Mickey Fulp – “Why Conflicted Copper Shows Little Consensus”

I chimed in on the capriciousness of copper in the late spring (Mercenary Musing, May 28, 2018).

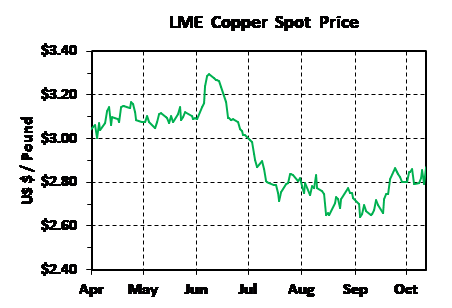

Since then, copper prices hit a 3.5 year high at $3.29/lb in early June but then lagged over the summer months. Weakness continues unabated with Friday’s close at $2.86 equating to a 13% loss from its ephemeral high in June:

The downtick has occurred despite strong fundamentals:

- World warehouse stocks are dropping, down 50% since the first of April and at lows not seen since early December of 2016:

- Strong demand from China includes an all-time record for concentrate imports in September at 1.93 million tonnes and a 15% year-to-date increase in refined copper imports according to the International Copper Study Group (ICSG).

- The Baltic Dry Index (BDI), a leading economic indicator, reached 52-week highs at over 1700 for much of August and remains at robust levels over 1500:

On the other hand, Chinese imports of copper scrap are down over 40% in gross tonnage from last year’s record high; this drop is mainly due to new regulations requiring higher purity scrap. However, the lower tonnage is no doubt mitigated by an increase in copper content. Also, other markets in Southeast Asia have ramped up their processing of lower-grade scrap into refined copper that eventually makes its way into China.

The only macroeconomic factor that has been negative for the price of copper since it reached its pinnacle during the first week of June was settlement of numerous Chilean labor contracts in July and August. Contrary to analyst expectations, there has been no disruption of copper supply in 2018 due to strikes.

In fact, the ICSG reports that worldwide copper production was up 5% in the first half of 2018. Despite that increase, there was a small supply deficit over the first half of 2018 at 50,000 tonnes. Depending on the source, year-end projections now range from a deficit of 90,000 to 200,000 tonnes.

There is one pending supply disruption. Temporary suspension of Codelco’s smelter operations at Chuquicamata and El Salvador will upgrade antiquated facilities to meet new Chilean environmental standards in mid-December and are expected to last 45 to 80 days.

Chinese copper import premiums have surged to $120 per tonne in late September, a level not seen since 2015. This is further evidence of a tightening supply situation.

So why have copper prices performed so poorly when supply-demand fundamentals have remained strong?

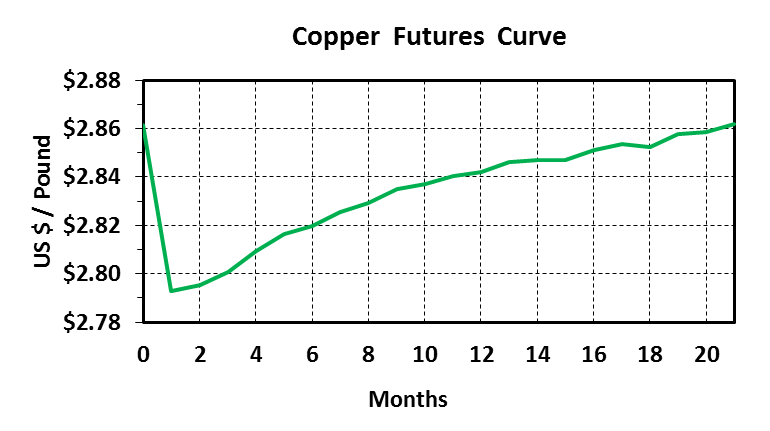

Apparently there is one reason and one reason only for the decline: Hedge fund speculators on both sides of the Pacific are massively net-short copper in the near-term and that has resulted in pronounced backwardation in the futures curve.

After the usual post-Chinese New Year demand increase from mid-February to early March, futures contracts were in contango. But since then, they have been in backwardation from the front month to the third or ninth month out with only a couple of exceptions. Contango occurred prior to the June high and was predicated on an August strike at Escondida. Also, the futures market was briefly in contango in late September.

Here is the strikingly backward LME forward curve for October 12 carried out to contango in June 2020. That is a whopping 20 months and reflects an extremely bearish view by speculators and traders for copper demand going forward:

The ongoing talking head chatter on tariffs and the so-called “trade war” between the US and China continues to weigh on all base metal markets and especially for copper. In my opinion, big traders and speculators have glommed onto the scenario of a major disruption in world trade and are betting on a sharp drop in Chinese demand for the red metal.

However, they seem to be discounting the idea that China will embark on another major infrastructure build-out, not only in-country but also via implementation of its Belt and Road Initiative. This massive undertaking is intended to link Eurasian and East African countries to China with a series of road corridors and maritime routes.

Quite frankly, I do not buy into these bearish views on copper. Given the current price in the $2.80 – $2.85 range, a significant amount of higher cost, low-margin production is underwater. I fully expect derivative markets to revert to normality; i.e., an outlook mostly driven by projections of short-term supply-demand fundamentals. At that point, the market will squeeze the massive short positions held by speculators.

In short, those specs with short positions are likely to take it in the shorts. This is the usual scenario when future positions are overwhelmingly on the one side of a trade.

And when that occurs, the price of a pound of copper should recover to well above $3.00. My target for 2019 is the previous high of $3.30, a base level many analysts agree is required to stimulate new developments and mine production in the copper sector.

After all, world population is growing by 85 million every year, a quarter of the humans living on Earth still do not have electricity, most of the above people are born and live in eastern Asia, and that particular region is developing infrastructure and modernization rapidly.

Electrification requires massive amounts of copper. Electronics, communications, construction, industrial machinery and equipment, transportation, and consumer products are also major consumers.

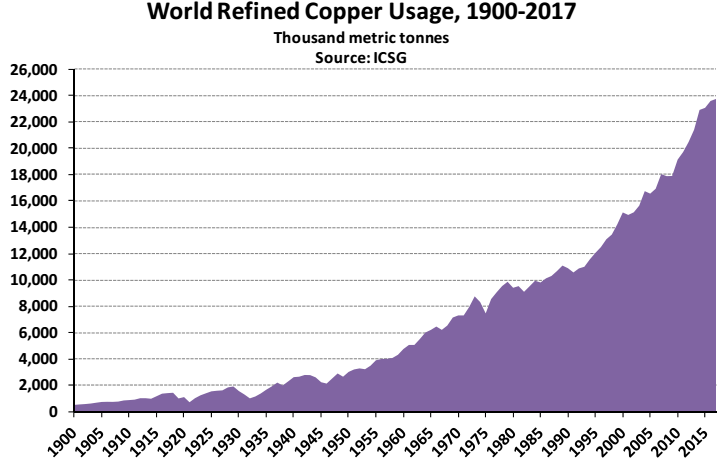

Here’s a chart showing the relentless growth in world copper usage from less than 500,000 tonnes in 1900 to nearly 24 million tonnes last year:

Moreover, while the world’s population has nearly tripled since 1950, the amount of copper consumed per person has more than doubled:

We now use about eight times the amount of copper consumed in 1950.

Therefore, I must conclude that the growth in copper demand will continue at a long-term annualized rate of 3.4%, just as it has since 1900.

I have presented a compelling case for continually increasing copper demand. When combined with a paucity of new supply in the pipeline, dropping mine grades, and lack of major discoveries in stable geopolitical jurisdictions over the past three decades, supply-demand fundamentals must inevitably lead to an increase in the price of copper.

And folks, this bullish scenario exists for copper throughout the short, medium, and long terms.

Ciao for now,

Mickey Fulp

Mercenary Geologist

Acknowledgment: Troy McIntyre is the research assistant for MercenaryGeologist.com.

The Mercenary Geologist Michael S. “Mickey” Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 35 years experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer, and speaker.

Contact: Contact@MercenaryGeologist.com

Disclaimer and Notice: I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in any report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation or advice to buy or sell stock or any asset or investment. All of my presentations should be considered an opinion and my opinions may be based upon information obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. My opinions are based upon information believed to be accurate and reliable, but my opinions are not guaranteed or implied to be so. The opinions presented may not be complete or correct; all information is provided without any legal responsibility or obligation to provide future updates. I accept no responsibility and no liability, whatsoever, for any direct, indirect, special, punitive, or consequential damages or loss arising from the use of my opinions or information. The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and may not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2018 Mercenary Geologist.com, LLC. All Rights Reserved.

MORE or "UNCATEGORIZED"

Silver Mountain Announces Closing of Prospectus Offering

Silver Mountain Resources Inc. (TSX-V: AGMR) (OTCQB: AGMRF) is ... READ MORE

Mandalay Extends the Storheden Gold Deposit Adjacent to the Operating Björkdal Mine

Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announce... READ MORE

Collective Mining Intercepts 632.25 Metres at 1.10 g/t Gold Equivalent in a 200 Metre Step-Out Hole to the South at Trap

Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FSE: GG1) is pl... READ MORE

Koryx Copper Intersects 207 Meters at 0.49% and 116 Meters at 0.54% Copper Equivalent

Significant copper and molybdenum intersections include: HM19: 11... READ MORE

Red Pine Intercepts Significant Mineralization at the Wawa Gold Project, including 5.34 g/t over 13.39 metres including 16.50 g/t gold over 0.97 metre and 13.62 g/t gold over 2.13 metres

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) is pleased ... READ MORE