NEVADA KING INTERCEPTS 2.31 G/T AU OVER 71.7M IN OXIDE MINERALIZATION 200M NORTH OF THE ATLANTA PIT

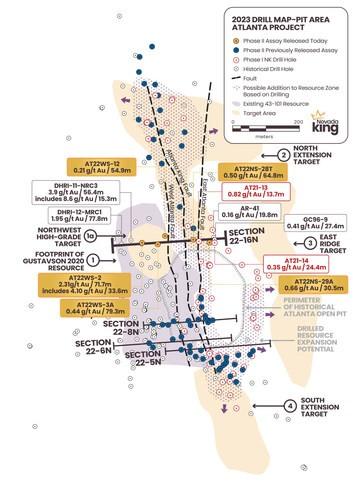

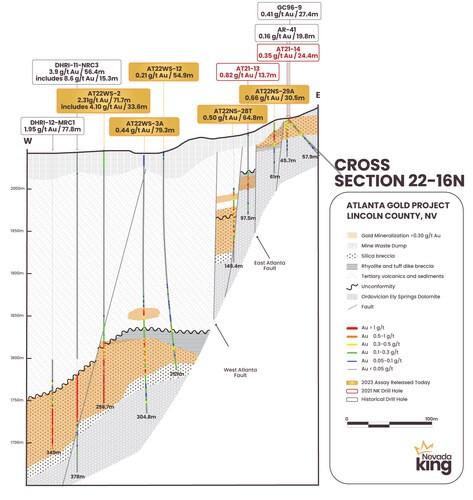

Nevada King Gold Corp. (TSX-V: NKG) (OTCQX: NKGFF) is pleased to announce assay results from four reverse circulation holes and one core hole recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. These holes were drilled 200m north of the Atlanta pit on Section 22-16N (Figure 1) and cut across the high-grade feeder zone that includes a network of structures comprising the Atlanta Mine Fault Zone. The Company has incorporated these new results to produce an updated interpretation on cross section of this part of the AMFZ (Figure 2).

Highlights:

| Hole No | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Notes |

| AT22WS-2 | 227.1 | 298.8 | 71.7 | 2.31 | 5.8 | Bottomed in mineralization |

| includes | 265.2 | 298.8 | 33.6 | 4.10 | 10.2 | Bottomed in mineralization |

| AT22NS-28T* | 65.5 | 130.3 | 64.8 | 0.50 | 9.2 |

Table 1: Highlight hole intervals released today

| Mineralization occurs along sub-horizontal horizons generally dipping gently westward, and true mineralized thickness in vertical holes is between 85% and 95% of reported drill intercept length. *Denotes core hole. |

- Hole AT22WS-2 (2.31 g/t Au over 71.7m) was drilled in the Northwest

- Target Zone, 32m eastward from historical hole DHRI-11-NRC3 (3.90 g/t Au over 56.4m). The Northwest Target Zone was initially identified by Meadow Bay in 2011 with hole DHRI-11-NRC3, but most of their subsequent holes stepped out westward and southward from this initial discovery hole and failed to go deep enough to fully penetrate mineralization.

- Nevada King started its drilling in the Northwest Target Zone in late 2022 with the objective of defining mineralization eastward from DHRI-11-NR3 moving toward the AMFZ and eventually southeastward into the main Gustavson 2020 resource envelope. Today’s holes released along Section 22-16 do indeed confirm that gold mineralization connects eastward into the AMFZ and presents an impressive 215m wide and 55-80m thick mineralized zone that remains wide open to the west and at depth, with averaged intercept gold grades ranging from 0.21 g/t to 3.9 g/t Au.

- Several of the holes released today and nearby historic holes bottomed in mineralization. Step-out drilling is currently underway along this section line and on parallel fences aligned along a north-south axis aimed at expanding the drill defined mineralized envelope laterally and to depth.

Cal Herron, Exploration Manager of Nevada King, stated, “Meadow Bay made a significant high-grade discovery with its 2011 and 2012 drilling of the Northwest Target Zone. Advancing where they left off, Section 22-16N confirms connection of gold mineralization from the Meadow Bay intervals eastward to the AMFZ. Nevada King’s fence drilling across the southern end of the Atlanta Mine Fault Zone along sections 22-5N (January 12, 2023), 22-6N (January 6, 2023), and 22-8N (February 1, 2023) demonstrate the importance of the AMFZ with respect to controlling thick zones of mineralization within the volcanic section west of the fault, as well as higher-grade mineralization on both sides of the fault. Follow-up drilling will allow for a better understanding of both the structural geometry and distribution of higher-grade mineralization, as well as defining the bottom to the mineralization. Drilling has been active on adjacent parallel sections and new results are anticipated shortly, which will allow us to further refine our modeling of grade distribution in the Northwest Target Zone.

“Looking back at the drilling done from our start in May 2021 to today, the one characteristic that remains constant from hole to hole throughout the entire system is the consistent and contiguous nature of the gold mineralization seen in drill intervals. Grade distribution is generally even and does not fluctuate greatly from sample to sample in the drill intervals. Even with the high-grade intervals, gold values increase and decrease in a steady and even manner. In my experience, this type of grade consistency is generally the hallmark of a strong and well-developed gold system. As it stands right now, we do not know how deep the gold mineralization extends at Atlanta nor do we know what the lateral boundaries of gold mineralization are. Knowing we are drilling into a strong gold system without knowing what the lateral and vertical limits on the system are, we can only imagine what is possible at Atlanta as we move into this 2023 exploration season.”

| Hole No | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Notes |

| AT22WS-3A | 179.9 | 259.1 | 79.3 | 0.44 | 3.8 | |

| AT22WS-12 | 204.2 | 259.1 | 54.9 | 0.21 | 1.2 | Bottomed in mineralization |

| AT22NS-28T* | 65.5 | 130.3 | 64.8 | 0.50 | 9.2 | |

| AT22WS-2 | 227.1 | 298.8 | 71.7 | 2.31 | 5.8 | Bottomed in mineralization |

| Includes | 265.2 | 298.8 | 33.6 | 4.10 | 10.2 | Bottomed in mineralization |

| AT22NS-29A | 1.5 | 32.0 | 30.5 | 0.66 | 14.0 | |

| Table 2: All holes released today along Section22-016N. Mineralization occurs along sub-horizontal horizons generally dipping gently westward, and true mineralized thickness in vertical holes is between 85% and 95% of reported drill intercept length. *Denotes core hole. |

||||||

| Hole No | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

| AT21-13 | 53.4 | 67.1 | 13.7 | 0.82 | 3.8 |

| AT21-14 | 0.0 | 24.4 | 24.4 | 0.35 | 38.4 |

| DHRI-11-NRC03 | 263.7 | 320.1 | 56.4 | 3.9 | 20.9 |

| includes | 265.2 | 280.5 | 15.3 | 8.6 | 13.22 |

| DHRI-12-MRC1^ | 271.3 | 349.1 | 77.8 | 1.95 | 6.49 |

| GC96-09 | 0 | 27.4 | 27.4 | 0.41 | 2.35 |

| AR-41 | 0 | 19.8 | 19.8 | 0.16 | 21.7 |

| Table 3: Historical holes used in Section 22-16N. AT21 series holes were drilled by Nevada King in 2021. DHRI series holes were drilled by Meadow Bay in 2011 and 2012. GC series hole was drilled by Golden Chief in 1996. AR series holes were drilled by Goldfields in 1990. Mineralization occurs along sub-horizontal horizons generally dipping gently westward, and true mineralized thickness in vertical holes is between 85% and 95% of reported drill intercept length. ^Denotes hole that bottomed in mineralization. |

|||||

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Company is well funded with cash of approximately $9.3 million as of February 2023.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

NI 43-101 Mineral Resources at the Atlanta Mine

| Resource

Category |

Tonnes

(000’s) |

Au Grade

(ppm) |

Contained Au Oz |

Ag Grade

(ppm) |

Contained Ag Oz |

| Measured | 4,130 | 1.51 | 200,000 | 14.0 | 1,860,000 |

| Indicated | 6,910 | 1.17 | 260,000 | 10.6 | 2,360,000 |

| Measured + Indicated | 11,000 | 1.30 | 460,000 | 11.9 | 4,220,000 |

| Inferred | 5,310 | 0.83 | 142,000 | 7.3 | 1,240,000 |

Figure 1. Location map for holes reported in this news release along drill section 22-16N relative to the perimeter of the historical Atlanta Pit and footprint of the Gustavson 2020 NI 43-101 resource. Shallow drillholes on the mine dumps have been removed from the plot for clarity. (CNW Group/Nevada King Gold Corp.)

Figure 2. Cross section 22-16N looking north across the central portion of the Atlanta Mine Fault Zone. Shallow intrusive activity and closely associated gold mineralization are localized within the volcanic and sedimentary sequence along the western side of the West Atlanta Fault. Higher grade mineralization is concentrated within narrow fault blocks formed adjacent to the East Atlanta Fault and east of the West Atlanta Fault. (CNW Group/Nevada King Gold Corp.)

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE