Mickey Fulp “Mercenary Alert: A New but Old Uranium Company Added to My List”

I have long predicted consolidation of the USA’s domestic uranium mining industry and that scenario has played out periodically over the past three years. In 2015, merger and acquisition activity has accelerated with small to mid-tier explorers, developers, and producers combining to form larger and stronger companies or swapping assets to consolidate uranium deposits and districts in the Western United States.

Today I report on recent developments from a well-established but reconstituted US uranium company and outline the various reasons I think it presents a current buying opportunity.

Uranium Resources Inc (URRE.NASDAQ) is a long-lived company founded in 1977 with a focus on the uranium fields of South Texas. In its history URI has produced over eight million lbs of U3O8 via in-situ recovery (ISR) technology but given today’s depressed prices, has no current production. To learn about the uranium ISR process, I encourage you to explore this interesting illustration provided by the company: Interactive ISR Uranium Tour.

URI holds about 190,000 acres of mineral rights in the Grants Mineral Belt of New Mexico along with an NRC license to produce up to three million lbs of yellowcake per annum. It controls 17,000 acres of mineral rights with two fully-licensed recovery plants in South Texas. It holds royalty interests on other development properties in New Mexico and Wyoming and has an extensive historical database of drill logs, assays, maps, and technical reports on projects in the Western United States and South Texas.

That said, a recent acquisition has changed the game plan for Uranium Resources Inc. In early June, it announced acquisition of Australia-listed Anatolia Energy Ltd (AEK.ASX) in an all-share transaction. Anatolia Energy’s flagship asset is a uranium development project in Turkey amenable to ISR mining and processing. The combined company will have a clear path to yellowcake production within a relatively short time frame.

The new Uranium Resources will have a tight share structure with an estimated 51.3 million shares outstanding and 64.9 million fully diluted including warrants and options that are currently out-of-the-money. URI shareholders will hold 59% and AEK shareholders 41% with the latter being offered a 29% premium to its pre-announcement closing price and 47% to the 30-day moving average. Management will control 1% and institutions about 42 % of the combined company.

URI has cut its burn rate by nearly 25% over the past year but it still comes in at about $9 million per annum. It had a working capital position of $6.9 million in filings on May 3. Upon closing of the deal, I project it to be at $3.0-3.5 million in cash and securities with long-term convertible debt standing at $8.0 million. It appears the company will need to complete a financing after closing to ensure sufficient working capital for the next year.

Closing is subject to standard terms and conditions including shareholder approval from both companies and is for scheduled on or about September 30, 2015. Uranium Resources has agreed to provide up to A$2 million (about US $1.6 million) in interest-bearing convertible loans to enable Anatolia to progress its Turkish project and complete the merger.

Both boards are in unanimous support of the arrangement and so is URI’s largest shareholder, Denver-based Resource Capital Funds, which will hold 14.3% post-merger. Uranium Resource Inc’s shares will trade on both the NASDAQ and Australian Stock Exchange.

The management team will consist mostly of current Uranium Resource Inc executives including CEO and President Chris Jones, a mining engineer with over 30 years of experience in the US and Canada; CFO Jeff Vigil; VP Exploration Ted Wilton, a uranium geologist who I have known for 35 years; VP-South Texas operations, engineer Dain McCoig; and John Lawrence, an engineer and lawyer with 30 years of experience in nuclear fuel cycle law and licensing. In Turkey, operations will be led by Anatolia Energy’s recent hires: COO Tom Young, a veteran of Cameco’s ISR operations in the Western US and Cervat Err, a founder of SRK-Turkey with 30 years of mining and environmental experience.

The newco Board of Directors will consist of five current directors of Uranium Resources and two from Anatolia Energy, including its current CEO, banker and financier Paul Cronin. Chairman of the Board is Terence Cryan, a New York investment banker. Directors will include the aforementioned Jones and Cronin, Marvin Kaiser, ex-Doe Run and Ranchers Exploration and Development, Tracy Stevenson of Bedrock Resources and ex-Rio Tinto, and Australian-based Mark Wheatley, formerly CEO of Southern Cross Resources, the predecessor to Uranium One. One additional director from AEK will be appointed.

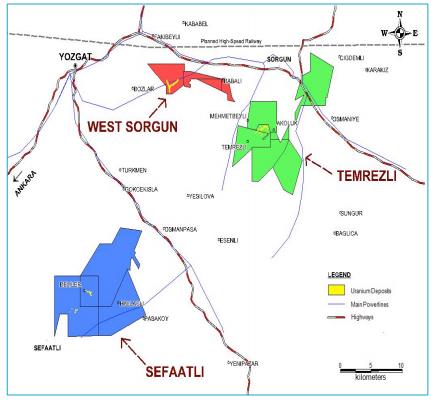

Anatolia Energy has a 100% interest subject to a 5% operating profit royalty in nine licenses covering over 18,000 ha of ground in the Anatolia region of central Turkey. The projects are located about 200 km east of Ankara by paved highway and are well-serviced by established infrastructure in the regional towns of Yozgat and Sorgun. Anatolia has identified several advanced exploration and development opportunities on the project. The key asset for URI’s acquisition is its Temrezli deposit:

Following up on regional aerial radiometric surveys and ground exploration from the 1960s, the Turkish government discovered significant uranium mineralization in several areas during the 1980s. Over the next ten years work at Temrezli included geological and topographic mapping, 473 rotary and 34 diamond drill holes with industry-standard down hole logging, sampling and assaying, and leach testing of selected mineralization.

Anatolia commenced exploration in 2010. It has drilled 112 core holes totaling over 16,000 meters, mainly twins to confirm the government’s results but also in-fill delineation holes, and step-outs to expand the mineralized body along strike. It conducted metallurgical studies to confirm leachability of uranium ores, calculated two resource estimates, and tabled a JORC-qualified preliminary feasibility study for ISR mining in February.

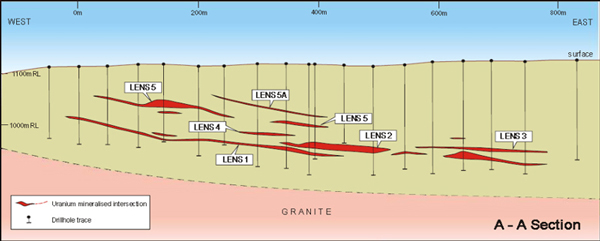

Temrezli is a sandstone uranium deposit with secondary mineralization concentrated in subparallel tabular lenses. It is hosted within a shallow marine sedimentary rock package consisting of interbedded sandstone, organic-rich mudstone, and siltstone unconformably deposited on granite basement. The source of uranium is thought to be areal leaching of the granitic rocks. This is a long-section showing the extent of shallow uranium-bearing horizons:

a

The latest estimate revealed a measured and indicated resource totaling 4.2 million tonnes grading 0.12% U3O8 for 11.3 million pounds at a 0.02% cut-off grade. Inferred resources are 1.0 million tonnes at 0.09%

U3O8.

Here is a plan map that details the presently known resources. Notice the lack of drilling beyond the current resources in both strike directions:

Exploration potential at Temrezli is excellent. The high confidence measured resources and best grade-thickness intervals at Temrezli are shown above. Note however, there has been very little testing along strike to the northeast of the known resource. To the southwest, mineralized horizons have been encountered at deeper levels and offer potential for the later years of a mining operation. Very few holes have drilled into basement and many others did not penetrate the entire prospective host rock formation. There also has been no condemnation drilling done for site facilities. Therefore, Temrezli is open in all directions.

There are significant exploration targets on other parts of the large land package. AEK recently encountered significant uranium mineralization in the second phase of drilling at two projects on the 5000 ha Sefaatli licenses and identified new prospects that warrant drilling. Early-stage prospects have also been identified on its West Sorgun holdings:

In reviewing the preliminary feasibility study at Temrezli, I found it lacking in several technical areas. In my opinion, it is more akin to a preliminary economic assessment under Canadian NI 43-101 regulations, partly because there is no calculation of mineable reserves. Also there is preliminary or incomplete data and analysis of metallurgical testing, porosity-permeability and uranium recovery studies, hydrological testing, well-field design, and details of evaporation rates and pond design for wastewater disposal.

Note that to calculate mineable reserves for an ISR project requires construction of a processing plant and production of uranium to demonstrate recovery factors. Therefore, most ISR projects simply go into production with a resource-only estimate. URI expects to have an updated technical report early in 2016.

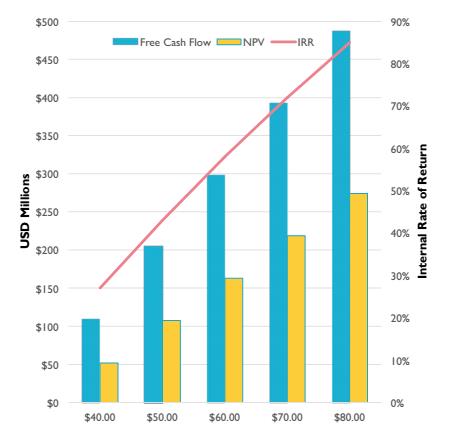

Anatolia Energy’s base case scenario for Temrezli outlined the potential for an economically mineable uranium deposit. The study assumed a “mineable resource” of 10.9 million pounds, 80% recovery, a mine life of 11 years, and a $65/lb uranium price. It produced an initial capital expenditure of $41 million, sustaining capital of $84 million, and LOM operating costs at $18/lb including royalties. Post-tax NPV at an 8% discount was $126 million; IRR was 51% with a payback period of 16 months.

According to the study, the project is most sensitive to increases in capital and operating costs and decrease in the sale price of uranium. In my opinion, uranium recovery should be added to this list and will be addressed in more detail in the updated technical report.

Here is a composite chart showing sensitivities for uranium sales price. It shows that at the current long-term contract price of about $50/lb, the economic model for Temrezli deposit is robustly economic with an NPV of $110 million and IRR of 36%:

As part of its routine due diligence, Uranium Resources looked critically at the technical and economic aspects of Temrezli prior to announcement of the merger. The latest joint corporate presentation reiterates AEK’s numbers for capex, opex, and the timeline for permitting, development, and initial production of about 1.5 years. It shows life-of-mine all-in sustaining costs at $30/ lb U3O8, indicating the project’s potential to be a high margin operation.

That said, additional technical work is required at Temrezli before an informed development decision can be made. Characteristics of the deposit that require more work include the porosity-permeability and flow characteristics in the various mineralized horizons, its multiple stacked lenses that could require additional well-field development, and surface evaporation studies and pond design because the impermeable granite basement precludes disposal in deep wells.

Part of the synergy between the two companies includes moving URRE’s shuttered Rosita uranium processing plant in South Texas to Temrezli. The company’s preliminary economic studies indicate an $8 million savings in capital costs versus construction of a new recovery plant in Turkey. They project a savings of $3 million by utilizing its experienced South Texas ISR team to get the plant re-assembled and running in Central Turkey. In addition, Temrezli is located in an economic development zone with no custom duties and reimbursement of value-added tax.

As with all uranium mining projects, there is a certain degree of permitting, environmental, and political risk. Note that the Turkish government, although strongly committed to a near-term nuclear energy build-out and with a stated goal of producing domestic uranium, has never mined the element. With rapidly increasing energy demand, Turkey is currently the sixth largest economy in Europe and is projected to become the fourth largest within the decade. Temrezli will be the country’s first uranium mine.

AEK’s initial economic study of the project showed it carries low capex and opex and potentially robust economics. However, until the aforementioned technical studies are completed, an updated economic study tabled, and mine permits received, financial risk for development of the project remains.

That said, URI indicates it has evaluated the project conservatively and thinks it can be developed at current uranium prices. You already know that one of my mantras is “every good geologist knows that grade is king”. From my point of view, this high-grade ISR uranium project has potential to produce high margin pounds of uranium.

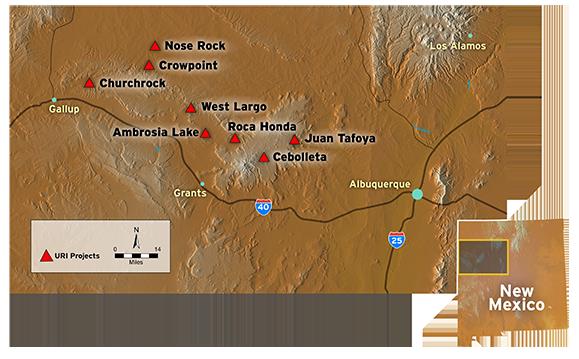

On the other side of the equation, Uranium Resources holds significant properties in the Grants Mineral Belt of New Mexico. Included are wholly-owned fee lands, fee lands leased from third parties, patented and unpatented claims, two State mineral leases, and surface rights leases that total over 190,000 acres. This map shows URI’s active projects in New Mexico, all which contain significant 43-101 qualified or historic resources:

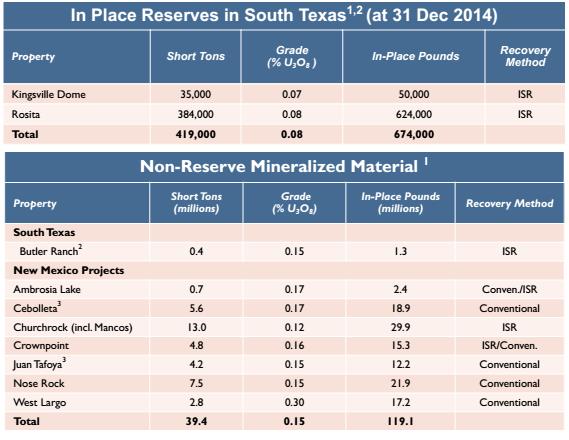

South Texas and New Mexico Qualified and Historic Resources

In addition to its pounds-in-the ground resources in New Mexico, Uranium Resources holds an NRC license for an ISR plant at Churchrock with a capacity of up to three million pounds U3O8 per annum.

It recently closed an agreement to swap land positions containing substantial uranium resources with Energy Fuels Inc (UUUU.MKT) (EFR.TSX) on respective flagship properties in New Mexico. The deal consolidates two of the three premier deposits in the prolific Grants Mineral Belt. With this trade, URI acquired historic resources at its Churchrock ISR project northeast of Gallup while UUUU gained resources and a shaft accessing its Roca Honda underground project north of Grants.

URI received additional consideration including $2.5 million in cash, a retained 4% gross royalty on its former ground at Roca Honda with a one-time $5 million buyout, $375,000 in Energy Fuels shares, and a 4% gross royalty on two satellite properties at Peninsula Energy’s (PEN.ASX) Lance ISR development project in the Powder River Basin of Wyoming.

Note that certain other New Mexico development properties are considered non-core assets and available for divestiture. These projects should be a source of future working capital, akin to the recent asset trade with Energy Fuels.

URI’s historic operations were in the ISR fields of South Texas. Its current holdings in South Texas are extensive and include five properties in various stages of exploration and three with past production. Alta Mesa Este, Butler Ranch, and Sejita Dome are recent acquisitions and advanced exploration projects within trucking distance of its former processing and recovery operations. Rosita and Kingsville Dome are licensed ISR projects on standby and past-producers with reserves remaining. Vasquez is mined out and undergoing reclamation. The idled Kingsville Dome processing plant has capacity to produce 800,000 lbs of yellowcake per year:

The company’s ISR reserves have been calculated using a 65% recovery factor and $53/lb uranium price. It projects all-in sustaining costs to be $40-$45 per lb U3O8 based on its past operational experience. Therefore, these two South Texas well field projects will require a higher uranium price for restart of production:

URI has two unfulfilled South Texas off-take contracts totaling five million pounds that were written by previous management during the mid-2000s uranium boom. They are collectively at an effective $9 discount to long-term contract prices with a geographic restriction (South Texas) but no time obligation. Company guidance indicates these contracts could likely be renegotiated.

In my opinion, the merger of Uranium Resources Inc and Anatolia Energy Ltd is accretive for both companies:

-

The combined entity will have a clear path to short-term production at Temrezli along with medium and long-term development assets in the United States, which consumes 30% of annual uranium supply worldwide.

-

URI will benefit from a dual listing on both the NASDAQ and the Australia Stock Exchange. With an anticipated increase in market capitalization, it will have better access to institutional and retail investors and enhanced liquidity in the world’s largest capital and nuclear energy markets.

-

The merger brings strong shareholders from both sides including Resource Capital Funds, Global X Management, Blackrock, RMB, Azarga Uranium, Aterra Capital, Sprott Asset Management, and Doyon Group.

-

Uranium Resource’s current management and operational team will retain their positions while Anatolia Energy’s CEO will occupy one of two designated director seats and brings uranium trading and financing experience to the Board of Directors. AEK’s newly hired COO, a veteran manager of Cameco’s ISR operations in the US, will head the Turkish project.

-

Temrezli is a high-grade ISR project with economic studies indicating both low capital expenditures and operating expenses. Relocation of the idled and redundant Rosita plant from South Texas to Turkey will reduce the initial capex of Temrezli by over 25%.

-

With all-in sustaining costs projected at $30/lb, it will be well within the lowest quartile of costs for uranium mine production. The project will now be developed by URI’s technical team of engineers and geologists with many years of ISR exploration, development, and production.

Uranium Resources’ stock traded slightly for about a week after announcement of the merger, indicating a positive reaction from the marketplace. Since mid-June however, the entire uranium sector has lost traction despite spot and term contract prices remaining flat.

URI is trading now in the mid-80 to low 90 cent range on unusually low volumes:

Factors accounting for the current lack of interest are the summer doldrums, the recent downturn in other hard commodity sectors, and speculators waiting for assurance that the merger will be consummated.

Uranium Resources now has a clear path to short-term production and is grossly undervalued with respect to North American peers in uranium development space. Its present market cap is a paltry $27 million or about $46 million on a combined basis.

Based on recent peer group combinations, I expect the market to substantially revalue the combined company once the merger is consummated; that catalyst is currently on track for about September 30.

Potential for profit is the reason I have accumulated the stock over the last couple of weeks and have chosen Uranium Resources as a website sponsor.

That said, I do not personally view URI as merely a short-term trade but more of a core holding. In my opinion, the company has the projects to produce high-margin pounds of uranium in the short, medium, and long-terms from various operations in different geographical locations.

Besides potential for short-term profits, this is also a contrarian timing play based on my bullish views on the mid- to long-term future of the uranium mining industry as a whole. You can explore these ideas in my recent keynote address at theMurdock Capital Partners Uranium Symposium in New York City.

Please do your own research on Uranium Resources Inc to determine if my ideas merit action in your portfolio of resource stocks.

Finally, I kindly remind you that this Alert is for your eyes only.

Ciao for now,

Mickey Fulp

Mercenary Geologist

Acknowledgment: Gwen Preston is the editor of MercenaryGeologist.com.

The Mercenary Geologist Michael S. “Mickey” Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 35 years’ experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer, and speaker.

Contact: Contact@MercenaryGeologist.com

Disclaimer and Notice: I am a shareholder of Uranium Resources Inc and it pays a fee of $4000 per month as a sponsor of this website. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in any report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation or advice to buy or sell stock or any asset or investment. All of my presentations should be considered an opinion and my opinions may be based upon information obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. My opinions are based upon information believed to be accurate and reliable, but my opinions are not guaranteed or implied to be so. The opinions presented may not be complete or correct; all information is provided without any legal responsibility or obligation to provide future updates. I accept no responsibility and no liability, whatsoever, for any direct, indirect, special, punitive, or consequential damages or loss arising from the use of my opinions or information . The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and may not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2015 Mercenary Geologist.com, LLC. All Rights Reserved.

MORE or "INDUSTRY ANALYSTS"

Mickey Fulp - Mercenary Alert: Is Zinc Still a Four-Letter Word?

Read the Report Here Mercenary Alert: Is Zinc Still a Four-Letter Word? ... READ MORE

Top 10 Financings of May 2017

May saw 125 financings close in the Canadian financial markets for C$366.5 million including 64 fina... READ MORE

ORENINC INDEX jumps as gold gets political again

ORENINC INDEX – Monday, June 12, 2017 North America’s leading junior mining finance data provide... READ MORE

The Week of June 5th to June 11th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday June 5th with... READ MORE

The Week of May 29th to June 4th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday, May 29th wit... READ MORE