Mako Mining Provides Q4 2022 Production Results with Record Gold Sales of 9,956 oz and Total Silver Recovered of 16,268 oz

Mako Mining Corp. (TSX-V: MKO) (OTCQX: MAKOF) is pleased to provide fourth quarter 2022 production results from its San Albino gold mine in northern Nicaragua, which is the sixth full quarter of production results since declaring commercial production on July 1, 2021. Financial results for Q4 2022, including detailed reporting of our operating costs, are expected to be released in April.

Q4 2022 Production Highlights

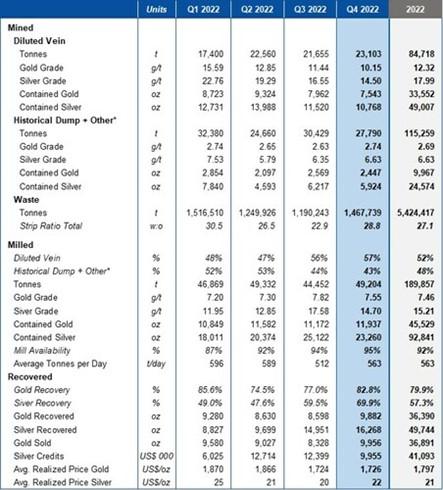

- 50,893 tonnes mined containing 9,990 ounces of gold at a blended grade of 6.11 grams per tonne gold and 16,692 ounces of silver at a grade of 10.20 grams per tonne silver

- 23,103 tonnes mined containing 7,543 oz Au at 10.15 g/t Au and 10,768 oz Ag at 14.50 g/t Ag from diluted vein material

- 27,790 tonnes mined containing 2,447 oz Au at 2.74 g/t Au and 5,924 oz Ag at 6.63 g/t Ag from historical dump and other mineralized material above cutoff grade

- 28.8:1 strip ratio overall which includes accelerated waste development of the West and the Central Pit

- 49,204 tonnes milled containing 11,937 oz Au at a blended grade of 7.55 g/t Au and 18,408 oz Ag at 11.64 g/t Ag

- 57% and 43% from diluted vein and historical dump and other, respectively

- 563 tonnes per day milled at 95% availability

- Recoveries of 82.8% and 69.9% for gold and silver, respectively, in Q4 2022

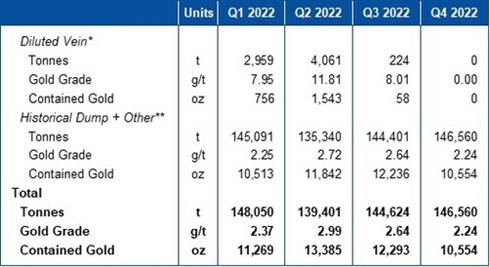

- 146,560 tonnes in stockpile containing 10,554 oz Au at a blended grade of 2.24 g/t Au

- 9,882 oz Au and 16,268 oz Ag recovered

- 9,956 oz Au and 9,955 oz Ag sold

Akiba Leisman, Chief Executive Officer of Mako states that, “Q4 2022 was a strong quarter with record gold sales and record silver recovered. The metallurgical challenges we experienced in Q2 and Q3 2022 are now firmly behind us, and the Company intends to continue optimizing the plant, with the expectation that it will be operating consistently at 600 tonnes per day (“tpd”) later in Q1 2023. Throughput reached 600 tpd 14 times during the quarter, which clearly demonstrates the capability of running 20% above the plant’s original 500 tpd nameplate capacity. Operating cash flow was robust at an average realized price of $1726 per ounce, where we will report AISC substantially below that of Q3 2022. Now that the gold price is 10% higher than what was realized in Q4 2022, our balance sheet will accelerate its strengthening, even after budgeting nearly $10 million of exploration expenditures for 2023.”

Mining

The mine averaged 553 tpd of diluted vein and historical dump + other material in Q4 2022 with a strip ratio of 28.8 which included accelerated waste development of the West and the Central Pit. The current stockpile is 146,548 tonnes containing 10,292 oz Au at 2.18 g/t Au.

The average grade of the diluted vein was 10.15 g/t Au during the quarter. A combination of geological mapping, additional lab testing, and new procedures implemented by our mine geologist have all contributed to improved mining selectivity, which limits the amount of preg-robbing material being fed to the plant, thereby enhancing recoveries. New blending processes allowed the mill to maintain high throughput without sacrificing recovery.

Lastly, initial development for a second waste dump began during the quarter with an initial capacity of 6 million tonnes which can eventually be expanded to 23 Mt.

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q4, 2022, the plant has been averaging 563 tpd at 95% availability (see Table 1). In Q4 2022 the plant processed 57% diluted vein material and 43% historical dump + other material to achieve an average blended grade of 7.55 g/t Au and 14.70 silver. The recovery for the quarter was 82.8% for gold and 69.9% for silver for the quarter. (See Table 1)

The gold recovery improvement from 77.0% in the third quarter to 82.8% in the fourth quarter was a result of the processing improvements implemented during the third quarter. A second carbon striping vessel was commissioned during the fourth quarter. The second vessel allows for more efficient carbon stripping and will result in reduced precious metal in the carbon circuit inventory. The retention screens in the CIL tanks were replaced with new screens during December. The new screens will improve the CIL tank profile, resulting in reduced metal concentrations in the tails solutions, which will improve overall circuit recovery.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

Table 1 – Production Results * Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade. **For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price. (CNW Group/Mako Mining Corp.)

Table 2 – Quarter End Stockpile Statistics * Includes stockpiles of mineralized material at the crusher. ** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade. (CNW Group/Mako Mining Corp.)

MORE or "UNCATEGORIZED"

Antimony Resources Corp. (ATMY) (K8J0) Reports Massive Antimony Bearing Stibnite - Drills 4.17% Sb over 7.40 meters Including Three Zones of Massive Antimony Bearing Stibnite which returned 28.8% Sb, 21.9% Sb, and 17.9% Sb Respectively

Highlights Assays received High-grade assays returned for Drill H... READ MORE

Kenorland Minerals and Auranova Resources Report Drill Results at the South Uchi Project, Ontario; Auranova Completes Initial Earn-in

Kenorland Minerals Ltd. (TSX-V: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) a... READ MORE

Wallbridge Exploration Drilling Continues to Intercept High-Grade Gold Mineralization at Martiniere

Wallbridge Mining Company Limited (TSX: WM) (OTCQB:WLBMF) announc... READ MORE

ValOre Reports Results from Successful 87 Hole Trado® Auger Drilling Campaign at Pedra Branca, Including 10.0 m at 12.95 g/t 2PGE+Au from Surface

Provides Update on Pedra Branca PGE Project and Strategic Growth ... READ MORE

Pasinex Announces 2024 Annual and 2025, Q1 Financial Results

Pasinex Resources Limited (CSE: PSE) (FSE: PNX) announced financi... READ MORE