Montage Gold Repurchases 1% NSR Royalty on Its Koné Project

Montage Gold Corp. (TSX-V: MAU) (OTCQX: MAUTF) is pleased to announce that it has repurchased a 1.0% net smelter returns royalty on its Koné project, in Côte d’Ivoire, for a total cash consideration of US$10 million.

Martino De Ciccio, CEO of Montage, commented: “Given the strong liquidity sources recently secured, we are pleased to have the strategic and financial flexibility to exercise our right to repurchase a 1.0% royalty on our Koné project, as part of our prudent capital allocation strategy. We believe that this investment offers the ability to significantly enhance the value unlocked by our exploration efforts as many identified exploration targets are covered by the royalty repurchased.

Moreover, we are delighted with the results of the ongoing 60,000-meter drilling programme as it provides confidence in our ability to deliver on our recently announced Measured and Indicated Resource discovery target of at least 1 million ounces at a grade of more than 1 g/t Au, which would be 50% higher compared to the current Koné deposit grade, to be achieved before the commencement of production. This would represent significant returns on our exploration investment and aligns with our strategic objective of boosting production from the commencement of production while maintaining an annual production of at least 300koz for more than 10 years.

We are excited with the momentum generated across our business and look forward to continuing to rapidly progress our strategy of creating a premier African gold producer while delivering value for all our stakeholders.”

The Royalty covers the properties previously held under Mankono Exploration Limited which Montage purchased from Barrick Gold Corporation and Endeavour Gold Corporation in November 2022. As part of the acquisition, Barrick and Endeavour were granted a 1.4% and 0.6% net smelter return royalty, respectively, based on their relative ownership interest in the Property. The combined 2.0% royalty was subject to a 50% buyback option for a fixed cash consideration of US$10.0 million, to be exercised by the second anniversary of the acquisition of Mankono. Consequently, the transaction reduces the royalty on the Property from 2.0% to 1.0%, with Barrick and Endeavour retaining a 0.7% and 0.3% NSR royalty, respectively.

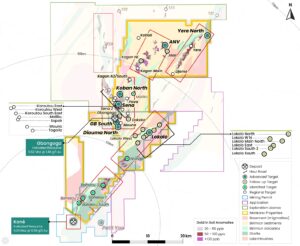

As shown in Figure 1, below, the Property initially comprised of 893km2, covers the original Gbongogo, Sissédougou and Sisséplé exploration licenses. The majority of the Gbongogo permit is now captured under the Koné project’s mining permit, as announced on July 10, 2024, with the remaining retained under exploration licenses. The area hosts significant exploration potential as it encompasses the Gbongogo deposit along with a number of advanced exploration targets including Gbongogo South, Diouma North, Lokolo Main, Sean, Koban North, ANV and Yere North. Many of these targets support the Company’s short-term strategic objective, as announced on October 7, 2024, of discovering more than 1 million ounces of higher-grade Measured and Indicated resources at a grade 50% higher than the Koné deposit, to be achieved before the commencement of production.

Source for Indicated Resources stated in map above: Updated Feasibility Study press release dated January 16, 2024 available on Montage’s website and on SEDAR+. See “Technical Disclosure”.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

ABOUT MONTAGE GOLD CORP.

Montage Gold Corp. (TSX-V: MAU) is a Canadian-listed company focused on becoming a premier multi-asset African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Feasibility Study published in 2024, the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years. Over the course of 2024, the Montage management team will be leveraging their extensive track record in financing and developing projects in Africa to progress the Koné project towards a construction launch.

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE