Magna Mining Announces Initial Mineral Reserves for the McCreedy West Mine in Sudbury, Ontario

Magna Mining Inc. (TSX-V: NICU) (OTCQX: MGMNF) (FSE: 8YD) is pleased to announce initial Mineral Reserves for the McCreedy West Mine, located in the North Range of the Sudbury Basin, Ontario, Canada. The McCreedy West Mine Mineral Reserves and Mineral Resources estimates disclosed herein were prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Highlights

- Probable Mineral Reserves of 987,000 tonnes at 1.59% Cu, 0.32% Ni, 0.01% Co, 1.15 g/t Pt, 1.23 g/t Pd, 0.32 g/t Au, 6.65 g/t Ag.

- Indicated Mineral Resources* of 5,632,000 tonnes at 1.10% Cu, 0.98% Ni, 0.03% Co, 0.82 g/t Pt, 0.92 g/t Pd, 0.23 g/t Au, 5.15 g/t Ag.

- Inferred Mineral Resources* of 874,000 tonnes at 1.37% Cu, 1.00% Ni, 0.02% Co, 1.26 g/t Pt, 1.24 g/t Pd, 0.26 g/t Au, 4.12 g/t Ag.

- Based on the Mineral Reserve Estimate, the 700/PM Copper-PGE Zones at McCreedy West demonstrate an initial three-year production profile, assuming forecasted mining rates which are in line with the current operation and 2026 guidance.

*Mineral Resources do not include Mineral Reserves

Jason Jessup, CEO stated, “We are proud to be able to announce our Mineral Reserves for the McCreedy West Mine, and it is a milestone for our company and a testament to the team we have built. These Mineral Reserves will support an initial three-year production profile, which is in line with the reserves that McCreedy West has operated with since being restarted in 2003 by FNX Mining. As we continue to diamond drill and plan further into the future, I am confident that we can continue to convert Mineral Resources and replace mined reserves for many years to come.”

The 2026 MRMR estimate is effective as of December 31, 2025 and reflects updated Mineral Resource estimation parameters and cut-off grade assumptions, as well as geological information from the Company’s drilling program. All Mineral Reserves are contained within the 700 Copper and PM Copper-PGE Zones and are comprised of a Mineral Reserve inventory of 987,000 tonnes at a grade of 1.59% Cu, 0.33% Ni, 0.005% Co, 1.15 g/t Pt, 1.30 g/t Pd, 0.32 g/t Au, and 6.65 g/t Ag. The Mineral Reserves in these footwall copper zones are composed of structural-controlled, chalcopyrite-rich veins ranging in width from less than one foot (0.305 metres) to greater than 10 feet (3.05 metres). The mining method currently employed at McCreedy West is long hole stoping with unconsolidated rock backfill. Stope design is based on a minimum mining width of 5 feet (1.52 metres), with an additional 1.5 feet (0.46 metres) dilution on both the hanging wall and footwall. The resulting tonnage and grade estimates include appropriate dilution and 85% stope recoveries. A cut-off grade was applied to each stope based on Net Smelter Return exceeding sustaining development, equipment and fixed plant capital costs, as well as operating costs of CAD$180.00 per short ton. Based on similar production rates as outlined in the Company’s 2026 guidance for McCreedy West (see news release dated February 5, 2026), the Mineral Reserve estimate supports a three year production profile for the 700/PM Copper Zones. The Intermain Nickel Zone is not included in the Mineral Reserve estimate or the three-year production profile but is incorporated in the Mineral Resource estimate.

Table 1: McCreedy West Mineral Reserve (as at December 31, 2025)1

| Deposit Type |

Category | Zone | Short Tons | Metric Tonnes |

Cu | Ni | Co | Pt | Pd | Au | Ag |

| % | % | % | g/tonne | g/tonne | g/tonne | g/tonne | |||||

| Footwall | Probable | Broken Inventory |

43,000 | 39,000 | 1.67 | 0.23 | 0.01 | 0.59 | 0.62 | 0.29 | 9.38 |

| Probable | 700/PM | 1,045,000 | 948,000 | 1.59 | 0.33 | 0.01 | 1.17 | 1.25 | 0.32 | 6.54 | |

| Total | P&P | 1,088,000 | 987,000 | 1.59 | 0.32 | 0.01 | 1.15 | 1.23 | 0.32 | 6.65 |

*Mineral Reserves are in addition to Mineral Resources.

Table 2: McCreedy West Mineral Resource – Indicated Category (as at December 31, 2025)2

| Deposit Type |

Category | Cut-off Grade |

Short Tons | Metric Tonnes |

Cu | Ni | Co | Pt | Pd | Au | Ag |

| % | % | % | g/tonne | g/tonne | g/tonne | g/tonne | |||||

| Contact | Indicated | 1.1% NiEq | 2,886,000 | 2,618,000 | 0.27 | 1.60 | 0.06 | 0.01 | 0.02 | 0.00 | 0.12 |

| Footwall | Indicated | 2.0% CuEq | 3,322,000 | 3,014,000 | 1.83 | 0.44 | 0.01 | 1.52 | 1.70 | 0.42 | 9.51 |

| Total | Indicated | 6,208,000 | 5,632,000 | 1.10 | 0.98 | 0.03 | 0.82 | 0.92 | 0.23 | 5.15 |

Table 3: McCreedy West Mineral Resource – Inferred Category (as at December 31, 2025)2

| Deposit Type |

Category | Cut-off Grade |

Short Tons | Metric Tonnes |

Cu | Ni | Co | Pt | Pd | Au | Ag |

| % | % | % | g/tonne | g/tonne | g/tonne | g/tonne | |||||

| Contact | Inferred | 1.1% NiEq | 67,000 | 61,000 | 0.24 | 1.58 | 0.05 | 0.01 | 0.02 | 0.01 | 0.27 |

| Footwall | Inferred | 2.0% CuEq | 897,000 | 813,000 | 1.46 | 0.95 | 0.02 | 1.35 | 1.33 | 0.28 | 4.40 |

| Total | Inferred | 964,000 | 874,000 | 1.37 | 1.00 | 0.02 | 1.26 | 1.24 | 0.26 | 4.12 |

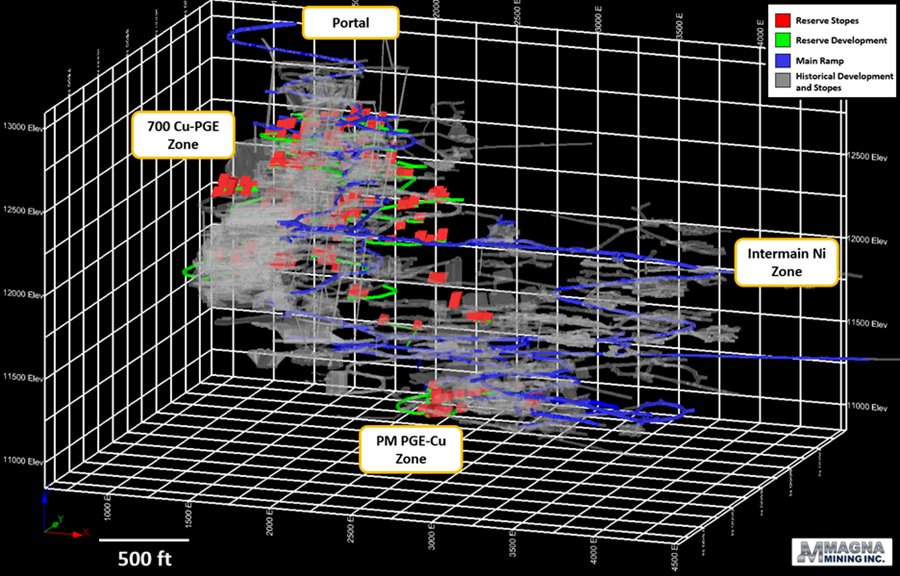

Figure 1: McCreedy West Mine 3D View Showing Historical Development and Footwall Reserve Stopes

The technical report in support of the above noted MRMR estimates will be filed by Magna Mining within 45 days of this news release.

1Notes on Mineral Reserves

- The effective date of the McCreedy West Mineral Reserve Estimate is December 31, 2025.

- Mineral Reserves are in addition to Mineral Resources.

- The Mineral Reserve estimate was prepared under the supervision of Mr. William van Breugel, P.Eng., B.A.Sc. Geological Engineering, Associate Engineer of SGS Geological Services and Mr. Henri Gouin, P.Eng., of SGS Geological Services, both are considered a “Qualified Person” as defined by NI 43-101.

- Mineral Reserves are based on metal prices of $7.72/lb Ni, $4.88/lb Cu, $18.12/lb Co, $1,410/oz Pt, $1,156/oz Pd, $3,815/oz Au, and $50/oz Ag. Metal recoveries considered are 85% for Ni, 91% for Cu, 68% for Co, 64% for Pt, 69.5% for Pd, 70.5% for Au, and 70% for Ag and a Cdn/Fx of $1.37.

- A cut-off grade was applied to each stope based on NSR exceeding sustaining development, equipment and fixed plant capital costs and operating costs of $180.00 per ton.

- Stope tons and grades include 3 feet of mining dilution for stopes and 85% stope recoveries.

- Figures may not sum exactly due to rounding.

2Notes on Mineral Resources

- The effective date of the McCreedy West Mineral Resource Estimate (“MRE”) is December 31, 2025. The MRE is based on drillhole assay data received up to September 10, 2025, which represents the cut-off date for assay data used in the estimate. The estimate has been depleted to account for all production through December 31, 2025.

- The Contact Zone Mineral Resource was previously disclosed in 2024 and was estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101. Dr. Armitage conducted two site visits to the McCreedy Property Mine, on August 22-23, 2023 (surface tour) and July 24, 2024. Mined material from 2024 was depleted from the previous MRE.

- The Footwall Zone Mineral Resource was estimated by Jonathan Cirelli, P.Geo. of Orix Geoscience Inc. and is an independent Qualified Person as defined by NI 43-101. Mr. Cirelli was previously employed at McCreedy West Mine during 2010-2011. A site visit was last conducted on November 20, 2025. The Footwall Zone Mineral Resource has been reviewed by Mr. Armitage.

- The Contact Zone Mineral Resource was previously disclosed in 2024 and was estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101. Dr. Armitage conducted two site visits to the McCreedy Property Mine, on August 22-23, 2023 (surface tour) and July 24, 2024. Mined material from 2024 was depleted from the previous MRE.

- The Mineral Resource is presented undiluted and in situ, constrained by diamond drillhole information and underground geological mapping, and is considered to have reasonable prospects for eventual economic extraction. Mineral Resources are exclusive of Mineral Reserves and mined-out material.

- Mineral Resources are classified in accordance with the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves.

- Mineral Resources, which are not Mineral Reserves have not demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. There is no certainty that Inferred Mineral Resources will be converted to Indicated Mineral Resources through continued exploration.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The Footwall Zone cut-off grade of 2.0% CuEq considers metal prices of $7.72/lb Ni, $4.88/lb Cu, $18.12/lb Co, $1,410/oz Pt, $1,156/oz Pd, $3,815/oz Au, and $50/oz Ag. Metal recoveries considered are 85% for Ni, 91% for Cu, 68% for Co, 64% for Pt, 69.5% for Pd, 70.5% for Au, and 70% for Ag.

- The Contact Zone cut-off grade of 1.1% NiEq considers metal prices of $8.50/lb Ni, $3.75/lb Cu, $17.00/lb Co, $950/oz Pt, $1,100/oz Pd and $1,950/oz Au. Metal recoveries considered are 78% for Ni, 95.5% for Cu, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au. Silver was not considered in the Contact Zone cut-off grade.

- Footwall Zone grades for Ni, Cu, Co, Pt, Pd, Au, and Ag are estimated using ~5.0 ft (1.52 m) composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used. Samples were capped before compositing when required. A density regression was calculated and used to populate density values in the model.

- Contact Zone grades for Ni, Cu, Co, Pt, Pd, Au, and Ag are estimated using ~5.0 ft (1.52 m) capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains. Average density values were assigned based on a database of 45,525 samples.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Qualified Person

The Contact Nickel Mineral Resources were estimated by Mr. Allan Armitage, Ph.D., P.Geo., of SGS Geological Services., an independent Qualified Person as defined by NI 43-101.

The Footwall Zone Mineral Resources were estimated by Jonathan Cirelli, P.Geo. of Orix Geoscience Inc. an independent Qualified Person as defined by NI 43-101. The Footwall Zone Mineral Resources have been reviewed by Mr. Armitage.

The Mineral Reserves were estimated under the supervision of Mr. William van Breugel, P.Eng., B.A.Sc. Geological Engineering, Associate Engineer of SGS Geological Services and Mr. Henri Gouin, P.Eng., of SGS Geological Services. Both Mr. van Breugel and Mr. Gouin are independent Qualified Persons as defined by NI 43-101.

The scientific or technical information in this news release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under Canadian National Instrument 43-101.

About Magna Mining Inc.

Magna Mining Inc. is a producing mining company with a strong portfolio of copper, nickel, and Platinum Group Metals (PGM) assets located in the world-class Sudbury mining district of Ontario, Canada. The Company’s primary asset is the McCreedy West Mine, currently in production, supported by a pipeline of highly prospective past-producing properties including Levack, Crean Hill, Podolsky, and Shakespeare.

Magna Mining is strategically positioned to unlock long-term shareholder value through continued production, exploration upside, and near-term development opportunities across its asset base.

MORE or "UNCATEGORIZED"

Aldebaran Announces Closing of Concurrent Private Placement

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

QGold Reports Results from Its Drilling Campaigns at Its Mine Centre Gold Project

Presented are results of the June and November 2025 drilling camp... READ MORE

NevGold Drills 8.51 g/t Oxide AuEq Over 10.6 Meters (8.11 g/t Au And 0.10% Antimony) Within 2.32 g/t Oxide AuEq Over 86.8 Meters (1.94 g/t Au And 0.10% Antimony); Discovers High-Grade Oxide Gold-Antimony “Armory Fault” Structure At Bullet Zone

NevGold Corp. (TSX-V:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) is ple... READ MORE

Aya Gold & Silver Reports High-Grade Silver Results at Zgounder

Extends Mineralization Near Western Fault Aya Gold & Silve... READ MORE