North Bay Resources Announces Resource Estimate of 474,000 ounces at Fran Gold Project, British Columbia

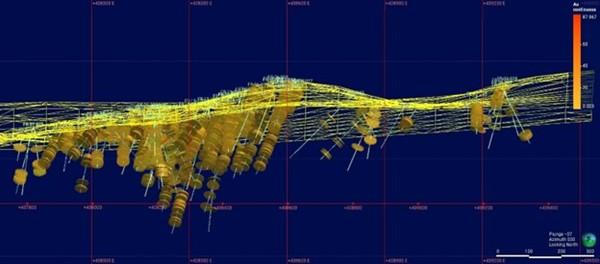

North Bay Resources, Inc. (OTC: NBRI) is pleased to announce a resource estimate (non-NI 43-101) for the Bullion Alley Zone at the Company’s Fran Gold Project. The preliminary resource estimate was completed by the Company using Leapfrog Geo + Edge 3D modelling software and diamond drilling data from 2001, 2005, 2006, 2012, and 2018 totaling 18,000 meters (55,000 feet) in 104 holes utilizing block model, with no cut-off:

Diagram 1. Fran Gold Block Model (Smooth)

| Bullion Alley – Main Zone | |||

| Mass (tonnes) |

Average (g/t) |

Total (grams) |

Total (tr. ounces) |

| 20,035,146 | 0.50 | 10,051,730 | 323,170 |

| Bullion Alley – Main Zone + East Extension | |||

| Mass (tonnes) |

Average (g/t) |

Total (grams) |

Total (tr. ounces) |

| 43,797,234 | 0.34 | 14,743,070 | 474,001 |

|

|

|||

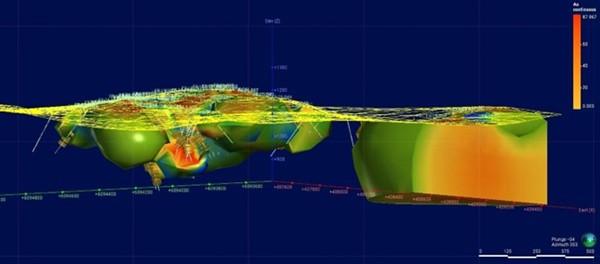

Diagram 2. Fran Gold Au >0.1 g/t cutoff

Recent data compilation has resulted in identification of the following significant drill intercepts.

| Hole ID | From (m) | To (m) | Width (m) | Grade g/t |

| 2001-01 | 46.0 | 234.0 | 188.0 | 0.1 |

| incl. | 102.8 | 127.1 | 24.3 | 0.5 |

| incl. | 220.0 | 234.0 | 14.0 | 0.6 |

| 2001-02 | 39.0 | 214.5 | 175.5 | 0.3 |

| incl. | 44.0 | 91.0 | 47.0 | 0.7 |

| incl. | 179.0 | 214.5 | 35.5 | 0.6 |

| 2001-04 | 66.0 | 180.0 | 114.0 | 0.1 |

| incl. | 75.0 | 95.5 | 20.5 | 0.3 |

| 2001-05 | 76.6 | 129.2 | 52.6 | 0.4 |

| 2001-06 | 19.8 | 74.0 | 54.2 | 0.3 |

| 2001-12 | 52.8 | 154.0 | 101.3 | 0.3 |

| 2002-26 | 40.7 | 82.0 | 41.3 | 1.2 |

| 2002-27 | 44.7 | 172.0 | 127.4 | 0.5 |

| 2002-31 | 167.1 | 185.3 | 18.3 | 0.5 |

| 2002-33 | 39.2 | 186.0 | 146.8 | 0.1 |

| incl. | 53.7 | 80.6 | 26.9 | 0.3 |

| 2002-34 | 16.7 | 195.5 | 178.9 | 0.2 |

| incl. | 154.5 | 195.5 | 41.0 | 0.7 |

| 2002-36 | 88.0 | 235.1 | 147.1 | 0.4 |

| 2002-37 | 118.0 | 229.6 | 111.6 | 0.1 |

| incl. | 118.0 | 133.8 | 15.9 | 0.5 |

| 2006-43 | 153.0 | 193.2 | 40.2 | 0.7 |

| 2006-47 | 35.1 | 81.6 | 46.5 | 1.3 |

| 2006-49 | 104.1 | 119.3 | 15.1 | 2.7 |

| 2006-50A | 44.3 | 118.1 | 73.8 | 0.7 |

| 2006-51 | 66.1 | 85.4 | 19.3 | 0.7 |

| 2006-53 | 79.8 | 92.9 | 13.1 | 1.6 |

| 2006-55 | 27.9 | 100.5 | 72.5 | 1.8 |

| 2006-56 | 90.5 | 116.5 | 26.1 | 1.2 |

| 2006-58 | 61.4 | 157.4 | 96.0 | 0.3 |

| 2006-59 | 21.8 | 74.1 | 52.3 | 0.6 |

| 2006-60 | 90.5 | 131.5 | 41.0 | 0.7 |

| 2006-61 | 9.1 | 58.8 | 49.6 | 0.6 |

| 2006-62 | 79.9 | 150.3 | 70.5 | 0.5 |

| 2007-66 | 72.5 | 102.0 | 29.5 | 0.3 |

| 2007-68 | 127.1 | 147.1 | 20.0 | 0.8 |

| 2007-69 | 171.3 | 197.8 | 26.6 | 0.5 |

| 2007-70 | 131.1 | 246.0 | 114.9 | 0.7 |

| 2007-71 | 32.9 | 116.9 | 84.0 | 0.9 |

| 2007-72 | 78.9 | 106.9 | 28.0 | 0.3 |

| 2007-73 | 180.6 | 194.2 | 13.6 | 0.4 |

| 2007-74 | 111.9 | 269.8 | 157.9 | 0.6 |

| incl. | 111.9 | 188.0 | 76.1 | 1.1 |

| 2007-75 | 49.0 | 124.5 | 75.5 | 0.8 |

| 2007-76 | 133.2 | 169.8 | 36.6 | 0.9 |

| 2018-91 | 249.4 | 296.0 | 46.6 | 0.4 |

| 2018-94 | 222.0 | 339.2 | 117.2 | 0.6 |

| 2018-95 | 202.7 | 309.0 | 106.3 | 1.0 |

| 2018-96 | 134.7 | 284.0 | 149.3 | 0.9 |

| 2018-103 | 105.7 | 178.6 | 72.9 | 1.4 |

*Non-weighted interval length has been used to determine avg. grade

The company continues to compile data in preparation for a NI 43-101 Compliant Mineral Resource Estimate. In particular, the addition of surface trenching data and sampling data for areas that have not been drill tested between the Main and East Zones as well as to the East and North-east where a significant gold in soil anomaly exists and may add to the data set. The deposit remains open in these directions as well as to the South where a parallel vein system exists and most significantly, throughout the main zone, at depth.

Fran Gold Project

The Fran Gold Project is next to Centerra Gold’s Mt. Milligan Project, with Reserves of 264Mt grading 0.3 gram per tonne gold and 0.2% copper and proximate to Artemis Gold’s Blackwater Mine, with Proven and Probable Reserves of 334Mt grading 0.8 grams per tonne gold. Both Mt. Milligan and the Blackwater Mine are two of the largest new mines in North America in the modern era. The Blackwater Mine has a Measured and Indicated Resource in excess of 10M ounces of gold.

Historical exploration and development planning at Fran focused on delineation of mid-high grade veins with an eye to underground mining of these veins. Very limited focus was placed on bulk tonnage and disseminated gold, although discussed in reports from 2006, no follow-up appears to have occurred. North Bay’s recent ongoing focus has been the development of mid-high grade surface material as feedstock for its Bishop Gold Mill. This in turn has led to a re-evaluation of the project potential resulting in what is currently a dual focus with high grade surface material going to the Company’s mill and further evaluation of the larger potential of the mass tonnage gold deposit. Data indicates substantial expansion potential at depth beyond 300m (984 feet) and extensions of the disseminated gold zones to the East and North-East where copper grades begin to rise. Drilling was stopped in these directions due to the loss of the mid-high grade veins that were the focus of historical exploration and these areas remain largely unexplored.

In addition to the bulk gold deposit, the Company continues to develop the project as mid-high grade feedstock for its 100 ton per day Bishop, California gold mill utilizing existing stockpiles and development of the surface oxide zone where trenching has shown consistent grade of 16 grams (0.5 ounces per ton) over 30m (110 feet) in trenches B+C.

Corporate Update

The Company has settled a demand loan totalling $361,951, and has now converted $350,000 of that debt into a 2 year secured debenture at 10% and issued warrant coverage on a dollar for dollar basis at an exercise price of $0.0007 totalling 500,000,000 warrants with a term of 3 years. Any shares issued (as a result of warrant exercise) are subject to a statutory one-year hold from the date of issuance of the debenture. A balance of $11,951 remains as a demand loan at the end of Q1 2025.

The Company has begun work with the Company’s prior auditors for the purpose of returning to SEC reporting status and upon completion may commence the uplisting process.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE