Magna Mining Intersects 29.2% Cu, 0.9% Ni, 53.0 g/t Pt + Pd + Au Over 1.0 Metre, 140 Metres Downdip of Previous Intersection Below the No. 3 Zone at the Levack Mine in Sudbury, Ontario

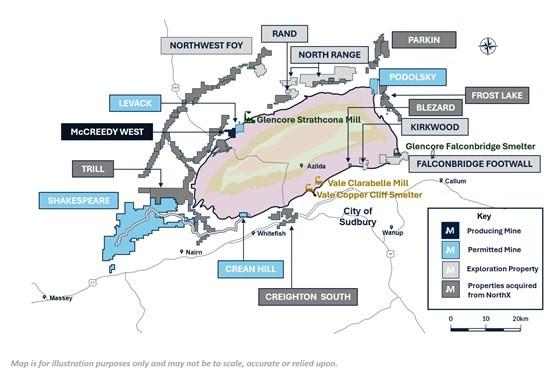

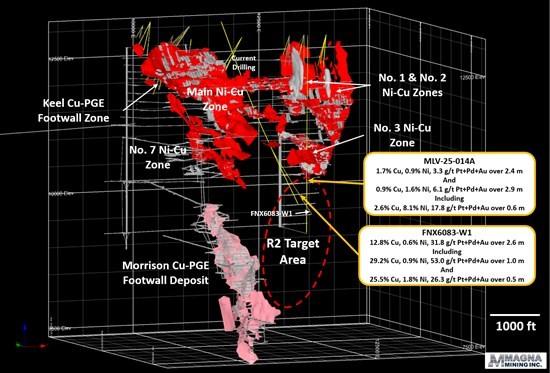

Magna Mining Inc. (TSX-V: NICU) (OTCQX: MGMNF) (FSE: 8YD) is pleased to provide an update on exploration activities and assay results from ongoing exploration at the past-producing Levack Mine, located in the North Range of the Sudbury Basin, northeastern Ontario, Canada (Figure 1). Drillhole FNX6083-W1 was drilled to test an area 140 metres below drill hole MLV-25-14A (see news release dated July 9, 2025) which intersected 2.6% copper, 8.1% nickel and 17.8 g/t platinum + palladium + gold over 0.6 metres. Drillhole FNX6083-W1 intersected multiple mineralized intervals ranging from veinlets of copper rich chalcopyrite and bornite, to more than 1 metre of massive chalcopyrite. Magna is referring to this target area in the footwall of the No. 3 Zone as the Rob’s 2 target.

Highlights from the new assay results include:

- FNX6083-W1 12.8% Cu, 0.6% Ni, 31.8 g/t Pt+Pd+Au over 2.6 metres

Including 29.2% Cu, 0.9% Ni, 53.0 g/t Pt+Pd+Au over 1.0 metres

And 25.5% Cu, 1.8% Ni, 26.3 g/t Pt+Pd+Au over 0.5 metres

Dave King, SVP Exploration and Geoscience stated, “Prior to acquiring the Levack Mine in Q1 of this year, we believed there remained the potential to discover another significant, high-grade copper, nickel and precious metal deposit in the footwall environment of the property. The drilling results announced in July from drillhole MLV-25-14A, combined with those released today which includes a subinterval of 29.2% copper and 29.9 g/t gold, along with 15.8 g/t palladium, 7.3 g/t platinum and 0.9% nickel over 1.0 metre, are encouraging and appear to confirm our belief that the prospective exploration environment at Levack remains under-explored. There are notable similarities in the geology and vein mineralogy intersected in our recent drilling with the upper levels of the Morrison Footwall Cu-PGE Deposit. We will continue to leverage our experience in the discovery and understanding of the geological controls within the Morrison Deposit to further advance the R2 exploration target. We are looking forward to providing additional assay results as we continue to define the extent of the R2 mineralization.”

There are currently two surface diamond drills operating at the Levack Mine, one completing three shallow infill and metallurgical drillholes on the Main Ni-Cu Zone in support of the Levack Restart Study, and a second drill exploring the footwall environment between the No. 3 Ni-Cu Zone and the Morrison Footwall Cu-PGE Deposit, with another wedge hole targeting the area north of the intersections reported today. Recall, drillhole MLV-25-14A (reported on July 9, 2025) was targeted beneath the No. 3 Ni-Cu Zone and was designed to test for subvertical mineralization, striking parallel to the Fecunis fault, based on Magna’s geological interpretation of this area, and relationship of these structures to the geological controls on the Morrison Deposit. Based on the results of MLV-25-14A and continued geological interpretation, historical drillhole FNX6083 was deepened to provide a geophysical platform, and survey results from this hole confirmed Magna’s interpretation of the mineralization in this area. Drillhole FNX6083-W1 was a wedge hole designed to test approximately 140 metres down-dip of the Ni-rich veins in MLV-25-14A and successfully intersected significant intervals of disseminated to stringer copper mineralization and two massive chalcopyrite veins. The massive sulphide veins graded 29.2% Cu, 0.9% Ni, 53.0 g/t Pt + Pd + Au over 2.6 metres and 25.5% Cu, 1.8% Ni, 26.3 g/t Pt + Pd + Au over 0.5 metres. Assays are summarized in Table 1 and drillhole collar information is presented in Table 2.

Morrison Deposit Geology and Footwall Copper-Precious Metals Mineralization

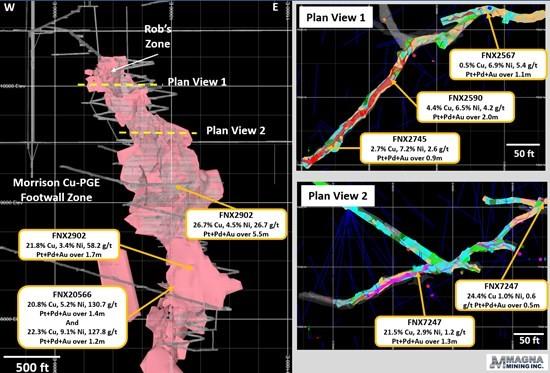

Mineralization intersected to date within the R2 target area shows similarities to the mineralogical trends seen in the upper levels of the Morrison Footwall Cu-PGE Deposit, located approximately 600 metres to the south-west in the Levack Mine. The Morrison Deposit occurs vertically beneath the No. 7 Contact Zone (Figure 2) and was discovered by FNX Mining in 2005 and subsequently developed and mined until 2019. Similar to other copper and precious metals-rich footwall deposits along the North Range of the Sudbury Basin, the massive sulphide veins of the Morrison Deposit vary from less than 1 metre to more than 6 metres in thickness and consist of chalcopyrite, cubanite, pentlandite and millerite with high-grade precious metal values. The Morrison Deposit has a distinct vertical mineralogical trend, transitioning from Ni-rich, pentlandite and pyrrhotite veins in the upper levels of the Rob’s Zone, to Cu-rich chalcopyrite veins that have increasing platinum, palladium, gold and silver concentrations at depth. The upper nickel-rich veins within the Rob’s Zone were commonly under 1 metre to 2 metres in thickness and under 150 metres in strike length. The relatively narrow, nickel-rich veins of the Rob’s Zone continued for approximately 150 metres downdip, before transitioning to narrow Cu-rich chalcopyrite dominated veins. The central portion of the Morrison Deposit contained chalcopyrite veins up to approximately 6 metres thick, within mineralized areas extending over 250 metres along strike. The mineralogical zonation between the nickel-dominated veins in drill hole MLV-25-14A and the copper and precious metals-rich veins reported today in drillhole FNX6083-W1 from the R2 target area appears to be consistent with that seen in the Morrison Deposit. See Figure 3 for detailed examples of the mineralization in the upper levels of the Morrison Deposit and associated vein grades.

Levack Exploration Plan

Magna is focusing its near-term exploration program at the Levack Mine on this prospective footwall environment, continuing to test the lateral and downdip extent of the R2 target and other high-priority Sudbury Breccia units that have the potential to host copper and precious metals-rich footwall deposits. Initial drilling on the R2 target will be designed to confirm and refine the geological model and define the extent of mineralization. Downhole geophysical electromagnetic surveys will continue to help target drilling within the most conductive areas of the mineralized system. Drilling will ramp up at Levack over the remainder of the year with two underground diamond drills mobilizing within the coming weeks.

Figure 1: Location of Magna Mining’s Existing Properties, and Key Sudbury Infrastructure

Figure 2: Oblique 3D View Looking North-East, Showing the Levack Mine Mineralized Zones in Relation to the R2 Target and Current Drilling

Figure 3: Longitudinal Section, Looking North, Showing the Levack Morrison Deposit Footwall Cu-PGE Deposit, Historical Diamond Drillhole results, and Example Plan Views of Mined Mineralization

Table 1: Summary of Drillhole Results

| Drillhole | Property | Zone | From (m) |

To (m) |

Length (m) |

Cu % |

Ni % |

Co % |

Pt g/t |

Pd g/t |

Au g/t |

TPM g/t |

NiEq | CuEq | |

| FNX6083-W1 | Levack | R2 Target | 991.85 | 992.22 | 0.37 | 16.68 | 0.07 | 0.00 | 1.33 | 2.44 | 0.09 | 3.86 | 9.57 | 17.03 | |

| and | 1005.48 | 1005.78 | 0.30 | 13.75 | 0.49 | 0.00 | 3.29 | 13.72 | 1.56 | 18.57 | 10.67 | 18.99 | |||

| and | 1048.48 | 1048.84 | 0.36 | 2.87 | 0.05 | 0.00 | 7.98 | 5.64 | 0.81 | 14.43 | 3.73 | 6.65 | |||

| and | 1050.70 | 1051.15 | 0.45 | 3.24 | 0.10 | 0.00 | 0.70 | 1.93 | 0.54 | 3.17 | 2.36 | 4.19 | |||

| and | 1056.41 | 1056.71 | 0.30 | 6.58 | 0.68 | 0.01 | 7.03 | 8.18 | 1.31 | 16.52 | 6.65 | 11.83 | |||

| and | 1152.23 | 1154.83 | 2.60 | 12.77 | 0.55 | 0.01 | 3.39 | 7.79 | 20.67 | 31.85 | 15.06 | 26.81 | |||

| Including | 1153.16 | 1154.16 | 1.00 | 29.21 | 0.92 | 0.02 | 7.26 | 15.84 | 29.87 | 52.97 | 28.62 | 50.96 | |||

| and | 1196.60 | 1197.14 | 0.54 | 25.53 | 1.80 | 0.03 | 10.40 | 12.08 | 3.80 | 26.28 | 19.54 | 34.79 |

Important Notes

All lengths are downhole length. True widths are uncertain at this time.

Ni Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Ni $/lb.

Cu Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Cui $/lb.

Metal prices in US$: $7.30/lb Ni, $4.10/lb Cu, $15.00/lb Co, $1,000/oz Pt, $1,050/oz Pd and $2,200/oz Au.

Table 2: Drillhole Collar Coordinates

| BHID | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

| FNX6083-W1 | 471667 | 5167000 | 398 | 116 | 63 | 1263 |

*Drillhole Coordinates are in Coordinate System NAD 83 Zone 17

Qualified Person for Technical Information

The scientific and technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under National Instrument 43-101.

Quality Assurance and Control

Sample QA/QC procedures for Magna have been designed to meet or exceed industry standards. Drill core is collected from the diamond drill and placed in sealed core trays for transport to Magna’s core facilities. Levack drilling utilizes NQ sized core and McCreedy West utilizes BQTK sized core. The core is then logged, and samples marked in intervals of up to 1.5m. Levack drill core is split and sampled ½ core, and McCreedy West is whole core sampled. Samples are then put into plastic bags with 10 bagged samples being placed into rice bags for transport to SGS Laboratories in Garson, Ontario for preparation, which are then shipped to Lakefield, Ontario for analysis. Samples are submitted in batches of 50 with 4 QA/QC samples including, 2 certified reference material standards and 2 samples of blank material.

About Magna Mining Inc.

Magna Mining Inc. is a producing mining company with a strong portfolio of copper, nickel, and platinum group metals (PGM) assets located in the world-class Sudbury mining district of Ontario, Canada. The Company’s primary asset is the McCreedy West Mine, currently in production, supported by a pipeline of highly prospective past-producing properties including Levack, Crean Hill, Podolsky, and Shakespeare.

Magna Mining is strategically positioned to unlock long-term shareholder value through continued production, exploration upside, and near-term development opportunities across its asset base.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE