher at 1,054.28 tonnes, or 33.89 million ounces, from 1017.75 tonnes last week.

In other commodities, Silver closed the week lower at $25.08/oz from $26.16/oz a week ago. Copper closed higher at $4.73/lb from $4.62/lb a week ago. Oil went higher as WTI closed lower at $104.70 a barrel from $109.33 a barrel a week ago.

The Dow Jones Industrial Average closed higher at 34,749 from 32,943 a week ago. Canada’s S&P/TSX Composite Index closed higher at 21,818 from 21,461 the previous week. The S&P/TSX Venture Composite Index closed higher at 853.94 from 846.35 a week ago.

Summary:

- Number of financings decreased to 26.

- Fourteen brokered financing were announced this week for $94m, a 2-week low.

- One bought-deal financing was announced this week for $50m, a 2-week low.

- Total dollars lessened to $150m, a 2-week low.

- Average offer increased to $5.8m, a 4-week high.

Major Financing Openings:

- Endeavor Silver Corp. (TSX:EDR) opened a $50.34 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about March 21, 2022.

- Elemental Royalties Corp. (TSX-V:ELE) opened a $14.01 million offering on a best efforts basis. The deal is expected to close on or about March 31, 2022.

- Monarch Mining Corp. (TSX:GBAR) opened a $10 million offering underwritten by a syndicate led by Stifel GMP on a best efforts basis. Each unit includes 1 warrant that expires in 60 months. The deal is expected to close on or about April 6, 2022.

- Goldshore Resources Inc. (TSX-V:GSHR) opened a $10 million offering underwritten by a syndicate led by Eventus Capital Corp. on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about April 6 2022.

Major Financing Closings:

- Silver Tiger Metals Inc. (TSX-V:SLVR) closed a $23 million offering underwritten by a syndicate led by Sprott Capital Partners LP on a bought deal basis. The deal is expected to close on or about March 17, 2022.

- Goliath Resources Ltd. (TSX-V:GOT) closed a $14.61 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 24 months.

- Avanti Energy Inc. (TSX-V:AVN) closed a $10.35 million offering underwritten by a syndicate led by Cormark Securities Inc. on a bought deal basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about March 15, 2022.

- North Peak Resources Ltd. (TSX-V:NPR) closed a $5.75 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE