Mako Mining Provides Q3 2022 Production Results

Mako Mining Corp. (TSX-V: MKO) (OTCQX: MAKOF) is pleased to provide third quarter 2022 production results from its San Albino gold mine in northern Nicaragua, which is the fifth full quarter of production results since declaring commercial production on July 1, 2021. Financial results for Q3 2022, including detailed reporting of our operating costs, are expected to be released in November.

Q3 2022 Production Highlights

- 52,084 tonnes mined containing 10,531 ounces of gold at a blended grade of 6.28 grams per tonne gold

- 21,655 tonnes mined containing 7,962 oz Au from diluted vein material at 11.44 g/t Au

- 30,429 tonnes mined containing 2,569 oz Au from historical dump and other mineralized material above cutoff grade (“historical dump + other“) at 2.63 g/t Au

- 7.0:1 strip ratio for Phase 1

- 22.9:1 strip ratio overall which includes accelerated waste development of the West and the Central Pit (“Arras Zone“)

- 44,452 tonnes milled containing 11,172 oz Au at a blended grade of 7.82 g/t Au

- 56% and 44% from diluted vein and historical dump and other, respectively

- 512 tonnes per day milled at 94% availability

- 77.0% gold recoveries for all of Q3 2022 and 86.4% gold recoveries after improvements made since August 10, 2022

- 144,624 tonnes in stockpile containing 12,293 oz Au at a blended grade of 2.64 g/t Au

- 8,598 oz Au recovered and 8,328 oz Au sold at an average realized price of US$1,724 per ounce (final Au shipment for Q3 2022 was sold on the first business day of Q4 2022)

Akiba Leisman, Chief Executive Officer of Mako states that, “Q3 2022 was a tale of two halves. Beginning in March 2022, the Company experienced metallurgical challenges with the transition from oxide to fresh material causing a diminution of recoveries in Q2(74.5%) and the first six weeks of Q3. Optimization of the plant along with new highly detailed grade and lithological controls in our mining procedures led us to correct these issues midway through the quarter, such that recoveries are now at or above the 86% recoveries announced in connection with our metallurgical testing from 2019 (see press release dated December 13, 2019). The mine is performing well, where the diluted vein material continues to positively reconcile to the resource model, and mill throughput was running just under nameplate capacity of 500 tonnes per day, including all availability factors. The mill averaged 512 tonnes per day for the quarter at 94% availability, 4% below nameplate capacity, as the Company observed that increases in tank residence time had a beneficial effect on recoveries. Post quarter end, with further optimizations, the plant is now running above nameplate capacity, including all availability factors. With all of these changes, the Company expects that the plant will recover substantially more gold in Q4 than the 8,598 ounces recovered in Q3. Operating cash flow from the mine remains robust, with exploration expenditures increasing to US$1.3 million per month, an aggregate of US$13.2 million of principal being repaid under the Company’s loan facilities with Wexford and Sailfish Royalty Corp. since the beginning of Q3 2021, and over 2 million common shares repurchased through our normal course issuer bid.”

Table 1 – Production Results

| * Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade. |

| **For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price. |

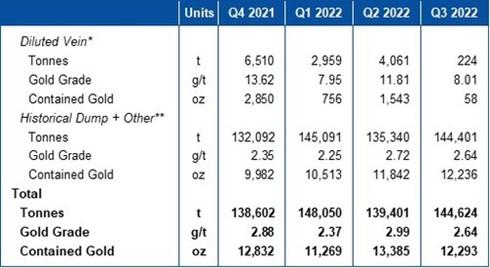

Table 2 – Quarter End Stockpile Statistics

| * Includes stockpiles of mineralized material at the crusher. |

| ** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade. |

Mining

The mine averaged 572 tpd of diluted vein material and historical dump + other in Q3 2022 with a strip ratio of 22.9 in total from the West and Central Pits. The current stockpile is 144,624 tonnes with 224 tonnes of higher-grade diluted vein material with a grade of 8.01 g/t Au and 144,401 tonnes of historical dump + other material at 2.64 g/t Au for total contained gold of 12,293 oz at 2.64 g/t Au.

The highest grade ore for the quarter was fresh material mostly from the West Pit with an average grade of 11.44 g/t Au. The detailed grade control procedures minimize the amount of hanging wall and foot wall material being mined with the diluted vein material. Testing has shown the hanging wall and foot wall material to have significantly higher preg-robbing potential than the diluted vein material. A combination of geological mapping, additional lab testing, and new procedures implemented by our site geologist during mining have all contributed to the improved selectivity. The vein material, along with a minimal amount of hanging wall and footwall material, are being mined separately from the balance of the hanging wall and foot wall material resulting in significantly improved control of the preg-robbing potential of the mill feed.

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q3, 2022, the plant has been averaging 512 tpd at 94% availability (see Table 1). In Q3 2022 the plant processed 56% diluted vein material and 44% historical dump + other material to achieve an average blended grade of 7.82 g/t Au and recovering an average of 77.0% (see Table 1).

Beginning August 10, 2022, several mill improvements were implemented to improve metal recovery. The overall recovery for the third quarter improved to 77.0% compared to 74.5% in the second quarter; however, the recovery was 86.4% after the improvements were implemented.

The improvements are listed below:

- Through selective mining procedures and blending protocols, the amount of preg-robbing material going through the mill was significantly reduced. The hanging wall and foot wall appears to have a much higher preg-robbing potential than the vein and weathered lithologies and our selective mining procedures were able to separate this material effectively.

- The mill throughput was temporarily reduced from 544 tpd in July to 470 tpd in September in order to increase the leach retention time. In October throughput is back to name plate capacity.

- The lower mill throughput also resulted in a grind size improvement from 77.2% passing 75 microns to 79.1% passing 75 microns.

- The measured free cyanide in the grinding circuit fell from 14.1 ppm to 2.1 ppm through improved operational procedures. The lower cyanide levels in the grinding circuit contributed to reduced losses through preg-robbing.

- The inventory of carbon in the CIL circuit was increased from 25 to 34 tonnes.

In addition, a second carbon stripping vessel is currently operating in the processing plant, which is expected to further debottleneck the carbon stripping circuit. The worn-out carbon retention screens are expected to be replaced over the course of the next two weeks. The pre-leach thickener is scheduled to return to service during the fourth quarter which will increase the leach retention time due to the higher leach percentage solids produced by the thickener. These additional optimizations may improve recoveries further.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE