NEVADA KING ANNOUNCES SIGNIFICANT SILVER INTERCEPTS FROM ITS 2021 ATLANTA DRILL PROGRAM

Nevada King Gold Corp. (TSX-V: NKG) (OTCQX: NKGFF) is pleased to announce silver assays from 31 holes drilled during its inaugural Phase I, 2021 drill program at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. These 2021 series holes were initially assayed only for gold while assays for silver and multi-elements were performed on an intermittent basis. However, after the silver assays were received and a detailed review of the drill core was completed, the presence of silver mineralization was wider spread than initially thought. Consequently, the Company has decided to assay all drill samples for gold, silver and multi-elements going forward. Highlights from the silver assaying of the 2021 drill holes are provided below.

Highlights:

| Hole No. | From

(m) |

To

(m) |

Interval

(m) |

Ag

(g/t) |

From

(m) |

To

(m) |

Interval

(m) |

Au

(g/t) |

| Significant Silver Assays | Associated Gold Assays | |||||||

| AT21-14 | 0 | 25.9 | 24.4* | 36.3 | 0 | 24.4 | 24.4 | 0.35 |

| Including | 15.2 | 24.4 | 7.6* | 59.4 | ||||

| AT21-15 | 24.4 | 53.3 | 22.9* | 32.3 | 24.4 | 42.7 | 9 | 0.67 |

| Including | 25.9 | 29.0 | 3.05 | 82.2 | ||||

| And Including | 45.7 | 50.3 | 4.6 | 54.7 | ||||

| AT21-18A | 0 | 50.3 | 45.7* | 55.5 | 16.8 | 42.7 | 29 | 1.10 |

| Including | 4.6 | 42.7 | 38.1 | 65.8 | ||||

| Including | 13.7 | 38.1 | 24.4 | 86.9 | ||||

| AT21-41A | 33.5 | 62.5 | 29.0 | 27.3 | 38.1 | 61.0 | 22.9 | 2.17 |

| Including | 42.7 | 54.9 | 12.2 | 52.9 | ||||

| AT21-50 | 48.8 | 79.2 | 30.5 | 54.1 | 48.8 | 79.3 | 30.5 | 1.39 |

| Including | 53.3 | 73.2 | 19.8 | 75.3 | ||||

| AT21-62 | 9.1 | 68.6 | 59.4 | 27.3 | 9.1 | 64.0 | 54.9 | 5.34 |

| Including | 15.2 | 18.3 | 3.0 | 33.1 | 30.5 | 41.2 | 10.7 | 11.19 |

| And Including | 22.9 | 25.9 | 3.0 | 48.4 | ||||

| And Including | 44.2 | 61.0 | 16.8 | 49.6 | ||||

| AT21-63 | 0 | 48.8 | 47.2* | 23.9 | 7.6 | 48.8 | 41.2 | 3.94 |

| Including | 15.2 | 48.8 | 33.5 | 30.5 | 38.1 | 47.3 | 9.1 | 9.23 |

| AT21-64 | 0 | 67.1 | 67.1 | 27.0 | 3.0 | 67.1 | 64.1 | 3.35 |

| AT21-65 | 0 | 53.3 | 53.3 | 35.7 | 3.0 | 51.8 | 48.8 | 2.32 |

| Including | 6.1 | 39.6 | 33.5 | 50.0 | ||||

| AT21-66 | 1.5 | 57.9 | 56.3 | 32.2 | 3.0 | 57.9 | 54.9 | 2.62 |

| Including | 39.6 | 56.4 | 16.8 | 55.1 | 51.8 | 54.9 | 3 | 13.35 |

| Table 1: Highlight intervals of silver assays released today from 2021 drill holes. Utilizing a 5 g/t Ag cutoff, the assay intervals are reported in two formats: (1) if all samples exceed 5 g/t, the total drill interval is averaged, and (2) if a string of samples within the drill interval assay below the cutoff value, the groups of samples exceeding 5 g/t are averaged and reported as an aggregate assay interval within the longer drill interval. *Denotes aggregate assay interval. |

||||||||

- Atlanta historically produced approximately 110,000 ounces of gold and 800,000 ounces of silver from 1,500,000 tons between 1975 and 19851 with a recoverable silver grade of about 17 g/t. Geologically, most of the higher grade portions of silver were mined around the East Atlanta Fault and immediately to the east of this fault.

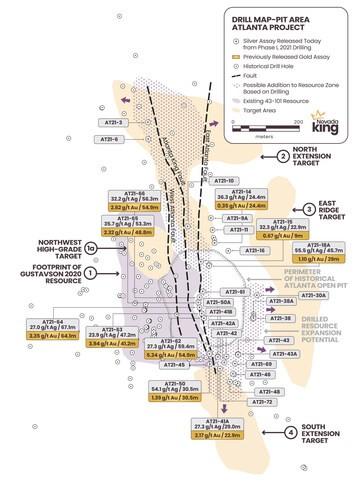

- Almost all of Nevada King’s 2021 holes were drilled east of the East Atlanta Fault within lower grade extensions of the historically mined deposit and also peripheral to the Gustavson 2020 resource model. The 31 holes listed in Table 2 and shown in Figure 1 were drilled immediately adjacent to the mined-out area, and an overall average of the entire mineralized hole lengths yields 21 g/t Ag based on length-weighted averaging according to the formula: average Ag grade = (SUM (intercept average x intercept length))/total intercept length of the 31 holes. Because this average is not based on a block calculation the Company can use the information only qualitatively for a general idea of silver grade within the silica breccia horizon east of the Atlanta Mine Fault Zone.

- While initial 2021 Nevada King drilling was designed to investigate potential for an eastward extension of the Gustavson 2020 pit-constrained gold resource, the discovery of high-grade gold hits in holes AT21-062 through AT21-065 at the bottom of the pit in late 2021 re-focused the Company’s attention further westward on the AMFZ going into the 2022 drilling season. Drill access to the three strands comprising this fault zone was finally achieved in late 2022 and initial assays show significantly higher silver grades within the AMFZ between the East Atlanta Fault and West Atlanta Fault compared to the areas drilled in 2021 east of the East Atlanta Fault (see January 6, 2023, and January 12, 2023, releases). It is important to bear in mind that this 100-150m wide structural zone was largely untouched by historical mining, with only minor production occurring along the East Atlanta Fault.

| ______________________________ |

| 1 NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates |

Cal Herron, Exploration Manager of Nevada King, commented: “Silver is rapidly gaining more luster as we systematically drill across and along the AMFZ. Silver mineralization to date is strongest within the silica breccia zone developed on top of massive dolomite and quartzite, while the highest grades occur proximal to high-angle faults cutting the silica breccia between the East Atlanta Fault and West Atlanta Fault. The Gustavson 2020 pit-constrained resource model calculated an average silver grade of 11g/t in the M+I category. Results from the recent drilling clearly show strong correlation of higher silver grade with the silica breccia horizon and grades are substantially higher than those reported in the Gustavson 2020 pit-constrained resource model. This bodes well for future drilling that will focus on intersecting these horizons west of the West Atlanta Fault. We now see the need for deeper holes west of the West Atlanta Fault, and as more assays come in we will gain a much better picture of the silver distribution and potential for boosting the overall resource grade.”

| Hole No. | From (m) |

To (m) |

Interval (m) |

Ag (g/t) |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

| Silver Assays | Gold Assays | |||||||

| AT21-3 | 155.5 | 179.8 | 24.4 | 8.75 | 94.5 | 131.1 | 25.9 | 1.00 |

| Including | 158.5 | 169.2 | 10.7 | 17.3 | ||||

| AT21-6 | 169.2 | 182.9 | 11.9* | 13.9 | 163.1 | 175.3 | 12.2 | 0.96 |

| Including | 169.2 | 182.9 | 10.7* | 13.9 | ||||

| AT21-9A | 0 | 44.2 | 21.3* | 9.41 | 32 | 51.2 | 6.1 | 0.37 |

| Including | 25.9 | 44.2 | 7.62* | 19.0 | ||||

| AT21-10 | 0 | 12.2 | 12.2 | 17.2 | 13.7 | 15.2 | 1.5 | 0.98 |

| Including | 1.5 | 9.1 | 7.6 | 23.6 | ||||

| AT21-11 | 0 | 33.5 | 16.8* | 12.1 | 0 | 19.8 | 10.7 | 0.97 |

| Including | 0 | 12.2 | 12.2 | 18.2 | ||||

| AT21-014 | 0 | 25.9 | 24.4* | 36.3 | 0 | 24.4 | 24.4 | 0.35 |

| Including | 15.2 | 24.4 | 7.6* | 59.4 | ||||

| AT21-015 | 24.4 | 53.3 | 22.9* | 32.3 | 24.4 | 42.7 | 9 | 0.67 |

| Including | 25.9 | 29.0 | 3.05 | 82.2 | ||||

| And Including | 45.7 | 50.3 | 4.6 | 54.7 | ||||

| AT21-016 | 0 | 29.0 | 18.3* | 5.37 | 1.5 | 7.6 | 6.1 | 0.44 |

| AT21-018A | 0 | 50.3 | 45.7* | 55.5 | 16.8 | 42.7 | 29 | 1.10 |

| Including | 4.6 | 42.7 | 38.1 | 65.8 | ||||

| Including | 13.7 | 38.1 | 24.4 | 86.9 | ||||

| AT21-030A | 0 | 16.8 | 13.7* | 13.4 | 9.1 | 91.5 | 21.3 | 0.72 |

| And | 65.5 | 94.5 | 22.9* | 7.95 | ||||

| AT21-038 | 0 | 35.1 | 35.1 | 15.8 | 0.0 | 32.0 | 32 | 0.59 |

| AT21-038A | 0 | 38.1 | 38.1 | 10.6 | 0.0 | 36.6 | 36.6 | 0.65 |

| Including | 0 | 12.2 | 12.2 | 18.2 | ||||

| AT21-41A | 33.5 | 62.5 | 29.0 | 27.3 | 38.1 | 61.0 | 22.9 | 2.17 |

| Including | 42.7 | 54.9 | 12.2 | 52.9 | ||||

| AT21-41B | 32.0 | 73.2 | 32.0* | 10.4 | 38.1 | 73.2 | 35 | 1.17 |

| Including | 59.4 | 67.1 | 7.6 | 24.5 | ||||

| AT21-42 | 9.1 | 51.8 | 36.6* | 2.9 | 9.1 | 36.6 | 27.4 | 0.79 |

| AT21-42A | 10.7 | 58.0 | 44.2* | 5.0 | 18.3 | 50.3 | 32.0 | 0.80 |

| Including | 19.8 | 32.0 | 12.2 | 12.0 | ||||

| AT21-43 | 6.1 | 30.5 | 22.9* | 8.33 | 10.7 | 29.0 | 18.3 | 0.95 |

| Including | 10.7 | 21.3 | 10.7 | 14.9 | ||||

| AT21-43A | 16.8 | 35.1 | 18.3 | 14.4 | 19.8 | 33.5 | 13.7 | 1.90 |

| Including | 21.3 | 33.5 | 12.2 | 20.2 | ||||

| AT21-45 | 45.7 | 91.4 | 44.2* | 13.1 | 50.3 | 91.5 | 41.2 | 1.03 |

| Includes | 67.1 | 77.8 | 10.7 | 41.7 | ||||

| AT21-46 | 6.1 | 27.4 | 21.3 | 5.0 | 7.6 | 19.8 | 12.2 | 1.78 |

| AT21-48 | 27.4 | 64.0 | 35.1* | 5.7 | 29.0 | 64.0 | 12.2 | 0.40 |

| Including | 27.4 | 38.1 | 10.7 | 14.3 | ||||

| AT21-50 | 48.8 | 79.2 | 30.5 | 54.1 | 48.8 | 79.3 | 30.5 | 1.39 |

| Including | 53.3 | 73.2 | 19.8 | 75.3 | ||||

| AT21-050A | 141.7 | 182.9 | 38.1* | 17.2 | 141.8 | 178.4 | 36.6 | 1.00 |

| Including | 158.5 | 167.6 | 9.1 | 45.2 | ||||

| AT21-061 | 0 | 41.1 | 39.6* | 14.6 | 3.0 | 36.6 | 33.6 | 0.60 |

| Including | 3.0 | 10.7 | 7.6* | 60.4 | ||||

| AT21-062 | 9.1 | 68.6 | 59.4 | 27.3 | 9.1 | 64.0 | 54.9 | 5.34 |

| Including | 15.2 | 18.3 | 3.0 | 33.1 | 30.5 | 41.2 | 10.7 | 11.19 |

| And Including | 22.9 | 25.9 | 3.0 | 48.4 | ||||

| And Including | 44.2 | 61.0 | 16.8 | 49.6 | ||||

| AT21-063 | 0 | 48.8 | 47.2* | 23.9 | 7.6 | 48.8 | 41.2 | 3.94 |

| Including | 15.2 | 48.8 | 33.5 | 30.5 | 38.1 | 47.3 | 9.1 | 9.23 |

| AT21-064 | 0 | 67.1 | 67.1 | 27.0 | 3.0 | 67.1 | 64.1 | 3.35 |

| AT21-065 | 0 | 53.3 | 53.3 | 35.7 | 3.0 | 51.8 | 48.8 | 2.32 |

| Including | 6.1 | 39.6 | 33.5 | 50.0 | ||||

| AT21-066 | 1.5 | 57.9 | 56.3 | 32.2 | 3.0 | 57.9 | 54.9 | 2.62 |

| Including | 39.6 | 56.4 | 16.8 | 55.1 | 51.8 | 54.9 | 3 | 13.35 |

| AT21-069 | 3.0 | 19.8 | 16.8 | 24.9 | 3 | 18.2 | 15.2 | 1.01 |

| AT21-072 | 13.7 | 42.7 | 19.8* | 6.1 | 35.1 | 42.7 | 7.6 | 0.77 |

| Table 2: All silver assays released today. Utilizing a 5 g/t Ag cutoff, the assay intervals are reported in two formats: (1) if all samples exceed 5 g/t, the total drill interval is averaged, and (2) if a string of samples within the drill interval assay below the cutoff value, the groups of samples exceeding 5 g/t are averaged and reported as an aggregate assay interval within the longer drill interval. *Denotes aggregate assay interval. |

||||||||

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016, the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Company is well funded with cash of approximately $10.2 million as of January 2023.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

| NI 43-101 Mineral Resources at the Atlanta Mine | |||||

| Resource

Category |

Tonnes

(000’s) |

Au Grade

(ppm) |

Contained Au Oz |

Ag Grade

(ppm) |

Contained Ag Oz |

| Measured | 4,130 | 1.51 | 200,000 | 14.0 | 1,860,000 |

| Indicated | 6,910 | 1.17 | 260,000 | 10.6 | 2,360,000 |

| Measured + Indicated | 11,000 | 1.30 | 460,000 | 11.9 | 4,220,000 |

| Inferred | 5,310 | 0.83 | 142,000 | 7.3 | 1,240,000 |

Figure 1: Location of 2021 drill holes containing significant silver intercepts in relation to the three major strands of the AMFZ. The 2021 drilling sought to expand the Gustavson 2020 resource zone eastward from the East Atlanta Fault strand, while the 2022 drill program concentrated on better defining higher-grade mineralization concentrated within and along the three strands of the AMFZ. (CNW Group/Nevada King Gold Corp.)

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE