Maple Gold Reports Final Assay Results at Eagle and Completes More than 7,000 Metres of Deep Drilling at Telbel

Maple Gold Mines Ltd. (TSX-V: MGM) (OTCQB: MGMLF) (FSE: M3G) is pleased to report results from the final 20% of assays that were received from the previously completed 14,720 metres of drilling at the 100%-controlled Eagle Mine Property. The Company is also pleased to report that more than 7,000 m have now been completed (6,000 m planned) at the Telbel Mine area of the Joutel Project, which is held by a 50/50 joint venture between the Company and Agnico Eagle Gold Mines Limited.

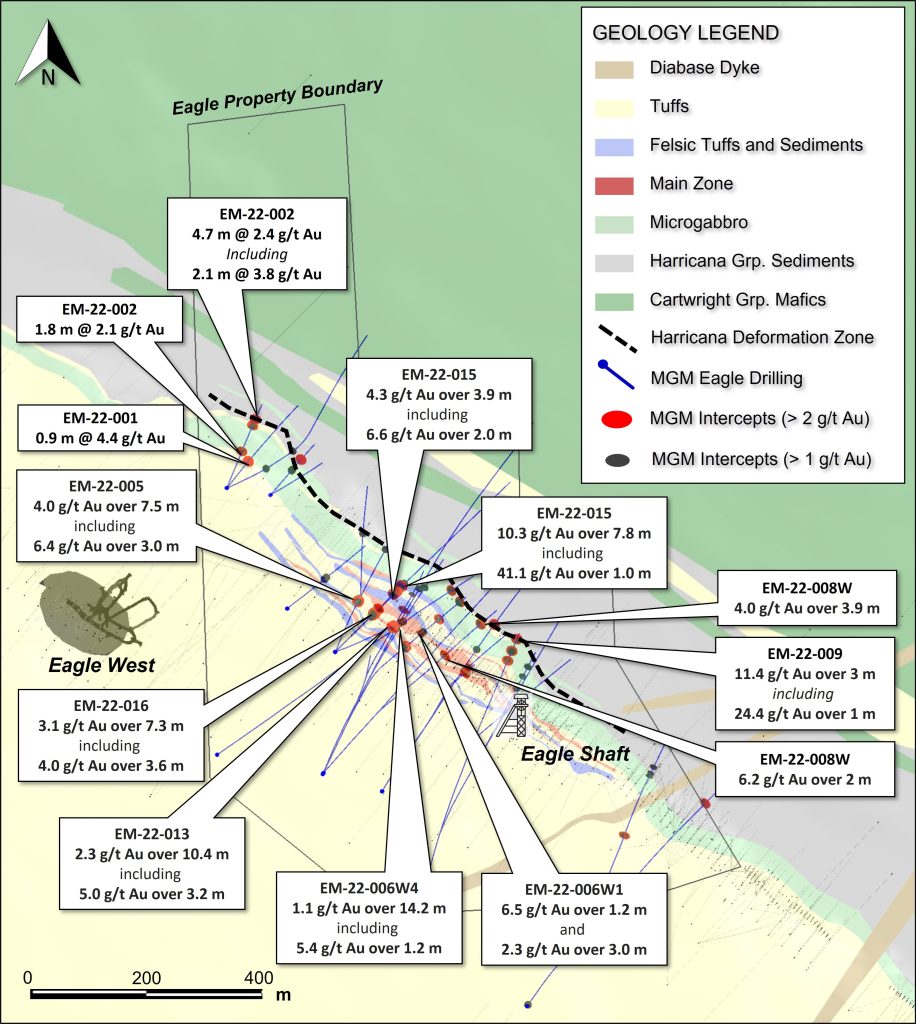

The final batch of assays received from completed drilling at Eagle correspond to approximately 3,000 m of the 14,720 m drilled to-date. The results continue to demonstrate continuity of mineralization and the potential significance of the multiple horizons/splays to the northwest of the former Eagle mine. Highlights include (see Table 1 and Figure 1 for highlighted results from all Maple Gold drilling at Eagle to-date):

- EM-22-008W intersected 6.2 grams per tonne gold over 2.0 m in the South Mine Horizon and 4.2 g/t Au over 3.9 m in sediments further downhole.

- EM-22-006W1 intersected multiple intercepts including 6.5 g/t Au over 1.2 m and 2.0 g/t Au over 3.0 m in the SMH and 2.3 g/t Au over 3.0 m at the microgabbro/Harricana sediment contact further downhole.

- EM-22-006W4 intersected 4.0 g/t Au over 0.7 m within a broader 1.1 g/t Au over 14.2 m intercept within the SMH.

- EM-22-017A intersected 2.9 g/t Au over 2.0 m and additional lower grade over broader near-surface intervals (1.0 g/t Au over 15.5 m from 93 m downhole).

“We have come along way since first consolidating the Joutel ground into our JV property package,” stated Matthew Hornor, CEO of Maple Gold. “All of our exploration and drilling work along the past-producing Eagle-Telbel mine trend is designed with the aim of defining high-grade zones of gold mineralization and additional mineral resources to complement the established potentially bulk-mineable resource present at Douay. Our first year of drilling at Eagle has more than covered our exploration spending commitments to earn a 100% interest and we are now in position to finalize our compilation and model updates to support focused follow-up drilling in areas we believe have the most promise to deliver additional high-quality ounces.”

Overview Summary and Key Takeaways from Drilling at Eagle

The Eagle-Telbel Mine trend produced 1.1 Moz at 6.5 g/t Au from 1974 – 1993, during a period when the price of gold averaged approximately $350 per ounce. During the first year of the JV (2021), all historical mining, stope and drilling data was digitized to underpin a new 3D geological model. The Company signed an option agreement to acquire a 100% interest in the Eagle Mine Property (see press release July 19, 2021) and has since completed more than 21,500 m of drilling across the 4 km long Eagle-Telbel Mine trend, with 14,720 m at Eagle (see Figure 1) and more than 7,000 m (assays pending) of JV drilling at Telbel.

The Company’s drilling to-date at Eagle has served to confirm that gold mineralization is not limited to a narrow stratigraphic interval (Eagle-Telbel Mine Horizon) but instead covers a significantly broader stratigraphic interval of over 100 m straddling the Harricana Deformation Zone. Drill core observations also support the Company’s concept of a significant structural component to gold mineralization in the form of an orogenic gold overprint.

Figure 1: Plan view map showing drilling to-date at Eagle with highlighted intercepts.

Several highlights from the Company’s first year of drilling at Eagle are summarized below (see Figure 1 above for locations):

- EM-22-005: 4.0 g/t Au over 7.5 m, including 6.4 g/t Au over 3.0 m

- EM-22-009: 11.4 g/t Au over 3 m, including 24.4 g/t Au over 1 m

- EM-22-013: 2.3 g/t Au over 10.4 m, including 5.0 g/t Au over 3.2 m

- EM-22-015: 10.3 g/t Au over 7.8 m, including 41.1 g/t Au over 1.0 m

- EM-22-015: 4.3 g/t Au over 3.9 m, including 7.4 g/t Au over 1.5 m

- EM-22-016: 3.1 g/t Au over 7.3 m, including 4.0 g/t Au over 3.6 m

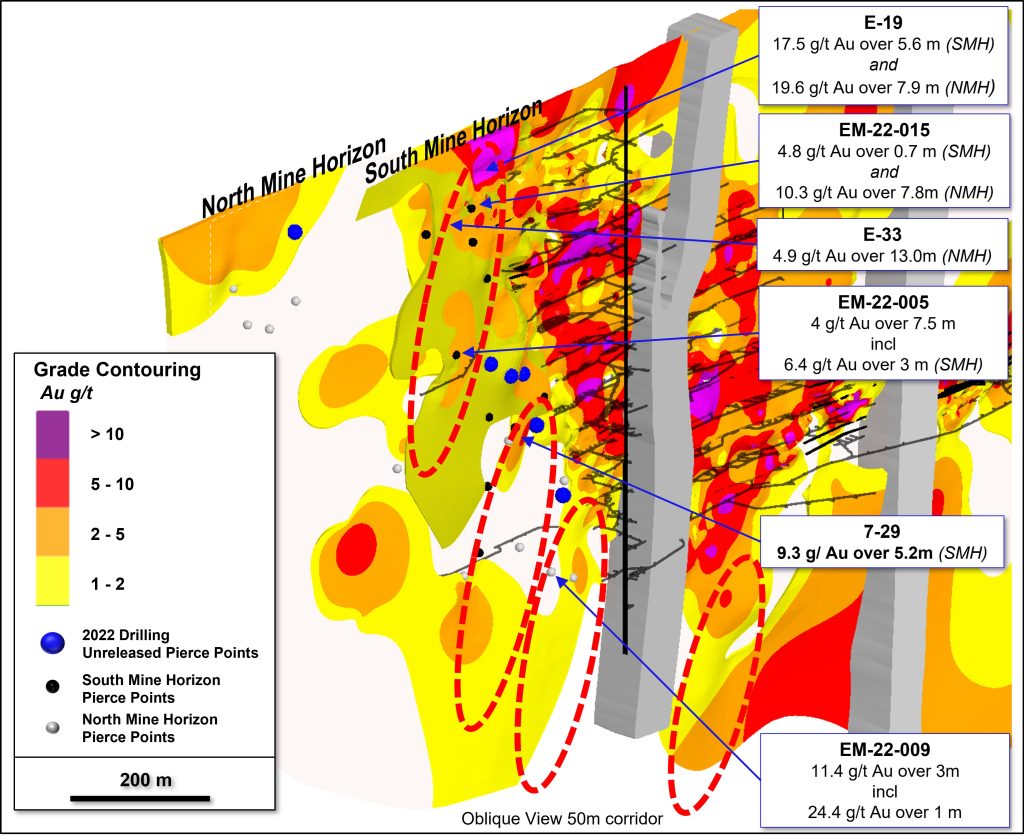

When combining the Company’s drilling results and observations with notable historical results and new geophysical data, several priority target areas emerge along the SMH and North Mine Horizon (“NMH”); including multiple cross-plunging target concepts that will form part of the focus for the Company’s next phase of drilling (~5,000 m). The Company has initiated target definition and permitting work for a planned summer 2023 follow-up program at Eagle (see press release March 16, 2023) and priority follow-up targets will also be defined at Telbel once assay results have been received and interpreted from the first phase of deep drilling.

Figure 2: Oblique view showing SMH and NMH trends with grade contouring and highlighted pierce points with corresponding intercepts and target areas.

Table 2: Highlighted Assay Results from Maple Gold Drilling at Eagle to-date

| Hole | UTME | UTMN | Azimuth | Plunge | Length (m) | From | To | Interval | Au g/t |

| EM-22-001 | 690565 | 5486334 | 40.6 | -66.8 | 356.6 | 132.0 | 134.6 | 2.6 | 1.7 |

| including | 133.7 | 134.6 | 0.9 | 4.4 | |||||

| EM-22-002 | 690565 | 5486334 | 22.0 | -52.4 | 243 | 183.2 | 185.0 | 1.8 | 2.1 |

| EM-22-002 | 200.4 | 205.0 | 4.7 | 2.4 | |||||

| including | 200.4 | 202.4 | 2.1 | 3.8 | |||||

| EM-22-003 | 690642 | 5486322 | 59.1 | -70.5 | 288 | Narrow intercepts <1 g/t Au | |||

| EM-22-004 | 690673 | 5486120 | 49.9 | -56.0 | 288 | 139.0 | 141.0 | 2.0 | 1.2 |

| EM-22-005 | 690758 | 5486043 | 22.6 | -75.7 | 714 | 346.0 | 360.0 | 14.0 | 2.2 |

| including | 346.0 | 353.5 | 7.5 | 4.0 | |||||

| including | 350.0 | 353.0 | 3.0 | 6.4 | |||||

| EM-22-006 | 690737 | 5485828 | 25.9 | -63.2 | 777.75 | 539.3 | 543.0 | 3.7 | 1.3 |

| EM-22-007 | 690736 | 5485826 | 23.9 | -73.2 | 985 | 877.0 | 878.0 | 1.0 | 2.0 |

| EM-22-009 | 690921 | 5485639 | 17.5 | 71.4 | 1009 | 920.4 | 921.0 | 0.6 | 10.8 |

| EM-22-009 | 951.0 | 956.0 | 5.0 | 1.6 | |||||

| EM-22-009 | 984.0 | 993.0 | 9.0 | 4.0 | |||||

| EM-22-009 | 990.0 | 993.0 | 3.0 | 11.4 | |||||

| EM-22-009 | 991.0 | 993.0 | 2.0 | 15.5 | |||||

| including | 992.0 | 993.0 | 1.0 | 24.4 | |||||

| EM-22-010 | 690841 | 5485795 | 32.5 | -71.4 | 570 | 539.5 | 540.0 | 0.5 | 14.0 |

| EM-22-010 | 543.0 | 544.0 | 1.0 | 8.3 | |||||

| EM-22-010W | 690841 | 5485795 | 34.1 | -61.2 | 932 | 921.0 | 922.0 | 1.0 | 3.7 |

| EM-22-011 | 690547 | 5485859 | 56.7 | -62 | 924 | 858.3 | 859.0 | 0.7 | 3.2 |

| EM-22-012 | 691098.7 | 5485413 | 35.3 | -78.6 | 1284 | 1232.2 | 1234.3 | 2.1 | 2.0 |

| EM-22-013 | 690757.5 | 5486043 | 63.8 | -69.8 | 327 | 257.0 | 267.4 | 10.4 | 2.3 |

| including | 257.0 | 260.2 | 3.2 | 5.0 | |||||

| EM-22-014 | 690565 | 5486334 | 64.5 | -67.9 | 646 | 231.0 | 231.7 | 0.7 | 4.6 |

| EM-22-015 | 690757.5 | 5486043 | 45 | -50.1 | 408 | 142.5 | 148.6 | 6.1 | 1.6 |

| EM-22-015 | 164.9 | 165.5 | 0.7 | 4.8 | |||||

| EM-22-015 | 217.1 | 221.0 | 3.9 | 4.3 | |||||

| including | 218.5 | 220.0 | 1.5 | 7.4 | |||||

| EM-22-015 | 228.0 | 235.8 | 7.8 | 10.3 | |||||

| including | 228.5 | 232.8 | 4.3 | 15.9 | |||||

| including | 230.0 | 231.0 | 1.0 | 41.1 | |||||

| EM-22-015 | 246.7 | 248.4 | 1.7 | 4.3 | |||||

| including | 247.5 | 248.4 | 0.9 | 7.1 | |||||

| EM-22-015 | 252.2 | 255.0 | 2.8 | 1.8 | |||||

| EM-22-016 | 690757.8 | 5486043 | 45.1 | -62.6 | 297 | 193.0 | 206.2 | 13.2 | 2.2 |

| including | 193.0 | 200.3 | 7.3 | 3.1 | |||||

| including | 196.0 | 199.6 | 3.6 | 4.0 | |||||

| EM-22-016 | 202.0 | 206.2 | 4.2 | 1.7 | |||||

| EM-22-017A | 690643 | 5486322 | 41.3 | -55.76 | 201 | 93.5 | 109.0 | 15.5 | 1.0 |

| including | 97.0 | 103.0 | 6.0 | 1.4 | |||||

| EM-22-017A | 137.0 | 144.0 | 7.0 | 1.4 | |||||

| including | 141.0 | 143.0 | 2.0 | 2.9 | |||||

| EM-22-005W | 690795 | 5486136 | 2.2 | -65.5 | 364 | 364.3 | 365.8 | 1.5 | 1.3 |

| 624.0 | 625.0 | 1.0 | 1.2 | ||||||

| EM-22-006W1 | 690736.7 | 5485828 | 29.5 | -57 | 435.2 | 476.0 | 479.0 | 3.0 | 2.0 |

| EM-22-006W1 | 482.8 | 484.0 | 1.2 | 6.5 | |||||

| EM-22-006W1 | 652.0 | 655.0 | 3.0 | 2.3 | |||||

| including | 653.5 | 654.1 | 0.6 | 6.6 | |||||

| EM-22-009W2A | 690921 | 5485639 | 21.4 | -65.9 | 634 | 828.0 | 830.0 | 2.0 | 1.4 |

| EM-22-010W1 | 690841 | 5485795 | 30.8 | -62 | 361 | 583.5 | 584.0 | 0.5 | 1.5 |

| EM-22-008W | 690737 | 5485828 | 45.6 | -58.1 | 377 | 527.0 | 529.0 | 2.0 | 6.2 |

| EM-22-008W | 630.1 | 634.0 | 3.9 | 4.2 | |||||

| including | 631.0 | 632.5 | 1.5 | 6.8 | |||||

| EM-23-006W4 | 690737 | 5485828 | 24.5 | -39.4 | 236 | 472.0 | 486.2 | 14.2 | 1.1 |

| including | 472.0 | 477.4 | 5.4 | 1.4 | |||||

| including | 481.6 | 482.3 | 0.7 | 4.0 | |||||

| EM-23-006W4 | 521.0 | 523.6 | 2.6 | 1.9 | |||||

| EM-22-012W | 691098.7 | 5485413 | 20 | -45.6 | 524.7 | 1095.3 | 1097.4 | 2.1 | 1.2 |

Notes: Drill holes EM-22-006W, EM-22-006X, EM-22-008 and EM-22-009W1 returned no significant assays. Drill hole EM-22-017 was lost at 51 m. True widths estimated at 40% to 70% of downhole width depending on the hole inclination.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work.

Quality Assurance and Quality Control

The Company implements strict Quality Assurance and Quality Control protocols at Eagle covering the planning and placing of drill holes in the field; drilling and retrieving the NQ-sized drill core; drill hole surveying; core transport; core logging by qualified personnel; sampling and bagging of core for analysis; transport of core from site to the Val d’Or, Québec AGAT laboratory; sample preparation for assaying; and analysis, recording and final statistical vetting of results. Check assays for gold are being done on a sample subset at ALS’ laboratory in Val d’Or.

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Québec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE