NexGold Infill Drilling Intersects 1.60 g/t Gold Over 36.80 Metres at the Goldboro Gold Project

NexGold Mining Corp. (TSX-V: NEXG) (OTCQX: NXGCF) is pleased to provide an update on its ongoing 25,000-metre diamond drill program initially announced on January 22, 2025 at the Company’s Goldboro Gold Project in Nova Scotia. The drill program is primarily designed to infill specific areas of the open pit Mineral Resource identified to improve geological and grade continuity and potentially upgrade certain areas of Inferred and Indicated Mineral Resources. The drilling is progressing well with two active diamond drills. The drilling is anticipated to be completed at the end of Q2 with final assays flowing in through the middle of Q3.

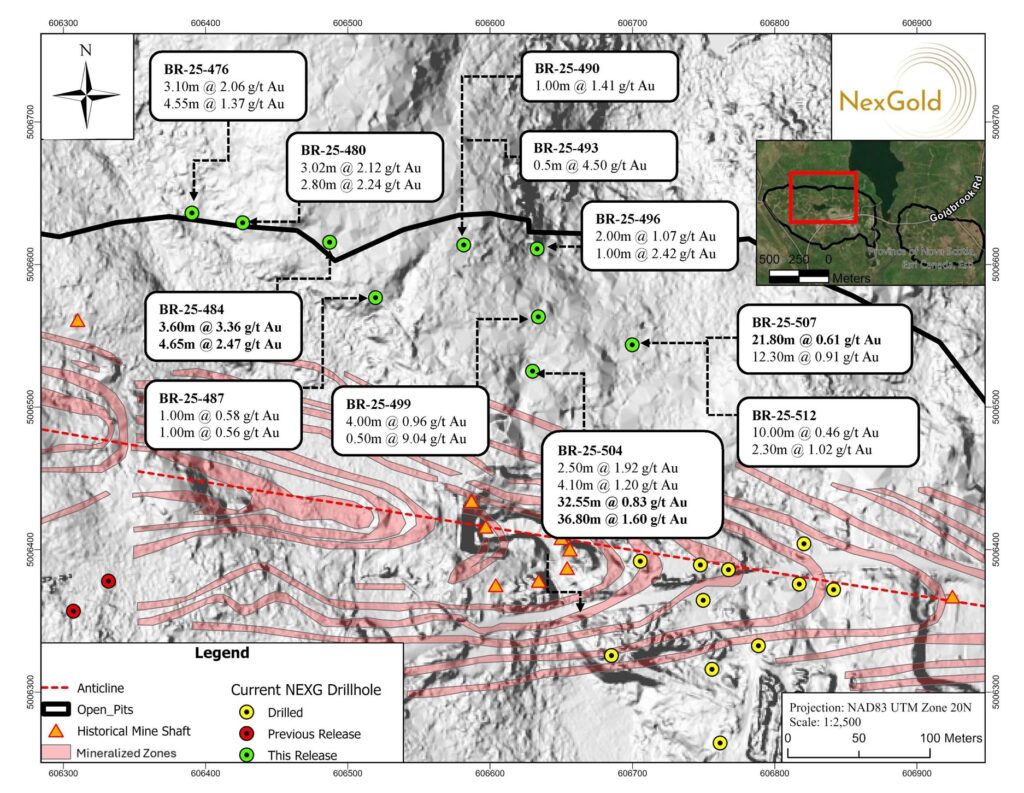

The assay results for an additional 11 infill diamond drill holes (BR-25-476, 480, 484, 487, 490, 493, 496, 499, 504, 507 and 512), totalling 3,063.00 metres, were from drilling in the proposed west pit (Figure 1; Table 1).

Kevin Bullock, President and CEO, stated: “With the 25,000-metre diamond drill program nearly complete and as we continue to receive assay data, we are encouraged by the results and their potential to positively impact the planned Mineral Resource update by providing more confidence through increased data density in certain areas of the deposit and the potential to add more mineralization in previously under-sampled intervals. Populating the Mineral Resource with additional geological and assay data will provide the basis of the planned Feasibility Study update. The Feasibility Study update will be ongoing while we await the final decision on the Nova Scotia Industrial Approval for the Project, having recently received the Notice of Completion regarding the Company’s Industrial Approval application – a significant milestone in the permitting of the Goldboro Gold Project. Both permitting and technical studies are well aligned for timing a construction decision in 2026.”

Selected drill intersections from 11 diamond drill holes in this release include:

- 1.60 g/t gold over 36.80 metres (from 271.20 to 308.0 metres) including 53.57 g/t gold over 0.60 metres in drill hole BR-25-504;

- 0.83 g/t gold over 32.55 metres (from 234.50 to 267.05 metres) including 6.00 g/t gold over 1.60 metres in drill hole BR-25-504;

- 0.61 g/t gold over 21.80 metres (from 209.00 to 230.80 metres), including 6.06 g/t gold over 0.60 metres in drill hole BR-25-507;

- 0.91 g/t gold over 12.30 metres (from 238.60 to 250.90 metres), including 1.42 g/t gold over 7.20 metres in drill hole BR-25-507;

- 2.47 g/t gold over 4.65 metres (from 266.55 to 271.20 metres), including 9.55 g/t gold over 1.00 metre in drill hole BR-25-484; and

- 3.36 g/t gold over 3.60 metres (from 205.40 to 209.00 metres), including 14.70 g/t gold over 0.80 metres in drill hole BR-25-484.

The Company has now released 42 drill holes (approximately 30% of the proposed program) from the infill program. Results from the drill program to date for the drilling conducted in the proposed west pit demonstrate the presence of mineralization that is consistent with previous drill results. In particular, the existing geological model appears to broadly predict the location of gold mineralization with local adjustments to the model where mineralization is either not in the exact positions predicted by the model or if no mineralization is intersected. Significantly, the drill program continues to intersect additional gold mineralization in areas where no mineralization was previously known or predicted. This occurs either in under-drilled areas or near historic drilling which were not thoroughly sampled. Mineralized solids will be adjusted where necessary to account for local variations in the model, and any impact due to additional assay data gathered during the drill program will be investigated during the forthcoming Mineral Resource estimate planned during H2 2025.

Figure 1: Plan map showing the location of the 11 diamond drill holes in this release

Table 1: Locations and orientations for 11 drill holes in this release.

| Drill hole | Easting | Northing | Elevation (m) |

Length (m) |

Azimuth | Inclination |

| BR-25-476 | 606390.4 | 5006636.1 | 66.1 | 284.0 | 180 | -48 |

| BR-25-480 | 606426.1 | 5006629.3 | 68.1 | 301.0 | 180 | -48 |

| BR-25-484 | 606487.2 | 5006615.7 | 69.0 | 308.0 | 180 | -50 |

| BR-25-487 | 606519.5 | 5006576.8 | 66.8 | 235.0 | 180 | -64 |

| BR-25-490 | 606581.5 | 5006613.8 | 67.7 | 226.0 | 180 | -47 |

| BR-25-493 | 606581.5 | 5006613.8 | 67.7 | 241.0 | 180 | -56 |

| BR-25-496 | 606632.9 | 5006611.0 | 60.9 | 278.0 | 180 | -59 |

| BR-25-499 | 606633.8 | 5006563.3 | 62.0 | 311.0 | 180 | -61 |

| BR-25-504 | 606629.7 | 5006525.2 | 61.6 | 308.0 | 180 | -62 |

| BR-25-507 | 606699.8 | 5006543.7 | 64.4 | 302.0 | 177 | -55 |

| BR-25-512 | 606699.8 | 5006543.7 | 64.4 | 269.0 | 177 | -65 |

Notes:

- Drill hole locations reported as Universal Transverse Mercator NAD83 Zone 20 coordinates.

- Some drill hole numbers are missing from the sequence. These drill holes are not reported in this press release since they were drilled in another location and will be reported in a separate release with other contiguous or related drilling information.

- Drill holes BR-25-466 to 475, 479, 498 and 501 were reported in previous press releases dated May 16 and June 5, 2025.

- Drill holes BR-25-477, 478, 481 to 483, 486, 489, 491, 495, 502, 505, 508, 510, 513, 518, 520, 522, and 524 were reported in a previous press release dated June 13, 2025.

Table 2: Highlighted drill intersections from 11 drill holes

| Drill hole | From (m) | To (m) | Length (m) | Au g/t |

| BR-25-476 | 124.00 | 127.10 | 3.10 | 2.06 |

| including | 126.50 | 127.10 | 0.60 | 8.81 |

| and | 181.80 | 182.30 | 0.50 | 0.76 |

| and | 198.00 | 200.60 | 2.60 | 0.75 |

| and | 209.00 | 209.50 | 0.50 | 1.34 |

| and | 237.85 | 242.40 | 4.55 | 1.37 |

| including | 239.00 | 241.40 | 2.40 | 3.40 |

| and | 275.00 | 275.50 | 0.50 | 1.50 |

| BR-25-480 | 128.50 | 129.00 | 0.50 | 2.39 |

| and | 159.70 | 162.70 | 3.00 | 1.33 |

| including | 161.70 | 162.70 | 1.00 | 3.49 |

| and | 223.40 | 226.00 | 2.60 | 0.90 |

| and | 236.50 | 245.40 | 8.90 | 0.23 |

| and | 258.80 | 261.82 | 3.02 | 2.12 |

| including | 259.80 | 260.30 | 0.50 | 7.28 |

| and | 267.82 | 268.82 | 1.00 | 1.14 |

| and | 279.20 | 282.00 | 2.80 | 2.24 |

| including | 281.00 | 282.00 | 1.00 | 4.36 |

| and | 293.34 | 294.70 | 1.36 | 1.25 |

| BR-25-484 | 145.70 | 146.70 | 1.00 | 1.97 |

| and | 201.00 | 202.00 | 1.00 | 2.54 |

| and | 205.40 | 209.00 | 3.60 | 3.36 |

| including | 205.40 | 206.20 | 0.80 | 14.70 |

| and | 246.60 | 247.20 | 0.60 | 1.10 |

| and | 253.00 | 254.65 | 1.65 | 0.59 |

| and | 266.55 | 271.20 | 4.65 | 2.47 |

| including | 269.20 | 270.20 | 1.00 | 9.55 |

| and | 67.00 | 75.00 | 8.00 | 0.62 |

| including | 73.00 | 74.00 | 1.00 | 3.35 |

| BR-25-487 | 90.50 | 91.50 | 1.00 | 0.56 |

| and | 169.60 | 170.60 | 1.00 | 0.58 |

| BR-25-490 | 17.00 | 18.00 | 1.00 | 0.98 |

| and | 26.00 | 27.00 | 1.00 | 1.41 |

| and | 116.50 | 117.00 | 0.50 | 0.59 |

| and | 190.50 | 200.00 | 9.50 | 0.18 |

| BR-25-493 | 199.00 | 199.50 | 0.50 | 4.50 |

| BR-25-496 | 62.00 | 63.00 | 1.00 | 0.90 |

| and | 148.00 | 150.00 | 2.00 | 1.07 |

| and | 233.00 | 234.00 | 1.00 | 2.42 |

| BR-25-499 | 36.50 | 38.00 | 1.50 | 0.54 |

| and | 86.10 | 87.10 | 1.00 | 0.84 |

| and | 115.50 | 119.50 | 4.00 | 0.96 |

| including | 115.50 | 116.00 | 0.50 | 5.72 |

| and | 157.50 | 158.00 | 0.50 | 9.04 |

| and | 171.00 | 172.00 | 1.00 | 3.68 |

| and | 175.80 | 176.30 | 0.50 | 2.10 |

| and | 191.50 | 194.00 | 2.50 | 1.17 |

| and | 279.70 | 285.00 | 5.30 | 0.49 |

| BR-25-504 | 33.40 | 34.10 | 0.70 | 1.98 |

| and | 100.70 | 101.20 | 0.50 | 0.55 |

| and | 110.00 | 112.50 | 2.50 | 1.92 |

| including | 110.00 | 110.50 | 0.50 | 9.33 |

| and | 120.50 | 121.00 | 0.50 | 9.87 |

| and | 138.25 | 139.50 | 1.25 | 1.38 |

| and | 178.60 | 182.70 | 4.10 | 1.20 |

| including | 180.80 | 181.70 | 0.90 | 4.18 |

| and | 198.90 | 199.50 | 0.60 | 1.20 |

| and | 234.50 | 267.05 | 32.55 | 0.83 |

| including | 234.50 | 236.10 | 1.60 | 6.00 |

| and | 271.20 | 308.00 | 36.80 | 1.60 |

| including | 278.00 | 278.60 | 0.60 | 53.57 |

| BR-25-507 | 21.40 | 22.10 | 0.70 | 0.64 |

| and | 54.00 | 54.50 | 0.50 | 0.57 |

| and | 76.80 | 80.00 | 3.20 | 0.43 |

| including | 76.80 | 77.30 | 0.50 | 2.07 |

| and | 86.25 | 87.60 | 1.35 | 1.71 |

| and | 156.50 | 157.00 | 0.50 | 0.62 |

| and | 159.40 | 161.40 | 2.00 | 0.56 |

| and | 173.50 | 174.00 | 0.50 | 2.00 |

| and | 189.80 | 190.30 | 0.50 | 1.06 |

| and | 209.00 | 230.80 | 21.80 | 0.61 |

| including | 219.40 | 220.00 | 0.60 | 6.06 |

| and | 238.60 | 250.90 | 12.30 | 0.91 |

| including | 238.60 | 245.80 | 7.20 | 1.42 |

| and | 264.15 | 268.00 | 3.85 | 0.59 |

| and | 300.50 | 301.00 | 0.50 | 0.72 |

| BR-25-512 | 80.50 | 81.00 | 0.50 | 0.53 |

| and | 181.00 | 191.00 | 10.00 | 0.46 |

| and | 197.00 | 197.50 | 0.50 | 1.73 |

| and | 259.10 | 261.40 | 2.30 | 1.02 |

| and | 265.30 | 266.45 | 1.15 | 1.30 |

Notes:

- Reported intervals are drilled core lengths and do not indicate true widths. True widths are estimated at between 50-100% of core length. For duplicate samples, the original sample assays are used to calculate the intersection grade. All grades are uncapped.

- Some drill hole numbers are missing from the sequence. These drill holes are not reported in this press release since they were drilled in another location and will be reported in a separate release with other contiguous or related drilling information.

- Drill holes BR-25-466 to 475, 479, 498 and 501 were reported in previous press releases dated May 16 and June 5, 2025.

- Drill holes BR-25-477, 478, 481 to 483, 486, 489, 491, 495, 502, 505, 508, 510, 513, 518, 520, 522, and 524 were reported in a previous press release dated June 13, 2025.

Technical Disclosure and Qualified Persons

QA / QC

The Company has implemented a quality assurance and quality control program to ensure sampling and analysis of all exploration work is conducted in accordance with the CIM Exploration Best Practices Guidelines. The NQ diameter drill core is sawn in half with one-half of the core sample dispatched to either Eastern Analytical Ltd. (Eastern) preparation facility in Springdale, Newfoundland and Labrador or the ALS Canada Ltd. (ALS) prep lab in Moncton, NB and then the pulp is sent to North Vancouver, BC for fire assay. The other half of the core is retained for future assay verification and/or metallurgical testing. Analysis for gold was completed by fire assay (30 g) with an AA finish. All assays in this press release are reported as fire assays only.

For samples analyzing greater than 0.5 g/t Au via 30 g fire assay, these samples will be re-analyzed at Eastern via total pulp metallics. For the total pulp metallics analysis, the entire sample is crushed to -10mesh and pulverized to 95% -150mesh. The total sample is then weighed and screened to 150mesh. The +150mesh fraction is fire assayed for Au, and a 30 g subsample of the -150mesh fraction analyzed via fire assay. A weighted average gold grade is calculated for the final reportable gold grade. Total pulp metallics assays for drill holes sited within this press release may be updated in a future news release. Check assays are conducted at Eastern for assay samples received from ALS and check assays are conducted at ALS for assays received from Eastern following the completion of a program.

Other QA/QC procedures include the regular insertion of blanks and CDN Resource Laboratories certified reference standards. The laboratory also has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream for all analysis.

Paul McNeill, P.Geo., VP Exploration of NexGold, is considered a “Qualified Person” for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved the scientific and technical disclosure contained in this news release on behalf of NexGold.

About NexGold Mining Corp.

NexGold Mining Corp. is a gold-focused company with assets in Canada and Alaska. NexGold’s Goliath Gold Complex (which includes the Goliath, Goldlund and Miller deposits) is located in Northwestern Ontario and its Goldboro Gold Project is located in Nova Scotia. NexGold also owns several other projects throughout Canada, including the Weebigee-Sandy Lake Gold Project JV, and grassroots gold exploration property Gold Rock. In addition, NexGold holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska. NexGold is committed to inclusive, informed and meaningful dialogue with regional communities and Indigenous Nations throughout the life of all our Projects and on all aspects, including creating sustainable economic opportunities, providing safe workplaces, enhancing of social value, and promoting community wellbeing.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE