ORENINC INDEX down as financings halve

ORENINC INDEX – Monday, January 13th 2020

North America’s leading junior mining finance data provider

Oreninc will be attending the Vancouver Resource Investment Conference 19-20 January 2020. Find us at booth #1117. Please contact us if you would like a meeting.

Oreninc CEO Kai Hoffmann will be presenting on

Sunday January 19th at 2:20pm in Workshop 5

“How your investment is killing the industry”

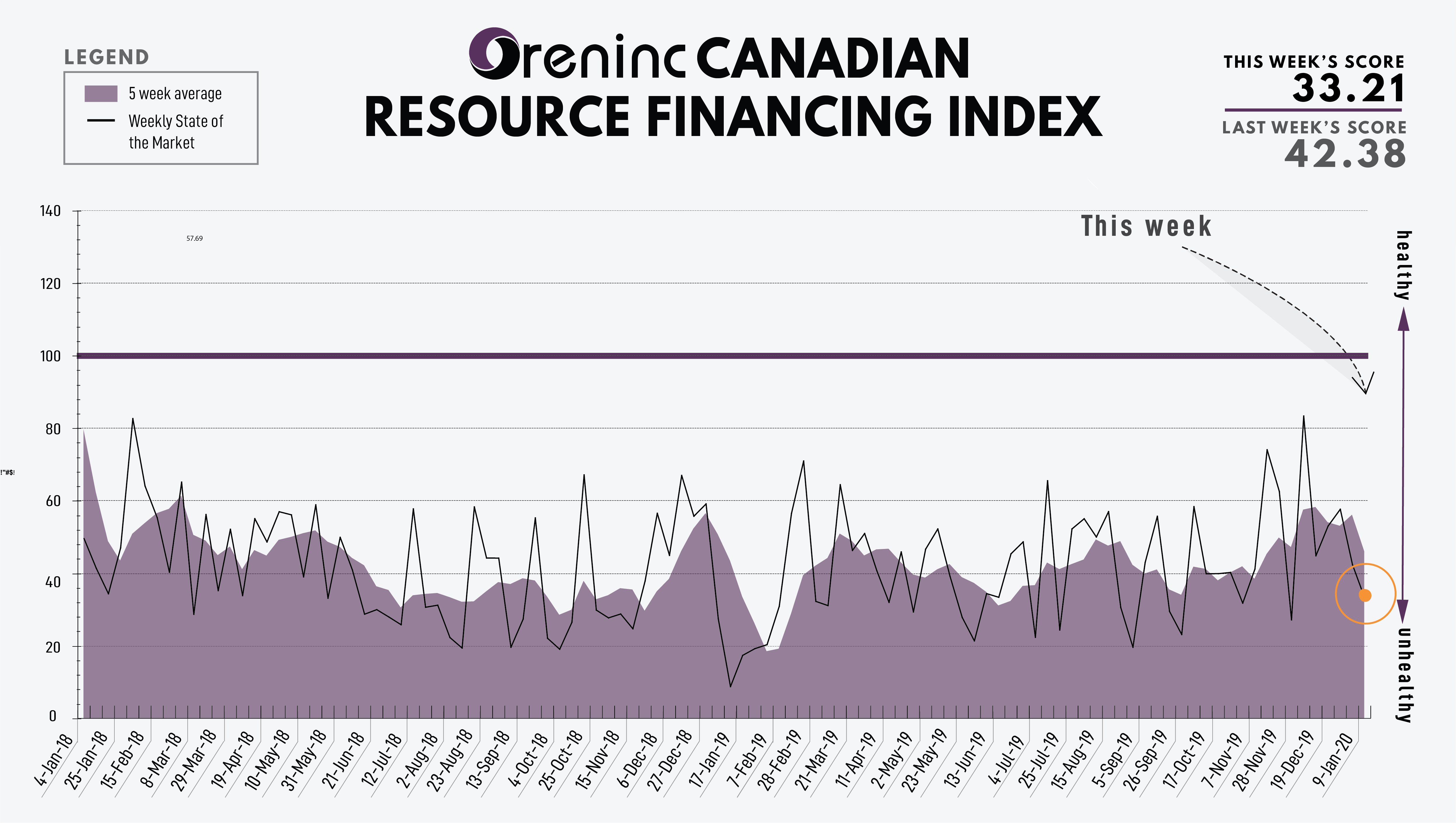

Last Week: 42.38 (Updated)

This week: 33.21

The Oreninc Index dropped by 10 index points in the first full trading week of 2020 ending January 9th, 2020 to 33.21 from an updated 42.38 a week ago during a volatile week for precious metal prices.

Gold spiked to US$1,600/oz this past week, its highest point since March 2013, when Iran launched a missile attack on two US bases in Iraq in retaliation for the US assassination of General Qassem Suleimani, the second-most powerful person in Iran, leader of its elite Quds military organisation and the director of its foreign policy in the region which has spread the country’s influence throughout several countries.

However, Iran’s missile attacks appear to be aimed at saving face at home rather than inflicting casualties on US forces, consequently deescalating tensions and dropping the gold price back to around $1,550/oz.

It also appears as though an Iranian air-defence missile system shot down a commercial Boeing 737-800 flight taking off from Tehran international airport for Ukraine killing all 176 on board.

The Trump administration added new economic sanctions on Iran including on steel, aluminium, copper and iron.

In the US, the Bureau of Labor reported weaker than expected jobs data showing 145,000 non-farm positions added in December, well down from November’s surprise 266,000, and lower than expectations for 164,000. Unemployment held at 3.5%, a 50-year low, with the number of unemployed also unchanged at 5.8 million. Wage growth also faltered, coming in at 2.9% compared to expectations of 3.1%.

On to the money: total fund raises announced decreased to $23.7 million, a 19-week low, which included two brokered financings for $9.99m, a one-week high, and two bought-deal financings, for $9.99m, also a one-week high. The average offer size almost doubled to $1.3 million, a three-week high, while the number of financings decreased to 18.

Gold received a strong boost as the week commenced, fell and recovered somewhat as the week drew to a close, ending the week up at US$1,562/oz from $1,552/oz a week ago. The yellow metal is up 2.97% so far this year. The US dollar index strengthened as it closed up down at 97.35 from 96.83 last week. Despite the action in gold, many gold stocks saw selling as part of a flight to cash. As such, the VanEck managed GDXJ closed down at US$40.90 from $41.91 a week ago. The index is down 3.22% so far in 2020. The US Global Go Gold ETF also down at US$16.99 from $17.36 a week ago. It is down 3.25% so far in 2020. The HUI Arca Gold BUGS Index closed down too at 231.12 from 238.26 last week. The SPDR GLD ETF saw its inventory sell off twenty tonnes as it closed down at 874.52 tonnes from 895.3 tonnes a week ago.

In other commodities, silver closed up at US$18.11/oz from $18.06/oz a week ago. The copper price regained some energy as it closed up at US$2.81/lb from $2.78/lb last week. The oil price also spiked as the week began before selling down as WTI closed down at US$59.04 a barrel from $63.05 a barrel a week ago.

The Dow Jones Industrial Average continued to break records, breaching 29,000 for the first time ever slightly before pulling back to close the week up at 28,823 from 28,634 a week ago. Canada’s S&P/TSX Composite Index also closed up at 17,234 from 17,066 the previous week. The S&P/TSX Venture Composite Index closed down at 582.35 from 587.44 last week.

Summary

- Number of financings decreased to 18.

- Two brokered financings were announced this week for $9.99m, a one-week high.

- Two bought-deal financings were announced this week for $9.99m, a one-week high.

- Total dollars decreased to $23.7m, a 19-week low.

- Average offer up to $1.3m, a three-week high.

Financing Highlights

Talisker Resources (CSE:TSK) announced bought $10 million bought deal private placement.

- Syndicate of underwriters led by PI Financial.

- 1 million shares @ $0.33 and 16.2 million charity flow-through shares $0.495.

- Proceeds will be used on the company’s projects in Canada.

- The offering was subsequently increased to $13 million by increasing the normal shares to 15.3 million.

Major Financing Openings

- Talisker Resources (CSE:TSK) opened a $10 million offering on a best efforts The deal is expected to close on or about February 4th.

- Laramide Resources (TSX:LAM) opened a $3 million offering on a best efforts Each unit includes a warrant that expires in three years. The deal is expected to close on or about January 30th.

- Silver One Resources (TSX-V:SVE) opened a $67 million offering on a best efforts basis. Each unit includes half a warrant that expires in three years.

- Copper Reef Mining (CSE:CZC) opened a $5 million offering on a best efforts basis.

Major Financing Closings

- Trigon Metals (TSX-V:TM) closed a $6 million offering on a best efforts basis. Each unit included a warrant that expires in three years.

- Zonte Metals (TSX-V:ZON) closed a $52 million offering on a best efforts basis. Each unit included half a warrant that expires in 18 months.

- Outcrop Gold (TSX-V:OCG) closed a $11 million offering on a best efforts basis. Each unit included a warrant that expires in five years.

- Southern Arc Minerals (TSX-V:SA) closed a $05 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Silver Mountain Announces Closing of Prospectus Offering

Silver Mountain Resources Inc. (TSX-V: AGMR) (OTCQB: AGMRF) is ... READ MORE

Mandalay Extends the Storheden Gold Deposit Adjacent to the Operating Björkdal Mine

Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announce... READ MORE

Collective Mining Intercepts 632.25 Metres at 1.10 g/t Gold Equivalent in a 200 Metre Step-Out Hole to the South at Trap

Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FSE: GG1) is pl... READ MORE

Koryx Copper Intersects 207 Meters at 0.49% and 116 Meters at 0.54% Copper Equivalent

Significant copper and molybdenum intersections include: HM19: 11... READ MORE

Red Pine Intercepts Significant Mineralization at the Wawa Gold Project, including 5.34 g/t over 13.39 metres including 16.50 g/t gold over 0.97 metre and 13.62 g/t gold over 2.13 metres

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) is pleased ... READ MORE