Magna Mining Completes Updated Preliminary Economic Assessment of the Crean Hill Project

Study Demonstrates 13 Year Mine Life, Modest Pre-Production Capital and Short Payback Period

Magna Mining Inc. (TSX-V: NICU) (OTCQB: MGMNF) (FSE: 8YD) is pleased to announce the successful completion of its Updated Preliminary Economic Assessment by SGS Geological Services on its 100% owned Crean Hill Project located in Sudbury, Ontario, Canada.

The PEA envisions an underground only mining operation, with Life of Mine potentially mineable resource being sold to a third-party existing mill in Sudbury. Underground mining would be initiated with a 15-month Advanced Exploration program followed by a 12-month pre-production ramp-up period and 13 years of commercial production. Initial mining will be done with ramp access via a new surface portal with the eventual rehabilitation and re-establishment of the historic #2 shaft for personnel access and hoisting as mining progresses deeper.

Note: All dollar values are reported in Canadian Dollars unless otherwise stated.

2024 PEA Highlights

- Low pre-production capital cost of $27.7M following AdEx period;

- Payback of pre-production period capital within the first year of commercial production, and payback of all capital including AdEx period capital within the second year of commercial production;

- Underground average production rate of 2,200 tonnes per day consisting of 1,650 tpd of higher-margin primary feed and 550 tpd of lower grade, incremental feed;

- Pre-tax NPV (8%) of $265.3 million and an Internal Rate of Return of 142% at conservative metal prices.

Magna Mining COO Jeff Huffman commented: “This updated Preliminary Economic Assessment focuses efforts on a high margin, underground-only mine plan. A low capital approach of establishing a new surface portal will provide quick access to the resource, allowing us to offset capital costs with early revenues. This PEA also benefits from increased certainty on third party processing terms. The project timeline has been derisked by having environmental permits approved and in-hand, as well as more detailed stope planning and sequence optimization. The PEA metal pricing assumptions have been updated to reflect a more conservative long term nickel price. We are excited and encouraged by the results of this PEA and look forward to continuing to advance the Crean Hill Project”.

The primary feed is designed to ensure rapid payback and minimize upfront capital requirements while simultaneously mitigating the potential impact of low metal prices. The lower cut-off grade of incremental material allows more complete extraction of the resource and the two-pronged nature of the mining sequence facilitates lower-cost extraction of the incremental material.

Financial Analysis

The Crean Hill PEA uses metal prices of US$ 8.50/lb nickel, US$ 4.00/lb copper, US$ 13.00/lb cobalt, US$ 900/oz platinum, US$ 1000/oz Palladium, US$ 2,150/oz gold, and a 1.35 C$/US$ exchange rate as outlined in Table 2.

The Base Case generates a pre-tax NPV (8%) of $265.3 million and an Internal Rate of Return of 142%, after-tax NPV (8%) is $194.1 million, with an IRR of 129%.

See Table 1 for a summary of PEA results.

Table 1: PEA Summary

| Units | Total | ||||||||||||||||

| Total Resource Mined | tonnes | 10,688,606 | |||||||||||||||

| Mine Life | years | 13 | |||||||||||||||

| Average Production Rate | tpd | 2,193 | |||||||||||||||

| Operating Cost | $/tonne | 158 | |||||||||||||||

| Advanced Exploration Bulk Sample* | $M | 32.1 | |||||||||||||||

| Pre-Production Capital | $M | 27.7 | |||||||||||||||

| Sustaining Capital | $M | 212.8 | |||||||||||||||

| Ni in Resource Sold | M lbs | 195.5 | |||||||||||||||

| Cu in Resource Sold | M lbs | 169.5 | |||||||||||||||

| Co in Resource Sold | M lbs | 6.8 | |||||||||||||||

| Pt in Resource Sold | koz | 313 | |||||||||||||||

| Pd in Resource Sold | koz | 359 | |||||||||||||||

| Au in Resource Sold | koz | 117 | |||||||||||||||

|

|||||||||||||||||

| Note: AdEx Bulk Sample revenue is not included in PEA economics. | |||||||||||||||||

Table 2: Metal Prices and Exchange Rates

| Item | Units | Base Case Pricing |

| Nickel | $US/lb | 8.50 |

| Copper | $US/lb | 4.00 |

| Cobalt | $US/lb | 13.00 |

| Platinum | $US/oz | 900 |

| Palladium | $US/oz | 1000 |

| Gold | $US/oz | 2150 |

| Exchange Rate | CAD:USD | 1.35 |

| USD:CAD | 0.74 |

Capital and Operating Costs

The Study was prepared in accordance with National Instrument 43-101 of the Canadian Securities Administrators. The capital and operating cost estimates for the Advance Exploration, Pre-Production and Production phases of the Project are summarized below in Tables 3-5. Capital costs are based on planned development of a ramp from surface to the bottom of the orebody and the rehab of #2 shaft to the mid-shaft loading pocket. The company is planning on commencing an AdEx bulk sample underground to confirm resource grade, continuity and dilution impacts in an effort to de-risk the project. It is envisioned that positive results from this program will lead to a pre-feasibility study and continued development of the Crean Hill Project.

Table 3: AdEx and Pre-Production Cost and Revenue Summary

| Item | Units | AdEx | Pre-Production | |

| Capital Cost | $M | 48.5 | 27.7 | |

| Operating Cost | $M | – | 62.9 | |

| Revenue | $M | 16.4 | 78.3 | |

| Total Cost Net Revenue | $M | 32.1 | 12.3 |

Table 4: Capital Costs by Period – Detail

| Item | Units | Pre-Production (Initial Capital) |

Production (Sustaining Capital) |

Total Capital Cost |

| Development | $M | 12.8 | 143.5 | 156.3 |

| Infrastructure | $M | 14.5 | 58.7 | 73.1 |

| G&A and Indirects | $M | 0.4 | 4.8 | 5.2 |

| Closure | $M | – | 5.8 | 5.8 |

| Total Capital Cost | $M | 27.7 | 212.8 | 240.5 |

Table 5: Operating Costs by Period – Detail

| Item | Units | Pre-Production | Production | Average Operating Cost Per Resource Tonne Mined ($/t) |

| Mining | $M | 40.3 | 894.7 | $87.47 |

| Crushing, Haulage and Processing | $M | 17.3 | 635.7 | $61.09 |

| G&A | $M | 5.3 | 92.9 | $9.19 |

| Total Operating Costs | $M | 62.9 | 1623.3 | $157.75 |

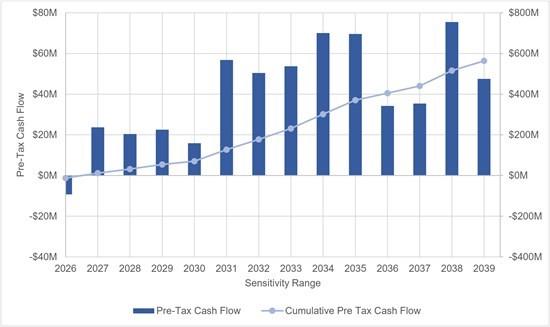

Figure 1: Life of Mine Pre-Tax Cash Flow

Mining and Infrastructure

Previous mining activity at the Crean Hill site makes this project particularly favorable for revitalization. The site is located near the Trans-Canada Highway, approximately 35km from Sudbury with access to a well-established supply and service sector focused on the mining industry. The PEA is based on underground mining only. A new ramp will allow rapid access to initial, near-surface, mining areas and dewatering will be carried out from the historic #2 shaft. As mining proceeds beyond 700m depth, rehabilitation of the existing shaft and key infrastructure will be completed. This capital expenditure will allow hoisting and personnel access via the #2 shaft and will enable ramp-access mining to continue at depth. Operating costs assumptions are based on use of a mining contractor during the advanced exploration phase, and owner operated equipment during the pre-production and operation phase for all mine development and production.

Underground production mining will be completed utilizing conventional longhole stoping methodology with hydraulic backfill. Power lines capable of supporting mining activities are in close proximity to the project and heating requirements will be met using propane. On-site crushing and sampling activities will occur before the ore is shipped to the local processing facility. Water treatment will be managed through a service agreement with the existing third-party treatment facility.

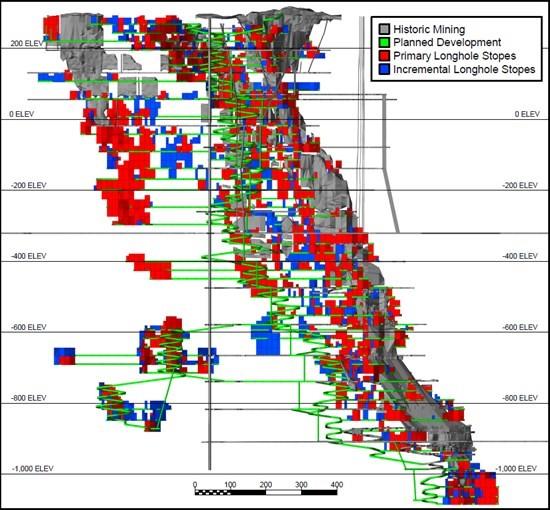

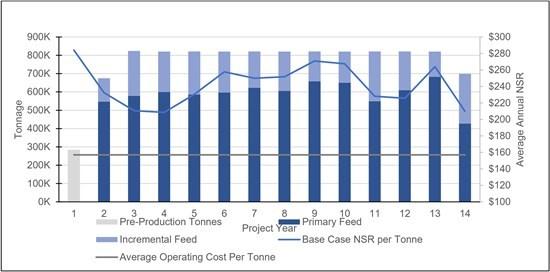

Figure 2 illustrates the historical mining and PEA mine plan. Figure 3 illustrates the LOM production profile and Table 6 summarizes the mine production statistics.

Figure 2: Crean Hill Mine Longitudinal Section Showing Historic Mining, Planned Development and Future Stoping

Table 6: PEA Production Statistics

| Item | Units | Primary | Incremental | Base Case |

| Resource Mined | tonnes | 7,996,761 | 2,691,845 | 10,688,606 |

| Average NSR | $/tonne | 258 | 148 | 240 |

| NiEq Cut-off Grade | % | 1.20 | 0.90 | – |

| Ni Grade | % | 0.92 | 0.56 | 0.83 |

| Cu Grade | % | 0.79 | 0.50 | 0.72 |

| Co Grade | % | 0.03 | 0.02 | 0.03 |

| Pt Grade | g/t | 1.01 | 0.63 | 0.91 |

| Pd Grade | g/t | 1.16 | 0.70 | 1.04 |

| Au Grade | g/t | 0.38 | 0.21 | 0.34 |

Figure 3: Life of Mine Production Profile

Permitting

The Crean Hill project is a brownfield site with an existing footprint and a Closure Plan that has been filed by Vale. Vale retains surface rights to the property and holds key permits including an Air Environmental Compliance Approval (ECA) for air emissions and a Sewage ECA for the wastewater management system. Additional surface infrastructure for new operations will be authorized by an amended Closure Plan. Other permits that would be required for mine development are an amended Air ECA, amended Sewage ECA, amended Permit to Take Water for mine dewatering and an additional sewage ECA for a domestic sewage system. There are no requirements for a federal or provincial environmental assessment. Permits for the commencement of AdEx at Crean Hill have been received.

Mineral Resources

The PEA potentially mineable resources are a subset of the current Crean Hill Mineral Resource Inventory (Table 7). Appropriate mining dilution and recoveries were applied to the design stopes depending on mining method used. Allan Armitage, Ph.D., P. Geo. of SGS Geological Services is an independent Qualified Person as defined by NI 43-101 and is responsible for the current Crean Hill MRE.

Table 7: Crean Hill Project Underground Mineral Resource Estimate, April 15, 2024

| Classification | Cut-off Grade | Tonnes | Cu (%) | Ni (%) | Co (%) | Pt (g/t) | Pd (g/t) | Au (g/t) | NiEq % |

| Indicated | 1.1% NiEq | 18,444,000 | 0.87 | 1.01 | 0.035 | 0.98 | 1.12 | 0.37 | 1.96 |

| Inferred | 1.1% NiEq | 989,000 | 0.53 | 0.70 | 0.026 | 0.98 | 1.66 | 0.29 | 1.56 |

|

Please see notes on Mineral Resource assumptions, at the end of this release, including metal prices and recoveries used. The underground cut-off grade of 1.10% NiEq considers metal prices of $8.50/lb Ni, $3.75/lb Cu, $17.00/lb Co, $950/oz Pt, $1100/oz Pd and $1,950/oz Au, metal recoveries of 78% for Ni, 95.5% for Cu, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au, a mining cost of US$80.00/t rock and processing, treatment and refining, transportation and G&A cost of US$42.50/t mineralized material. |

|||||||||

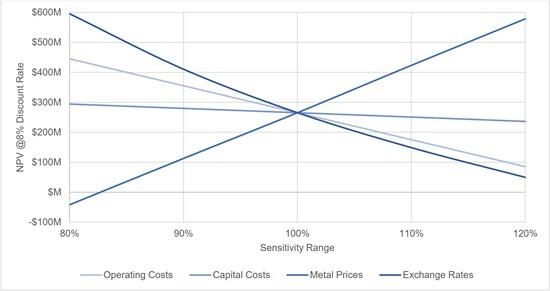

Crean Hill Project Economic Sensitivities

The Crean Hill Project is most sensitive to metal market prices and least sensitive to project capital cost. Operating costs and exchange rate sensitivities fall between metal prices and capital costs and display similar sensitivities.

Table 8: Crean Hill Project Sensitivities – Pre-Tax NPV(8%) ($M)

| Variance | Metal Price | Exchange Rate | Capex | Opex |

| -20% | -42 | 595 | 294 | 445 |

| -10% | 113 | 411 | 280 | 355 |

| Base | 265 | 265 | 265 | 265 |

| 10% | 423 | 149 | 251 | 175 |

| 20% | 578 | 50 | 236 | 85 |

Figure 4: Crean Hill Project Sensitivities – Pre-Tax NPV(8%)

Table 9: Crean Hill Project Sensitivities – Metal Price Comparison

| Units | 3 Yr Trailing Average | 2023 PEA | Base Case | Spot Price July 20, 2024 | |

| Nickel | $US/lb | 9.96 | 9.50 | 8.50 | 7.30 |

| Copper | $US/lb | 4.06 | 3.50 | 4.00 | 4.20 |

| Cobalt | $US/lb | 19.89 | 22.00 | 13.00 | 12.45 |

| Platinum | $US/oz | 971 | 1000 | 900 | 965 |

| Palladium | $US/oz | 1622 | 1800 | 1000 | 923 |

| Gold | $US/oz | 1915 | 1700 | 2150 | 2401 |

| Pre-Tax NPV (8%) | $M | 491.6 | 481.7 | 259.3 | 181.6 |

| Pre-Tax IRR | % | 200 | 185 | 90 | 58 |

| Post-Tax NPV (8%) | $M | 348 | 341.2 | 189.2 | 135.1 |

| Post-Tax IRR (%) | % | 182 | 168 | 82 | 53 |

Qualified Person

The following Qualified Persons oversaw the completion of the work in preparation of the PEA and are responsible for the contents:

Independent QP for Geology and Mineral Resource Estimates

Mr. Allan Armitage, Ph.D., P.Geo., of SGS Geological Services.

Mr. Armitage conducted personal inspection of the site on May 25-26, 2022, July 25, 2023, July 02, 2024 and July 25, 2024.

Independent QP for Underground Mining and Financial Analysis

Mr. Henri Gouin, P.Eng., of SGS Geological Services.

Mr. Gouin last conducted a personal inspection of the site on May 13, 2024.

Independent QP for Underground Mining, Financial Analysis, Permitting and Environmental

Mr. William van Breugel, P.Eng., B.A.Sc. Geological Engineering, P.Eng., Associate Engineer of SGS Geological Services.

Independent QP for Processing and Recovery

Mr. Dominic Fragomeni, P.Eng., Frago-Met Solution Ltd.

Technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under Canadian National Instrument 43-101.

Crean Hill Property Mineral Resource Estimate Notes:

- The effective date of the Crean Hill Property Mineral Resource Estimate (MRE) is April 15, 2024. This is the close out date for the final mineral resource models and mine out models (as-builts).

- Allan Armitage, Ph.D., P. Geo. of SGS Geological Services is an independent Qualified Person as defined by NI 43-101 and is responsible for the current Crean Hill MRE. Armitage conducted multiple site visits to the Crean Hill Property including on May 25-26, 2022, July 25, 2023, July 02, 2024 and July 25, 2024.

- The classification of the current MRE into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The mineral resource is presented undiluted and in situ, constrained by 3D grade control resource models, and are considered to have reasonable prospects for eventual economic extraction. The mineral resource is exclusive of mined out material.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The Crean Hill mineral resource estimate is based on a validated drill hole database which includes data from 4,646 surface and underground diamond drill holes completed between 1951 and March 2024. The drilling totals 739,448 m. The resource database totals 103,952 assay intervals representing 290,253 m of data.

- The mineral resource estimate is based on a three-dimensional (“3D”) resource model of the main mineralization and a broader dilution envelope. 3D models of mined out areas were used to exclude mined out material from the current MRE.

- Grades for Ni, Cu, Co, Pt, Pd, Ag and Au are estimated for each mineralization domain using ~2.0 m capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- Specific gravity values were assigned to each block based on a regression formula defined by a database of 32,592 samples. SG=(0.2057xNi%+2.88).

- Based on the size, shape, and orientation of the Crean Hill Deposit, it is envisioned that the deposits may be mined using both bulk and selective mining methods including Longhole Stoping.

- The MRE is reported at a base case cut-off grade of 1.10% NiEq. The mineral resource grade blocks are quantified above the base case cut-off grade and within the constraining mineralized wireframes (considered mineable shapes).

- The underground cut-off grade of 1.10% NiEq considers metal prices of $8.50/lb Ni, $3.75/lb Cu, $17.00/lb Co, $950/oz Pt, $1100/oz Pd and $1,950/oz Au, metal recoveries of 78% for Ni, 95.5% for Cu, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au (Ag is not considered), a mining cost of US$80.00/t rock and processing, treatment and refining, transportation and G&A cost of US$42.50/t mineralized material.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

About Magna Mining Inc.

Magna Mining is an exploration and development company focused on nickel, copper and PGM projects in the Sudbury region of Ontario, Canada. The Company’s flagship assets are the past producing Shakespeare and Crean Hill Mines. The Shakespeare Mine is a feasibility stage project which has major permits for the construction of a 4,500 tonne per day open pit mine, processing plant and tailings storage facility and is surrounded by a contiguous 180km2 prospective land package. Crean Hill is a past producing nickel, copper and PGM mine with a technical report dated August 2022.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE