Minera Alamos Copperstone PEA

Minera Alamos Inc. (TSX-V:MAI) is pleased to announce the reissuance of the Preliminary Economic Assessment on the 100% owned Copperstone Mine in Arizona, USA. The study demonstrates potentially robust post-tax economics which, due to pre-existing infrastructure on surface and underground, result in both low initial capital and an overall low capital intensity ratio on a per gold ounce basis. The project now also benefits from its significant tax assets and recently reduced royalty encumbrance while also having potential for resource expansion and further exploration success. The PEA supports the construction and development of a high-grade gold underground mining operation at Copperstone producing an average of 40,765 payable oz gold per year over its an initial approximate 6 year mine life.

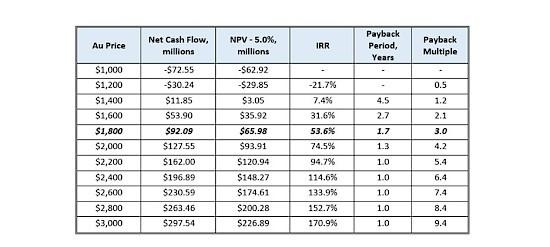

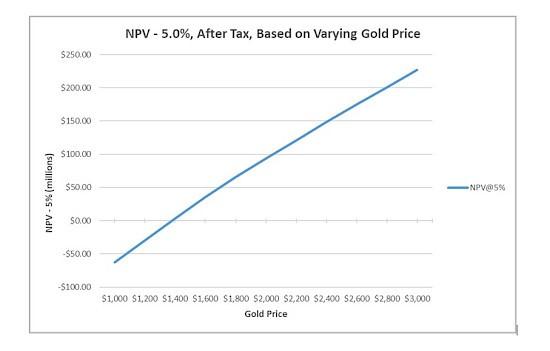

This newly prepared PEA does not address or incorporate ongoing work and trade-off studies currently being evaluated by the Minera Alamos team but does reflect a reduction in the Net Smelter Royalty burden on the project as an existing 1.5% NSR was extinguished since the first publication of the PEA by Sabre Gold Mines in 2023. Furthermore, in light of the significant move in gold prices in the last 18 months, the study includes a sensitivity analysis that takes into account gold prices ranging from $1,000/oz to $3,000/oz compared to the original study that had a gold price sensitivity range of $1,600/oz to $2,000/oz.

Minera Alamos Inc., the Issuer of this report, retained Hard Rock Consulting, LLC to prepare a restated version of the 2023 Preliminary Economic Assessment for the Copperstone Project that HRC completed previously for Sabre Gold Mines Corp. The report titled “National Instrument 43-101 Technical Report: Preliminary Economic Assessment for the Copperstone Project, La Paz County, Arizona, USA” with an effective date of June 26, 2023 has been modified by HRC to change the issuer name from Sabre Gold Mines Corporation to Minera Alamos Inc, address changes to the royalty and streaming structures post-business combination, and reflects the current property holdings. This report presents the mineral resource statement and documents the results of the PEA in fulfillment of the Standards of Disclosure for Mineral Projects according to Canadian National Instrument 43-101.

This report was prepared in accordance with the requirements and guidelines set forth in NI 43-101 Companion Policy 43-101CP and Form 43-101F1 (June 2011), and the mineral resources presented herein are classified according to Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards – For Mineral Resources and Mineral Reserves, prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council on November 19, 2019. The mineral resource statement reported herein is based on all available technical data and information as of February 15, 2023. The effective date of this report in full is February 6th, 2025.

The PEA base case assumes a gold price of $1,800 per oz. All currency references herein are in US$.

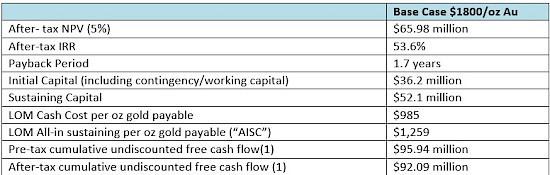

Highlights from the Preliminary Economic Assessment ($1,800/oz base case)

- Consistent Production – Models an underground mine operation that will process 198,000 tonnes of ore at an average of 544 tonnes per day over the 5.6-year mine life.

- Excellent Payback Period – The mine plan sequences the high-grade portions of the resource in early years to optimize grade and cash flow resulting in a payback period of 1.7 years and generating approximately $92m in after-tax cumulative undiscounted cash flow.

- Low Initial Capital – Significant site infrastructure, such as pre-existing tailings and partial processing facilities, surface buildings and rehabilitated underground development allow for reduced upfront construction cost and low initial capital per payable gold ounce produced over the LOM.

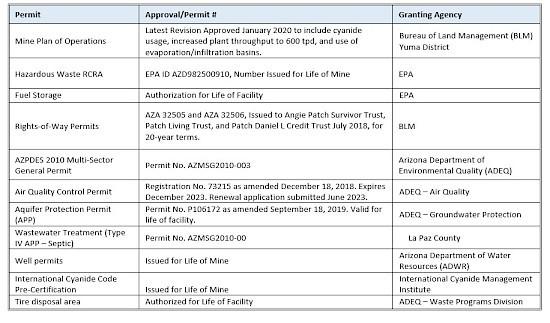

- Fully Licensed and Permitted – Permits are in place for initial construction and subsequent operation of the project as well as the necessary water and surface rights. Minor modifications required for a better optimised processing flow sheet as a result of the PEA and the Companys’ plans will be addressed as required in the coming months by the Company.

Base Case Financial Results:

Abbreviations include: NPV = net present value, IRR = internal rate of return, LOM = life of mine, AISC = all-in sustaining cost.

Location, Access, Physiography, Infrastructure

The Copperstone property is located 125 miles west of Phoenix, Arizona and is accessed via Interstate I-10 to the town of Quartzsite, Arizona. The site access road is located about 9 miles north of Quartzsite along US Highway 95. The access road is a well-maintained gravel road, the Cyprus Mine Road, that travels west for 5.5 miles to the project site.

The Project is situated on the flat, sandy desert terrain of the La Posa Plain, at the northeastern end of the Dome Rock Mountains, and is surrounded by a natural desert scrub environment. Major supply centres and ample skilled and unskilled labour are available locally, in Phoenix and in Yuma. Access to the Sante Fe rail line is available nearby, and international air service and railway access are both available in Phoenix.

Property, History, Geology, Mineralization

The Copperstone Project encompasses approximately 10.6 square miles of surface area and mineral rights in La Paz County, County, Arizona. The Project is wholly owned by Minera Alamos, which controls the 546 federal unpatented mining claims comprising the Copperstone Project area.

Prior production at Copperstone included open pit mining with a 2,500 tpd carbon-in-pulp heap leach from 1987 to 1993 with reported production of 514,000 oz of gold from 5,600,000 tons of ore grading 0.089 oz/t (2.8 g/t) of gold (Ackermann Engineering Services, 1998. Reference Notes, SME Meeting Talk November 19, 1998; unpublished document). In 2011, a 450 tpd floatation mill was built on site and in 2012 underground mining commenced from two declines that were previously developed in the bottom of the open pit. Operations took place from January 2012 to July 2013 with reported production of approximately 16,900 oz of gold from 163,000 tons of ore grading 0.104 oz/t (3.2g/t) of gold (Kerr Mines, Inc., 2017. 2017 QA/QC Procedures and Results, Copperstone Mine; internal report prepared for Kerr Mines, Inc.)

Minera Alamos owns 100% of the Copperstone Project which is situated at the northern tip of the Moon Mountains in west-central Arizona, regionally within the Basin and Range geo-physiographic province, and within the westernmost extent of the Whipple-Buckskin-Rawhide detachment system. Mid-Tertiary low-angle normal faults (detachment faults) are recognized as significant regional structures in this portion of the Basin and Range, where major detachment faults are associated with mylonitization of lower-plate rocks and brittle faulting and rotation of upper-plate rocks.

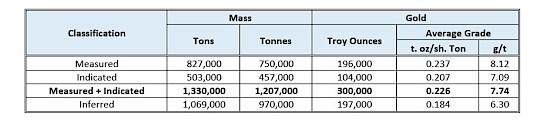

Mineral Resources

The original PEA in the name of Sabre provided a revised mine plan from the previously completed studies, including revised resource estimates, mining methods, mining dilution and recovery assumptions. The revised resource estimate used high yield restriction methodology to ensure that the influence of the high-grade samples did not extend beyond their observed range of continuity. No changes were made in the revised mine plan in the reissued PEA.

- Mineral Resources have an effective date of February 15, 2023. The Qualified Person responsible for the Mineral Resource estimate is Mr. Richard A. Schwering, P.G., SME-RM, an employee of Hard Rock Consulting, LLC.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Inferred mineral resources are that part of a mineral resource for which the grade or quality are estimated on the basis of limited geological evidence and sampling. Inferred mineral resources do not have demonstrated economic viability and may not be converted to a mineral reserve. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

- The mineral resource is reported at an underground mining cut-off of 0.092 oz/ton (3.15 g/t) Au beneath the historic open pit and within coherent wireframe models, and for estimated blocks which meet the criteria of a minable shape. The cut-off is based on the following assumptions: a gold price of $1,800/oz; assumed mining cost of $90/ton ($99.21/tonne), process costs of $47/ton ($51.81/tonne), general and administrative and property/severance tax costs of $15.00/ton ($16.53/tonne), refining and shipping costs of $12.00/oz, a metallurgical recovery for gold of 95%, and a 3.0% gross royalty.

- Rounding may result in apparent differences when summing tons, grade and contained metal content. Tonnage and grade measurements are in U.S. Customary and Metric units. Grades are reported in troy ounces per short ton (oz/ton) and grams per tonne (g/t). Contained metal is reported as troy ounces.

Initial and Sustaining Capital

The initial capital cost of the project is $36.3 million, to be incurred over a 14-month period including construction and ramp up to full production. Initial capital intensity is quite low when compared to the gold ounces produced during the life of mine and is calculated as $158 per payable gold ounce produced. Cumulative sustaining capital(1) is estimated at $52.1 million with over 60% spent in operating years 1-3 for the underground mine development and tailings management facilities.

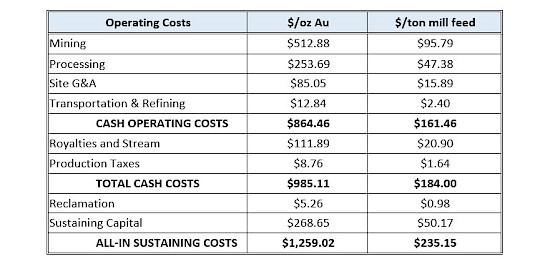

Operating, Cash and All-in Sustaining Costs

Free Cash Flow

The average annual after-tax free cash flow is $16.4 million and the cumulative LOM after-tax free cash flow are estimated at $92.09 million. The Company has a large tax asset base which significantly reduces the tax impacts on cash flow.

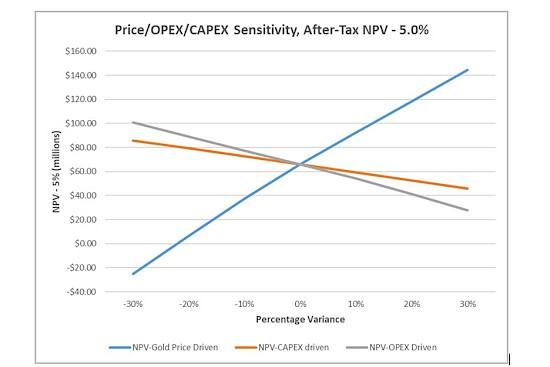

Project Sensitivities

At base case prices and a 5% discount rate, the after tax NPV and IRR are most sensitive to gold prices and to a much lesser extent capital and operating expenditures.

Mining Operations

Due to historic underground mining that has taken place on the property in 2012 and 2013 and an exploration drift established in 2017, there is currently approximately 4,000 meters of underground access development, most of which was rehabilitated in the fall of 2021.

The mining method proposed for the Copperstone Project is a mechanized cut and fill using cemented rock fill. The cut and fill mining method was chosen for its flexibility in effectively mining low vein dip angles. This method also minimizes the amount of dilution during mining by careful geological and management control of the mining.

The production rate at full production is 600 ton per day with a 3-month ramp-up period. Each stope is calculated to be able to produce 176 tpd. Based on that assumption, 3.5 active faces are required to meet production requirements. Due to inefficiencies in developing new stopes, backfill placement and unplanned delays a total of six active areas are scheduled in the mine plan.

The mine design is based on a cut-off grade 3.34 grams per tonne (0.107 opt) with 28.9% internal dilution, 10% external dilution and an ore recovery of 95% and is composed of 46% Measured, 18% Indicated, and 36% Inferred Mineral Resources.

Plant Flowsheet

The plant flowsheet is for a 544 tonne per day capacity, consisting of two-stage crushing and grinding, followed by whole ore leaching with Merrill Crowe recovery to produce doré bars.

Surface Infrastructure

Existing infrastructure at the Copperstone Project includes office facilities, warehouse, equipment maintenance shops and assay laboratory buildings, a change house, 10 trailer house hook-ups, a septic system, and a variety of shipping containers which provide for secure core storage. Incoming commercial 69 kV overhead electrical power is delivered to an on-site power substation. Water is currently delivered from three water wells to a 375,000-gallon storage tank in the mineral processing area. The right to extract and use groundwater from the aquifer within the La Posa Plain is authorized by the Arizona Department of Water Resources pursuant to A.R.S. Section 45-514. Potable water is delivered by truck. Mine communications are supported by cellular and satellite phone and internet service. Existing surface rights and right of ways are sufficient for all proposed exploration, mining, and processing activities, including tailings and waste storage and disposal areas.

Government Permits

All major permits for operations for the State of Arizona are in place with minor modifications required for the revised mine plan and flow sheet, Aquifer Protection Permit, Air Quality Permit and Storm Water Multi Sector General Permit. The US Bureau of Land Management (BLM) permit, Mine Plan of Operation (MPO) is in place but requires modifications to mainly remove equipment from the existing permitted flow sheet process plant.

The right to extract and use groundwater from the aquifer within the La Posa Plain is authorized by the Arizona Department of Water Resources pursuant to A.R.S. Section 45-514.

Existing surface rights and right of ways are sufficient for all proposed exploration, mining, and processing activities, including tailings and wase storage and disposal areas.

The Reclamation Plan has been approved by the State of Arizona and no amendments are expected to be required. Minera Alamos is required by the Aggregate Mine Land Reclamation Act to obtain an Inspector’s approval of the MPO amendment addressing new infrastructure and disposal facilities and plans for post-mining reclamation of those facilities.

Project Schedule and Next Steps

Management has been working with a number of groups to arrange debt financing and will continue to evaluate all available options to raise the required initial capital. Management will continue to work on potential optimizations of plant and equipment including the potential sourcing of used plant and equipment. The Company will also continue to incorporate any site development activities alongside site maintenance currently being performed on the Project. The Copperstone Project will take approximately 14 months for construction and ramp up to full production.

The Project Management team has significant construction and operating experience in underground mines within the Americas.

Opportunities to Enhance Value

Management has identified several opportunities to enhance value for the Copperstone Project that will be further evaluated during the development phase. Management is considering various engineering, procurement, construction and management approaches including hybrid models to incorporate internal expertise and capabilities that provide an efficient transition from development to operations. Further opportunities include:

- Expand Resources– The two priority areas for expansion would focus on additional drilling along the down dip plunge of the C and D zones within the main Copperstone shear, the South Zone and the Footwall zone. The second area of priority would follow up drilling between the A and B zones where previous drilling encountered high grade mineralization but has not been investigated further.

- Mining – Will further investigate if marginal grade material can be added to the stopes if the stope access cost is excluded due to the stope already being developed. Continue to look at the optimization of the mine design including the number of access points, internal raises to improve ventilation, stope height and width.

- Process Plant – The Company will evaluate opportunities for increasing plant throughput to the extent mining rates can be increased from the current mine plan and potential resource expansion.

- Used Equipment – Evaluate options for used equipment to reduce initial cost and lead time.

Exploration Potential

Several identified opportunities remain to enhance the value of the Copperstone Project and will be further evaluated during the construction phase.

- Drill test for the presence of the footwall zone at depth and underneath the D zone.

- Historic drill hole CS-266 intercepted gold mineralization (3.4 grams/tonne over 3.0 metres) approximately 200 meters southwest of the Copperstone pit and has not been followed up.

- Continued drilling to define and expand the southwest zone which is 760 meters southwest of the Copperstone pit.

- Historic drill hole 06CS-20 intercepted gold mineralization (20.5 grams/tonne over 1.5 metres), approximately 900m southwest of the Copperstone pit and has been neither been followed up on nor has there been any drilling within 150m of the drill hole.

Qualified Persons and QA/QC

Darren Koningen, P. Eng., Minera Alamos’ CEO, has reviewed and approved the scientific and technical information regarding Minera Alamos and its projects contained in this news release. Darren Koningen is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101.

The Preliminary Economic Assessment team includes HRC QPs, Richard A. Schwering, P.G., SME-RM, Jeffery W. Choquette, P.E., Jennifer J. Brown P.G., and Dr. Deepak Malhotra, Ph.D. who are the Independent Qualified Persons for the 2025 PEA and who have prepared the scientific and technical information on the Copperstone project and reviewed the information that is summarized in this press release. The qualified persons preparing the PEA report have followed industry accepted practices for verifying that the data used in the study is suitable for the purposes used. Site visits by three of the qualified persons (including Darren Koningen from Minera Alamos and Richard A. Schwering, Jennifer J. Brown, and Jeffery Choquette from HRC) is part of the data verification procedures. A more detailed description of data verification undertaken by the qualified persons will be included in the relevant sections of the technical report that will be filed within 45 days of this press release.

Shares for Debt Settlement

The Company announces that it has entered into agreements with three arms-length parties, each of whom are former insiders and related parties to Sabre Gold Mine Corp. (see News Release dated February 6, 2025). The Company has agreed to settle an aggregate amount of $93,000, by the issuance of 269,575 common shares of the Company to the Creditors at a price of $0.345 per share.

The shares issuable in connection with this debt settlement will be subject to receipt of approval of the TSX Venture Exchange and will have a minimum hold period expiring four months and one day after issuance.

PEA Cautionary Note:

Readers are cautioned that the PEA is preliminary in nature and includes inferred resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional work is needed to upgrade these mineral resources to mineral reserves.

About Minera Alamos Inc.

Minera Alamos is a gold production and development Company. The Company has a portfolio of high-quality Mexican assets, including the 100%-owned Santana open-pit, heap-leach mine in Sonora that is currently going through the start-up of operations at the new Nicho Main deposit. The 100%-owned Cerro de Oro oxide gold project in northern Zacatecas has considerable past drilling and metallurgical work completed and the proposed mining project is currently being guided through the permitting process by the Company’s permitting consultants. The La Fortuna open pit gold project in Durango (100%-owned) has a positive, robust preliminary economic assessment (PEA) completed, and the main Federal permits are in place. Minera Alamos is built around its operating team that together brought three open pit heap leach gold mines into successful production in Mexico over the last 14 years. Minera Alamos also wholly-owns the Copperstone mine and associated infrastructure in La Paz Country, Arizona, an advanced development asset with a permitted plan of operations that can be developed in parallel with planned project advancements in Mexico.

The Company’s strategy is to develop very low capex assets while expanding the projects’ resources and continuing to pursue complementary strategic acquisitions

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE