Mako Mining Provides Q2 2022 Production Results

Mako Mining Corp. (TSX-V: MKO) (OTCQX: MAKOF) is pleased to provide second quarter 2022 production results from its San Albino gold mine in northern Nicaragua, which is the fourth full quarter of production results since declaring commercial production on July 1st, 2021. Financial results for Q2 2022, including detailed reporting of our operating costs, are expected to be released in August.

Q2 2022 Production Highlights

- 47,220 tonnes mined containing 11,421 ounces of gold at a blended grade of 7.52 grams per tonne gold

- 22,560 tonnes mined containing 9,324 oz Au from diluted vein material at 12.85 g/t Au

- 24,660 tonnes mined containing 2,097 oz Au from historical dump and other mineralized material above cutoff grade (“historical dump + other“) at 2.65 g/t Au

- 7.0:1 strip ratio for Phase 1

- 26.5:1 strip ratio overall which includes accelerated waste development of the West and the Central Pit (“Arras Zone“)

- 49,332 tonnes milled containing 11,576 oz Au at a blended grade of 7.30 g/t Au

- 47% and 53% from diluted vein and hanging-wall/footwall, respectively

- 589 tonnes per day (“tpd“) milled at 92% availability

- 74.5% gold recoveries (majority of material processed was fresh material)

- 139,401 tonnes in stockpile containing 13,385 oz Au at a blended grade of 2.99 g/t Au

- 8,630 oz Au recovered and 9,027 oz Au sold at an average realized price of US$1,866 per ounce

Akiba Leisman, Chief Executive Officer of Mako states that, “this quarter was the fourth full quarter of commercial production at San Albino. The mine is performing well, where the diluted vein material continues to positively reconcile to the resource model, and mill throughput has been running at above nameplate capacity of 500 tonnes per day, including all availability factors. The mill averaged 589 tonnes per day for the quarter at 92% availability, 8% above nameplate capacity. Replenishment of spare parts and minor adjustments to the plant since the beginning of the year improved mill availability throughout the first half of 2022, and we expect to be running at or above nameplate capacity for the foreseeable future. Recoveries have been below the 86% metallurgical recoveries predicted in our December 2019 metallurgical update (see press release dated December 13, 2019), due to organic carbon present in the hanging-wall and footwall of the vein. The plant is going through a series of optimizations to eliminate free cyanide concentrations in the recycled water, which will continue throughout Q3 2022. Additionally, we have implemented robust sampling mechanisms, and mining and stockpiling processes aimed at ensuring that particularly problematic material is kept away from the mill. Fortunately, the high grade vein material is not as problematic as the hanging-wall and footwall material, and to the extent possible we will be processing the diluted vein separately during the quarter with the plant optimized specifically for the high grade material. With all of these changes, we are optimistic that improvements in recoveries can be made later this year. A total of 9,027 ounces were sold in the quarter (9,580 ounces sold in Q1 2022), and operating cash flow from the mine remains robust, with exploration expenditures increasing, preparations for rainy season complete, an aggregate of US$10.3 million of principal being repaid under the Company’s loan facility with Wexford and Sailfish Royalty Corp. since the beginning of Q3 2021, and 2 million common shares repurchased through our normal course issuer bid.”

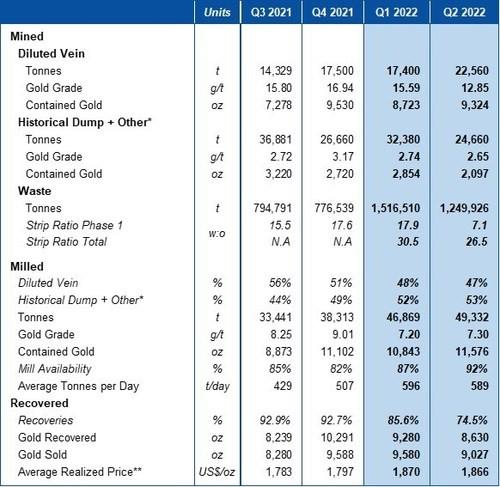

Table 1 – Production Results

| * Includes historical dump, hanging-wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade | |

| **For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price |

Table 2 – Mining by phases Q2 2022

Table 3 – Quarter End Stockpile Statistics

| * Includes stockpiles of mineralized material at the crusher. | |

| ** Includes historical dump, hangingwall, footwall, historical muck and all other non-vein mineralized material above cutoff grade. |

Mining

The mine averaged 519 tpd of diluted vein material and historical dump + other in Q2 2022 with a strip ratio of 26.5 in total from the West Pit and Arras Zone that includes accelerated waste stripping in preparation for the rainy season (see Table 2). The current stockpile is 139,401 tonnes with 4,061 tonnes of higher grade diluted vein mineralization with a grade of 11.81 g/t Au and 135,340 tonnes at 2.72 g/t Au of historical dump + other for a total contained gold of 13,385 oz (mineral grade of 2.99 g/t Au).

The higher-grade material for the quarter came from the West Pit with an average grade of 8.02 g/t Au. As we are now deeper in the deposit we are mining mostly fresh material. The detailed grade control processes and procedures have been very effective in controlling mining dilution with a range as low as 30 cm on either side of the vein. Along with geological mapping and assays, additional lab testing has been implemented to identify increased organic content of the more difficult to process material, typically found in the footwall and hanging-wall rather than the high-grade vein itself. These improvements have increased the ability to selectively mine, separate, and stockpile according to grade and metallurgical characteristics while maintaining low dilution.

There were no additional night shifts to increase production during Q2. The rainy season started in mid-May and, as anticipated, production was delayed due to weather with a decline in June tonnage of approximately 22%. Although year-to-date production remains 1.6% over forecast, a limited extra shift of one excavator and seven trucks will start in July in an effort to ensure waste stripping stays on schedule.

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q2, 2022, the plant has been averaging 589 tpd at 92% availability (see Table 1). In Q2 2022 the plant processed 47% diluted vein material and 53% historical dump + other to achieve an average blended grade of 7.30 g/t Au and recovering an average of 74.5% (see Table 1).

The first two quarters of 2022 saw the mill operate at a throughput rate significantly higher than previous quarters. This was primarily due to improved equipment performance. The gold recovery was lower than previous quarters due to the much higher quantity of fresh material in the mill feed.

The fresh material contains naturally occurring carbon which can interfere with the gold recovery process. Eliminating free cyanide in the grinding circuit and only adding cyanide to the slurry in the CIL is essential in order to achieve optimal recoveries. Reducing cyanide concentrations from recycled water to optimal levels required a change in reagents. We were previously using the standard INCO/SO2 process (sodium metabisulfite and copper sulfate) but the results weren`t consistent and reliable. To adjust, we are now detoxing with sodium hypochlorite (common bleach), but the logistics needed to obtain necessary quantities took some time to develop. Further mill optimization efforts to lower cyanide concentrations in the mill grinding circuit are planned in the months ahead to more effectively treat the increased quantity of fresh material feeding the mill.

In the meantime, we have developed robust sampling mechanisms and mining and stockpiling processes aimed at ensuring particularly problematic material is kept away from the mill. The high grade vein material does not exhibit as strong pre-robbing tendencies as the material from the hanging-wall and footwall, and to the extent possible we will be processing that material separately during the quarter with the plant optimized specifically for the high grade material.

In addition, a second carbon stripping vessel is scheduled for installation in the third quarter of 2022 which will further debottleneck the carbon stripping circuit.

All of the above mentioned improvements to the processing plant have helped the plant achieve processing rates of an average of 589 tpd in Q2 2022, with over 9,000 ounces of gold sold for the third consecutive quarter (see Table 1).

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE