ORENINC INDEX down as deal size shrinks

ORENINC INDEX – Monday, October 26th 2020

North America’s leading junior mining finance data provider

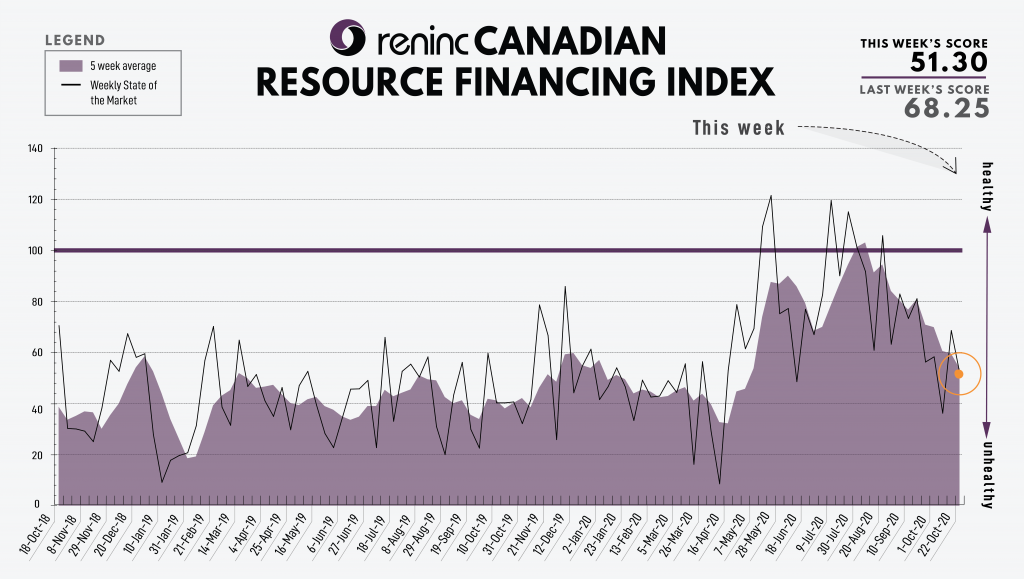

Last Week: 68.25 (Updated)

This week: 51.30

The Oreninc Index fell in the week ending October 23rd, 2020 to 51.30 from an updated 68.25 a week ago as deal size shrunk.

The COVID-19 virus global death toll has exceeded 1.1 million with almost 43 million cases reported worldwide, with Europe and other parts of the world experiencing a second wave of contagion.

The past week saw the final debate between the US presidential election candidates, incumbent Donald Trump and former vice president Joe Biden. With two short weeks to go before the polls open, some 40 million people have already submitted postal ballots. The proximity of the election also means it is increasingly unlikely that another stimulus package or COVID-19 relief deal will be agreed and passed, even though the Democrats and Republicans are reportedly closing-in on agreeing terms.

Gold meanwhile continues to fluctuate above and below the US$1,900/oz level. However, US investment bank Goldman Sachs now says commodities are on the cusp of entering a structural bull market due in part to a weakening US dollar and rising inflation risk.

The US Labor Department said 787,000 million people filed first-time jobless claims, a fall of 55,000 from the previous week’s revised level, the lowest level of new claims since the COVID-19 pandemic struck in March. The four-week moving average for new claims fell 21,500 to 811,250. Continuing jobless claims fell to 8.373 million.

With time running out for the UK and European Union to agree the terms of their new trade relationship, political posturing finally seems to be being set aside with both parties keen to reach a deal.

On to the money: the aggregate financings announced decreased to $78 million, a two-week low, which included four brokered financings for $12 million, a ten-week low, and one bought deal financing for $6 million, a three-week low. The average offer size fell to $2.1 million, an eight-week low, while the number of financings increased to 38.

With less than a month to go before the US presidential election, the gold price continues to exhibit volatility around the US$1,900/oz level as the spot price closed down at $1,899/oz from $1,930/oz a week ago. The yellow metal is up 25.18 so far this year. The US dollar index strengthened as it closed up at 93.68 from 93.05 a week ago. The VanEck managed GDXJ increased as it closed down at $57.67 from $59.50 a week ago. The index is now up 36.46% so far this year. The HUI Arca Gold BUGS Index also closed down at 333.49 from 340.18 last week. The SPDR GLD ETF inventory sold down a little, closing the week up at 1,272.56 tonnes, or 40.91 million ounces, from 1,271.52 tonnes last week.

In other commodities, Silver fell as it closed the week down at $24.16/oz from $25.15/oz a week ago. Copper closed down at $3.06/lb from $3.08/lb a week ago. Oil continued to strengthen as WTI closed up at $40.88 a barrel from $40.60 a barrel a week ago.

The Dow Jones Industrial Average jumped higher as it closed down at 28,606 from 28,586 a week ago. Canada’s S&P/TSX Composite Index also moved down to close at 16,438 from 16,562 the previous week. The S&P/TSX Venture Composite Index closed down at 725.31 from 732.25 last week.

Summary

- Number of financings increased to 38.

- Four brokered financings were announced this week for $12 million, a ten-week low.

- One bought-deal financing was announced this week for $6 million, a three-week low.

- Total dollars decreased to $78 million, a two-week low.

- Average offer decreased to $2.1 million, an eight-week low.

Financing Highlights

Euro Manganese (TSX-V:EMN) opened a private placement financing for $11.4 million

- 9 million shares and 58.1 million CHESS depositary interests (CDIs) @ $0.19.

- Proceeds will be used to further progress the Chvaletice manganese project in Czech Republic.

- The issue was oversubscribed and received strong support from both new and existing shareholders, including a number of new institutional and specialist resources investment funds.

- The offering is intended to close in two tranches, comprising of 716,384 shares and 31.2 million CDIs for $6.1 million on or about October 28th and a second tranche of 1.2 million shares and 26.9 million CDIs for $5.3 million subject to shareholder approval to be sought in December.

Major Financing Openings:

- International Tower Hill Mines (TSX:ITH) opened a $52 million offering on a best efforts basis.

- Euro Manganese (TSX-V:EMN) opened a $4 million offering on a best efforts basis.

- Silver Elephant Mining (TSX:ELEF) opened a $6 million offering underwritten by a syndicate led by Mackie Research Capital on a bought deal The deal is expected to close on or about November 13th.

- Radisson Mining Resources (TSX-V:RDS) opened a $6 million offering underwritten by a syndicate led by Eight Capital on a best efforts Each unit includes half a warrant that expires in 18 months. The deal is expected to close on or about November 12th.

Major Financing Closings

- International Tower Hill Mines (TSX:ITH) closed a $52 million offering on a best efforts basis.

- Santacruz Silver Mining (TSX-V:SCZ) closed a $10 million offering on a best efforts Each unit included a warrant that expires in three years.

- Volcanic Gold Mines (TSX-V:VG) closed a $61 million offering underwritten by a syndicate led by Haywood Securities on a bought deal basis. Each unit included half a warrant that expires in 18 months.

- Macarthur Minerals (TSX-V:MMS) closed a $83 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Elevation Gold Reports Financial Results for Year Ended December 31, 2023, including $66.4M in Total Revenue

Elevation Gold Mining Corporation (TSX-V: ELVT) (OTCQB: EVGDF) i... READ MORE

Reunion Gold Announces the Signing of a Mineral Agreement With the Government of Guyana for Its Oko West Project

Reunion Gold Corporation (TSX-V: RGD; OTCQX: RGDFF) is pleased to announ... READ MORE

Drilling Confirms 4 km of Favourable Corridor at Lynx Gold Trend

Puma Exploration Inc. (TSX-V: PUMA) (OTCQB: PUMXF) is thrilled to... READ MORE

Grid Metals Intersects 7 m at 1.28% Li2O at over 125 m Below the Previously Deepest Drill Holes at Donner Lake; Provides Project Update

Grid Metals Corp. (TSX-V:GRDM) (OTCQB:MSMGF) is pleased to announ... READ MORE

Azimut and SOQUEM Cut Thick Spodumene Pegmatites at Galinée, James Bay Region, Quebec

Azimut Exploration Inc. (TSX-V: AZM) (OTCQX: AZMTF) is pleased ... READ MORE