Miata Doubles Mineralized Footprint at Jons Trend with a 500m Step Out in Hole 039 and Highlights 54 m at 1.04 g/t Au in Hole 043

Miata Metals Corp. (CSE: MMET) (FSE: 8NQ) (OTCQB: MMETF) is pleased to announce further drill results from the Jons Trend Zone at its Sela Creek Gold Project in Suriname.

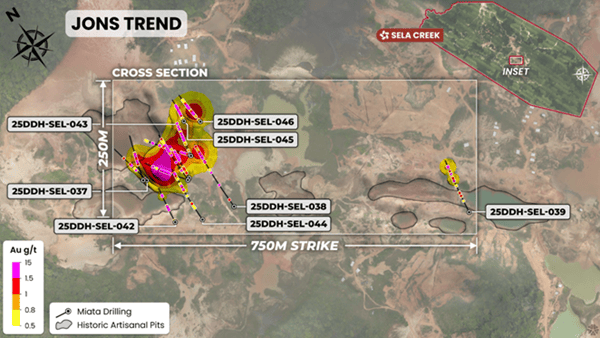

Results from holes 25DDH-SEL-037 through 25-DDH-SEL039 and 25DDH-SEL-042 through 25DDH-SEL-046 confirm gold mineralization at Jons Trend across a 750 m by 250 m corridor to a depth of 200 m, remaining open along strike and at depth. Importantly, a 500 m step-out further validates this continuity, more than doubling the known mineralized footprint. Reprocessing of geophysical data indicates the main structures at Sela Creek, which potentially reflect the extent of the gold system, continue to a depth of 1.5 km.

Highlights

- 500 m step-out (hole 25DDH-SEL-039) confirms strike continuity and expands Jons Trend by over 100%, with 4.9 m of 4.04 g/t gold and 13.6 m at 0.80 g/t gold

- Every hole at Jons trend has intersected gold mineralization, with most holes intersecting multiple, subparallel gold-bearing zones

- Continuous gold mineralization now apparent over 750 m x 250 m, open along strike and to depth, an increase in size of over 100 percent

- Drilling continues to return wide mineralized intervals, including:

- 54 m at 1.04 g/t gold and 3.4 m at 1.12 g/t gold (hole 25DDH-SEL-043)

- 53.6 m at 0.84 g/t gold (hole 25DDH-SEL-038)

- 18.9 m at 1.01 g/t gold and 5.4 m at 2.29 g/t gold (25DDH-SEL-044)

- 9 m at 0.79 g/t gold and 16.5 m at 0.83 g/t gold and 4.4 m at 3.13 g/t gold (25DDH-SEL-045)

- 34 m at 1.05 g/t gold and 12 m at 1.15 g/t gold hole (25DDH-SEL-046)

- 10,061 metres drilled in 2025, completing the annual target, with results from 2,755 metres pending

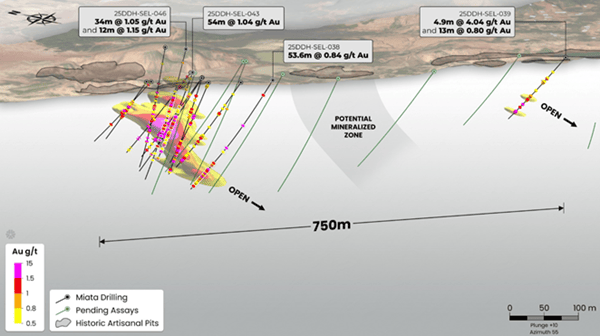

Figure 1. Oblique view of drilling in Jons Trend with an implicit grade model, showing that mineralization is open in all directions. Readers are cautioned that the model illustrates exploration potential based on limited data only and is not a guarantee that such gold grades are present.

“The drilling at Jons Trend continues to deliver significant mineralization across a large footprint that is entirely open, which supports the potential for a future open-pit resource at Sela Creek,” stated Dr. Jacob Verbaas, CEO of Miata Metals. “With all drill holes at Jons Trend across a 750 by 250 metre corridor returning mineralized intercepts, Jons Trend is rapidly emerging as the first major zone of mineralization on the project. We are just starting to grasp the extent of this target.

“Equally important, our ongoing work across the Sela Creek property allows us to define the project-scale controls on gold mineralization. We expect to accelerate our discovery-focused program in Q1 2026 with a fully funded two-rig program, which will allow us to work multiple prospects in parallel. Several prospects are drill-ready and primed for discovery. Our objective in 2026 is to demonstrate that Sela Creek is the next major gold district in Suriname.”

A Robust and Expanding Gold System

Drilling at Jons Trend continues to deliver wide, consistent intervals of gold mineralization hosted in strongly deformed quartz-pyrite-pyrrhotite veining within a thick turbidite sequence. Turbidite sequences tend to be homogeneous and laterally very continuous. This continuity is apparent in the grade distribution such as in hole 25DDH-SEL-046 (fig 3) as well as the strike length which is currently 750 m and open. Overall, Jons Trend is emerging as a large bulk-tonnage prospect that is potentially amenable to open-pit mining. Implicit grade shell modeling (fig 1 & 2) indicates repeated zones of south-easterly plunging mineralization.

Figure 2. Plan view of drilling at Jons Trend with implicit grade model projected to surface. Readers are cautioned that the model illustrates exploration potential exploration potential based on limited data only and is not a guarantee that such gold grades are present.

Continuity Confirmed by 500 m Step-Out

The results include hole 25DDH-SEL-039, a 500 m step-out that extends the mineralization of Jons Trend over 750 m (FIG 1). Hole 25DDH-SEL-039 yielded 4.9 m at 4.04 g/t gold (fig. 4) and 13.6 m at 0.8 g/t gold in separate intervals. Several holes were drilled in between the main discovery zone and 25DDH-SEL-039 to confirm the continuation of Jons Trend. Jons Trend so far has been drilled to an average depth of 134 m and remains open to depth and along strike.

Magnetic Data Implies Continuity to Depths of over 1 km

An inversion of the magnetic data indicates that the main structures on Sela Creek, including the steeply dipping Central Guyana Shear Zone continue to 1500m depth. The Central Guyana Shear Zone is a dominant project-scale gold control that runs the length of the Sela Creek concession. Given that the structural controls are indicative of the fluid system on Sela Creek the Company believes that gold mineralization may continue to these depths.

Figure 3. 25DDH-SEL-046 from 74 to 90 meters (within 17m of 1.59 g/t gold from 74 m), showing continuous grade distribution.

Figure 4. 25DDH-SEL-039, from 132 – 137 m, proving that the Jons Trend zone extends for 750 m along strike and remains open.

Table 1. Drill results. Intervals are reported as hole length, true width data is noted in Table 2.

| Hole ID | From | To | Interval | Grade (g/t Au) | Cut off | Hole length | Prospect |

| 25DDH-SEL-037 | 1.1 | 8.6 | 7.5 | 0.82 | 0.23 | 128.80 | Jons Pit |

| And | 38.6 | 49.8 | 11.2 | 0.54 | 0.03 | ||

| Including | 38.6 | 43.0 | 4.4 | 0.84 | 0.35 | ||

| And | 57.9 | 68.0 | 10.1 | 1.57 | 0.07 | ||

| Including | 61.0 | 63.0 | 2.0 | 5.53 | 3.65 | ||

| And | 90.0 | 93.0 | 3.0 | 0.77 | 0.38 | ||

| 25DDH-SEL-038 | 28.1 | 29.6 | 1.5 | 1.21 | 1.21 | 227.80 | Jons Trend |

| And | 87.0 | 89.0 | 2.0 | 1.43 | 0.09 | ||

| And | 134.0 | 135.0 | 1.0 | 2.46 | 2.46 | ||

| And | 143.0 | 144.0 | 1.0 | 0.63 | 0.63 | ||

| And | 167.9 | 221.5 | 53.6 | 0.84 | 0.03 | ||

| Including | 167.9 | 174.0 | 6.1 | 0.99 | 0.16 | ||

| Including | 182.0 | 221.5 | 39.5 | 0.94 | 0.10 | ||

| Including | 182.0 | 192.0 | 10.0 | 1.38 | 0.35 | ||

| Including | 195.0 | 200.0 | 5.0 | 1.71 | 0.36 | ||

| 25DDH-SEL-039 | 34.0 | 35.0 | 1.0 | 0.52 | 0.52 | 152.80 | Jons Trend |

| And | 48.0 | 54.0 | 6.0 | 0.60 | 0.35 | ||

| And | 57.0 | 62.0 | 5.0 | 0.86 | 0.53 | ||

| And | 79.0 | 80.8 | 1.8 | 0.62 | 0.61 | ||

| And | 92.4 | 106.0 | 13.6 | 0.80 | 0.25 | ||

| Including | 92.4 | 98.0 | 5.6 | 1.02 | 0.62 | ||

| And | 114.3 | 117.0 | 2.7 | 0.87 | 0.32 | ||

| And | 122.0 | 125.0 | 3.0 | 0.50 | 0.28 | ||

| And | 132.1 | 137.0 | 4.9 | 4.04 | 0.98 | ||

| Including | 133.0 | 135.9 | 2.8 | 5.62 | 2.96 | ||

| 25DDH-SEL-042 | 4.1 | 8.6 | 4.5 | 0.68 | 0.54 | 147.05 | Jons Trend |

| And | 58.0 | 63.4 | 5.4 | 0.83 | 0.01 | ||

| Including | 61.0 | 63.4 | 2.4 | 1.12 | 0.41 | ||

| And | 71.0 | 74.9 | 3.9 | 1.09 | 0.19 | ||

| And | 113.8 | 121.0 | 7.2 | 1.51 | 0.39 | ||

| Including | 116.0 | 119.0 | 3.0 | 2.32 | 1.37 |

| Hole | From | To | Interval (m) | Grade (g/t Au) | Cut off | Hole length | Prospect |

| 25DDH-SEL-043 | 10.1 | 12.3 | 2.2 | 0.59 | 0.59 | 152.80 | Jons Trend |

| and | 28.0 | 31.4 | 3.4 | 0.51 | 0.24 | ||

| and | 59.0 | 69.0 | 10.0 | 0.47 | 0.09 | ||

| and | 75.0 | 129.0 | 54.0 | 1.04 | 0.19 | ||

| including | 76.0 | 81.0 | 5.0 | 1.84 | 0.75 | ||

| including | 83.0 | 97.0 | 14.0 | 1.32 | 0.28 | ||

| including | 104.0 | 111.0 | 7.1 | 1.78 | 0.70 | ||

| including | 126.0 | 129.0 | 3.0 | 1.86 | 0.77 | ||

| and | 138.6 | 142.0 | 3.4 | 1.12 | 0.27 | ||

| and | 151.0 | 152.8 | 1.8 | 2.20 | 0.83 | ||

| 25DDH-SEL-044 | 45.0 | 47.0 | 2.0 | 0.48 | 0.21 | 179.80 | Jons Trend |

| and | 61.0 | 65.0 | 4.0 | 0.93 | 0.62 | ||

| and | 89.9 | 91.0 | 1.2 | 0.55 | 0.16 | ||

| and | 107.0 | 125.9 | 18.9 | 1.01 | 0.02 | ||

| including | 112.0 | 114.6 | 2.6 | 2.08 | 1.33 | ||

| including | 121.0 | 125.9 | 4.8 | 1.94 | 0.36 | ||

| and | 131.5 | 133.8 | 2.4 | 0.47 | 0.36 | ||

| and | 147.0 | 148.0 | 1.0 | 0.76 | 0.76 | ||

| and | 151.0 | 155.2 | 4.2 | 0.58 | 0.31 | ||

| and | 158.0 | 159.0 | 1.0 | 1.07 | 1.07 | ||

| and | 162.1 | 167.5 | 5.4 | 2.29 | 0.08 | ||

| including | 163.9 | 165.7 | 1.8 | 4.22 | 4.15 | ||

| 25DDH-SEL-045 | 25.1 | 28.1 | 3.0 | 0.41 | 0.21 | 188.80 | Jons Trend |

| and | 56.0 | 57.0 | 1.0 | 1.45 | 1.45 | ||

| and | 63.3 | 64.0 | 0.8 | 0.56 | 0.56 | ||

| and | 69.9 | 71.0 | 1.2 | 2.93 | 2.93 | ||

| and | 75.0 | 84.0 | 9.0 | 0.79 | 0.48 | ||

| including | 75.0 | 77.8 | 2.8 | 1.28 | 0.88 | ||

| and | 90.5 | 107.0 | 16.5 | 0.83 | 0.08 | ||

| including | 90.5 | 96.5 | 6.0 | 1.50 | 0.08 | ||

| including | 95.7 | 96.5 | 0.8 | 4.54 | 4.54 | ||

| including | 104.0 | 105.0 | 1.0 | 1.89 | 1.89 | ||

| and | 108.6 | 111.0 | 2.4 | 0.47 | 0.32 | ||

| and | 114.5 | 116.0 | 1.5 | 1.65 | 0.45 | ||

| and | 128.5 | 132.9 | 4.4 | 3.13 | 0.53 | ||

| including | 129.0 | 131.0 | 2.0 | 5.57 | 4.40 | ||

| and | 141.4 | 143.0 | 1.6 | 0.78 | 0.23 | ||

| and | 146.7 | 149.0 | 2.3 | 2.64 | 0.66 |

| Hole ID | From | To | Interval (m) | Grade (g/t Au) | Cut off | Hole length | Prospect |

| 25DDH-SEL-046 | 20.6 | 23.6 | 3.0 | 0.58 | 0.31 | 209.80 | Jons Trend |

| and | 50.5 | 61.0 | 10.5 | 0.45 | 0.16 | ||

| including | 50.5 | 55.0 | 4.5 | 0.60 | 0.18 | ||

| including | 58.0 | 61.0 | 3.0 | 0.44 | 0.34 | ||

| and | 66.0 | 68.0 | 2.0 | 0.48 | 0.44 | ||

| and | 73.0 | 107.0 | 34.0 | 1.05 | 0.13 | ||

| including | 74.0 | 91.0 | 17.0 | 1.59 | 0.90 | ||

| and | 120.0 | 132.0 | 12.0 | 1.15 | 0.13 | ||

| including | 130.1 | 131.0 | 0.9 | 4.37 | 4.37 | ||

| and | 137.0 | 138.4 | 1.3 | 2.36 | 2.36 | ||

| and | 144.0 | 145.0 | 1.0 | 3.79 | 3.79 | ||

| and | 154.0 | 156.0 | 2.0 | 0.94 | 0.54 | ||

| and | 166.0 | 167.0 | 1.0 | 0.62 | 0.62 | ||

| and | 177.2 | 178.0 | 0.8 | 0.62 | 0.62 | ||

Table 2. Collar information. True width of intervals in table 1 is calculated as true width % x interval. For example 34.0 m in hole 25DDH-SEL-046 has a true width of 87% x 34 = 29.58 m.

| Hole ID | Easting* | Northing | Elevation (m) | Azimuth | Dip | Length (m) | Estimated True width | |

| 25DDH-SEL-037 | 754,675 | 418,259 | 107 | 348 | -48 | 128.8 | 77 | % |

| 25DDH-SEL-038 | 754,793 | 418,125 | 105 | 355 | -55 | 227.8 | 99 | % |

| 25DDH-SEL-039 | 755,178 | 417,872 | 109 | 5 | -44 | 152.8 | 87 | % |

| 25DDH-SEL-042 | 754,679 | 418,160 | 114 | 10 | -62 | 147.05 | 91 | % |

| 25DDH-SEL-043 | 754,774 | 418,254 | 106 | 5 | -65 | 152.8 | 100 | % |

| 25DDH-SEL-044 | 754,729 | 418,135 | 110 | 0 | -52 | 179.8 | 87 | % |

| 25DDH-SEL-045 | 754,801 | 418,319 | 134 | 0 | -78 | 188.8 | 71 | % |

| 25DDH-SEL-046 | 754,826 | 418,301 | 129 | 351 | -75 | 209.8 | 87 | % |

All drill results, including collar locations, are available on the Company website through this link. True widths are within 90% of disclosed width unless otherwise noted.

QAQC

Samples were analyzed at FILAB Suriname, a commercial certified laboratory under ISO 9001:2015. Samples are crushed and pulverized to 85% passing 88 µm prior to analysis using a 50 g fire assay (50 g aliquot) with an Atomic Absorption (AA) finish. For samples that return assay values over 5.0 grams per tonne (g/t), another cut was taken from the original pulp and fire assayed with a gravimetric finish. Miata Metals inserts certified reference standards, as well as blanks and ¼ core duplicates in the sample sequence for quality control and assurance.

QP Statement

The scientific and technical information in this news release has been reviewed and approved by Dr. Jacob Verbaas, P.Geo., a director of the Company and Qualified Person as defined under the definitions of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Miata Metals Corp.

Miata Metals Corp. is a Canadian mineral exploration company listed on the Canadian Securities Exchange, as well as the OTCQB and Frankfurt Exchanges. The Company is focused on the acquisition, exploration, and development of mineral properties. The Company holds a 70% interest in the ~215km2 Sela Creek Gold Project with an option to acquire a full 100% interest in the Project, and a 70% beneficial interest in the Nassau Gold Project with an option to acquire 100%. Both exploration properties are located in the greenstone belt of Suriname.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE