Montage Gold Enters into Strategic Partnership with African Gold to Advance the High-Grade Didievi Project in Côte d’ivoire

HIGHLIGHTS:

- Montage to obtain up to 19.9% ownership stake in African Gold (ASX:A1G), through the issuance of up to 2.19 million common shares for deemed aggregate consideration of up to circa C$6.3 million

- African Gold to appoint Silvia Bottero, EVP Exploration of Montage, as Non-Executive Director and Martino De Ciccio, CEO of Montage, as Strategic Advisor to the Board of Directors

- African Gold owns several exploration properties in Côte d’Ivoire, including its flagship Didievi project which hosts an Inferred Resource of 4.93Mt at 2.9 g/t Au containing 452,000oz of gold, as published by African Gold

- Montage appointed operator of the Didievi project to take advantage of its presence and expertise in Côte d’Ivoire

- African Gold is currently undertaking a 10,000-meter drill programme at its Didievi project which continues to return high-grade extension intercepts

Montage Gold Corp. (TSX-V: MAU) (OTCQX: MAUTF) is pleased to announce that it has entered into a strategic partnership with African Gold Limited (ASX:A1G), given its highly attractive exploration portfolio in Côte d’Ivoire, including its high-grade Didievi project, obtaining an up to 19.9% interest in African Gold through the issuance of up to 2.19 million common shares of Montage representing a deemed consideration of up to approximately C$6.3 million.

Montage will be participating alongside a broader non-brokered private placement whereby an additional 26.3 million ordinary shares in African Gold will be issued to subscribers. Through the Offering, African Gold will obtain aggregate gross proceeds of approximately C$1.66 million based on a share issuance price of A$0.07. African Gold had a market capitalization of approximately A$29.4 million (US$18.5 million) prior to the Offering.

African Gold’s flagship Didievi project in Côte d’Ivoire is located close to established gold mining operations including Allied Gold’s Bonikro and Agbaou mines, as well as Perseus’ Yaoure mine. African Gold is currently undertaking a 10,000-meter drill programme at its Didievi project which continues to return high-grade extension intercepts on its main target, known as the Blaffo Guetto trend. The Didievi project hosts an Inferred Resource of 4.93Mt at 2.9 g/t Au containing 452,000 ounces of gold, as published by African Gold1.

Through the strategic partnership, Silvia Bottero, EVP Exploration of Montage, will be appointed as Non-Executive Director to the Board of Directors of African Gold and Montage will become the operator of the Didievi project to take advantage of the significant synergies and expertise Montage can leverage in Côte d’Ivoire.

Martino De Ciccio, CEO of Montage, commented: “We are very pleased to form a strategic partnership with African Gold and work alongside them to rapidly unlock exploration value across their highly attractive portfolio in Côte d’Ivoire, including the high-grade Didievi project, by leveraging our presence and expertise in the country. Our strategic investment in African Gold follows a thorough review of potential partnerships in Côte d’Ivoire, based on a value-driven approach that considers risk-adjusted geological potential and is supported by technical due diligence.

We continue to be pleased with the strong momentum generated across our business and look forward to unlocking significant exploration value at our flagship Koné project, while its build progresses on time and on budget. Additionally, we remain focused on sourcing future growth through greenfield exploration success. In line with this objective, and as part of our evaluation of strategic partnerships, we are continuing to make considerable progress in staking highly prospective exploration grounds in Côte d’Ivoire, to reinforce our presence in the country and leverage the expertise of our well-established exploration team.”

Adam Oehlman, CEO of African Gold commented: “We are excited to partner with Montage Gold given their extensive exploration track record and strong presence in Côte d’Ivoire. This collaboration offers an exciting opportunity to unlock exploration value at notably our flagship Didievi project. Furthermore, Montage’s robust technical due diligence process strengthens our belief that the Didievi project is highly prospective.

We are very pleased with the ongoing 10,000-meter drill programme at our Didievi project, which continues to return high-grade extension intercepts, and look forward to further drilling the property this year given our strengthened financial position.”

Key terms of the Strategic Partnership

Montage has entered into a binding term sheet in respect of a transaction whereby Montage and African Gold will enter into an Investment Agreement, Investor Rights Agreement and Technical Services Agreement to give effect to the Share Exchange Transaction. The rights of Montage under the Investor Rights Agreement will persist so long as Montage holds at least 10% of the issued and outstanding African Gold ordinary shares, with the exception of the ROFR (set forth below), which is subject only to Montage retaining a shareholding of any level in African Gold, with the following key terms:

- Equity Swap: Montage will obtain an up to 19.9% ownership in African Gold, through a Share Exchange Transaction which results in the issuance of up to 104,749,216 African Gold ordinary shares to Montage, and the issuance of up to 2,189,340 common shares of Montage (“Montage Shares”) to African Gold equating to an up to 0.6% ownership in Montage, for a total implied transaction consideration of up to C$6.3 million. Montage insiders intend to participate in the Offering for up to 12,371,429 shares in African Gold, which would reduce the size of the Share Exchange Transaction commensurately and reduce the share issuance of Montage Shares to African Gold. The Share Exchange Transaction is based on a Montage share price of C$2.87 and an African Gold share price of A$0.07. Montage Shares will be issued to African Gold under an exemption from the prospectus requirements of applicable Canadian securities laws and will be subject to a hold period of four months and one day from the date of issuance to African Gold. Any African Gold sale of Montage shares will be subject to certain notice rights to enable Montage Gold to designate a suitable purchaser(s), subject to the Investor Rights Agreement Threshold.

- Technical Services Agreement: Montage and African Gold will enter into an agreement whereby Montage will be appointed operator of the Didievi project to direct exploration activities and its administration until December 31, 2026. Montage may terminate its operator service by providing a 3-months written notice, and may also elect to continue to be the operator after December 31, 2026 by providing written notice to African Gold. The budget and expenditures related to exploration, general management, studies, and all associated activities for the Didievi project will be approved by the Board of Directors of African Gold and paid by African Gold. Montage will be reimbursed for any out-of-pocket expenditures linked to the management of the project.

- Assignment of pre-emptive rights: African Gold will assign to Montage its pre-emptive rights to acquire a 20% project level shareholding in the Didievi project (and other permits) owned by minority shareholders.

- Participation Rights: Requirement for African Gold to provide Montage with reasonable opportunity to participate in future equity issuances to maintain Montage’s ownership percentage in African Gold, payable in Montage common shares, cash, or a combination of either.

- Board Nominee: Appointment of a Montage nominee to the Board of Directors of African Gold. As such, on closing of the Share Exchange Transaction, Silvia Bottero, EVP Exploration of Montage, will be appointed as Non-Executive Director to the Board of Directors of African Gold. Martino De Ciccio, CEO of Montage, will be appointed as Strategic Advisor to the Board of Directors of African Gold.

- Joint–Technical-Committee: Appointment of Silvia Bottero, EVP Exploration at Montage, to a newly formed joint-technical-committee with African Gold on all properties of African Gold.

- Right of First Refusal (“ROFR”): Granted in favour of Montage on the Didievi Project and with respect to African Gold’s rights to acquire the Angoda Permit (PR-585) located adjacent to the Didievi Project.

The Share Exchange Transaction and the Offering are expected to close in Q2-2025 and are subject to conditions including (a) approval of the shareholders of African Gold; and (b) entry into definitive transaction documents, among other customary conditions.

ABOUT AFRICAN GOLD

African Gold owns a highly prospective portfolio of exploration properties in Côte d’Ivoire, led by their flagship Didievi project, which has multi-million ounce potential. Strategically located close to established gold mining operations including Allied Gold’s Bonikro and Agbaou mines, as well as Perseus’ Yaoure project.

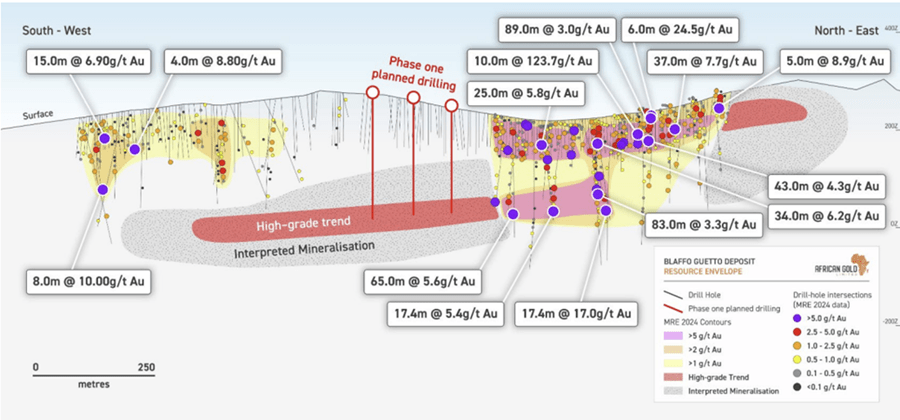

The Didievi project hosts an Inferred Resource of 4.93Mt at 2.9 g/t gold, representing 452,000oz of gold2, for its main target, known as the Blaffo Guetto trend. On October 15, 2024, African Gold reported drilling results from the Didievi Project, including2:

- 65.0m at 5.6 g/t Au from 177m

- 155.0m at 1.1 g/t Au with a notable interval of 52m at 2.9 g/t Au from 178m

Previous drilling on Blaffo Guetto returned shallow intercepts on the Blaffo Guetto, including2:

- 65.0m at 5.6 g/t Au from 177m including 22m at 10.9 g/t Au

- 155m at 1.1 g/t Au from 105m including 52m at 2.9 g/t Au from 178m

- 31.4m at 3.5 g/t Au from 250m including 18m at 5.6 g/t Au from 252m

- 10.0m at 123.7 g/t Au from 66m including 2m at 613.1 g/t Au

- 83.3m at 3.3 g/t Au from 166.9m including 18m at 12 g/t Au

- 17.4m at 17.0 g/t Au from 244m including 1m at 216.0 g/t Au

- 89.0m at 3.0 g/t Au from 0m including 23m at 9.5 g/t Au

- 43.0m at 4.3 g/t Au from 57 m including 17m at 9.5 g/t Au

- 69.0m at 2.9 g/t Au from 31m including 37m at 4.9 g/t Au

- 37.0m at 7.7 g/t Au from 42m including 24m at 11.0 g/t Au

African Gold is currently undertaking a 10,000-meter drill programme at its Didievi project, the largest in the company’s history, as shown in Figure 1 below, which continues to return high-grade extension intercepts and is expected to be completed in April 2025, marking a significant milestone in African Gold’s growth strategy.

Figure 1: Blaffo Guetto long section with planned phase one drilling2

ABOUT MONTAGE GOLD

Montage Gold Corp. is a Canadian-listed company focused on becoming a premier multi-asset African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Updated Feasibility Study published in 2024, the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years and is expected to enter production in Q2-2027.

TECHNICAL DISCLOSURE

Mineral Resource and Reserve Estimates

The Koné and Gbongogo Main Mineral Resource Estimates were carried out by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Western Australia, who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43–101.

The Mineral Reserve Estimate was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd., who is considered to be independent of Montage Gold. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under NI 43–101.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release relating to Montage Gold have been verified and approved by Silvia Bottero, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mrs. Bottero, EVP Exploration of Montage, is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (SACNASP), a member of the Geological Society of South Africa and a Member of AusIMM.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE