The Prospector News

NevGold Discovers More Significant Oxide Gold-Antimony Results: 2.11 g/t AuEq Over 67.1 Meters (1.30 g/t Au And 0.18% Antimony), Including 4.29 g/t AuEq Over 30.5 Meters (2.79 g/t Au And 0.33% Antimony), and Also Including 7.12 g/t AuEq Over 16.8 Meters (5.05 g/t Au And 0.46% Antimony) at the Limousine Butte Project, Nevada

You have opened a direct link to the current edition PDF

Open PDF CloseNevGold Discovers More Significant Oxide Gold-Antimony Results: 2.11 g/t AuEq Over 67.1 Meters (1.30 g/t Au And 0.18% Antimony), Including 4.29 g/t AuEq Over 30.5 Meters (2.79 g/t Au And 0.33% Antimony), and Also Including 7.12 g/t AuEq Over 16.8 Meters (5.05 g/t Au And 0.46% Antimony) at the Limousine Butte Project, Nevada

NevGold Corp. (TSX-V:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) is pleased to announce that it has discovered further significant oxide gold-antimony drill results at its Limousine Butte Project in Nevada. The Company continues to unlock the substantial gold-antimony potential of the Project, highlighting its promising prospects for further exploration and development in Nevada, one of the world’s prolific mining jurisdictions.

Key Highlights

- Further positive, near-surface, oxide gold-antimony historical drillholes at Resurrection Ridge include:

- LB023: 2.11 g/t AuEq* over 67.1 meters (1.30 g/t Au and 0.18% Sb), including 4.29 g/t AuEq* over 30.5 meters (2.79 g/t Au and 0.33% Sb), and also including 7.12 g/t AuEq* over 16.8 meters (5.05 g/t Au and 0.46% Sb)

- LB029: 1.16 g/t AuEq* over 79.3 meters (0.53 g/t Au and 0.14% Sb), including 1.86 g/t AuEq* over 18.3 meters (0.53 g/t Au and 0.14% Sb)

- *Gold equivalents (“AuEq”) are based on assumed metals prices of US$2,000/oz of gold and US$35,000 per tonne of antimony (~30% discount to current spot prices), and assumed metals recoveries of 85% for gold and 70% for antimony.

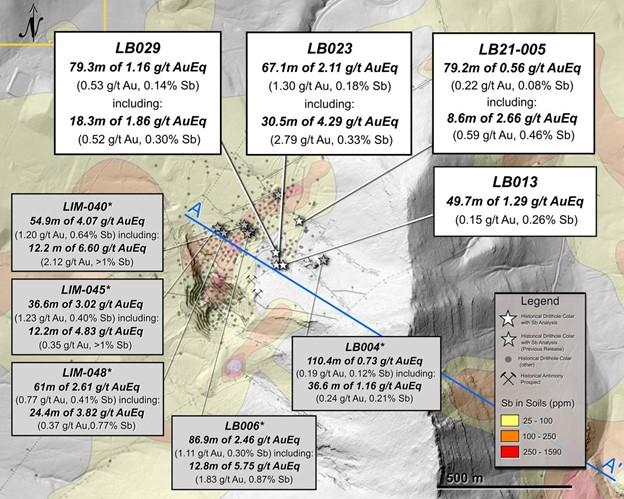

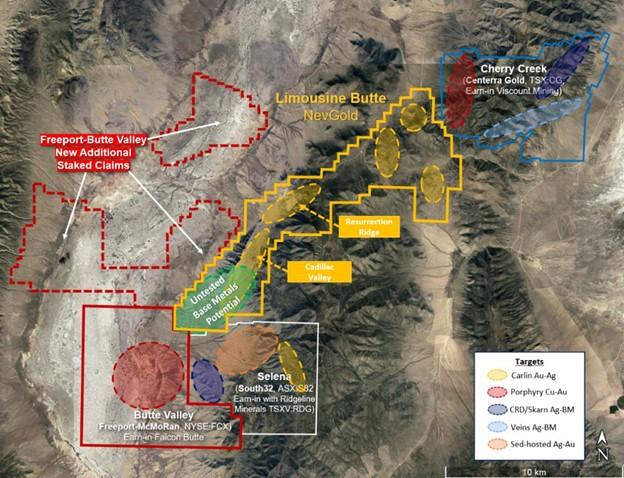

- Drillholes at Resurrection Ridge are drilled with spacing showing strong potential to advance the Project to an initial gold-antimony Mineral Resource Estimate (see Figure 1)

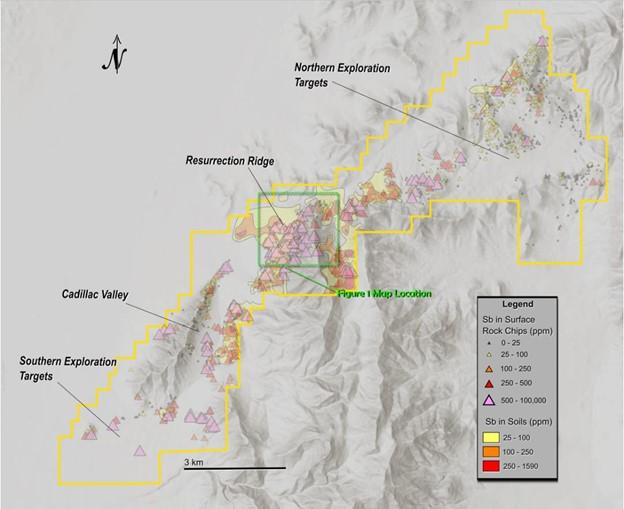

- Resurrection Ridge and Cadillac Valley oxide gold-antimony mineralization footprint demonstrates the significant oxide gold-antimony potential across a large, open mineralized footprint (Figure 1)

- All areas at the Project with gold-antimony potential are permitted and ready to drill under the Limo Butte Plan of Operations (“PoO”) approved in November-2024 (see NevGold News Release from November 27, 2024)

- Significant antimony (Sb) upside: historical drilling had an upper detection limit of 1% Sb but many drill intervals exceeded the limit; these holes are currently being re-assayed at American Assay Lab in Reno, Nevada without the 1% upper detection limit

- NevGold will continue re-evaluating historical drilling from the Project, focusing on both oxide gold and antimony; large portions of the existing database were not analyzed for antimony creating a significant, low-cost opportunity to re-assay historical drilling

Limo Butte Planned 2025 Activities / Status Update

NevGold will continue its active exploration program at Limo Butte including:

- Evaluate the historical geological database with focus on gold and antimony (in progress);

- Re-analyze historical drilling with focus on gold and antimony (in progress);

- Drill test gold-antimony targets (subject to the results of the evaluation);

- Initiate preliminary metallurgical studies (in preparation).

Figure 1 – Limousine Butte Gold-Antimony Project with selected gold-antimony drillhole results.

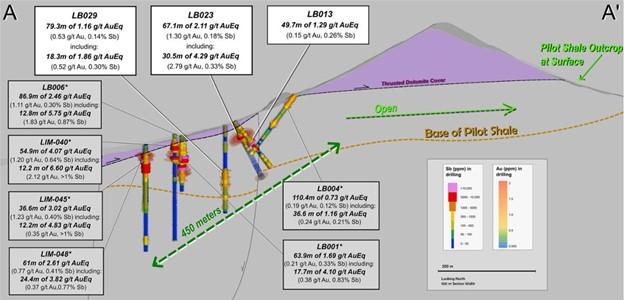

Figure 2 – Limousine Butte Gold-Antimony Project cross-section with selected gold-antimony drillhole results. Thin colored discs show Antimony (Sb ppm) in drilling, and wide colored discs show Gold (Au ppm) in drilling.

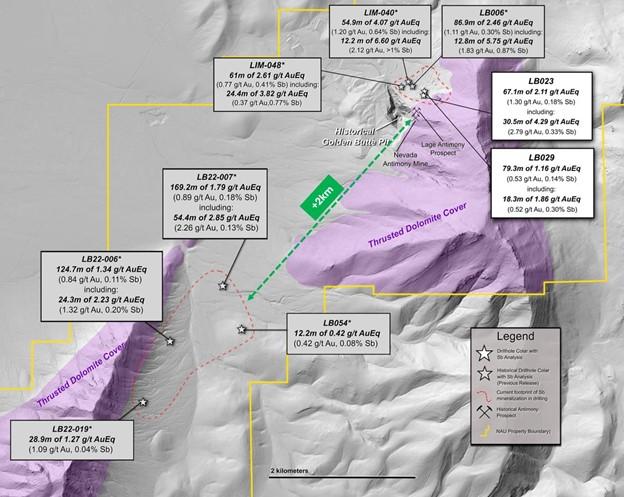

Figure 3 – Limousine Butte Gold-Antimony Project with selected gold-antimony drillhole results.

NevGold CEO, Brandon Bonifacio, comments: “The discovery of more significant oxide gold-antimony drill results at Resurrection Ridge continues to be a key development at our emerging Limo Butte oxide gold-antimony project. Drillholes at Resurrection Ridge have been drilled with spacing showing strong potential to advance the target area to an initial Mineral Resource Estimate. We have now defined two large mineralization footprints at both Resurrection Ridge and Cadillac Valley, and the oxide gold-antimony grades, near-surface mineralization, and hole thickness highlight the significant gold-antimony opportunity at the Project. As we have stated in previous news releases, we continue to analyze and re-assay holes from both Resurrection Ridge and Cadillac Valley and we still have a number of holes to release with combined gold-antimony results. To date, we have released a total of 15 holes, and we will have frequent updates as we receive further assays from the lab. The timing and market conditions continue to improve, and this is an optimal environment to advance the gold-antimony potential at Limo Butte as there is a clear commitment from the United States to advance high-quality, domestic, mineral projects.”

Historical and Re-Assayed Drill Results

| Hole ID | Length, m* | g/t Au | % Sb | g/t AuEq** | From, m | To, m |

| Resurrection Ridge | ||||||

| LB023 | 67.1 | 1.30 | 0.18% | 2.11 | 24.4 | 91.5 |

| including | 30.5 | 2.79 | 0.33% | 4.29 | 30.5 | 61.0 |

| also including | 16.8 | 5.05 | 0.46% | 7.12 | 42.7 | 59.4 |

| LB029 | 79.3 | 0.53 | 0.14% | 1.16 | 122.0 | 201.2 |

| including | 18.3 | 0.52 | 0.30% | 1.86 | 128.0 | 146.3 |

| LB013 | 49.7 | 0.15 | 0.26% | 1.29 | 30.8 | 80.5 |

| LB21-005 | 79.2 | 0.22 | 0.08% | 0.56 | 64.5 | 143.7 |

| including | 8.6 | 0.59 | 0.46% | 2.66 | 65.5 | 74.1 |

| LB006*** | 86.9 | 1.11 | 0.30% | 2.46 | 36.6 | 123.4 |

| including | 12.8 | 1.83 | 0.87% | 5.75 | 79.2 | 92.0 |

| also including | 6.7 | 2.29 | +1%**** | 6.77 | 85.3 | 92.0 |

| LB001*** | 63.9 | 0.21 | 0.33% | 1.69 | 13.1 | 77.0 |

| including | 17.7 | 0.38 | 0.83% | 4.10 | 55.2 | 72.8 |

| also including | 6.4 | 0.16 | +1%**** | 4.64 | 55.2 | 61.6 |

| LB003*** | 22.3 | 2.26 | 0.32% | 3.69 | 67.1 | 89.3 |

| including | 7.9 | 5.97 | 0.57% | 8.55 | 81.4 | 89.3 |

| LB004*** | 110.4 | 0.19 | 0.12% | 0.73 | 0.0 | 110.4 |

| including | 36.6 | 0.24 | 0.21% | 1.16 | 6.7 | 43.3 |

| LIM-40*** | 54.9 | 1.20 | 0.64% | 4.07 | 18.3 | 73.2 |

| including | 12.2 | 2.12 | +1%**** | 6.60 | 48.8 | 61.0 |

| LIM-45*** | 36.6 | 1.23 | 0.40% | 3.02 | 24.4 | 61.0 |

| including | 12.2 | 0.35 | +1%**** | 4.83 | 36.6 | 48.8 |

| LIM-48*** | 61.0 | 0.77 | 0.41% | 2.61 | 24.4 | 85.4 |

| including | 24.4 | 0.37 | 0.77% | 3.82 | 48.8 | 73.2 |

| Hole ID | Length, m* | g/t Au | % Sb | g/t AuEq** | From, m | To, m |

| Cadillac Valley | ||||||

| LB22-007*** | 169.2 | 0.89 | 0.18% | 1.70 | 213.5 | 382.7 |

| including | 54.4 | 2.26 | 0.13% | 2.85 | 213.5 | 267.9 |

| also including | 3.10 | 0.76 | 2.76% | 13.15 | 259.2 | 267.9 |

| LB22-006*** | 124.7 | 0.84 | 0.11% | 1.34 | 127.4 | 252.1 |

| including | 24.3 | 1.32 | 0.20% | 2.23 | 160.6 | 184.9 |

| LB22-019*** | 28.9 | 1.09 | 0.04% | 1.27 | 170.7 | 199.6 |

| LB054*** | 12.2 | 0.42 | 0.08% | 0.79 | 12.2 | 24.4 |

*Downhole thickness reported; true width varies depending on drill hole dip and is approximately 70% to 90% of downhole thickness.

**The gold equivalents (“AuEq”) are based on assumed metals prices of US$2,000/oz of gold and US$35,000 per tonne of antimony (~30% discount to current spot prices), and assumed metals recoveries of 85% for gold and 70% for antimony.

***Selected drillholes released in previous News Releases on February 27, 2025, March 26, 2025, and April 10, 2025.

**** Historical drilling had an upper detection limit of 1% Sb but many drill intervals exceeded the limit.

Limo Butte Geology & Antimony Potential

A review of historical geochemical and drilling data at the Limousine Butte Project has identified multiple areas with strong gold-antimony potential. These zones correlate closely with outcrops of the Devonian Pilot Shale, the primary host rock for Carlin-type gold mineralization in the area. Positive gold grade at Limousine Butte is typically associated with silicification and the formation of jasperoid breccias within the Pilot Shale, an alteration feature also observed in the positive antimony results.

Through the Project data review, the Company uncovered reports detailing two small-scale historic mining operations at the Nevada Antimony Mine and Lage Antimony Prospect within the Limo Butte Project boundary. The Nevada Antimony Mine featured two prospect pits that extracted stibnite (formula: Sb2S3) from a hydrothermal breccia. The Lage Antimony Prospect reported historical unverified sampling results with up to 14.46% Antimony with additional prospect pits extracting antimony.

Historical geochemical rock chip sampling within the past-producing Golden Butte pit from a Brigham Young University Thesis study produced numerous results that exceeded 1% antimony in jasperoid breccias (see Figure 1). Several results were greater then 5% antimony, including a sample of 9.6% antimony with visible stibnite and stibiconite. BYU Thesis Report

NevGold VP Exploration, Greg French, comments: “The re-assay program continues to produce positive gold-antimony results. The gold-antimony mineralization in the northwest-southeast direction at Resurrection Ridge extends approximately 500 meters (Figure 2) and remains open to the east. Previous geological models have interpreted the dolomite cover to be the base unit that is below mineralization. Re-logging drill holes and the outcroppings to the east indicate that the dolomite cover is actually a thrust plate over the host Pilot Shale unit, expanding the prospective target area. We have currently defined over 5 km of strike length between Resurrection Ridge and Cadillac Valley, and we will continue to analyze the data from both of these target areas to incorporate results in the planning for the next drill program and metallurgical test work.”

Figure 4 – Limousine Butte Project with historical antimony in rock chips and soils. The total strike length between Resurrection Ridge and Cadillac Valley is +5km.

US Executive Order – Announced March 20, 2025

The Company is pleased to report the recent, sweeping Executive Order to strengthen American mineral production and reduce U.S. reliance on foreign nations for its mineral supply. Antimony (Sb) has been identified as an important “Critical Mineral” in the United States essential for national security, clean energy, and technology applications, yet no domestically mined supply currently exists.

The Executive Order invokes the use of the Defense Production Act as part of a broad United States Government effort to expand domestic minerals production on national security grounds. As it relates to project permitting, the Order states that it will “identify priority projects that can be immediately approved or for which permits can be immediately issued, and take all necessary or appropriate actions…to expedite and issue the relevant permits or approvals.” Furthermore, the Order includes provisions to accelerate access to private and public capital for domestic projects, including the creation of a “dedicated mineral and mineral production fund for domestic investments” under the Development Finance Corporation.

This decisive action by the US Government highlights the urgent need to expand domestic minerals output to support supply chain security in the United States. This important Order will help revitalize domestic mineral production by improving the permitting process and providing financial support to qualifying domestic projects.

Importance of Antimony

Antimony is considered a “Critical Mineral” by the United States based on the U.S. Geological Survey’s 2022 list (U.S.G.S. (2022)). “Critical Minerals” are metals and non-metals essential to the economy and national security. Antimony is utilized in all manners of military applications, including the manufacturing of armor piercing bullets, night vision goggles, infrared sensors, precision optics, laser sighting, explosive formulations, hardened lead for bullets and shrapnel, ammunition primers, tracer ammunition, nuclear weapons and production, tritium production, flares, military clothing, and communication equipment. Other uses include technology (semi-conductors, circuit boards, electric switches, fluorescent lighting, high quality clear glass and lithium-ion batteries) and clean-energy storage.

Globally, approximately 90% of the world’s current antimony supply is produced by China, Russia, and Tajikistan. Beginning on September 15, 2024, China, which is responsible for nearly half of all global mined antimony output and dominates global refinement and processing, announced that it will restrict antimony exports. In December-2024, China explicitly restricted antimony exports to the United States citing its dual military and civilian uses, which further exacerbated global supply chain concerns. (Lv, A. and Munroe, T. (2024)) The U.S. Department of Defense (“DOD”) has designated antimony as a “Critical Mineral” due to its importance in national security, and governments are now prioritizing domestic production to mitigate supply chain disruptions. Projects exploring antimony sources in North America play a key role in addressing these challenges.

Perpetua Resources Corp. (NASDAQ:PPTA) (TSX:PPTA) has the most advanced domestic gold-antimony project in the United States. Perpetua’s project, known as Stibnite, is located in Idaho approximately 130 km northeast of NevGold’s Nutmeg Mountain and Zeus projects. Positive advancements at Stibnite including the technical development and permitting has led to US$75 million in Department of Defense awards, and over $1.8 billion in indicative financing from the Export Import Bank of the United States (see Perpetua Resources News Release from April 8, 2024) (Perpetua Resources. (2025))

Drillhole Orientation Details

| Hole ID | Target Zone | Easting | Northing | Elevation (m) | Length (m) | Azimuth | Dip |

| LB023 | Resurrection Ridge | 667143 | 4417273 | 2174 | 187 | 70 | -60 |

| LB029 | Resurrection Ridge | 667128 | 4417307 | 2162 | 237.7 | 0 | -90 |

| LB013 | Resurrection Ridge | 667142 | 4417273 | 2177 | 164.7 | 90 | -50 |

| LB21-005 | Resurrection Ridge | 667279 | 4417487 | 2179 | 253.8 | 0 | -90 |

| LB006 | Resurrection Ridge | 667030 | 4417384 | 2125 | 152.7 | 0 | -90 |

| LB001 | Resurrection Ridge | 667036 | 4417384 | 2125 | 77 | 0 | -90 |

| LB003 | Resurrection Ridge | 667134 | 4417528 | 2133 | 129.4 | 0 | -90 |

| LB004 | Resurrection Ridge | 667313 | 4417277 | 2239 | 198.7 | 270 | -50 |

| LIM-40 | Resurrection Ridge | 667018 | 4417409 | 2124 | 289.6 | 0 | -90 |

| LIM-45 | Resurrection Ridge | 666929 | 4417389 | 2103 | 179.8 | 0 | -90 |

| LIM-48 | Resurrection Ridge | 666927 | 4417374 | 2105 | 286.5 | 0 | -90 |

| LB22-007 | Cadillac Valley | 665211 | 4415453 | 2031 | 403.5 | 254 | -86 |

| LB22-006 | Cadillac Valley | 664692 | 4414921 | 2042 | 379.8 | 144 | -77 |

| LB22-019 | Cadillac Valley | 664433 | 4414318 | 2096 | 335.3 | 116 | -66 |

| LB054 | Cadillac Valley | 665323 | 4415090 | 2059 | 157.0 | 0 | -90 |

Figure 4 – Limousine Butte Land Holdings and District Exploration Activity

Historical Data Validation

NevGold QA/QC protocols are followed on the Project and include insertion of duplicate, blank and standard samples in all drill holes. A 30g gold fire assay and multi-elemental analysis ICP-OES method was completed by ISO 17025 certified American Assay Labs, Reno.

The Company’s Qualified Person, Greg French, Vice President, Exploration has completed a review of the historical data in this press release. The historic data collection chain of custody procedures and analytical results by previous operators appear adequate and were completed to industry standard practices. For the Newmont and US Gold data a 30g gold fire assay and multi-elemental analysis ICP-OES method MS-41 was completed by ISO 17025 certified ALS Chemex, Reno or Elko Nevada.

Geochemical ICP (5g) analysis for the Wilson, Christianson and Tingey report was completed by Geochemical Services Inc. and the XRF analyses (glass disk or pellets) by Brigham Young University.

Technical information contained in this news release has been reviewed and approved by Greg French, CPG, the Company’s Vice President, Exploration, who is NevGold’s Qualified Person under National Instrument 43-101 and responsible for technical matters of this release.

About the Company

NevGold is an exploration and development company targeting large-scale mineral systems in the proven districts of Nevada and Idaho. NevGold owns a 100% interest in the Limousine Butte and Cedar Wash gold projects in Nevada, and the Nutmeg Mountain gold project and Zeus copper project in Idaho.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE