ORENINC INDEX ends 2021 with a nosedive

ORENINC INDEX – Monday, January 3rd 2022

North America’s leading junior mining finance data provider

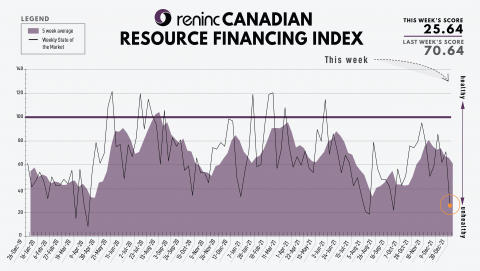

Last Week: 70.64

This week: 25.64

The Oreninc Index decreased in the trading week ending December 31st, 2021 to 25.64 from 70.64 a week ago as the financing activity is historically low during the year-end holiday season.

On to the money: the aggregate financings announced decreased to $12 million, a 91-week low, with one new brokered financings and no new bought-deal financings announced. The average offer size increased to $0.8 million, a 52-week low, and the number of financings decreased to 16.

Gold closed the week up at $1,828/oz from $1,810/oz a week ago. The US dollar index closed down at 95.67 from 96.02 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week up at $41.93 from $41.61 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week lower at 258.87 from 253.89 last week. The SPDR GLD ETF inventory closed the week lower at 975.66 tonnes, or 31.36 million ounces, from 984.38 tonnes last week.

In other commodities, Silver closed the week higher at $23.38/oz from $22.91/oz a week ago. Copper closed higher at $4.45/lb from $4.40/lb a week ago. Oil went higher as WTI closed higher at $75.21 a barrel from $73.79 a barrel a week ago.

The Dow Jones Industrial Average closed higher at 36,338 from 35,950 a week ago. Canada’s S&P/TSX Composite Index closed lower at 21,222 from 21,229 the previous week. The S&P/TSX Venture Composite Index closed lower at 939.18 from 934.97 a week ago.

Summary:

- Number of financings decreased to 16.

- One brokered financing was announced this week for $2m, a 14-week low.

- No bought-deal financing was announced this week.

- Total dollars decreased to $12m, a 91-week low.

- Average offer lessened to $0.8m, a 52-week low.

Major Financing Openings:

- Rokmaster Resources Corp. (TSX-V:RKR) opened a $3.3 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Bam Bam Resources Corp. (CSE:BBR) opened a $3.26 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 36 months.

- Jourdan Resources Inc. (TSX-V:JOR) opened a $2 million offering underwritten by a syndicate led by xxx on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Puma Exploration Inc. (TSX-V:PUM) opened a $0.92 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

Major Financing Closings:

- Skeena Resources Limited (TSX-V:SKE) closed a $30.91 million offering on a best efforts basis. The deal is expected to close on or about December 23, 2021.

- RTG Mining Inc. (TSX:RTG) closed a $13.02 million offering on a best efforts basis.

- 1911 Gold Corp. (TSX-V: AUMB) closed a $8 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a best efforts basis. The deal is expected to close on or about December 29, 2021.

- Satori Resources Inc. (TSX-V:BUD) closed a $4.72 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE