METALLA ADDS ROYALTIES ON BARRICK GOLD’S WORLD CLASS LAMA COMPLEX

Metalla Royalty & Streaming Ltd. (NYSE American: MTA) (TSX-V: MTA) is pleased to announce it has entered into a Royalty Purchase Agreement with an arm’s length third-party dated December 9, 2022, to acquire an existing 2.5% to 3.75% gross value return royalty on gold and silver, and a 0.25% to 3.0% net smelter return royalty on copper and other non-precious minerals, extracted from the majority of the Lama project owned by Barrick Gold Corp. (NYSE: GOLD) (TSX: ABX) for total consideration of $7.5 million in common shares and cash.

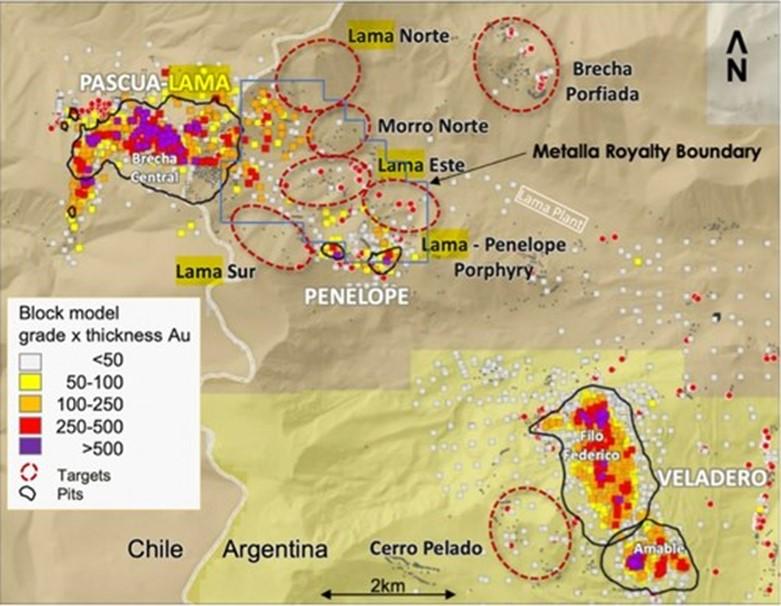

Brett Heath, President & CEO of Metalla, commented, “The Lama project is part of one of the largest gold deposits in the world currently being contemplated by Barrick as a standalone operation. Our royalty will provide Metalla shareholders with outstanding exposure to one of the most significant geological gold bearing trends with a substantial amount of near-term growth, exploration upside, and first in class operator.” Mr. Heath continued “We are excited by the $75 million being spent by Barrick on defining resources on the Lama extensions most of which is covered by the royalty area. This has resulted in some exciting drill results with a new discovery of a gold-copper porphyry style mineralization at depth. Barrick has initiated a study to evaluate the development of a standalone operation at Lama, on the Argentinean side, expected to be completed in Q2 2023, and provide a development decision for the Lama project in 2024.”

LAMA (2.5% GVR)(1)(2)(3)(4)(6)

Lama is the Argentine portion of the 21Moz gold Pascua-Lama project straddling the border between Chile and Argentina. The Chilean Pascua portion has been placed into a closure process while the Argentina Lama portion, which has contained metal of 3.13 Moz gold and 236.9 Moz silver, is being considered as a standalone underground project as part of a potential Veladero-Lama complex operation. Barrick has spent over $4 billion on infrastructure in the vicinity and the Lama project would utilize the semi-completed process plant and tailings facilities. Barrick has outlined a block cave underground Lama project with an initial processing capacity of 13-15 Ktpd with the potential to expand to 30 Ktpd in the future.

Barrick has committed up to $75 million at the Lama project with 10 to 12 drill rigs operating and studies are ongoing to evaluate the capital required to complete the mill and plant facilities in Argentina with a goal to target a development decision in 2024. Recent drilling in the royalty area has confirmed mineralization 300 meters to the east of the current known resource in an area known as Lama East with significant intercepts including 1.79 g/t AuEq over 96.2 meters. At the Lama porphyry target, drilling confirmed the existence of gold-copper porphyry style mineralization at depth with a footprint of 2-km by 1.5-km. The Lama deposit remains open to the east, south and west of the project where no deep drilling has been conducted.

The gold GVR royalty provides for an escalation feature whereby the royalty rate increases from 2.5% to 3.75% after 5 Moz of gold production. In addition, the copper royalty which begins at a 0.25% NSR royalty escalates up to a 3.0% NSR royalty based upon the cumulative net smelter returns from the royalty area.

LAMA REGIONAL ROYALTY MAP(3)

Penelope (2.5% GVR)1,4,5,6

Penelope is a satellite pit of the greater Lama project in the southeast section of the Lama project and less than 10km from the Veladero mine which is in a 50% JV between Barrick and Shandong Gold Mining (SHA: 600547) (1787: HK). In 2021, a small geo-metallurgical drill campaign was carried out to collect additional metallurgical data with a focus on the potential for treating the ore through heap leach processing at Veladero where the mine is nearing an end.

| Reserve & Resource Estimate – Penelope | ||||||

| Tonnes | Gold | Silver | ||||

| (000’s) | (g/t) | (Koz) | (g/t) | (Koz) | ||

| Measured Resources | 570 | 2.7 | 51.5 | 5.2 | 95 | |

| Indicated Resources | 6,870 | 2.1 | 475.1 | 6.4 | 1,425 | |

| Measured & Indicated Resources | 7,450 | 2.2 | 526.6 | 6.4 | 1,520 | |

| Inferred Resources | 30 | 2.2 | 2.2 | 3.4 | 3.39 | |

LAMA ROYALTY MAP(3)

TRANSACTION STRUCTURE

Metalla has agreed to pay an aggregate of $7.5 million in consideration for the Royalties to be satisfied by Metalla through the payment of $2.5 million in cash and the issuance of $2.5 million in common shares on the closing date of the Transaction (based on the 15-day volume-weighted average price of shares traded on the NYSE American LLC prior to this announcement at a price of US$5.3553 per share (representing an aggregate of 466,827 common shares of Metalla). The remaining $2.5 million in cash or common shares of Metalla is to be paid within 90 days upon the earlier of a 2 Moz gold mineral reserve estimate on the royalty area or 36 months after the closing date of the Transaction. Under the RPA, Metalla will retain a pre-emptive right on the future sale of the remaining half of the royalty. The Transaction is subject to customary closing conditions (including the consent of Barrick to the assignment of the Royalties which cannot be unreasonably withheld under the terms of the royalty agreement) and exchange approvals and is expected to close in Q1 2023.

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, M.Sc., geologist and member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT METALLA

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE