ORENINC INDEX increases as gold starts to shine

ORENINC INDEX – Monday, December 24th 2018

North America’s leading junior mining finance data provider

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

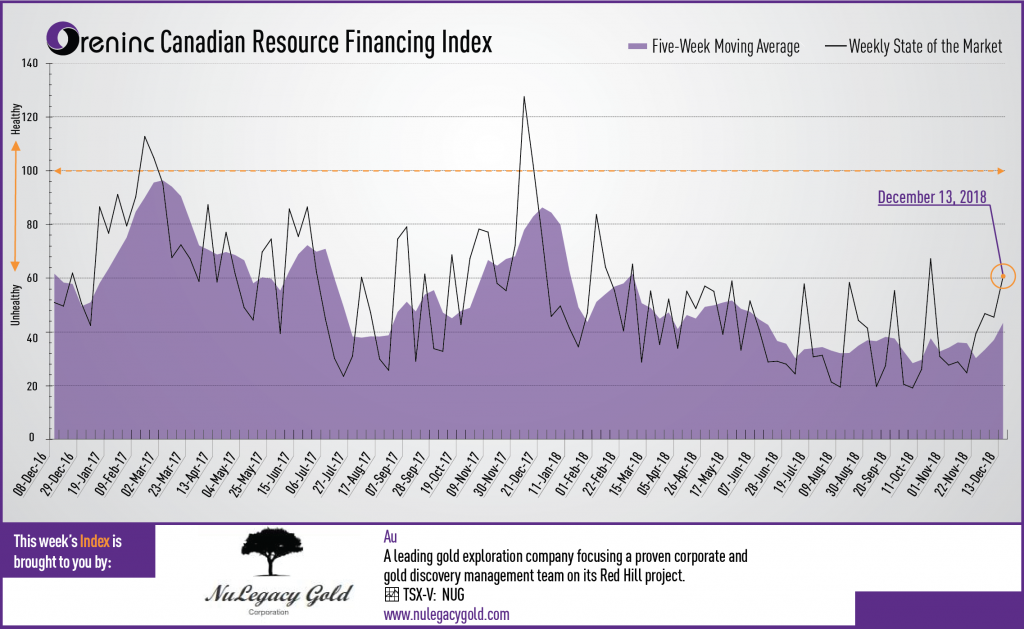

Last week index score: 59.99 (updated)

This week: 57.04

The Oreninc Index fell in the week ending December 20th, 2018 to 57.04 from an updated 59.99 a week ago as gold starts to shine.

Gold is closing the year with strength hitting a five-week high to break back about the US$1,250/oz level and closing above its 200-day moving average, whilst shrugging-off the latest interest rate increase by the US Federal Reserve, as stock markets take a bashing.

During the week, the US Federal Reserve Federal open Market Committee increased interest rates by 0.25% whilst chairman Jerome Powell indicated that more interest rate increases will occur during the next couple of years. However, with the spectre of inflation rising, the market thinks that rate increases will not only slow but that rates may even start to come down again in 2020.

Meanwhile the slide of oil continues as it slumped to a 14-month low amid general concerns of a slowing global economy and the slide in the stockmarket.

On the political front, the US government began a partial shutdown Saturday after President Donald Trump failed to get enough support to fund his US-Mexico border wall. The president is seeking more than US$5.0 billion for the wall but failed to get support from the Senate. This is the third time Trump’s government has shut down in 2018.

On to the money: total fund raises announced decreased again to C$62.0 million, a four-week low, that included one brokered financing, and one bought-deal financing for C$3.0 million, an eight-week low. The average offer size halved to C$1.3 million, a ten-week low, whilst the number of financings increased to 49, a 52-week high.

Gold put in a week of strong growth to add some festive sparkle in the last trading week before Christmas, closing up at US$1,256/oz from US$1,239/oz a week ago. It is down 3.52% this year. The US dollar index fell to at 96.95 from 97.44 last week. The higher gold price pushed the van Eck managed GDXJ up as it closed at US$28.94 from US$27.77 a week ago. The index is down 14.81% so far in 2018. A similar tale at the US Global Go Gold ETF that closed up at US$11.04 from US$10.92 a week ago. It is now down 15.04% so far in 2018. The HUI Arca Gold BUGS Index closed up at 156.47 from 152.66 last week. The SPDR GLD ETF continued to add ounces to inventory to close up at 772.67 tonnes from 763.56 tonnes a week ago.

In other commodities, silver added a few cents to close up at US$14.65/oz from US$14.58/oz a week ago. Copper shed some cents to close down at US$2.67/lb from US$2.76/lb a week ago. Oil saw losses again as WTI saw a significant retraction to close down at US$45.59 a barrel from US$51.20 a barrel a week ago.

The Dow Jones Industrial Average continued to see selling as it closed down at 22,445 from 24,100 last week. Canada’s S&P/TSX Composite Index also saw selling as it closed down at 13,935 from 14,595 the previous week. The S&P/TSX Venture Composite Index also closed down again at 530.20 from 555.38 last week.

Summary

- Number of financings increased to 49, a 52-week high.

- One brokered financing was announced this week, a four-week low.

- One bought-deal financing was announced this week for C$3.0m, an eight-week low.

- Total dollars decreased to C$62.0m, a four-week low.

- Average offer size decreased to C$1.3m, a ten-week low.

Financing Highlights

Royal Nickel (TSX:RNX) announced a C$9.0 million bought deal raise via a syndicate of underwriters led by Haywood Securities to purchase 13.04 million shares @ C$0.46 cents per share for an initial $6.0 million.

- The underwriters also agreed to purchase on a bought deal private placement basis 6.52 million shares @ $0.46 cents for additional proceeds of $2.99 million. The private placement will be sold to Eric Sprott or his designee.

- Proceeds will fund exploration and development at its Beta Hunt gold mine in Australia.

Major Financing Openings

- Royal Nickel (TSX:RNX) opened a C$9.0 million offering underwritten by a syndicate led by Haywood Securities on a best efforts

- Aurcana (TSX-V:AUN) opened a C$29 million offering on a best efforts basis. Each unit includes a warrant that expires in three years.

- Barksdale Capital (TSX-V:BRO) opened a C$5 million offering on a strategic deal basis. The deal is expected to close on or about January 4th, 2019.

Major Financing Closings

- Barkerville Gold Mines (TSX-V:BGM) closed a C$05 million offering on a bought deal basis.

- McEwen Mining (TSX:MUX) closed a C$03 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis.

MORE or "UNCATEGORIZED"

West Red Lake Gold Announces Closing of $29 Million Bought Deal Public Offering

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to... READ MORE

McEwen Copper Announces an Additional US$35 Million Investment by Nuton, a Rio Tinto Venture

McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MU... READ MORE

Midland, in Partnership with RTEC, Intersects Several New Spodumene Pegmatites During the 2024 Drilling Program on the Galinée Project

Midland Exploration Inc. (TSX-V: MD), in partnership with Rio Tinto Expl... READ MORE

Abcourt Intersects 10.4 g/t Gold over 12 Metres in Channel on the New Stripping carried out in the Cartwright Area of the Flordin Project

Mines Abcourt Inc. (TSX-V: ABI) (OTCQB : ABMBF) is pleased to an... READ MORE

Metals Creek Drills 110 Meters of 1.69% Copper and 7.05 g/t Silver at the Tillex Copper Project

Longest intercept to date on the Tillex Copper Project Two higher grade ... READ MORE