ORENINC INDEX climbs as broker action returns

ORENINC INDEX – Monday, September 17th 2018

North America’s leading junior mining finance data provider

ORENINC MINING DEAL CLUB Access to high-quality, pre-vetted financing opportunities www.miningdealclub.com

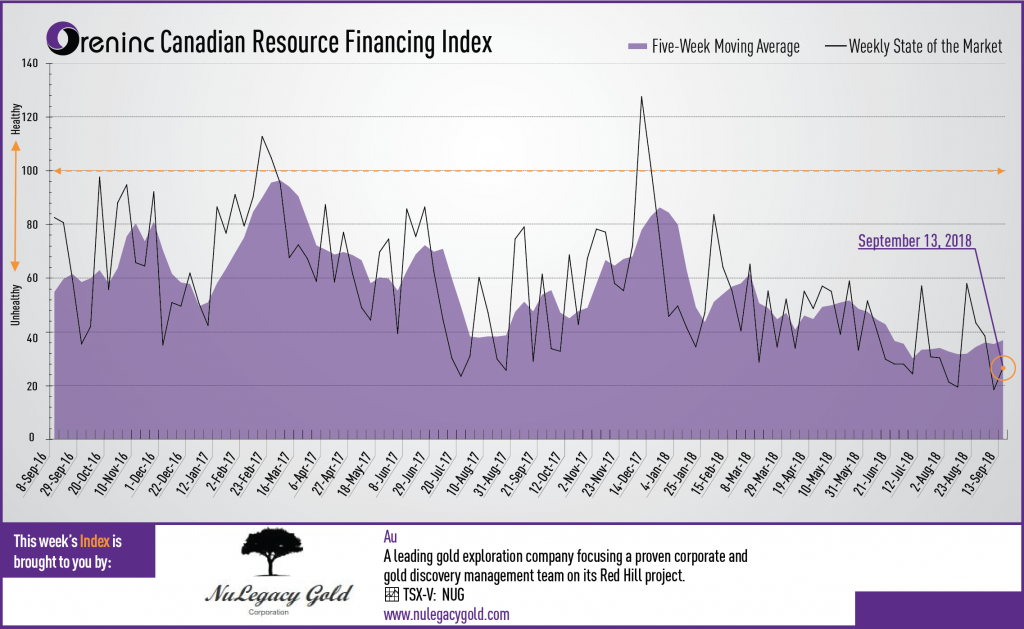

Last week index score: 18.40

This week: 26.49

Prospero Silver (TSX:V) completed drilling at its Buenavista target in Durango, Mexico.

The Oreninc Index climbed in the week ending September 14th, 2018 to 26.49 from 18.40 a week ago, as broker action returned to the market.

News out of Washington says that US President Donald Trump wants to go ahead and levy tariffs on US$200 billion worth of Chinese goods, whilst simultaneously engaging in trade talks with the Asian nation. The news tempered a winning week for US stocks whilst reference points such as the gold price and US dollar index had rather flat weeks, although with high volatility. The gold market is expected to remain lacklustre until there is a better line-of-sight on possible future US interest rate increases that will come with the US Federal Reserve Open Market Committee meeting at the end of the month.

The coming week sees the mining investment community congregate in Colorado for the Precious Metals Summit, where Oreninc will be in attendance, and from where it will move onto the Denver Gold Forum.

On to the money: total fund raises announced increased to C$22.4 million, a one-week high, which included two brokered financings for C$3.5 million, a three-week high, and two bought-deal financings for C$3.5 million, a four-week high. The average offer size fell to C$1.1 million, a one-week low, whilst the number of financings rose to 20, a two-week high.

Gold continued to oscillate around the US$1,200/oz level, but the spot price closed slightly down at US$1,194/oz compared to US$1,196/oz a week ago. It is now down 8.29% this year. The US dollar index fell to 94.92 from 95.34 last week as US President Donald Trump said he would push ahead with more tariffs against China. The van Eck managed GDXJ continued its downward course as it closed slightly down at US$26.81 from US$26.85 a week ago. The index is down 21.45% so far in 2018. The US Global Go Gold ETF bucked the trend and closed up at US$10.45 from US$10.34 a week ago. It is now down 19.68% so far in 2018. The HUI Arca Gold BUGS Index followed suit and closed up at 137.48 from 136.23 last week. However, the SPDR GLD ETF continued to shed ounces with its inventory closing down at 742.53 tonnes from 745.44 tonnes a week ago.

In other commodities, silver continued to fall to close down at US$14.06/oz from US$14.17/oz a week ago. Copper added some cents again to close up at US$2.64/lb from US$2.62/lb last week. Oil added over a dollar to close up at US$68.99 a barrel from US$67.75 a barrel a week ago.

The Dow Jones Industrial Average saw a return to growth as it closed up at 26,154 from 25,916 last week. However, Canada’s S&P/TSX Composite Index continued its downward trajectory and closed down at 16,013 from 16,090 the previous week. The S&P/TSX Venture Composite Index returned to growth as it closed up at 715.16 from 712.06 last week.

Summary

- Number of financings rose to 20, a two-week high.

- Two brokered financings were announced this week for C$3.5m, a three-week high.

- Two bought-deal financing was announced this week for C$3.5m, a four-week high.

- Total dollars increased to C$22.4m, a one-week high.

- Average offer size deceased to C$1.1 m, a one-week low

Financing Highlights

Ascot Resources (TSXV:AOT) announced a non-brokered private placement to a consortium of accredited investors of up to 3.0 million shares that will qualify as flow-through shares @ C$1.00 for gross proceeds of up to C$3.0 million.

- Ascot expanded its 2018 drill program and intends to use the funds to continue drilling through October 2018.

- The offering is expected to close on or about September 27th.

Major Financing Openings

- Ascot Resources (TSXV:AOT) opened a C$3 million offering on a best efforts

- Galantas Gold (TSXV:GAL) opened a C$13 million offering on a best efforts basis.

- Prairie Provident Resources (TSX:PPR) opened a C$2 million offering underwritten by a syndicate led by Marquee Energy on a bought deal Each unit includes half a warrant that expires in two years.

- GT Gold (TSXV:GT) opened a C$2 million offering on a best efforts

Major Financing Closings

- Great Bear Resources (TSXV:GBR) closed a C$07 million offering on a best efforts basis. Each unit included half a warrant that expires in two years.

- Osisko Metals (TSXV:OM) closed a C$10 million offering underwritten by a syndicate led by Industrial Alliance Securities on a best efforts

- Nevada Exploration (TSXV:NGE) closed a C$2 million offering on a best efforts Each unit included half a warrant that expires in two-and-a-half years.

- Ironside Resources (TSXV:IRC) closed a C$1 million offering on a best efforts

Company News

Prospero Silver (TSX:V) completed drilling at its Buenavista target in Durango, Mexico.

- Eleven holes for 2,811m were completed. All holes cut anomalous silver mineralization, with highlights including 1.6m @ 353g/t Ag within a broader interval of 49m @ 43g/t Ag in hole BVF-18-05.

- Buenavista is the fourth target to be drilled under the terms of a second round of strategic investment from Fortuna Silver Mines.

- Buenavista is a precious metal-bearing, structurally-controlled epithermal vein system centered on a rhyolite dome complex.

- The drill rig has been moved to the Bermudez target that will be the fifth and final project to be drilled under the Fortuna strategic investment. An initial three holes for 1,500m of core drilling is planned.

Analysis

With all holes at Buenaventura intercepting anomalous silver mineralization this target is looking like a possible JV contender once the initial program of target testing with Fortuna Silver is completed.

MORE or "UNCATEGORIZED"

West Red Lake Gold Announces Closing of $29 Million Bought Deal Public Offering

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to... READ MORE

McEwen Copper Announces an Additional US$35 Million Investment by Nuton, a Rio Tinto Venture

McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MU... READ MORE

Midland, in Partnership with RTEC, Intersects Several New Spodumene Pegmatites During the 2024 Drilling Program on the Galinée Project

Midland Exploration Inc. (TSX-V: MD), in partnership with Rio Tinto Expl... READ MORE

Abcourt Intersects 10.4 g/t Gold over 12 Metres in Channel on the New Stripping carried out in the Cartwright Area of the Flordin Project

Mines Abcourt Inc. (TSX-V: ABI) (OTCQB : ABMBF) is pleased to an... READ MORE

Metals Creek Drills 110 Meters of 1.69% Copper and 7.05 g/t Silver at the Tillex Copper Project

Longest intercept to date on the Tillex Copper Project Two higher grade ... READ MORE