ORENINC INDEX down as summer ends

ORENINC INDEX – Monday, September 3rd 2018

North America’s leading junior mining finance data provider

Free sign-up at www.oreninc.com

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

Subscribe at www.miningdealclub.com

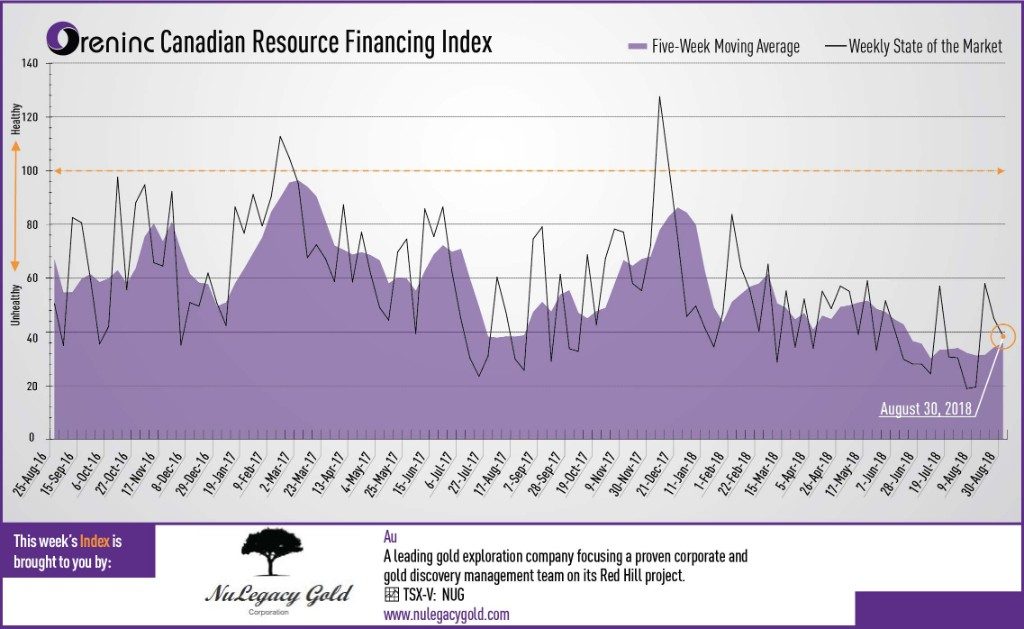

Last week index score: 44.93 (updated)

This week: 38.44

Nexus Gold (TSXV:NXS) received results from a 105-line kilometre soil sampling survey at its Rakounga concession in Burkina Faso.

NuLegacy Gold (TSXV:NUG) extends Serena zone with summer step-out drilling on its Red Hill property located in the Cortez gold trend in Nevada, USA.

The Oreninc Index continued to fall in the week ending August 31st, 2018 as it pulled back to 38.44 from an updated 44.93 a week ago.

Gold continues to hover around the US$1,200/oz level during a relatively quiet week, the last week of summer. With market activity set to pick up following the US Labor Day on Monday 3rd September, market observers are split between those who think metals prices will start to build and those that think the sell-off will continue. As things stand, gold is on track for its fifth straight monthly decline, its longest monthly losing streak since 2013.

September also sees the mining investment community congregate in Colorado for the Precious Metals Summit, where Oreninc will be in attendance, and the Denver Gold Forum.

On to the money: total fund raises announced rose to C$114.9 million, a 21-week high, which included no brokered financings and no bought deal financings. The average offer size doubled to C$4.9 million, a 21-week high, whilst the number of financings increased to 23, a five-week high.

Gold lost some ground to close out the week at US$1,202/oz from US$1,205/oz a week ago, retrenching from a mid-week high of US$1,211/oz. It is now down 7.61% this year. The US dollar index remained at 95.14 as it was last week. The van Eck managed GDXJ recovery deflated as it closed down at US$27.64 from US$28.21 a week ago. The index is down 19.02% so far in 2018. The US Global Go Gold ETF also saw its recovery deflate as it closed down at US$10.76 from US$10.89 a week ago. It is now down 17.29% so far in 2018. The HUI Arca Gold BUGS Index closed down at 143.23 from 146.81 last week. The SPDR GLD ETF continued in sell mode with its inventory closing down at 755.16 tonnes from 764.58 tonnes a week ago.

In other commodities, silver continued to fall to close down at US$14.54/oz from US$14.82/oz a week ago. Copper also fell again to close down at US$2.67/lb from U$2.72/lb last week. Oil continued to grow as it closed up at US$69.80 a barrel from US$68.72 a barrel a barrel a week ago, its highest level in over a month on the back of continued supply disruptions from Iran and Venezuela and a fall in US inventories.

The Dow Jones Industrial Average saw more strong growth to close up at 25,964 from 25,790 last week. Canada’s S&P/TSX Composite Index couldn’t follow suit and closed down at 16,262 from 16,356 the previous week. The S&P/TSX Venture Composite Index continued to grow as it closed up at 724.71 from 711.37 last week.

Summary:

- Number of financings increased to 23, a five-week high.

- No brokered financings were announced this week, a one-week low.

- No bought-deal financing was announced this week, a two-week low.

- Total dollars skyrocketed to C$114.9m, a 21-week high.

- Average offer size doubled to C$4.9 m, a 21-week high.

Financing Highlights

Red Eagle Mining (TSX:R) announced a private placement for gross proceeds of about C$50 million consisting of 250 million shares @ C$0.20.

- Shareholder Annibale SAC that owns 9.5% agreed to backstop it.

- Proceeds will be used for repayment of long term debt and working capital at the Santa Rosa gold mine in Antioquia, Colombia, as part of a financial restructure that includes the retirement of a US$60 million credit facility and interest, writing off supplier account payables, appointing a new independent chairman and a 10:1 share consolidation.

Gold Standard Ventures (TSX:GSV) announced a non-brokered private placement of up to 5.1 million shares @ C$2.05 for gross proceeds of up to C$10.5 million.

- Goldcorp (TSX:G) will acquire 2.9 million shares to increase its stake to 13.60% of the company.

- OceanaGold (TSX:OGC) will acquire 975,609 shares to increase its stake to 15.58% of the company.

- The net proceeds will be used for continued exploration and early-stage development of the Railroad-Pinion project in Nevada, USA.

Major Financing Openings

- Red Eagle Mining (TSX:R.TO) opened a C$50 million offering on a best efforts basis.

- Gold Standard Ventures (TSX:GSV) opened a C$10.5 million offering on a best efforts basis. The deal is expected to close on or about September 5th.

- Great Bear Resources (TSXV:GBR) opened a C$10 million offering on a best efforts basis. Each unit includes half a warrant that expires in two years.

Major Financing Closings

- Diamcor Mining (TSXV:DMI) closed a C$3.23 million offering on a best efforts basis. Each unit included half a warrant that expires in three years.

- Sunvest Minerals (TSXV:SSS) closed a C$1.56 million offering on a best efforts basis. Each unit included half a warrant that expires in three years.

- California Gold Mining (TSXV:CGM) closed a C$1.3 million offering on a best efforts basis. Each unit included half a warrant that expires in 25 months.

Company News

Nexus Gold (TSXV:NXS) received results from a 105-line kilometer soil sampling survey at its Rakounga concession in Burkina Faso.

- The survey identified an anomalous gold trend that extends for about 7km along the southwest-northeast axis and broadens to widths of 2.5km.

- The newly identified trend aligns with the previously identified 5km Pelatanga-Rawema trend on the adjacent Bouboulou concession.

Analysis

The survey was designed to investigate the gold bearing potential on the permit ground occurring between the Koaltenga gold zone, located near the western boundary of the Rakounga concession, and Pelatanga-Rawema gold trend on Nexus’ adjacent Bouboulou exploration permit. This initial success bodes well for the future exploration potential of the property over a large area.

NuLegacy Gold (TSXV:NUG) extends Serena zone with summer step-out drilling on its Red Hill property located in the Cortez gold trend in Nevada, USA.

- The Serena zone was extended 100m west by step-out drilling, that included 22.1m @ 6.59g/t Au.

- Drilling in the Avocado/Gap zone between the Avocado and Serena zones contained varying amounts of alteration, Carlin style trace elements, and anomalous gold, and sections of the Devil’s Gate limestone formation, indicating that they were to the east of the best stratigraphy.

Analysis

This result indicates that the Serena zone is open to the west, towards the geophysically well-defined Western Slope anomaly and with excellent grade. This drilling also helps prove the concept that following newly recognized mineralizing low angle fault structures to the west to where they intercept the best stratigraphic host rocks works. Added to NUGs previously Serena drilling, this result will now see exploration focus on expanding the Serena zone with at least four follow-up holes planned within the 10-12 drill hole program beginning in September.

MORE or "UNCATEGORIZED"

KOOTENAY SILVER CLOSES BROKERED PUBLIC OFFERING FOR GROSS PROCEEDS OF C$10.35 MILLION

Kootenay Silver Inc. (TSX-V: KTN) is pleased to announce that the... READ MORE

U.S. Gold Corp. Closes $4.9 Million Non-Brokered Registered Direct Offering

U.S. Gold Corp. (NASDAQ: USAU), is pleased to announce that it h... READ MORE

Getchell Gold Corp. Announces Final Tranche of Debenture Financing

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) (FWB: GGA1) is ple... READ MORE

Imperial Reports Production Update for 2024 First Quarter

Imperial Metals Corporation (TSX:III) reports quarterly copper an... READ MORE

ALX Resources Corp. Intersects Additional Uranium Mineralization at the Gibbons Creek Uranium Project, Athabasca Basin, Saskatchewan

ALX Resources Corp. (TSX-V: AL) (FSE: 6LLN) (OTC: ALXEF) is pleas... READ MORE