OceanaGold Releases Waihi District Pre-Feasibility Study with Attractive Economics and Initial Wharekirauponga Reserve of 1.2 Million Ounces

OceanaGold Corporation (TSX: OGC) (OTCQX: OCANF) is pleased to announce the Waihi District Pre-feasibility Study results, which includes the existing Waihi operation and the proposed Wharekirauponga underground mine in New Zealand.

Waihi District PFS Highlights

- Initial Mineral Reserve for Wharekirauponga Underground of 4.1 Mt at 9.2 g/t for 1.2 Moz of gold

- After-tax NPV5% of $621 million at a gold price of $2,400 per ounce, or $138 million at $1,750 per ounce

- IRR of 24% at a gold price of $2,400 per ounce, or 9.2% at $1,750 per ounce

- Gold production of 1.6 Moz over a 15-year mine life at an average All-in Sustaining Cost of $994 per ounce (or $634 per ounce over the Wharekirauponga-only mine life)

- Significant project upside at Wharekirauponga with ~400 koz of Inferred Resources and recent results confirming the EG Vein Zone mineralization extends a further 270 metres to the south and remains open in all directions

- Growth capital of $556 million over an 8-year period, expected to be funded from Free Cash Flow

- First ore from Wharekirauponga Underground expected in 2032

- Early-works 2025 capital budget of $40 to $45 million approved for design and construction activities, subject to receipt of necessary permits.

Gerard Bond, President & CEO of OceanaGold, said “This PFS is a major milestone for OceanaGold and the Waihi operation. We plan to safely and responsibly develop the Wharekirauponga Underground mine which extends the life of the Waihi operation to at least 2038, while generating strong returns for our shareholders and wider economic benefits for local communities and New Zealand.

There remains significant exploration upside at Wharekirauponga, as seen in the exploration results we have released since the June 30, 2024 date of the PFS. The orebody remains open in all directions, with high-grade mineralization now defined to 270 metres beyond existing resources. Drilling is scheduled to continue on the EG Vein Zone in 2025 with the goal of expanding the orebody, extending the life of the Waihi operation and improving the economic returns to all stakeholders.”

The technical report is prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects with an effective date of June 30, 2024. The technical report is available under the Company’s profile on SEDAR+ at www.sedarplus.com and on our website at www.oceanagold.com.

Overview

The town of Waihi on the North Island of New Zealand is located approximately 140 kilometres southeast of Auckland and is the location of a significant gold district which has produced an estimated 8 million ounces of gold to date.

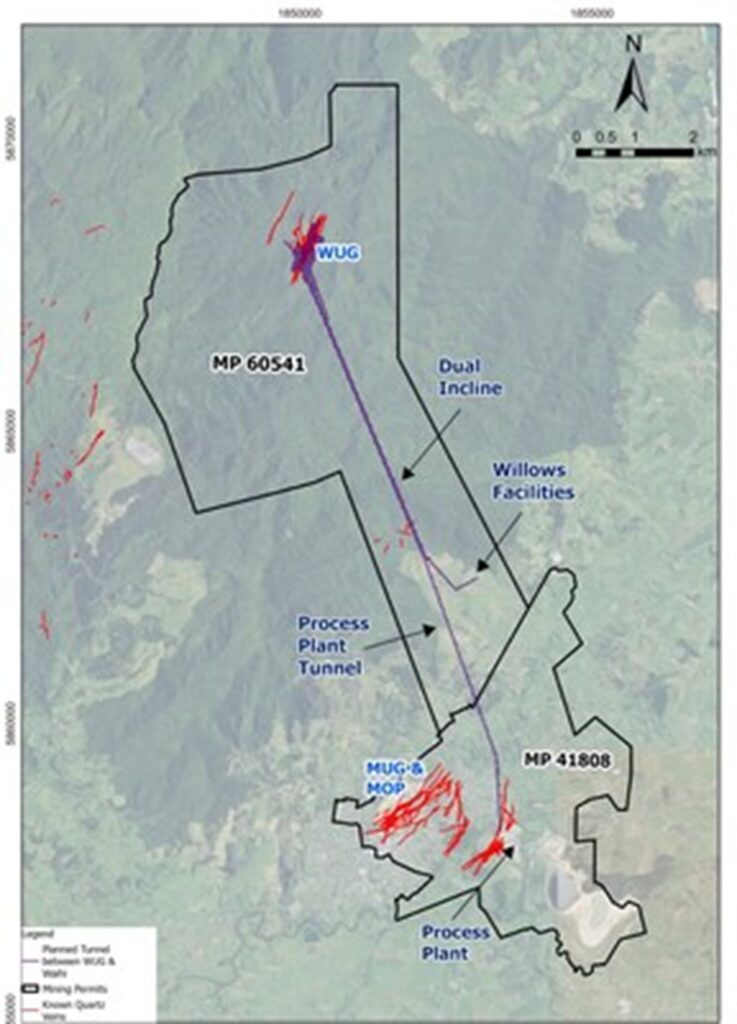

The PFS for the Waihi District includes the Martha Underground mine (“MUG”) and the Wharekirauponga Underground mine (“WUG”). WUG is located approximately 10 kilometres north of Waihi (Figure 1). The Company owns a property (Willows), adjacent to and outside of the Coromandel Forest Park, that will host the main access portal to, and service the development of WUG.

For a visual overview of the site and proposed project infrastructure, please see the accompanying VRIFY media at https://vrify.com/meetings/recordings/7bed3b3f-699c-42e0-b243-f219d70af6fa.

The PFS is based on Mineral Reserves only and operating metrics reflect the inclusion of both MUG and WUG as they contribute to production. Existing operations at MUG, which have been in active production since 2019, are expected to continue until 2033. Production from WUG is expected to begin in 2032, with first stope ore in 2033 and mining to continue until 2038.

Mineral Reserves

Mineral Reserves in the Waihi District comprise underground reserves only. The Mineral Reserves estimate as of June 30, 2024 is presented in Table 1.

Table 1: MUG and WUG combined Mineral Reserves estimate as of June 30, 2024

| Mineral Reserve Area | Class | Tonnes (Mt) | Au (g/t) | Ag (g/t) | Au (Moz) | Ag (Moz) | |

| MUG | Proven | – | – | – | – | – | |

| Probable | 4.4 | 3.8 | 16.1 | 0.5 | 2.3 | ||

| Total MUG | 4.4 | 3.8 | 16.1 | 0.5 | 2.3 | ||

| WUG | Proven | – | – | – | – | – | |

| Probable | 4.1 | 9.2 | 16.1 | 1.2 | 2.1 | ||

| Total WUG | 4.1 | 9.2 | 16.1 | 1.2 | 2.1 | ||

| Total Mineral Reserves | 8.5 | 6.4 | 16.1 | 1.7 | 4.4 | ||

Notes:

- The WUG Mineral Reserves estimate was reviewed and approved by, or is based on information prepared by or under the supervision of, Euan Leslie, MAusIMM CP, the Company’s Group Mining Engineer and a qualified person under NI 43-101.

- The MUG Mineral Reserves estimate was reviewed and approved by, or is based on information prepared by or under the supervision of, David Townsend, MAusIMM CP, the Company’s Mining Manager and a qualified person under NI 43-101.

- Mineral Reserves are reported based on OceanaGold’s mine design, mine plan, mine schedule and cash flow model at a gold price of $1,750/oz.

- Tonnages include allowances for losses resulting from mining methods. Tonnages are rounded to the nearest 100,000 tonnes.

- Ounces are estimates of metal contained in the Mineral Reserves and do not include allowances for processing losses. Ounces are rounded to the nearest hundred thousand ounces.

- All figures have been rounded; totals may therefore not sum exactly.

- Tonnage and grade measurements are in metric units. Gold ounces are reported as troy ounces and “g/t” represents grams per tonne.

- All key assumptions, parameters and methods used to estimate Mineral Reserves and the data verification procedures followed are set out in the technical report titled ” NI 43-101 Technical Report – Waihi District Pre-feasibility Study, New Zealand” dated December 11, 2024 with an effective date of June 30, 2024 (the “Technical Report”), which is available under the Company’s profile on SEDAR+ at www.sedarplus.com and on the Company’s website at www.oceanagold.com.

Mineral Resources

The Mineral Resources estimate at the Waihi District comprise both open pit and underground resources. The Mineral Resource estimate as of June 30, 2024 for Waihi is presented in Table 2.

Table 2: Summary of Mineral Resources estimate as of June 30, 2024

| Area | Indicated | Inferred | ||||||||

| Tonnes | Grade | Grade | Au | Ag | Tonnes | Grade | Grade | Au | Ag | |

| (Mt) | (g/t Au) | (g/t Ag) | (Moz) | (Moz) | (Mt) | (g/t Au) | (g/t Ag) | (Moz) | (Moz) | |

| MOP | 6.50 | 1.95 | 13.44 | 0.41 | 2.81 | 2.3 | 2.1 | 12.1 | 0.2 | 0.9 |

| GOP | 3.22 | 1.44 | 3.76 | 0.15 | 0.39 | 0.8 | 1.0 | 2.6 | 0.03 | 0.1 |

| MUG | 6.42 | 5.29 | 25.51 | 1.09 | 5.27 | 2.7 | 4.7 | 27.1 | 0.4 | 2.4 |

| WUG | 2.39 | 17.88 | 28.02 | 1.37 | 2.15 | 1.3 | 9.6 | 17.1 | 0.4 | 0.7 |

| Total Mineral

Resources |

18.53 | 5.07 | 17.82 | 3.02 | 10.6 | 7.1 | 4.3 | 17.6 | 1.0 | 4.0 |

Notes:

- Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources estimates were prepared by or under the supervision of, Leroy Crawford-Flett, MAusIMM CP, the Company’s Exploration and Geology Manager and a qualified person under NI 43-101.

- Mineral Resources are reported at a gold price of $1,950/oz.

- Mineral Resources estimate for MUG is reported below the MOP5 design and constrained to within a conceptual underground design based upon the incremental cut-off grade of 2.15 g/t Au.

- Mineral Resources estimate for WUG is reported within a conceptual underground design at a 2.10 g/t Au cut-off grade.

- Mineral Resources estimates for Martha Open Pit (“MOP”) and Gladstone Open Pit (“GOP”) are reported within conceptual pit designs and incremental cut-off grades of 0.50 g/t Au and 0.56g/t Au, respectively. The MOP conceptual pit design is limited by infrastructural considerations.

- Tonnage and grade measurements are in metric units. Gold ounces are reported as troy ounces and “g/t” represents grams per tonne.

- No dilution is included in the reported figures and no allowances for processing or mining recoveries have been made.

- All figures have been rounded; totals may therefore not sum exactly.

- All key assumptions, parameters and methods used to estimate Mineral Resources and the data verification procedures followed are set out in the Technical Report, which is available under the Company’s profile on SEDAR+ at www.sedarplus.com and on the Company’s website at www.oceanagold.com.

- Mineral Resource close out dates for data used in the estimation are as follows: MUG – June 11, 2024; MOP – February 1, 2024; WUG – April 24, 2024; GOP – September 1, 2022.

PFS Operating Summary

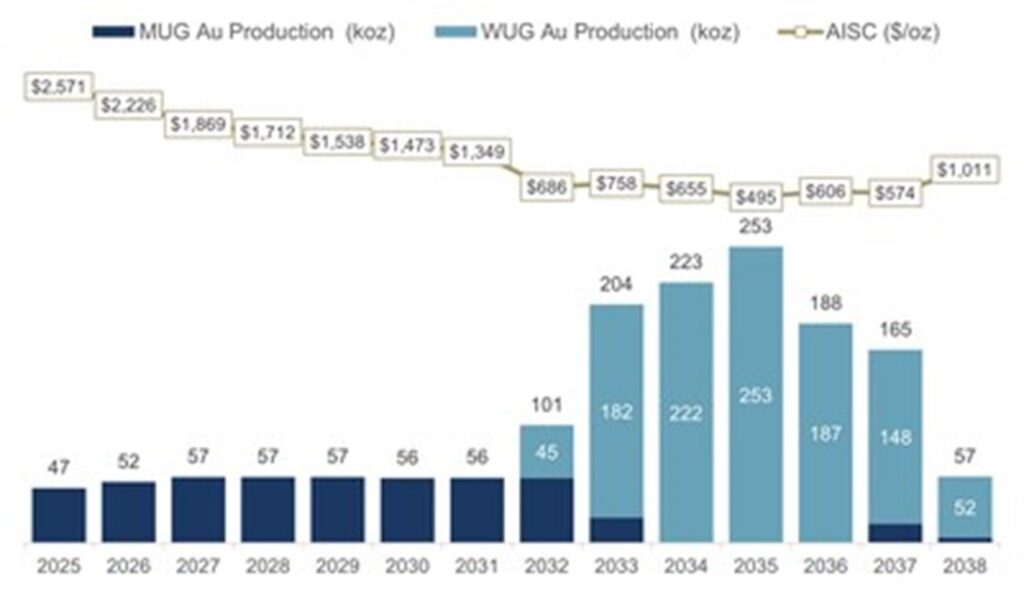

The Waihi District PFS covers the current operating Martha underground mine (“MUG”) and the new Wharekirauponga underground mine. MUG and WUG are expected to produce a combined 1.6 million ounces of payable gold over a 15 year mine life (2024-2038) with peak production of 253 koz of gold in 2035 and a life-of-mine average All-In Sustaining Cost of $994 per ounce (Figure 2).

MUG is expected to be the primary ore source until 2033, when mining transitions to WUG. A mill expansion to 0.8 Mtpa is also included in the PFS, which begins to process at the increased throughput levels in 2033. WUG begins commercial production in 2033 with an average AISC of $634 per ounce, demonstrating the strong margins of this high-grade orebody.

Project Economics

At a Reserve gold price assumption of $1,750 per ounce, the Waihi District generates pre-tax and after-tax NPV5% values of $259 million and $138 million respectively, and an IRR of 9.2%.

Using a flat $2,400 per ounce gold price over the life of the operation, the project is estimated to produce pre-tax and after-tax NPV5% values of $902 million and $621 million respectively, and an IRR of 24.0%.

Table 3: PFS economic results

| Description | Units | Reserve Case | $2,400 Case |

| Gold Price | $ per ounce | 1,750 | 2,400 |

| Payable Gold | 000 ounces | 1,593 | 1,593 |

| Life of Mine Free Cash Flow – Pre-Tax | $M | 648 | 1,629 |

| Life of Mine Free Cash Flow – After-Tax | $M | 431 | 1,147 |

| NPV @ 5% – Pre-Tax | $M | 259 | 902 |

| NPV @ 5% – After-Tax | $M | 138 | 621 |

| IRR | % | 9.2 % | 24.0 % |

Capital and Operating Costs

The total non-sustaining capital investment for the Waihi District is estimated to be $556 million, spread over eight years (Table 4) beginning in 2025. Growth capital expenditures include WUG mine development, surface infrastructure, expansion of the process plant and water treatment plant and construction of a new tailings storage facility (“TSF”). WUG is accessed via 6.5 kms of underground development from surface, with two ventilation shafts to be located in the Coromandel Forest Park.

Table 4: Total capital cost summary ($M)

| Description | Non-Sustaining Capex | Sustaining Capex | Total |

| WUG | 357.9 | 62.9 | 420.9 |

| MUG | – | 102.1 | 102.1 |

| Processing and Water Treatment | 92.8 | 8.4 | 101.2 |

| TSFs | 44.4 | 80.5 | 124.9 |

| Other Capital | 60.6 | 16.0 | 76.7 |

| Rehabilitation | – | 71.6 | 71.6 |

| Total | 555.8 | 341.6 | 897.4 |

Total life of mine operating costs are summarized in Table 5.

Table 5: Operating cost summary ($M & $/t)

| Description | $M | $/t Ore Mined |

| UG Mining – MUG | 488.8 | 110.8 |

| UG Mining – WUG | 264.4 | 65.2 |

| Life of Mine | 753.2 | 89.0 |

| $M | $/t Ore Processed | |

| Processing | 222.7 | 26.3 |

| G&A Costs | 191.0 | 22.6 |

| Refining / Freight Costs | 5.6 | 0.7 |

| Other – Carbon Costs and stockpile movements | 28.2 | 3.3 |

| Total Operating Costs | 1,200.8 | 141.8 |

Permitting

The New Zealand government Fast-track Approvals Bill was formally introduced into the New Zealand Parliament on March 7, 2024. It has completed the process of parliamentary sub-committee review and is expected to be enacted by the New Zealand Parliament imminently and become effective in the first quarter of 2025. In October 2024, the New Zealand Government named the Waihi North Project (“WNP”), including WUG, as a listed project that will be eligible to apply for approvals through processes under the Bill once the Bill becomes law.

Key permitting and schedule assumptions included in the PFS are:

- The Bill will be passed and the fast-track process will be open for applications before the end of March 2025;

- The WNP Fast-track application including the supporting Assessment of Environmental Effects (AEE) will be lodged in March 2025; and

- Fast-track approvals to commence construction will be granted to OceanaGold by the end of November 2025.

Early-works construction, including infrastructure at Willows (the main underground portal site), the water treatment plant and services trench, is expected to begin in the second half of 2025 and enables the decline and underground development to commence in late 2026.

Development of WUG and the Waihi North Project generally has the potential to create significant socio-economic contributions for the communities in the Waihi region and for New Zealand. This includes significant in-country investment and a substantial increase in direct and indirect employment opportunities, with the project having the potential to extend operation of the Waihi operation to and beyond 2038. Company tax payments in New Zealand are estimated at $482 million (NZ$790 million) at a $2,400/oz gold price. OceanaGold operates to the highest environmental and social standards which has enabled it to run a successful and responsible mining business in New Zealand for over three decades.

Next Steps

Detailed engineering and design work is ongoing for the services trench, the water treatment plant upgrade, and bulk earthworks for Willows Facilities area (at the WUG underground portal site). The services trench will connect power, water and telecommunications from the existing process plant to the portal site. Geotechnical investigations will continue to enable detailed portal boxcut and waste rock stack design, and the first 1.5 km of decline to the first ventilation shaft. These activities are included in the $40 to $45 million approved capital budget for 2025.

Future drilling programs at Wharekirauponga and Martha target both resource conversion and growth. A broad development and drilling strategy is planned with the objective to both grow and convert Wharekirauponga resources along the EG Vein and parallel hanging wall and footwall veins as well as further test the mineralized T-Stream and Western Veins immediately to the west. The current focus of drilling is the EG Vein and the hanging wall and footwall veins and the continuation and conversion of high-grade mineralization further to the southwest.

Currently ~400,000 ounces of Inferred Mineral Resource at a grade of 9.6 g/t Au have also been defined (as of June 30, 2024) in the central and northern area of the EG Vein Zone available for conversion. Approximately 17,700 metres of drilling is planned and budgeted for Wharekirauponga and Martha in 2025.

About OceanaGold

OceanaGold is a growing intermediate gold and copper producer committed to safely and responsibly maximizing the generation of Free Cash Flow from our operations and delivering strong returns for our shareholders. We have a portfolio of four operating mines: the Haile Gold Mine in the United States of America; Didipio Mine in the Philippines; and the Macraes and Waihi operations in New Zealand. For further information please contact:

Qualified Persons

Except as otherwise set out herein, the scientific and technical information in this press release relating to the Waihi operation was reviewed and approved by, or is prepared by or under the supervision of Euan Leslie, MAusIMM CP, David Townsend, MAusIMM CP and Leroy Crawford-Flett, MAusIMM CP, each of whom is an employee of the Company and a qualified person under NI 43-101. The scientific and technical information in this press release relating to exploration matters was reviewed and approved by, or is prepared by or under the supervision of, Craig Feebrey, MAusIMM, the Company’s Executive Vice President and Chief Exploration Officer and a qualified person under NI 43-101.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE