ORENINC INDEX jumps as brokered action increased

ORENINC INDEX – Monday, August 24th 2020

North America’s leading junior mining finance data provider

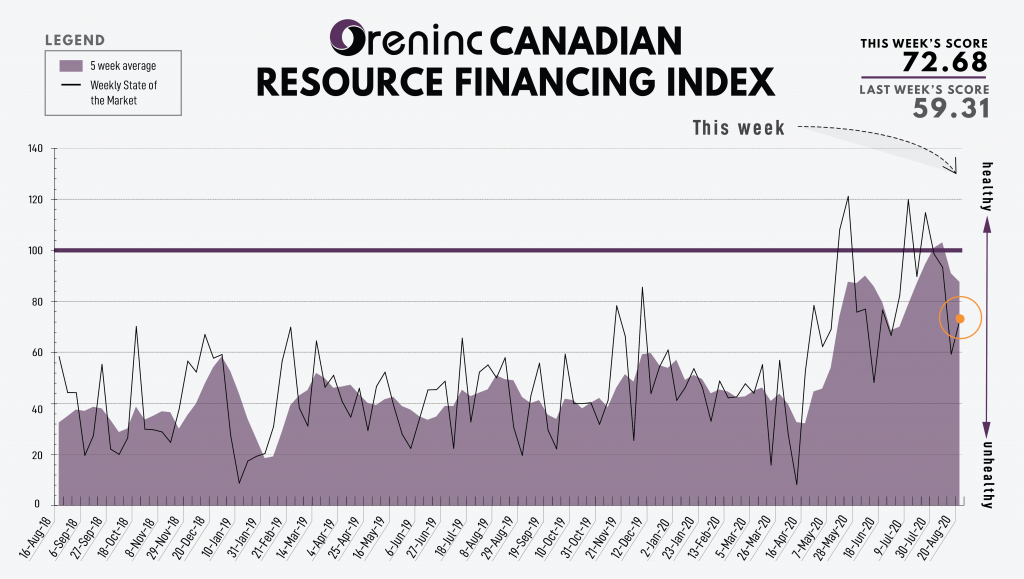

Last Week: 59.31 (Updated)

This week: 72.68

The Oreninc Index increased in the week ending August 21st, 2020 to 72.68 from an updated 59.31 a week ago as brokered action increased.

The COVID-19 virus global death toll has topped 800,000 with more than 23 million cases reported worldwide.

Another volatile week of broad swings for the gold price as the publication of the US Federal Reserve Open Market Committee minutes saw gold weaken by suggesting the yield control is not on the horizon on the grounds that it sees little benefit from doing so.

As the US saw stronger than expected home sales data in July, according to the National Association of Realtors, which reported that existing home sales increased 24.7% to a seasonally adjusted and annualized rate of 5.86 million units up from 4.72 million in June. National median home prices broke the US$300,000 level for the first time.

Real estate may be improving in the US, but the initial weekly jobless claims rose again by 135,000 to 1.106 million in the week to Saturday. The four-week moving average declined to 1.2 million according to US Labor Department data. Continuing jobless claims fell by 636,000 to 14.8 million.

On the international front, US president Donald Trump has declined to engage in trade talks with China which were supposed to occur six months following their February agreement on tariffs.

Japan’s economy experienced its sharpest contraction sine 1980 in the quarter to June 30 as gross domestic product fell 7.8%.

In the European Union, leaders are trying to protect the economy by maintaining open borders despite spikes in COVID-19 cases in various countries. EU negotiators also think it increasingly unlikely that a trade deal will be signed with the UK as the two sides continue to not see eye-to-eye on issues such as access to UK fishing waters and level playing field requirements conditions to maintain fair competition. Without a deal, trade relations with the UK will be governed by WTO trade principles and tariffs.

On to the money: aggregate financings announced increased to $124 million, a two-week high, which included eight brokered financings for $72.4 million, a four-week high, and three bought deal financings for $32.4 million, a four-week high. The average offer size increased to $3.2 million, a two-week high, while the number of financings fell to 39.

The Gold spot price experienced another volatile week as it climbed over $2,000/oz before pulling back to close the week down at $1,940/oz from $1,945/oz a week ago. The yellow metal is up 27.89% so far this year. The US dollar index ended its losing streak as it closed up at 93.24 from 93.09 week. The VanEck managed GDXJ continued to pull back and closed down at $57.20 from $57.98 a week ago. The index is now up 35.35% so far this year. The US Global Go Gold ETF saw a smidgen of growth as it closed up at $23.42 from $23.39 a week ago. It is up 33.37% so far this year. The HUI Arca Gold BUGS Index also closed up at 336.87 from 330.32 last week. The SPDR GLD ETF inventory increased, closing the week up at 1,252.38 tonnes or 40.2 million ounces from 1,248.29 tonnes last week.

In other commodities, Silver also saw big swings before closing the week up at $26.79/oz from $26.44/oz a week ago. Copper briefly broke through US$3/lb before closing the week up at $2.93/lb from $2.88/lb a week ago. Oil improved as WTI closed up at $42.34 a barrel from $41.01 a barrel a week ago.

The Dow Jones Industrial Average closed up again at 27,931 from 27,433 a week ago. Canada’s S&P/TSX Composite Index closed down at 16,514 from 16,544 the previous week. The S&P/TSX Venture Composite Index fell a smidge to 737.65 from 739.98 last week.

Summary

- Number of financings decreased to 39.

- Eight brokered financings were announced this week for $72.4 million, a four-week high.

- Three bought-deal financings were announced this week for $32.4 million, a four-week high.

- Total dollars increased to $124 million, a two-week high.

- Average offer increased to $3.2 million, a two-week high.

Financing Highlights

Benchmark Metals opened a $21 million best efforts private placement

- 7 million units @ $1.30 for of $10 million, 3.2 million flow-through units @ $1.56 for $5 million and 3.4 million charity flow-through units @ $1.75 for $6 million.

- Subsequently expanded to $48 million.

- Each unit consists of one share and half a warrant exercisable @ $1.80 for two years.

- Proceeds will be used for eligible Canadian exploration expenses at its Lawyers gold-silver project in British Columbia, Canada.

Aya Gold & Silver (TSX-V:AYA) opened a bought deal to raise $20 million.

- Desjardins Capital Markets as lead underwriter

- 5 million units @ $2.10.

- Each unit comprises one share and half a warrant exercisable @ $3.30 for three years.

- Proceeds will be used for the continued optimization of the Zgounder silver mine in Morocco.

Major Financing Openings

- Benchmark Metals (TSX-V:BNCH) opened a $21 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis. Each unit includes half a warrant that expires in two years. The deal is expected to close on or about September 15th.

- Aya Gold & Silver (TSX:AYA) opened a $20 million offering underwritten by a syndicate led by Desjardins Capital Markets on a best efforts basis. Each unit includes half a warrant that expires in three years. The deal is expected to close on or about September 3rd.

- McEwen Mining (TSX:MUX) opened a $13.08 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis. The deal is expected to close on or about September 10th.

- Minera Alamos (TSX-V:MAI) opened a $10 million offering on a bought deal basis. The deal is expected to close on or about September 3rd.

Major Financing Closings

- Josemaria Resources (TSX:JOSE) closed a $30.99 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis.

- Reconnaissance Energy Africa (TSX-V:RECO) closed a $23 million offering underwritten by a syndicate led by Haywood Securities on a best efforts basis. Each unit included a warrant that expires in five years.

- Chesapeake Gold (TSX-V:CKG) closed a $20 million offering on a best efforts basis.

- Southern Silver Exploration (TSX-V:SSV) closed a $14 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

PPX Mining Announces Closing Of $1.35 Million Private Placement

PPX Mining Corp. is pleased to announce that it has closed its fu... READ MORE

Elevation Gold Reports Financial Results for Year Ended December 31, 2023, including $66.4M in Total Revenue

Elevation Gold Mining Corporation (TSX-V: ELVT) (OTCQB: EVGDF) i... READ MORE

Reunion Gold Announces the Signing of a Mineral Agreement With the Government of Guyana for Its Oko West Project

Reunion Gold Corporation (TSX-V: RGD; OTCQX: RGDFF) is pleased to announ... READ MORE

Drilling Confirms 4 km of Favourable Corridor at Lynx Gold Trend

Puma Exploration Inc. (TSX-V: PUMA) (OTCQB: PUMXF) is thrilled to... READ MORE

Grid Metals Intersects 7 m at 1.28% Li2O at over 125 m Below the Previously Deepest Drill Holes at Donner Lake; Provides Project Update

Grid Metals Corp. (TSX-V:GRDM) (OTCQB:MSMGF) is pleased to announ... READ MORE