Meridian Drills Further High-Grade Au-Cu-Ag & Zn Mineralization at Santa Helena and Opens New Gold Exploration Frontier at Santa Fé

Meridian Drills Further High-Grade Au-Cu-Ag & Zn Mineralization at Santa Helena and Opens New Gold Exploration Frontier at Santa Fé

Meridian Mining UK S (TSX: MNO) (FSE: N2E) (Tradegate: N2E) (OTCQX: MRRDF) is pleased to provide an update on its Santa Helena Au-Cu-Ag & Zn project. Drilling has returned multiple intersections of high-grade Au-Cu-Ag & Zn mineralization from Santa Helena’s ongoing resource delineation drill program[1]. This is highlighted by CD-727 where a greater than 100 gram-metre interval is being reported.

Highlights:

- Meridian drills multiple intersections of shallow high-grade Au-Cu-Ag & Zn mineralization at Santa Helena :

- CD-749: 6.1m @ 10.5g/t AuEq (7.1% CuEq);

- CD-742: 7.6m @ 6.9g/t AuEq (4.6% CuEq);

- Including 2.6m @ 10.5g/t AuEq (7.0% CuEq);

- CD-735: 9.6m @ 5.8g/t AuEq (3.9% CuEq);

- Including 5.7m @ 8.8g/t AuEq (5.9% CuEq);

- CD-727: 15.2m @ 7.4g/t AuEq (4.9% CuEq);

- Including 10.4m @ 9.4g/t AuEq (6.3% CuEq);

- CD-719: 8.4m @ 10.2g/t AuEq (6.8% CuEq);

- Including 5.0m @ 14.4g/t AuEq (9.7% CuEq);

- CD-715: 14.6m @ 5.7g/t AuEq (3.8% CuEq);

- Including 9.2m @ 7.4g/t AuEq (5.0% CuEq);

- Santa Fé’s exploration program maps new frontier for gold exploration via the Aguapei Formation;

- – Aguapei quartz conglomerate channels samples up to 1.5g/t Au;

- – Aguapei Formation is a significant contributor to production in the Alto Guaporé gold province; and

- Regional gold and copper exploration programs expanding with drilling commenced at Cigarra.

True widths are ~85-95% of down-holes widths.

Meridian is also reporting that Santa Fé’s first reconnaissance exploration program has discovered gold mineralization hosted by the overlying basal conglomerates of the Aguapei Formation. The Aguapei has been actively mined for gold in the Alto Guaporé gold province west of Cabaçal. This opens a new frontier for gold exploration in the southeastern areas of the Cabaçal project. The Company is also reporting on the expansion of the exploration program, and the commencement of regional drilling at the Cigarra Cu-Au prospect.

Mr. Gilbert Clark, CEO, comments: “Today’s results are confirming that significant and near-surface extensions of open mineralization extend out from the historical Santa Helena mine. This resource potential I see as being the base of a future second processing hub at Santa Helena, supported by the expanding near mine exploration upside. Santa Fé’s first exploration program has hit the Cabaçal mine sequence, indicating the presence of a large open hydrothermal system. In addition, Santa Fe’s exploration program has opened a new greenfields exploration frontier, following the assaying of gold hosted by the overlying and highly prospective Aguapei Formation. The Aguapei Formation is a prodigious gold host for the Alto Guaporé gold province to the west. Our confidence that the Cabaçal Au-Cu belt is the pre-eminent VMS Au-Cu development project of South America has never been stronger.”

Santa Helena Drilling

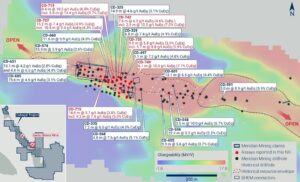

The Santa Helena infill drill program continues, delivering strong results, with recent infill drilling focussed in the western sectors of the deposit (“Figure 1” & “Table 1”). Drilling is being conducted to increase confidence in the Au-Cu-Ag & Zn mineralization’s geometry and grade continuity characteristics. The recent focus has been particularly in the western limits and extensions of the historical mining area where spacing information from historical programs reduces. The underground grade control information did not fully project into these areas in the later stages of the past operation, and a number of diamond holes drilled from underground were not assayed in part or in full.

Figure 1: Santa Helena drilling highlights.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/265631_7a34b93e2431cb57_001full.jpg

Some of strongest intersections highlights include:

CD-735: 9.6m @ 5.8g/t AuEq (3.9% CuEq) from 31.4m – returned from a position centred ~15m above the level of past workings; up dip from CD329’s 6.8m @ 7.4g/t AuEq (4.9% CuEq) from 38.7m;

CD-742: 7.6m @ 6.9g/t AuEq (4.6% CuEq) from 37.7m, including 2.6m @ 10.5g/t AuEq (7.0% CuEq) from 37.7m (terminating in a void). The hole lies lateral to the unmined sequence intersected in CD-521 (15.4m @ 3.8 g/t AuEq / 2.5% CuEq) from 37.2m;

CD-727: 15.2m @ 7.4g/t AuEq (4.9% CuEq) from 32.6m, including 10.4m @ 9.4g/t AuEq (6.3% CuEq) from 32.6m, from a position centred ~15m above the level of past workings;

CD-719: 8.4m @ 10.2g/t AuEq (6.8% CuEq) from 40.8m, including 5.0m @ 14.4g/t AuEq (9.7% CuEq) from 41.8m, from an intact pillar position in the western sector of the workings;

CD-715: 14.6m @ 5.7g/t AuEq (3.8% CuEq) from 28.9m, including 9.2m @ 7.4g/t AuEq (5.0% CuEq) from 30.7m, from a position centred ~10m above the level of past workings with the lowest levels in a pillar; and

CD-749: 6.1m @ 10.5g/t AuEq (7.1% CuEq) from 37.0m (terminating in a void).

Of all of the results, CD-727 has been one of the strongest holes in the project with an interval of 100 gram-meters, and is on an adjacent section to historical BP hole, JUCHD-031, which returned 27.6m @ 5.2g/t AuEq (3.5% CuEq) from 24.9m.

In addition to the intervals above, there are a large number of strongly supporting intersections easily accessible to open pit development from the western zone, with subsidiary highlights being:

| Hole-id | Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

| CD-758 | |||||||||

| 20.0 | 1.0 | 0.7 | 0.5 | 0.2 | 8.5 | 0.9 | 0.3 | 22.6 | |

| CD-756 | |||||||||

| 6.1 | 6.3 | 4.2 | 1.6 | 1.6 | 37.1 | 6.6 | 0.8 | 22.7 | |

| Including | 3.3 | 9.6 | 6.4 | 2.5 | 2.6 | 56.4 | 9.6 | 1.3 | 24.6 |

| CD-747 | |||||||||

| 12.7 | 2.8 | 1.9 | 0.6 | 0.5 | 20.3 | 3.9 | 0.7 | 23.1 | |

| Including | 5.5 | 4.9 | 3.3 | 0.7 | 1.0 | 33.3 | 6.9 | 1.0 | 26.5 |

| CD-741 | |||||||||

| 15.0 | 2.4 | 1.6 | 1.0 | 0.9 | 12.6 | 1.2 | 0.6 | 7.9 | |

| Including | 4.8 | 5.9 | 4.0 | 2.7 | 2.5 | 31.3 | 1.5 | 1.6 | 9.5 |

| CD-738 | |||||||||

| 7.1 | 5.7 | 3.8 | 2.2 | 1.2 | 43.4 | 5.5 | 1.0 | 24.6 | |

| Including | 5.5 | 7.2 | 4.8 | 2.8 | 1.5 | 55.4 | 6.8 | 1.3 | 25.5 |

| 12.1 | 1.6 | 1.1 | 0.3 | 0.1 | 14.4 | 2.7 | 0.8 | 33.9 | |

| CD-725 | |||||||||

| 20.0 | 1.7 | 1.1 | 0.7 | 0.4 | 13.7 | 1.2 | 0.6 | 13.4 | |

| Including | 4.6 | 3.3 | 2.2 | 2.4 | 1.0 | 27.8 | 0.6 | 1.4 | 15.0 |

| CD-723 | |||||||||

| 13.9 | 2.9 | 2.0 | 0.4 | 0.5 | 28.9 | 4.3 | 0.9 | 34.5 | |

| Including | 6.7 | 4.8 | 3.2 | 0.8 | 0.8 | 49.7 | 6.7 | 1.4 | 34.5 |

| CD-712 | |||||||||

| 22.2 | 2.0 | 1.4 | 0.8 | 0.4 | 20.9 | 1.9 | 0.4 | 27.1 | |

| Including | 7.8 | 3.8 | 2.5 | 1.7 | 0.9 | 41.1 | 2.8 | 0.6 | 27.1 |

| CD-706 | |||||||||

| 17.1 | 2.8 | 1.9 | 1.1 | 0.2 | 31.9 | 3.6 | 0.8 | 43.0 | |

| Including | 2.9 | 7.8 | 5.2 | 2.7 | 1.2 | 73.9 | 9.1 | 2.0 | 44.5 |

The drilling is proving useful in approaching the resource modelling in clarifying geometries and testing the void model. The void hole has been largely as predicted from underground Total-Station survey control, although voids intersected in CD-742 and CD-749 showed some minor dislocations from the available end-of-mine model. Some reviews will be made to check on the completeness of the records, or whether those positions could have been influenced by local subsidence. In the same way that mineralization is intersected above the voids that was not incorporated into the mine schedule before closure, it is suspected that there are fold keels and flexures where sulphides may be positioned below. CD-742 for example, being on the same section as JUCHD031, but with a thinner interval. Some further reviews are underway to evaluate whether possible keel positions can be approached from another angle.

The JUCHD-031 – CD-727 position appears to be the focus of the system, with the sheet branching laterally into lobes (e.g. – up dip hole CD-738: 7.1m @ 5.7g/t AuEq (3.8% CuEq) from 24.6m, including 5.5m @ 7.2g/t AuEq (4.8% CuEq) and 12.1m @ 1.6g/t AuEq (1.1% CuEq) from 33.9m.

Resource definition will be ongoing, although some drilling with the low-impact portable rigs is being conducted at Santa Fé, and at Cigarra, and to test strike upside from Santa Helena at Sucuri.

Exploration Update

Aguapei Gold Occurrence

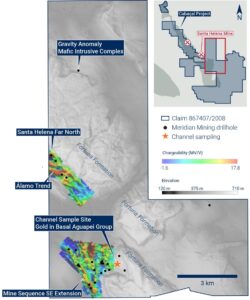

The Aguapei Group is a younger sequence than the Cabaçal Belt and is located along the margin of the Cabaçal belt (“Figure 2”). Channel sampling of the outcrop has identified gold mineralization hosted by the Aguapei’s basal quartz conglomerate unit within a paleochannel and returned the following:

| Channel_id | Interval | Au (g/t) |

Cu (pct) |

Ag (g/t) |

Zn (pct) |

Pb (pct) |

| CA_CN_028 | 0.53 | 1.52 | 0.00 | 0.09 | 0.00 | 0.00 |

| CA_CN_029 | 0.28 | 0.22 | 0.00 | 0.35 | 0.00 | 0.00 |

| CA_CN_030 | 0.40 | 0.09 | 0.00 | 0.02 | 0.00 | 0.00 |

| CA_CN_031 | 0.45 | 0.31 | 0.00 | 0.07 | 0.00 | 0.00 |

| CA_CN_032 | 0.40 | 0.83 | 0.00 | 0.07 | 0.00 | 0.00 |

Gold mineralization is known from the Aguapei Group sedimentary rocks in the Alto Guaporé gold province to the far west, where it is locally in structural contact with the greenstone and hosts part of the resource inventory of that belt. So far as the Company is aware, this is the first recognition of gold in this formation in the Cabaçal Belt. This raises some significant exploration implications:

- That the greenstone sequence may be at explorable depths beneath the Aguapei cover;

- That sedimentary units are locally sourced from a gold-bearing basement unit yet to be discovered;

- That under the right conditions, the unit itself may potentially concentrate economic placer gold.

The recognition of the Cabaçal greenstone sequence in a down-cut valley at Santa Helena North (see below), in an area largely covered by colluvial sediments, indicates that further exploration is needed to delineate the geometry of its contact with the Aguapei. A field mapping program is evaluating this unconformable contact. The basal sedimentary unit of the Aguapei Group flanking the Cabaçal Belt is assigned to Fortuna Formation, the same formational unit as that in the Guaporé Belt although the structural histories of the units may have some local variances.

A series of short holes were drilled in an area of ~100Ha where the channel sampling detected the gold mineralization in the Aguapei, most positioned to the west in more localized channels with only two to the east where the bulk of the formation is developed. Little is known about the geometry of the contact and potential focus of the main channel positions above the unconformity and a different style of geophysical exploration such as seismic or deep ground penetrating radar may be required to map the more favourable sites for mineralization. The drilling did confirm that the Aguapei with relatively shallow depths of 10-30m, including a previously unmapped felsic intrusive phase. Low level gold (CD-737: 13ppb Au from 14.1 – 14.7m) and silver (CD-737: 2.6g/t Ag from 12.1 – 12.6m) support some input from an eroding precious metal source rock into the system. Drilling was paused in this area whilst the Company evaluates the best methodologies for mapping the unconformable contact.

Figure 2: Trend of the basal Fortuna Formation to the Aguapei Group, which channel sampling has identified as auriferous. Branches of the basal conglomerate and sandstone horizon also extend over the greenstone to the west.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/265631_7a34b93e2431cb57_002full.jpg

The Company has been greatly encouraged by this new gold occurrence identified by its ongoing exploration campaigns.

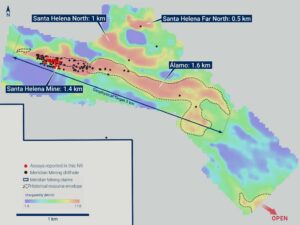

Santa Helena North Update

Further gradient-assay induced polarization surveys have been conducted to the northeast of Santa Helena. The Company previously reported the presence of a 1.0 km strike-length chargeability anomaly – Santa Helena North – with associate sulphide mineralization in this region[2] . The survey has been extended and a further greenstone enclave with an associated chargeability anomaly has been defined – Santa Helena Far North – with a strike length of 0.5 km strike (“Figure 3”).

Figure 3: New chargeability domains northeast of Santa Helena.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/265631_7a34b93e2431cb57_003full.jpg

One drill hole was completed over the Santa Helena North anomaly CD-767, for which assays are pending. The anomaly shows some suggestions of structural disruption and some further work will be required to ensure a complete stratigraphic profile is being intersected. A second hole – CD-762 – was completed as a first test of an area off the main geophysical anomaly, but where some gold in rock chip anomalous float has been detected (to 1.6pm Au). The hole contained trace mineralization (peak of 144 ppb Au over 1.0m from 48.0m, detached from base metal zones, and minor base metal bands (Table 2: peaking 3.2m @ 0.16% Zn, from 19.8m; 3.3m @ 0.19% Cu from 34.3m, within a broader trace sulphide halo). The area is yet to be covered systematically with a full set of techniques but importantly highlights the presence of greenstone in erosionally down-cut area of the Proterozoic Aguapei Group sandstone, with potential for strike extension. Surveying with the Geonics probe detected a broad off-hole conducted to the west of CD-762, measuring 75 x 75m, dipping at ~35o to the northwest, with a conductivity thickness of 8 Siemens.

Santa Fé Update

The Company has drilled a first campaign now at the Santa Fé area, with 1,212 m completed – partly to test the Santa Fé chargeability corridor which extends over 2.5km in broad spaced drilling. Partly as an initial broad test in the channel sampling, although drill positions were limited to the east of the channel where the bulk of the Aguapei unit extends. Importantly, the Company believes that the chargeability corridor represents a correlative to the mine sequence unit and bounding lithologies. There is lateral variation in metal contents, varying from pyrite dominated sequences, to more copper dominated sequences. CD-759 and CD-674 at the southern end of the conductivity trend intersected pyritic halo zones, up to 40-50m wide, with sulphur content reaching up to 16.1% S. There are elevated levels of molybdenum which can act as a VMS pathfinder, along with sodium depletion which is consistent with hydrothermal leaching processes. Correlative positions along strike show variance in the metal assemblage including still pyritic zones, but with more copper dominated intervals such as CD717’s, containing intervals of ~4 – 21m at grades between 0.1 – 0.3% Cu (Table 3).

Regional Update

Two more regional reconnaissance holes were drilled – to test the broader regional geology and projection of the greenstone belt. The historical VTEM survey and historical survey geophysical surveys were previously limited to the mapped greenstone, ignoring the Aguapei Group. Based on regional magnetics, an argument existed for structural extensions to the Santa Helena trend, possibly branching through the southern sector of the licence area. One deeper hole was drilled to test a magnetic inversion model and confirmed a deeper Aguapei cover (vertical depth of 86m, CD-765), with the hole terminating in a gabbroic intrusive similar to the footwall gabbro at Santa Helena. Another hole was drilled into the flank of a gravity anomaly ~5km northeast of Santa Helena, and unexpectedly passed directly into a gabbro unit, in a position expected to be near the upper levels of the Aguapei Group’s Fortuna Formation. This is believed also to represent a basement high, suggesting again a highly variable but explorable thickness to the unit.

Drilling in this southeastern area is paused now whilst final assay results are awaited, with the focus switching to the initial program at Cigarra. The land access team is working to establish agreements also on the newly granted licences and initiate the process of application for new environmental licences for exploration in these areas.

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with 70% passing 85% passing 200µm. Routine gold analyses have been conducted by Au‐AA24 (fire assay of a 50g charge with AAS finish). High‐grade samples (>10g/t Au) are repeated with a gravimetric finish (Au‐GRA22), and base metal analysis by methods ME-ICP61 and OG62 (four acid digest with ICP-AES finish). Visible gold intervals are sampled by metallic screen fire assay method Au‐SCR21. Samples are held in the Company’s secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lots exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 85-95% of intersection width. Assay figures and intervals are rounded to 1 decimal place.

Gold equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. AuEq (g/t) = (Au(g/t) * 65%Recovery) + (1.492*Cu(%) * 89%Recovery) + (0.474*Zn% * 89%Recovery)) + (0.013*Ag(g/t) * 61%Recovery)). CuEq (%) = (Cu(%) * 89%Recovery) + (0.318*Zn% * 89%Recovery)) + (0.67*Au(g/t) * 65%Recovery) + (0.0087*Ag(g/t) * 61%Recovery)). Metallurgical testwork is currently in progress to evaluate recoveries in primary lithologies and saprolite, with formulas to be updated based on revised recoveries pricing. The same formula has provisionally been applied to satellite targets at Santa Helena North and in the Santa Fé area.

Induced polarization surveys have been conducted by the Company’s in-house team utilizing its GDD GRx8-16c receiver and 5000W-2400-15A transmitter. Results are sent daily for processing and quality control to the Company’s consultancy, Core Geophysics. Modelling of conductivity response is undertaken using industry-standard Maxwell software. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person Statement

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, verified and approved the technical information in this news release.

About Meridian

Meridian Mining is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

- Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report dated March 31, 2025, entitled: “Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study” outlines a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million, leading to capital repayment in 17 months (assuming metals price scenario of USD 2,119 per ounces of gold, USD 4.16 per pound of copper, and USD 26.89 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 742 per ounce gold equivalent & production profile of 141,000 ounce gold equivalent life of mine, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.3:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold, 0.44% copper and 1.64g/t silver (at a 0.25 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.meridianmining.co.

Table 1: Assay Results from Santa Helena Drilling

| Hole-id | Dip | Azi | EOH (m) |

Zone | Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

| CD-758 | -59 | 188 | 65.0 | SHM | |||||||||

| 20.0 | 1.0 | 0.7 | 0.5 | 0.2 | 8.5 | 0.9 | 0.3 | 22.6 | |||||

| Including | 1.4 | 3.2 | 2.1 | 1.0 | 1.1 | 21.3 | 2.0 | 0.3 | 34.6 | ||||

| 1.0 | 0.4 | 0.2 | 0.1 | 0.0 | 4.2 | 0.6 | 0.4 | 46.6 | |||||

| 1.3 | 0.6 | 0.4 | 0.1 | 0.3 | 1.6 | 0.2 | 0.0 | 53.9 | |||||

| CD-757 | -81 | 189 | 72.1 | SHM | |||||||||

| 8.7 | 1.5 | 1.0 | 0.3 | 0.4 | 13.9 | 1.5 | 0.5 | 18.7 | |||||

| Including | 0.9 | 7.1 | 4.8 | 1.7 | 3.0 | 62.5 | 3.9 | 1.8 | 19.4 | ||||

| Including | 1.0 | 2.9 | 2.0 | 0.7 | 0.8 | 21.9 | 3.0 | 0.4 | 26.4 | ||||

| CD-756 | -81 | 189 | 75.0 | SHM | |||||||||

| 6.1 | 6.3 | 4.2 | 1.6 | 1.6 | 37.1 | 6.6 | 0.8 | 22.7 | |||||

| Including | 3.3 | 9.6 | 6.4 | 2.5 | 2.6 | 56.4 | 9.6 | 1.3 | 24.6 | ||||

| 3.3 | 0.6 | 0.4 | 0.3 | 0.0 | 8.3 | 0.6 | 0.3 | 31.2 | |||||

| 3.4 | 0.5 | 0.3 | 0.0 | 0.1 | 0.9 | 0.9 | 0.0 | 42.4 | |||||

| 1.2 | 0.6 | 0.4 | 0.3 | 0.0 | 3.5 | 0.7 | 0.1 | 72.0 | |||||

| CD-754 | -85 | 196 | 60.0 | SHM | |||||||||

| 2.8 | 0.6 | 0.4 | 0.6 | 0.0 | 12.5 | 0.3 | 0.3 | 18.5 | |||||

| 3.0 | 0.7 | 0.5 | 0.1 | 0.1 | 2.7 | 1.0 | 0.2 | 31.1 | |||||

| Including | 1.4 | 0.9 | 0.6 | 0.1 | 0.1 | 3.0 | 1.6 | 0.3 | 32.6 | ||||

| 1.5 | 0.9 | 0.6 | 1.0 | 0.0 | 4.7 | 0.6 | 0.3 | 42.5 | |||||

| 4.0 | 0.4 | 0.3 | 0.0 | 0.1 | 1.0 | 0.6 | 0.1 | 49.0 | |||||

| CD-749 | -89 | 000 | 49.6 | SHM | |||||||||

| 6.1 | 10.5 | 7.1 | 2.4 | 3.2 | 61.7 | 10.1 | 1.2 | 37.0 | |||||

| CD-747 | -55 | 190 | 90.1 | SHM | |||||||||

| 12.7 | 2.8 | 1.9 | 0.6 | 0.5 | 20.3 | 3.9 | 0.7 | 23.1 | |||||

| Including | 5.5 | 4.9 | 3.3 | 0.7 | 1.0 | 33.3 | 6.9 | 1.0 | 26.5 | ||||

| Including | 2.5 | 7.6 | 5.1 | 1.1 | 1.9 | 41.1 | 9.4 | 1.1 | 26.5 | ||||

| 2.3 | 0.5 | 0.3 | 0.3 | 0.0 | 7.7 | 0.5 | 0.2 | 38.9 | |||||

| CD-746 | -44 | 192 | 70.1 | SHM | |||||||||

| 3.5 | 1.1 | 0.7 | 0.0 | 0.5 | 4.8 | 0.8 | 0.0 | 14.0 | |||||

| 1.6 | 0.8 | 0.5 | 0.3 | 0.1 | 28.3 | 0.6 | 0.5 | 31.6 | |||||

| 4.5 | 0.8 | 0.5 | 0.3 | 0.2 | 6.3 | 0.6 | 0.2 | 41.3 | |||||

| 1.4 | 2.1 | 1.4 | 0.3 | 0.2 | 8.6 | 4.0 | 0.4 | 51.6 | |||||

| CD-742 | -90 | 000 | 50.4 | SHM | |||||||||

| 7.6 | 6.9 | 4.6 | 1.1 | 1.1 | 55.6 | 10.2 | 1.9 | 37.7 | |||||

| Including | 2.8 | 7.7 | 5.2 | 2.0 | 1.0 | 77.3 | 10.6 | 2.3 | 37.7 | ||||

| Including | 2.6 | 10.5 | 7.0 | 0.8 | 1.9 | 64.7 | 16.6 | 2.6 | 42.6 | ||||

| CD-741 | -72 | 195 | 70.1 | SHM | |||||||||

| 15.0 | 2.4 | 1.6 | 1.0 | 0.9 | 12.6 | 1.2 | 0.6 | 7.9 | |||||

| Including | 4.8 | 5.9 | 4.0 | 2.7 | 2.5 | 31.3 | 1.5 | 1.6 | 9.5 | ||||

| 6.5 | 1.1 | 0.7 | 0.2 | 0.2 | 8.5 | 1.7 | 0.2 | 36.0 | |||||

| 3.8 | 1.1 | 0.8 | 0.3 | 0.1 | 7.5 | 1.8 | 0.6 | 48.6 | |||||

| 2.3 | 0.4 | 0.3 | 0.0 | 0.1 | 1.3 | 0.8 | 0.3 | 58.0 | |||||

| CD-738 | -73 | 189 | 75.0 | SHM | |||||||||

| 7.1 | 5.7 | 3.8 | 2.2 | 1.2 | 43.4 | 5.5 | 1.0 | 24.6 | |||||

| Including | 5.5 | 7.2 | 4.8 | 2.8 | 1.5 | 55.4 | 6.8 | 1.3 | 25.5 | ||||

| Including | 2.8 | 10.2 | 6.9 | 3.9 | 2.2 | 81.7 | 9.8 | 1.8 | 25.9 | ||||

| 12.1 | 1.6 | 1.1 | 0.3 | 0.1 | 14.4 | 2.7 | 0.8 | 33.9 | |||||

| Including | 1.4 | 4.4 | 3.0 | 0.7 | 0.1 | 40.4 | 8.3 | 1.9 | 33.9 | ||||

| CD-736 | -67 | 198 | 55.0 | SHM | |||||||||

| 6.0 | 1.6 | 1.0 | 0.5 | 0.6 | 10.8 | 0.7 | 0.3 | 6.2 | |||||

| Including | 2.2 | 2.7 | 1.8 | 1.2 | 1.0 | 12.8 | 1.3 | 0.6 | 6.6 | ||||

| 3.6 | 0.4 | 0.3 | 0.0 | 0.0 | 0.5 | 0.9 | 0.0 | 17.4 | |||||

| 3.3 | 1.7 | 1.1 | 0.2 | 0.0 | 17.5 | 3.2 | 1.2 | 24.7 | |||||

| Including | 2.0 | 2.3 | 1.6 | 0.3 | 0.0 | 25.5 | 4.5 | 1.8 | 26.0 | ||||

| 3.2 | 0.3 | 0.2 | 0.2 | 0.0 | 1.8 | 0.3 | 0.1 | 37.7 | |||||

| 0.7 | 0.7 | 0.5 | 0.0 | 0.1 | 2.8 | 1.4 | 0.3 | 50.5 | |||||

| CD-735 | -76 | 184 | 75.0 | SHM | |||||||||

| 9.6 | 5.8 | 3.9 | 1.6 | 1.7 | 34.3 | 5.3 | 0.5 | 31.4 | |||||

| Including | 5.7 | 8.8 | 5.9 | 2.4 | 2.6 | 50.5 | 8.0 | 0.7 | 32.7 | ||||

| Including | 2.1 | 12.1 | 8.1 | 3.4 | 3.7 | 68.7 | 10.6 | 0.9 | 32.7 | ||||

| 2.3 | 1.5 | 1.0 | 0.6 | 0.1 | 14.5 | 2.2 | 0.9 | 46.9 | |||||

| 1.6 | 0.4 | 0.3 | 0.1 | 0.0 | 3.1 | 0.6 | 0.2 | 59.3 | |||||

| CD-734 | -70 | 194 | 50.1 | SHM | |||||||||

| 3.0 | 0.6 | 0.4 | 0.1 | 0.2 | 3.4 | 0.6 | 0.1 | 6.3 | |||||

| 14.0 | 1.0 | 0.6 | 0.4 | 0.1 | 9.7 | 1.1 | 0.4 | 11.8 | |||||

| Including | 4.5 | 2.2 | 1.4 | 1.2 | 0.1 | 19.0 | 2.5 | 0.8 | 21.3 | ||||

| 2.6 | 2.3 | 1.5 | 0.1 | 0.1 | 14.8 | 4.6 | 0.7 | 30.7 | |||||

| CD-730 | -68 | 194 | 55.2 | SHM | |||||||||

| 11.9 | 1.2 | 0.8 | 0.6 | 0.3 | 9.5 | 0.8 | 0.3 | 15.9 | |||||

| Including | 1.4 | 3.0 | 2.0 | 3.2 | 0.3 | 46.9 | 0.3 | 1.2 | 16.6 | ||||

| 1.0 | 0.7 | 0.5 | 0.1 | 0.1 | 5.3 | 1.4 | 0.4 | 30.5 | |||||

| 1.5 | 0.8 | 0.5 | 0.1 | 0.1 | 8.2 | 1.4 | 0.6 | 35.5 | |||||

| 0.9 | 1.9 | 1.3 | 0.8 | 0.1 | 10.6 | 2.7 | 0.6 | 43.0 | |||||

| CD-729 | -61 | 196 | 51.1 | SHM | |||||||||

| 4.3 | 0.5 | 0.4 | 0.3 | 0.0 | 5.6 | 0.7 | 0.2 | 16.7 | |||||

| 9.4 | 0.7 | 0.5 | 0.2 | 0.1 | 8.2 | 0.9 | 0.2 | 24.2 | |||||

| CD-727 | -66 | 193 | 63.2 | SHM | |||||||||

| 15.2 | 7.4 | 4.9 | 1.9 | 2.2 | 47.7 | 6.8 | 0.8 | 32.6 | |||||

| Including | 10.4 | 9.4 | 6.3 | 2.6 | 3.0 | 65.0 | 7.7 | 1.0 | 32.6 | ||||

| Including | 4.7 | 12.1 | 8.1 | 3.1 | 4.4 | 83.2 | 8.6 | 0.9 | 34.3 | ||||

| 3.3 | 2.2 | 1.4 | 0.4 | 0.2 | 19.6 | 3.5 | 0.6 | 54.3 | |||||

| CD-725 | -60 | 190 | 65.1 | SHM | |||||||||

| 20.0 | 1.7 | 1.1 | 0.7 | 0.4 | 13.7 | 1.2 | 0.6 | 13.4 | |||||

| Including | 4.6 | 3.3 | 2.2 | 2.4 | 1.0 | 27.8 | 0.6 | 1.4 | 15.0 | ||||

| 2.9 | 1.1 | 0.7 | 0.2 | 0.1 | 3.0 | 1.8 | 0.4 | 36.8 | |||||

| 6.5 | 0.4 | 0.3 | 0.1 | 0.1 | 3.8 | 0.5 | 0.1 | 47.2 | |||||

| CD-723 | -60 | 190 | 95.0 | SHM | |||||||||

| 13.9 | 2.9 | 2.0 | 0.4 | 0.5 | 28.9 | 4.3 | 0.9 | 34.5 | |||||

| Including | 6.7 | 4.8 | 3.2 | 0.8 | 0.8 | 49.7 | 6.7 | 1.4 | 34.5 | ||||

| Including | 2.3 | 7.7 | 5.1 | 0.9 | 1.0 | 73.0 | 12.3 | 2.9 | 38.0 | ||||

| Including | 1.3 | 4.6 | 3.1 | 0.2 | 0.3 | 28.8 | 9.2 | 1.8 | 43.5 | ||||

| 7.3 | 0.3 | 0.2 | 0.0 | 0.0 | 3.2 | 0.6 | 0.4 | 57.0 | |||||

| CD-720 | -70 | 193 | 60.2 | SHM | |||||||||

| 14.5 | 1.1 | 0.7 | 0.5 | 0.3 | 10.6 | 0.6 | 0.6 | 13.0 | |||||

| Including | 3.1 | 2.6 | 1.7 | 1.7 | 0.8 | 16.9 | 0.7 | 1.5 | 13.0 | ||||

| 1.5 | 2.9 | 1.9 | 0.3 | 0.4 | 16.6 | 5.0 | 0.9 | 32.2 | |||||

| 8.1 | 0.5 | 0.4 | 0.1 | 0.1 | 2.9 | 0.8 | 0.2 | 38.0 | |||||

| CD-719 | -81 | 191 | 80.0 | SHM | |||||||||

| 8.4 | 10.2 | 6.8 | 2.4 | 2.3 | 77.4 | 11.7 | 1.8 | 40.8 | |||||

| Including | 5.0 | 14.4 | 9.7 | 3.6 | 3.4 | 110.6 | 15.7 | 2.3 | 41.8 | ||||

| 1.4 | 0.9 | 0.6 | 0.0 | 0.1 | 10.9 | 1.8 | 0.5 | 55.2 | |||||

| CD-718 | -85 | 186 | 65.0 | SHM | |||||||||

| 5.5 | 2.3 | 1.6 | 1.1 | 0.7 | 19.4 | 1.1 | 0.2 | 23.8 | |||||

| 0.7 | 6.0 | 4.0 | 1.5 | 1.2 | 37.6 | 7.3 | 1.9 | 31.8 | |||||

| 8.8 | 0.9 | 0.6 | 0.1 | 0.1 | 6.9 | 1.6 | 0.4 | 36.5 | |||||

| CD-715 | -70 | 190 | 65.1 | SHM | |||||||||

| 14.6 | 5.7 | 3.8 | 1.0 | 1.5 | 49.4 | 6.3 | 0.8 | 28.9 | |||||

| Including | 9.2 | 7.4 | 5.0 | 1.5 | 2.0 | 62.2 | 7.8 | 1.0 | 30.7 | ||||

| Including | 1.5 | 11.2 | 7.5 | 2.1 | 3.0 | 82.0 | 12.4 | 1.7 | 30.7 | ||||

| Including | 2.2 | 11.6 | 7.8 | 2.7 | 3.5 | 100.3 | 10.3 | 1.2 | 37.5 | ||||

| 3.5 | 1.0 | 0.7 | 0.3 | 0.1 | 12.9 | 1.2 | 0.6 | 47.2 | |||||

| CD-714 | -69 | 193 | 30.1 | SHM | |||||||||

| 19.6 | 0.6 | 0.4 | 0.2 | 0.2 | 3.4 | 0.5 | 0.1 | 2.4 | |||||

| CD-712 | -70 | 189 | 60.0 | SHM | |||||||||

| 22.2 | 2.0 | 1.4 | 0.8 | 0.4 | 20.9 | 1.9 | 0.4 | 27.1 | |||||

| Including | 7.8 | 3.8 | 2.5 | 1.7 | 0.9 | 41.1 | 2.8 | 0.6 | 27.1 | ||||

| Including | 4.4 | 5.4 | 3.6 | 1.6 | 1.5 | 47.7 | 4.7 | 0.6 | 28.1 | ||||

| CD-711 | -70 | 194 | 25.0 | SHM | |||||||||

| 20.4 | 0.5 | 0.3 | 0.1 | 0.2 | 2.2 | 0.4 | 0.1 | 0.4 | |||||

| Including | 3.3 | 1.2 | 0.8 | 0.2 | 0.2 | 2.3 | 1.7 | 0.2 | 17.5 | ||||

| CD-708 | -77 | 179 | 85.1 | SHM | |||||||||

| 5.8 | 0.6 | 0.4 | 0.1 | 0.1 | 4.8 | 0.9 | 0.1 | 44.6 | |||||

| 7.9 | 1.6 | 1.1 | 0.1 | 0.1 | 19.3 | 2.8 | 0.7 | 58.2 | |||||

| Including | 3.0 | 2.4 | 1.6 | 0.1 | 0.2 | 33.5 | 4.4 | 1.1 | 58.2 | ||||

| 3.6 | 2.0 | 1.4 | 0.1 | 0.1 | 14.6 | 4.0 | 0.7 | 68.7 | |||||

| CD-706 | -66 | 188 | 65.3 | SHM | |||||||||

| 17.1 | 2.8 | 1.9 | 1.1 | 0.2 | 31.9 | 3.6 | 0.8 | 43.0 | |||||

| Including | 13.0 | 3.3 | 2.2 | 1.3 | 0.3 | 38.8 | 4.1 | 1.0 | 44.5 | ||||

| Including | 2.9 | 7.8 | 5.2 | 2.7 | 1.2 | 73.9 | 9.1 | 2.0 | 44.5 | ||||

| CD-705 | -51 | 190 | 41.9 | SHM | |||||||||

| 4.1 | 0.5 | 0.3 | 0.4 | 0.1 | 9.0 | 0.1 | 0.4 | 0.0 | |||||

| Including | 24.4 | 1.0 | 0.7 | 0.2 | 0.3 | 3.2 | 1.2 | 0.3 | 8.0 |

Table 2: Assay Results from Santa Helena North

| Hole-id | Dip | Azi | EOH (m) |

Zone | Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

| CD-762 | -80 | 028 | 90.1 | SHNth | |||||||||

| 3.2 | 0.1 | 0.1 | 0.0 | 0.0 | 0.4 | 0.2 | 0.0 | 19.8 | |||||

| 1.9 | 0.1 | 0.1 | 0.0 | 0.0 | 0.4 | 0.1 | 0.0 | 27.9 | |||||

| 3.3 | 0.3 | 0.2 | 0.0 | 0.2 | 2.6 | 0.1 | 0.0 | 34.3 | |||||

| Including | 2.1 | 0.4 | 0.3 | 0.0 | 0.2 | 3.5 | 0.1 | 0.0 | 35.5 | ||||

| Including | 0.8 | 0.6 | 0.4 | 0.0 | 0.4 | 3.2 | 0.1 | 0.0 | 36.2 |

Table 3: Assay Results from Santa Fé Drilling

| Hole-id | Dip | Azi | EOH (m) |

Zone | Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

| CD-766 | -59 | 270 | 100.7 | NSI | |||||||||

| CD-765 | -60 | 210 | 150.3 | NSI | |||||||||

| CD-764 | -44 | 046 | 106.1 | SFE | |||||||||

| 0.5 | 0.1 | 0.1 | 0.0 | 0.0 | 2.2 | 0.2 | 0.1 | 37.5 | |||||

| 0.5 | 0.1 | 0.1 | 0.0 | 0.0 | 2.0 | 0.2 | 0.1 | 45.6 | |||||

| 0.8 | 0.1 | 0.1 | 0.0 | 0.0 | 1.2 | 0.2 | 0.1 | 48.0 | |||||

| CD-759 | -45 | 047 | 135.4 | SFE | |||||||||

| 0.4 | 0.1 | 0.1 | 0.0 | 0.0 | 0.3 | 0.0 | 0.0 | 28.0 | |||||

| 0.9 | 0.1 | 0.1 | 0.0 | 0.0 | 0.4 | 0.1 | 0.1 | 37.5 | |||||

| 1.0 | 0.1 | 0.1 | 0.0 | 0.0 | 1.9 | 0.2 | 0.1 | 97.0 | |||||

| 1.4 | 0.2 | 0.1 | 0.0 | 0.1 | 0.5 | 0.0 | 0.0 | 104.6 | |||||

| CD-755 | -45 | 044 | 90.2 | SFE | |||||||||

| 1.6 | 0.2 | 0.1 | 0.0 | 0.1 | 0.1 | 0.0 | 0.0 | 14.4 | |||||

| 5.4 | 0.4 | 0.3 | 0.0 | 0.3 | 0.3 | 0.0 | 0.0 | 42.5 | |||||

| Including | 1.2 | 0.8 | 0.5 | 0.0 | 0.6 | 0.5 | 0.0 | 0.0 | 46.0 | ||||

| CD-753 | -90 | 000 | 25.2 | SFE | NSI | ||||||||

| CD-751 | -90 | 000 | 25.4 | SFE | NSI | ||||||||

| CD-744 | -90 | 000 | 26.4 | SFE | NSI | ||||||||

| CD-739 | -45 | 178 | 65.1 | SFE | NSI | ||||||||

| CD-737 | -45 | 179 | 49.4 | SFE | NSI |

| Hole-id | Dip | Azi | EOH (m) |

Zone | Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

| CD-728 | -46 | 045 | 100.1 | SFE | |||||||||

| 3.5 | 0.1 | 0.1 | 0.0 | 0.1 | 0.2 | 0.0 | 0.0 | 2.3 | |||||

| 1.5 | 0.1 | 0.1 | 0.0 | 0.0 | 0.3 | 0.1 | 0.0 | 69.0 | |||||

| 0.4 | 0.2 | 0.1 | 0.0 | 0.0 | 0.9 | 0.4 | 0.3 | 78.0 | |||||

| CD-724 | -46 | 044 | 75.7 | SFE | |||||||||

| 10.3 | 0.2 | 0.1 | 0.0 | 0.1 | 0.5 | 0.1 | 0.0 | 12.0 | |||||

| Including | 4.1 | 0.3 | 0.2 | 0.0 | 0.1 | 0.6 | 0.2 | 0.0 | 12.0 | ||||

| CD-722 | -45 | 044 | 100.1 | SFE | |||||||||

| 21.4 | 0.2 | 0.1 | 0.0 | 0.1 | 0.2 | 0.0 | 0.0 | 10.0 | |||||

| Including | 3.8 | 0.3 | 0.2 | 0.0 | 0.2 | 0.5 | 0.0 | 0.0 | 26.4 | ||||

| 2.0 | 0.1 | 0.1 | 0.0 | 0.0 | 0.1 | 0.2 | 0.0 | 40.0 | |||||

| CD-717 | -45 | 045 | 101.0 | SFE | |||||||||

| 16.6 | 0.3 | 0.2 | 0.0 | 0.19 | 0.3 | 0.0 | 0.0 | 11.4 |

________________________

1 See Meridian news release of April 15, 2025.

2 Meridian Mining News Release of July 9, 2025

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE