ORENINC INDEX down as dollars and average deal size increased

ORENINC INDEX – Monday, February 17th 2020

North America’s leading junior mining finance data provider

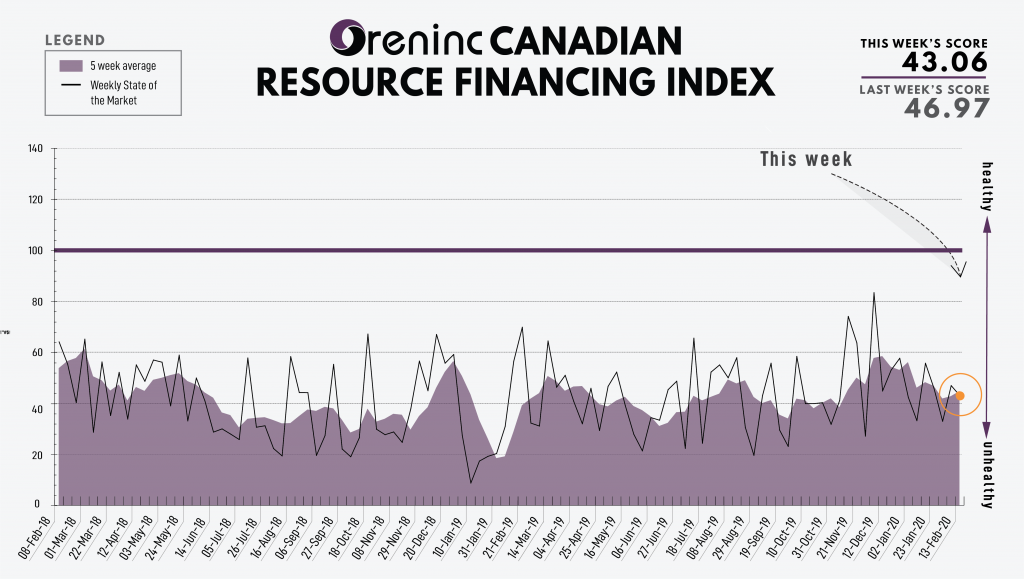

Last Week: 46.97

This week: 43.06

The Oreninc Index fell slightly in the week ending February 14th, 2020 to 43.06 from 46.97 a week ago as the dollars announced and average deal size increased.

The coronavirus outbreak continues to dominate the news with the death toll having increased past 1,380 and the number of infections from the virus in China almost at 64,000. China reclassified how cases are counted which resulted in a jump of almost 15,000 cases in China.

With much of China on lock-down, the International Energy Agency forecast a drop in global oil demand for the first time in a decade, as the economic impacts continue to be felt. China’s GDP growth this year is expected to come in well under the 6% forecast at the start of the year. Another challenge for oil producers emerged after BP promised to zero out all its carbon emissions by 2050.

In the US, the Federal Reserve Bank of New York cut its liquidity providing repurchase agreements by more than analysts had forecast. Meanwhile, Federal Reserve Chairman Jerome Powell told Congress the US economy is “in a very good place.” The main concern being the forecast US$1 trillion federal budget deficit this year.

On to the money: total fund raises jumped to $75.2 million, a two-week high, which included one brokered financing for $6 million, a two-week low, and one bought-deal financing for $6 million, also a two-week low. The average offer size jumped to $2.35 million, a one-week high, while the number of financings remained the same at 32.

Gold came fighting back to close up at US$1,584/oz from $1,570/oz a week ago. The yellow metal is up 4.4% so far this year. The US dollar index saw another strong week as it closed up at 99.12 from 98.68 last week. The VanEck managed GDXJ closed up at US$40.97 from $40.25 a week ago. The index is down 3.05% so far in 2020. The US Global Go Gold ETF also closed up at US$16.51 from $16.21 a week ago. It is down 5.98% so far in 2020. The HUI Arca Gold BUGS Index closed down a smidge at 225.36 from 226.55 last week. The SPDR GLD ETF inventory continued to rise as it closed up at 923.99 tonnes from 916.08 tonnes a week ago.

In other commodities, spot silver closed up a touch at US$17.74/oz from $17.70/oz a week ago. Copper seems to have bottomed out for now closing the week up at US$2.60/lb from $2.55/lb a week ago. The oil price also improved as WTI closed up at US$52.05 a barrel from $50.32 a barrel a week ago.

The Dow Jones Industrial Average continued to gain to close up at 29,398 from 29,102 a week ago. Canada’s S&P/TSX Composite Index also closed up at 17,848 from 17,655 the previous week. The S&P/TSX Venture Composite Index closed down again at 570.49 from 574.16 last week.

Summary

- Number of financings remained at 32.

- One brokered financing was announced this week for $6 million, a two-week low.

- One bought-deal financing was announced this week for $8 million, a two-week low.

- Total dollars increased to $75.2 million, a two-week high.

- Average offer up to $2.35 million, a one-week high.

Financing Highlights

Rupert Resources (TSX-V:RUP) opened and closed a $13.1 million non-brokered private placement.

- Agnico subscribed for 15.4 million units @ C$0.85.

- Each unit is comprised of one share and 0.75 of a warrant exercisable @ C$1.00 for three years.

- Strategic investment by Agnico Eagle Mines, who now holds 9.9% of Rupert.

- Proceeds will be used to explore the Pahtavaara project in Finland.

Major Financing Openings

- Rupert Resources (TSX-V:RUP) opened a $13.08 million offering on a best efforts basis. Each unit includes a warrant that expires in two years.

- Troilus Gold (TSX-V:TLG) opened a $10 million offering on a best efforts basis. The deal is expected to close on or about February 28th.

- Rubicon Minerals (TSX:RMX) opened a $8.01 million offering underwritten by a syndicate led by Cormark Securities on a bought deal basis. The deal is expected to close on or about February 27th.

- Irving Resources (CSE:IRV) opened a $5.4 million offering on a best efforts basis.

Major Financing Closings

- Regency Gold (TSX-V:RAU.H) closed a $15 million offering on a best efforts basis. Each unit included half a warrant that expires in two years.

- Rupert Resources (TSX-V:RUP) closed a $13.08 million offering on a best efforts basis. Each unit included a warrant that expires in two years.

- Generation Mining (CSE:GENM) closed a $11.4 million offering underwritten by a syndicate led by Haywood Securities on a bought deal basis.

MORE or "UNCATEGORIZED"

JUGGERNAUT CLOSES FINANCING WITH CRESCAT CAPITAL AS LEAD INVESTOR FOR 19.97%

PLANS FOLLOW UP DRILLING ON EXTENSIVE HIGH-GRADE COPPER-GOLD TARG... READ MORE

KARORA REPORTS RECORD REVENUE AND STRONG CASH FLOW FOR Q1 2024

Karora Resources Inc. (TSX: KRR) announced financial and operatin... READ MORE

OceanaGold Completes IPO, Raises US$106M for the Sale of 20% Interest in OGPI

OceanaGold Corporation (TSX: OGC) (OTCQX: OCANF) is pleased to an... READ MORE

Drilling Continues to Expand Gold Resource at OKO

G2 Goldfields Inc. (TSX: GTWO) (OTCQX: GUYGF) is pleased to provi... READ MORE

CANTEX INTERSECTS UP TO 25.07% LEAD-ZINC WITH 72g/t SILVER AT ITS 100% OWNED NORTH RACKLA PROJECT, YUKON AND WILL COMMENCE DRILLING ITS COPPER PROJECT WHERE PREVIOUS DRILLING INTERSECTED 2.5m OF 3.93% COPPER

Cantex Mine Development Corp. (TSX-V: CD) (OTCQB: CTXDF) provides... READ MORE